The President’s health reform plan would raise the Medicare tax rate for single filers with incomes over $200,000 and married filers with incomes over $250,000 — a provision that was included in the Senate-passed health bill — and also would extend this tax to the unearned income these affluent households receive such as income from capital gains, dividends, and royalties. These proposals, which would help finance the expansion of health coverage to more than 30 million Americans, would affect only U.S. households at the very top of the income scale while improving tax equity and economic efficiency.

These provisions would affect only the 2.6 percent of U.S. households with the highest incomes, according to the Urban Institute-Brookings Institution Tax Policy Center.[1] The Medicare taxes that the other 97.4 percent of Americans pay would remain unchanged. Among elderly households, only the top 2.2 percent would be touched, with the other 97.8 percent remaining unaffected.

These proposals would mainly affect people with incomes exceeding $1 million a year. The Tax Policy Center reports that 74 percent of the increase in Medicare tax contributions would come from people making over $1 million a year, and 91 percent would come from people with incomes over $500,000. Among elderly households, 78 percent of the new tax contributions would come from those with incomes exceeding $1 million, while 93 percent would come from seniors with incomes over $500,000.

The proposals also would improve both tax equity and economic efficiency. Under current law, people with very high incomes generally pay a smaller share of their income in Medicare taxes than middle-class and low-income working families do because they derive much of their income from capital gains and dividends, which are now exempt from the Medicare tax. The proposal would address this disparity.

The broadening of the Medicare tax would also somewhat improve economic efficiency. The current, very large difference between the overall tax rate applied to ordinary income and the much lower rate applied to capital gains encourages inefficient tax-sheltering activities; it creates large tax incentives for wealthy individuals to engage in financial engineering schemes to convert ordinary income into capital gains. By modestly reducing the differential between the tax rates on ordinary income and the rates on capital gains, the proposal takes a step toward reducing these incentives for tax-shelter activity.

Under the current Medicare tax, employees and employers each pay a flat 1.45 percent of a worker’s wage and salary income. (Unlike Social Security payroll taxes, which are not imposed on earnings above a specified ceiling, Medicare taxes are collected on all of a worker’s earnings.) Although employers nominally pay half of the tax, most economists believe that employees ultimately pay the employer share as well — or 2.9 percent overall — as employers pass the tax through to employees in the form of lower wages. (Self-employed workers pay the full 2.9 percent tax but are allowed to deduct half of this amount for income-tax purposes.)

The President’s plan would leave the Medicare tax unchanged for the 97.4 percent of Americans with incomes below $200,000 for single filers and $250,000 for couples. For those high-income households that have incomes above these thresholds, it would modify the tax in two ways.

First, it adopts a provision of the Senate-passed health bill that would raise the employee share of the Medicare tax by 0.9 percentage points — from 1.45 percent to 2.35 percent — on the portion of these households’ earnings that exceeds the $250,000 threshold ($200,000 for unmarried filers). Earnings up to these thresholds would continue to be taxed at the current rate.

Second, it would apply the current 2.9 percent rate to these households’ unearned income. This tax would apply only to unearned income above the $250,000 threshold ($200,000 for unmarried filers). Thus, if a married couple had $150,000 in earned income and $150,000 in capital gains and dividends, it would pay the current tax rate on all of its earnings and would pay 2.9 percent of the last $50,000 of its unearned income. The first $100,000 of its unearned income would continue to be exempt from the tax.

In addition, all active income that people above $250,000 secure from operating a closely held business organized as an S corporation would continue to be exempt from the Medicare tax.[2]

The provisions raising the amount of Medicare HI tax that high-income households pay will provide $184 billion in revenue over ten years, according to very preliminary estimates from the Joint Committee on Taxation.[3] These revenues, along with various other revenues and substantial program savings, primarily in Medicare, enable the health reform legislation to reduce deficits modestly both over the next ten years and beyond.

In addition to helping ensure that the health reform legislation is fully paid for, broadening the base of the Medicare tax for high-income households (by extending it to unearned income) would be sound economically. A major source of inefficiency in today’s tax code is that it taxes different types of income at sharply different rates. The much lower tax rates applied to capital gains and dividend income than for earnings stand out in this respect. As the Tax Policy Center has explained:

Low tax rates on capital gains are an important part of many individual income tax shelters, which employ sophisticated financial techniques to convert ordinary income (such as wages and salaries) to capital gains. For top-bracket taxpayers, tax sheltering can save 20 cents per dollar of income sheltered. Tax sheltering is economically inefficient because the resources that go into designing and managing tax shelters could be used instead for productive purposes, and many tax shelter investments pay subpar returns, turning a profit only after considering the tax benefits. [4]

The proposal to broaden the base of the Medicare tax would narrow the gap between the tax rates that high-income people face on ordinary income and the rates they face on capital gains — and would thereby modestly reduce incentives for economically unproductive tax sheltering. [5]

As is well known, incomes have surged in recent decades for households at the top of the income scale while stagnating for ordinary Americans. High-income households also have benefited from very large tax cuts.

- Between 1995 and 2007, the percentage of income that households with incomes over $1 million paid in federal income taxes fell by nearly one-third, from 31.4 percent to 22.1 percent.[6]

- Over the 1995-to-2007 period, the effective income tax rate of the 400 Americans with the highest incomes was cut nearly in half: this group paid an average of 29.9 percent of its income in federal income taxes in 1995, as compared to 16.6 percent in 2007. (To make it into the top 400, a household needed an adjusted gross income of at least $139 million in 2007.) [7]

This substantial reduction in tax burdens at the top end of the income scale occurred at the same time that

before-tax income disparities were widening markedly. In fact, during the most recent economic expansion (from the end of 2001 to the end of 2007), two-thirds of all of the income gain in the nation went to the 1 percent of Americans with the highest incomes.

[8]The new Medicare tax provisions would mitigate this somewhat by making payroll taxes a bit less regressive. The Congressional Budget Office has found that the percentage of total income that a typical middle-class household pays in Medicare and Social Security taxes is nearly six times higher than the percentage of income that people in the top 1 percent of the population pay.[9] The fact that the Medicare tax now applies to wages, salaries, and self-employment income but not to capital gains and dividend income is a key reason why wealthy Americans pay a substantially smaller share of their income in Medicare taxes than low- and middle-income people do.

Capital gains and dividends account for only a tiny share of the income of low- and middle-income families. But they make up 22 percent of the income of people who make between $500,000 and $1 million and 61 percent of the income of people who make more than $10 million. [10]

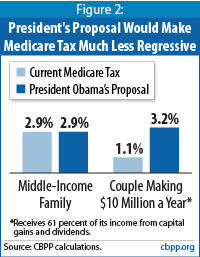

- A middle-class family whose income is derived entirely from wages currently faces the full 2.9 percent Medicare tax. [11]

- But a couple making $10 million a year that receives 61 percent of its income from capital gains and dividends (and the rest from salaries) pays only 1.1 percent of its income in Medicare tax.

-

Under the President’s proposal, this multi-millionaire couple would pay 3.2 percent of its income in Medicare tax. (The rate would be lower than 3.2 percent if part of the couple’s $10 million income consisted of active Subchapter S corporation income.)

The President’s proposal would largely eliminate the disparity in effective Medicare tax rates.

These proposals relating to the Medicare tax also would be extremely well targeted. As noted, only the 2.6 percent of households with the highest incomes would be affected at all. And, largely because capital gains, dividends, and other unearned income are so heavily concentrated at the very top of the income scale, households with incomes of more than $1 million, who often now pay only tiny percentages of their income in the Medicare tax, would provide 74 percent of the new revenues from these proposals.

This effect is even greater among seniors. Only 2.2 percent of them would face any increase in taxes. And those with annual incomes exceeding $1 million would be responsible for 78 percent of the new taxes that seniors would pay.

The President’s proposal also would improve Medicare’s finances by increasing the revenues dedicated to the Medicare program. As under the Senate-passed health reform bill, the revenues from the additional tax on earned income would be credited to the Medicare Hospital Insurance (HI) trust fund. The combination of the health reform package’s substantial Medicare savings from making the program more efficient and this tax measure would extend the solvency of the HI trust fund by at least ten years, from 2017 to 2027.[12]