- Home

- Limiting The Tax Exclusion For Employer-...

Limiting the Tax Exclusion for Employer-Sponsored Insurance Can Help Pay for Health Reform

Universal Coverage May Be Out of Reach Otherwise

Limiting the tax exclusion for employer-sponsored health insurance could provide significant revenues for health reform without eroding employer-sponsored insurance or causing other undesirable side effects — if the cap and the rest of the health reform legislation are well designed and contain several key features that past proposals have lacked. Limiting the tax exclusion deserves serious consideration for several reasons.

First, the exclusion is poorly designed, providing the greatest benefit to those with the highest income.

Second, the exclusion makes the problem of high and rising health care costs somewhat worse, encouraging employers and individuals to purchase costlier coverage than they otherwise would.

Third, and perhaps most important, the White House has announced that it will insist that health reform legislation be fully paid for. Congress will likely find it difficult to meet this objective unless the bill includes a cap on the exclusion as a significant source of financing. As a result, attaining universal coverage may depend on including a cap in the legislation.

Exclusion Is Nation’s Costliest Tax Subsidy

The exclusion of employer-provided health insurance from taxable income is considered a “tax expenditure” or “tax subsidy” because it is an exception to the usual rule that all compensation is counted as taxable income. In fact, the employer tax exclusion is the largest single subsidy in the tax code. [1] According to the Joint Committee on Taxation, it reduced federal tax collections by $246 billion in 2007 — $145 billion in income taxes and $101 billion in payroll taxes. [2]

Most working-age Americans and their dependents receive health coverage through their employer. In 2007, 63 percent of people under age 65 were covered by employment-based insurance. [3]

The workplace has become an important source of health coverage for several reasons. First, employment-based groups offer an effective means of pooling the risk of incurring high health care costs, because the groups are formed for reasons other than the workers’ health and thus generally have a mix of low-cost, healthy people and higher-cost people with greater health needs. Second, large firms can obtain health insurance with relatively low administrative and marketing costs. [4] Third, employee compensation in the form of employment-based health insurance receives preferential tax treatment.

Cash wages and most other forms of compensation are counted as income for purposes of income and payroll taxes. Even compensation paid in-kind (for example, the use of a house or a car) is generally taxable. Employer-sponsored health insurance, however, is an exception. If an employer pays all or part of a worker’s insurance premiums, those payments are excluded from the worker’s taxable income for purposes of both income and payroll taxes. Workers participating in a Section 125 (“cafeteria”) plan may also pay their share of insurance premiums on a tax-free basis.

Exclusion Is Poorly Targeted, Increases Health Care Spending

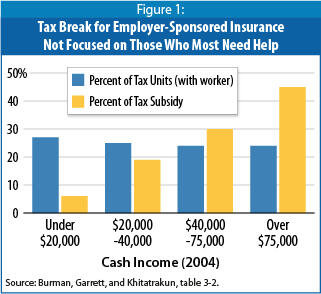

Although the tax exclusion provides a big boost to employer-sponsored health coverage, it is poorly targeted. It gives the greatest benefit to those with the highest incomes, although they are the group that least needs help paying for health insurance. The 24 percent of tax units with incomes over $75,000 in 2004 received almost half of the benefits of the exclusion, while the 27 percent of tax units with incomes under $20,000 received just 6 percent of the benefits (see Figure 1).

The tax exclusion is worth less to those with low and moderate incomes for three reasons: (1) they are less likely to have jobs that offer health insurance, (2) if offered employer-sponsored insurance, they are less likely to participate (because many cannot afford to pay their share of the premium), and (3) they are in lower tax brackets and thus receive a smaller tax benefit from the exclusion.[5] For example, a low-income person in the 15-percent bracket receives an income-tax subsidy of 15 cents for every dollar of employer-provided health insurance, whereas a high-income individual in the 35-percent bracket receives a subsidy of 35 cents on the dollar.

In addition to being poorly targeted, the tax exclusion exacerbates the problem of high and rising health care costs. Like any subsidy, it encourages more spending on the item that is subsidized, particularly for those with high incomes who derive the greatest benefit from the exclusion. By reducing the after-tax price of health insurance, the exclusion provides an incentive for employers and individuals to select more generous or costly coverage than they otherwise would purchase. That, in turn, leads to an increase in the demand for health care services, pushes up prices in the health care sector, and ultimately makes health care and health coverage less affordable. [6]

Exclusion Can Be Reformed Without Eroding Employer-Sponsored Insurance

Because of these problems, many analysts have recommended scaling back the exclusion. For example, capping it at some reasonable dollar level could encourage people to seek, and providers to practice, more effective health care and thereby slow the growth in health care costs.

There are legitimate concerns about such a course. Unless combined with other essential reforms of the health system, limiting the exclusion could seriously weaken employer-sponsored insurance without creating a viable alternative way to pool health risks to keep coverage affordable. For example, the Bush Administration’s proposal to replace the exclusion with a fixed deduction would have left people who lost access to employer-sponsored coverage to fend for themselves in the poorly regulated market for individual health insurance. [7]

In the context of comprehensive health reform, however, limiting the tax exclusion can provide a significant source of financing without eroding employer-sponsored insurance — if the limit and the rest of the legislation are well designed. Three design issues are particularly crucial.

First, most health reform proposals include a requirement that individuals obtain health insurance for themselves and their families. This requirement is important: faced with having to meet an individual requirement, many workers would find employer-sponsored health insurance more attractive than it is now, even if a minority of them had to pay taxes on part of the benefit. Employers would have every reason to continue offering health insurance, and employees would have every incentive to accept the offer. In Massachusetts, the individual mandate has resulted in an increase in employer-sponsored coverage. Employment-based insurance contracts have also proved popular in the Netherlands, which has an individual requirement.

Second, some health reform proposals also include a requirement that employers of more than a certain size offer insurance to their employees or pay some sort of charge. This “play-or-pay” requirement would discourage employers from dropping health coverage if it became partly taxable for some people.

Third, appropriate adjustments in the cap could be made. Some critics of capping the tax exclusion have correctly observed that the premiums for the insurance that some firms offer may be high not because a plan provides particularly generous benefits but because (1) the workers are in an area with high health care spending or insurance costs, (2) the workers are older or sicker than average, or (3) the firm is relatively small, so a greater portion of the premium goes to administrative costs (rather than benefits) than is the case for larger firms.

Some of these concerns can be addressed by other components of health reform. It is essential that a cap be accompanied by a provision barring insurers — including insurers in the small group market — from continuing to vary premiums based on beneficiaries’ health status or on firm size. The other concerns can be addressed by adjusting the cap based on a firm’s location and the age of its workforce, as detailed below, so that workers do not pay more because they live in an area with above-average health costs or because their firm has an older workforce.

Structuring a Limit on the Exclusion

A limit on the employer exclusion could be structured in at least three ways:

- Based on the value of the insurance. Under this approach, only contributions to the most expensive insurance plans would be taxable. Tax-preferred contributions for health insurance and health care costs would be included in taxable income only to the extent that they exceeded a certain amount (which, as noted, could be subject to several adjustments). For example, the Congressional Budget Office (CBO) has estimated that taxing contributions that exceed the 75th percentile of health insurance premiums paid through employers would raise $108 billion in income and payroll taxes over five years and $452 billion over ten years. [8] Note that under this approach, as long as different types of coverage (individual, family, individual plus spouse, and so on) have different thresholds, the cap would not disadvantage families with children or any other household category. (See box.)

- Based on the income of the taxpayer. Under this variant, only people with incomes above a certain threshold would face taxation on their employer’s contributions to the cost of their health insurance. For example, in one version estimated by CBO, the tax exclusion would be phased out for single persons with incomes above $80,000 and married couples with incomes above $160,000. CBO estimates that this option would raise $182 billion over five years and $552 billion over ten years. [9] An alternative would be to use the income thresholds at which eligibility for Roth Individual Retirement Accounts begins to phase out — $105,000 for individuals and $166,000 for couples in 2009.

- Based on both the value of the insurance and the income of the taxpayer . It would also be possible to apply both of the foregoing tests. Under this approach, a cap would be placed on the value of tax-preferred insurance, but it would apply only to upper-income taxpayers whose tax-favored health contributions exceeded that amount. Options of this sort would raise significantly less revenue, although the amount could still be substantial. (No estimates are readily available for options of this nature.)

Whichever approach policymakers adopt, they must also address important, additional design issues.

Administering a Limit

If properly designed, a limit on the tax exclusion could be administered equitably and without large compliance burdens for employers or workers. Different approaches would be required for employers that purchase insurance and those that self-insure.

Small employers generally purchase insurance from an insurance company and pay a clearly identifiable premium for each employee and dependent. These employers could easily report the current premium amount, as well as the portion of the premium that they contribute, on workers’ pay stubs and W-2 statements. Large employers generally act as their own insurer and do not pay premiums to an insurance company. Such self-insured employers, however, must already calculate premiums charged to former employees eligible for continuation of coverage under COBRA (the Consolidated Omnibus Budget Reconciliation Act). These employers could report the most recently determined COBRA premium (excluding the additional 2-percent administrative charge), and the employer contribution to the cost of that premium, for the worker’s coverage type (individual, family, individual plus spouse, or individual plus child). [10]

Claims That Capping the Exclusion Will Disproportionately Burden Families with Children Are Mistaken

Health insurance premiums vary by type of coverage. Insurance plans distinguish between individual and family coverage. Some plans also have categories for an individual plus spouse and an individual plus child. Family coverage costs the most because it covers the most people.

Any proposal to cap the tax exclusion that is based on the value of the insurance must specify separate limits for each type of coverage. If these limits do not accurately reflect the differences in the cost of insurance, the exclusion may affect a greater proportion of those with family coverage than those with individual coverage, or vice versa.*

Some opponents of capping the exclusion have argued or implied that a cap will disproportionately affect, and thereby harm, families with children. This claim is mistaken. A cap would only have that effect if it were poorly designed, and it is easy to design a cap without such a flaw. Policymakers can readily avoid imposing a disproportionate burden on families with children, or any other coverage group, by setting the tax caps for each coverage category with due regard to the distribution of insurance costs. For example, a cap could be set at the 75th or 80th percentile of the premium charge for each coverage category (individual, family, individual plus spouse, etc.). Such an approach would affect the same percentage of households in each category. Thus, there is no reason that a cap need disproportionately affect families with children or any other group.

In fact, children as a group are likely to benefit from a well-designed cap, because inclusion of a cap should make it more likely that the legislation achieves near-universal coverage. As this paper explains, policymakers likely will fall short of producing sufficient savings to finance near-universal coverage unless health reform legislation includes a cap. As a result, without a cap, more of the 8 million children who currently lack insurance are likely to remain uninsured.

Protecting High-Cost Groups

Some opponents of modifying the tax exclusion correctly note that premiums are high in some cases because the covered workers are in an area with high health care spending or insurance costs, or are older or sicker than average, or the firm is small. But Congress can address some of these differences by other aspects of health reform — for example, by requiring insurers not to vary premiums based on health status or firm size. It can account for the remaining factors by adjusting the amount of premiums subject to tax based on the firm’s location and the age of its workforce.

Specifically, Congress could direct the Internal Revenue Service (IRS) to issue a set of geographic and age-based adjustment factors that firms would apply to the raw premium amounts to determine the amounts reported on W-2 forms. These adjustments, based on the recommendations of a new national health insurance exchange, the Department of Health and Human Services, or another such entity, could reflect several alternative sources of data, such as the Insurance Component of the Medical Expenditure Panel Survey, Medicare enrollment and claims data, or enrollment and claims data for plans in the health insurance exchange. Appropriate modifications to the geographic adjustment factor would be made for firms whose workforce is spread over several locations.

Limiting Related Tax Benefits

If Congress limits the tax exclusion for employer contributions to health insurance, the cap should also cover other types of health benefits that employees may accrue as tax-exempt compensation, including:

- Flexible Spending Accounts (FSAs). FSAs allow employees to pay out-of-pocket health costs with pre-tax dollars. Employees have a set amount deducted from each paycheck to be deposited in their FSA — free of any income or payroll tax — from which they are reimbursed for out-of-pocket health costs they incur during the year. [11]

- Premium Conversion. Under premium conversion, employees can set aside a portion of their earnings to pay their share of health insurance premiums on a pre-tax basis. Employees can use premium conversion as well as an FSA to pay for both premium and non-premium out-of-pocket health care costs.

- Health Reimbursement Arrangements (HRAs) and Health Savings Accounts (HSAs). HRAs are employer-maintained accounts that reimburse employees for medical expenses. Only employers may contribute to HRAs, and these contributions are exempt from income and payroll taxes. HSAs are individual accounts from which people who have a high-deductible health policy can draw funds to pay out-of-pocket health expenses. Contributions to HSAs are tax deductible and withdrawals are tax exempt as long as they are used for out-of-pocket medical costs. Both employees and employers can contribute to HSAs.

The amounts of these other types of tax preferences (other than employee contributions to HSAs) are known to employers, can be reported by them on W-2 forms, and can be included in the amount of tax-preferred health spending subject to any limitation. Like the employer exclusion, these tax subsidies foster overconsumption of health care, and one of the prime goals of a limit would be to restrain such overconsumption. (By reducing the effective price of health insurance or health care services, these tax preferences encourage individuals to spend more on health insurance or health services than they otherwise would.) FSAs are particularly problematic in this regard: they can be used to purchase a wide array of common household items and non-essential health care treatments that health insurance would virtually never cover, and their use-it-or-lose-it requirement [12] promotes wasteful year-end health spending binges.

Another reason to count the above tax subsidies when limiting employer-provided health benefits is to ensure that employers do not circumvent that limit by shifting tax-free spending for health insurance away from employer premium contributions and toward FSAs, premium conversion, HRAs, and HSAs. Otherwise, for example, employers could reduce their premium payments and increase cash wages by the same amount, enabling employees to pay the additional premiums and cost-sharing tax-free using premium conversion and FSAs.

Some employers provide in-kind health benefits that are not taxable — for example, on-site nurses or clinics, smoking cessation programs, immunizations, or other wellness programs. In framing a limit on the tax preference for employment-based health coverage, Congress could ignore these benefits, assign a per-person estimate of their value to each employee, or assign a value only if it exceeds a specified threshold amount. The simplest approach, which we recommend, would be to ignore them.

Indexing the Limit

If a limit on the tax benefits for employment-based insurance applies only to contributions that exceed a certain value, it will be necessary to determine how to adjust the threshold over time. The Senate Finance Committee’s recent paper on options for financing health care reform lists three ways to index a limit on the exclusion — by the annual growth rate of national health expenditures (NHE) per person, of the gross domestic product (GDP) per person, or of the Consumer Price Index (CPI). [13] Another alternative is to index the limit by the growth in the medical care component of the CPI. Between 1990 and 2007, NHE per person grew by 5.9 percent per year, the medical CPI by 4.6 percent, GDP per person by 3.7 percent, and the overall CPI by 2.8 percent.

If the limit grows more slowly than health insurance premiums, more and more health insurance spending — and more and more people — will become subject to taxation with each passing year. This would raise growing amounts of revenue over time and exert increasing pressure to slow the growth of premiums and health care costs. But indexing the limit at too low a rate — for example, by the overall CPI — could ultimately threaten the sustainability of comprehensive employer-sponsored insurance. In contrast, if the limit grows at the same rate as premiums, it will not have this effect; it will continue to affect about the same fraction of people and plans over time [14] and likely create less political opposition, although it will also do less to restrain the growth in health care costs. An intermediate possibility is to index the limit by NHE per person, insurance premiums, or a similar measure for a period of time and to index it at a slightly slower rate in the longer run — perhaps by the medical CPI — in order to help moderate costs over time.

Actuarial-Value Limit Would Be More Complicated, Less Effective

As an alternative to a cap of the sort described here, a few analysts have proposed taxing employer-sponsored insurance that exceeds some actuarial value. [15] (The actuarial value is the cost that actuaries estimate would result from insurance claims if a nationally representative population received the covered benefits.) This approach, however, would be ill-advised.

The actuarial-value approach would be much more complicated to administer than the one proposed here, because an individual actuarial calculation would have to be done for every employer-sponsored plan in the country. In addition, some entity, perhaps the IRS, would have to specify the representative population to be used in making the calculation, since the results could differ significantly depending on the population used. [16] In many cases, a firm would have to hire an actuary to perform the analysis.

The unsuccessful attempt to implement 1986 legislation establishing new non-discrimination requirements for employer-sponsored insurance illustrates the difficulty of such a valuation process. “The IRS struggled unsuccessfully to provide valuation rules,” according to two expert tax practitioners, and “the limited guidance that was ultimately provided, which took years to develop, was universally criticized.” [17] Also, many plans proved impossible to value because their benefits were not written down in sufficient detail.

Taxing health insurance based on its actuarial value would also fail to promote more efficient use and delivery of health care. Actuarial value reflects only the extent of covered benefits; it does not take account of factors that can significantly affect the cost of delivering those benefits, such as differences in provider networks, care-management processes, and administrative overhead. [18] Therefore, the actuarial-value approach would dull the incentive to choose a less expensive plan, because a person enrolled in an efficient plan would face the same tax consequences as someone in a less efficient plan that delivered the same package of benefits but at greater cost.

Cap Likely Needed to Achieve Universal Coverage

Health reform legislation that seeks to attain universal coverage is likely to cost about $1 trillion over ten years. The White House has recently reiterated its position that the legislation must be fully paid for. It announced on June 1 that “we are insisting that health reform be deficit neutral over the next five to 10 years, through scoreable offsets.” OMB Director Peter Orszag declared that this requirement “is ironclad, no ambiguity, not up for negotiation.” [19]

It is difficult to see how such legislation can be financed unless it includes a cap on the tax exclusion for employer-sponsored health insurance. Universal coverage thus may hinge on whether a cap is part of the legislation.

Savings from Medicare and Medicaid are likely to reach, at best, $400 billion to $450 billion over ten years. The Administration has proposed reforms in these programs that CBO estimates would save $295 billion over ten years, and additional savings options — particularly in the areas of Medicare fee-for-service provider rates and pharmaceutical pricing — might raise up to $100 billion more. To be enacted, however, many of these proposals will have to overcome vigorous opposition from powerful health care interests, including health insurers and pharmaceutical manufacturers. If they are enacted, they will likely cover less than half of the cost of health reform legislation.

In the absence of a cap on the employer exclusion, the available revenue options will likely fall well short of filling the gap. The Administration has proposed raising $266 billion over ten years by capping itemized deductions for households with incomes over $250,000 at a 28-percent rate, but the proposal appears unlikely to pass in its current form. Variants of this idea, designed to address criticisms of the Administration’s proposal, can and should be considered but would raise significantly less money. For example, capping itemized deductions for households in the top two tax brackets at their current rates of 33 and 35 percent would save under $100 billion over ten years. [20]

Other revenue options that merit strong consideration include curbing FSAs and HSAs, increasing the federal excise tax on alcoholic beverages (which has eroded greatly in recent decades and will erode further if no action is taken), establishing an excise tax on highly-sweetened soft drinks (which contribute to obesity), and Administration proposals to close certain tax loopholes. [21] But all these measures combined, along with the Medicare and Medicaid savings, would likely fall far short of paying for health reform that attains universal or near-universal coverage.

Another way to raise significant revenue would be to apply the 1.45 percent Medicare payroll tax imposed on workers, as distinguished from the employer’s share, to all income, not just to wages and salaries. This option would extend the Medicare tax to capital gains, dividends, and other non-earnings income and would raise $38 billion a year, according to Citizens for Tax Justice. It would have the added benefit of helping to shore up the Medicare Hospital Insurance Trust Fund. But it is likely to be exceedingly difficult to enact.

The conclusion that emerges is that capping tax preferences for employment-based insurance, in a form that produces substantial revenues, is likely to be essential — along with other financing measures — if legislation to achieve universal coverage is to be paid for and, therefore, to become a reality at last.

End Notes:

[1] U.S. Congress, Joint Committee on Taxation (JCT), Estimates of Federal Tax Expenditures for Fiscal Years 2008-2012, Publication JCS-2-08, October 31, 2008, pp. 14-15.

[2] JCT, Tax Expenditures for Health Care, Publication JCX-66-08, July 30, 2008, p. 2. The estimate assumes that if the exclusion for employer-sponsored insurance were repealed, employees would not be permitted to deduct the premiums as medical expenses.

[3] U.S. Census Bureau, Income, Poverty, and Health Insurance Coverage in the United States: 2007 , August 2008, Publication P60-235.

[4] Mark Merlis, Simplifying Administration of Health Insurance, National Academy of Social Insurance and National Academy of Public Administration, January 2009.

[5] Leonard E. Burman, Bowen Garrett, and Surachai Khitatrakun, “The Tax Code, Employer-Sponsored Insurance, and the Distribution of Tax Subsidies,” in Henry J. Aaron and Leonard E. Burman, Using Taxes to Reform Health Insurance (Washington: Brookings Institution, 2008), p. 43.

[6] JCT, Tax Expenditures for Health Care, p. 12.

[7] Edwin Park, Administration’s Proposed Tax Deduction for Health Insurance Seriously Flawed, Center on Budget and Policy Priorities, July 31, 2007.

[8] Congressional Budget Office, Budget Options, Volume 1: Health Care, December 2007, option 9, p. 24.

[9] CBO, Budget Options, option 10, pp. 25-26.

[10] Paul Fronstin, Capping the Tax Exclusion for Employment-Based Health Coverage: Implications for Employers and Workers . Washington: Employee Benefit Research Institute, January 2009. EBRI Issue Brief No. 325.

[11] Chuck Marr and Kris Cox, Curbing Flexible Spending Accounts Could Help Pay for Health Care Reform, Center on Budget and Policy Priorities, May 27, 2009.

[12] Employees must spend all of their annual FSA contributions by March 15 of the following year or forfeit any remaining balance.

[13] Senate Finance Committee, Financing Comprehensive Health Care Reform: Proposed Health System Savings and Revenue Options, May 20, 2009.

[14] Jonathan Gruber, Statement for the Senate Finance Committee roundtable on financing comprehensive health care reform, May 12, 2009.

[15] Stan Dorn, Capping the Tax Exclusion of Employer-Sponsored Health Insurance: Is Equity Feasible?, Urban Institute, June 2009.

[16] American Academy of Actuaries, Critical Issues in Health Reform: Actuarial Equivalence, May 2009.

[17] Mary B.H. Hevener and Charles K. Kerby III, “Administrative Issues: Challenges of the Current System,” in Aaron and Burman, Using Taxes to Reform Health Insurance, p. 158.

[18] American Academy of Actuaries, Actuarial Equivalence.

[19] See Peter R. Orszag, “A Belt and Suspenders Approach to Fiscally Responsible Health Reform,” June 1, 2009, http://www.whitehouse.gov/omb/blog/09/06/01/ABeltandSuspendersApproachtoFiscallyResponsibleHealthReform, and Jonathan Weisman, “Jittery Bond Market Threatens President’s Agenda,” Wall Street Journal, May 30, 2009.

[20] After 2010, the tax rates in the top brackets will return to their pre-2001 levels of 36 percent and 39.6 percent. Under this option, itemized deductions would continue to be deducted at 33 percent and 35 percent rather than at 36 percent and 39.6 percent.

[21] Marr and Cox, Curbing Flexible Spending Accounts; Chuck Marr and Gillian Brunet, Reversing the Erosion in Alcohol Taxes Could Help Pay for Health Care Reform , Center on Budget and Policy Priorities, May 27, 2009; Chuck Marr and Gillian Brunet, Taxing High-Sugar Soft Drinks Could Help Pay for Health Care Reform , Center on Budget and Policy Priorities, May 27, 2009.

End Notes

* Elise Gould, How Capping the Tax Exclusion May Disproportionately Burden Children and Families, Economic Policy Institute and First Focus, May 2009. Gould examines the proposal by President Bush’s Advisory Panel on Federal Tax Reform, which failed to distinguish between family plans and individual-plus-one plans, and consequently would have disproportionately affected families with children.