- Home

- Tax Measures Help Balance State Budgets

Tax Measures Help Balance State Budgets

A Common and Reasonable Response to Shortfalls

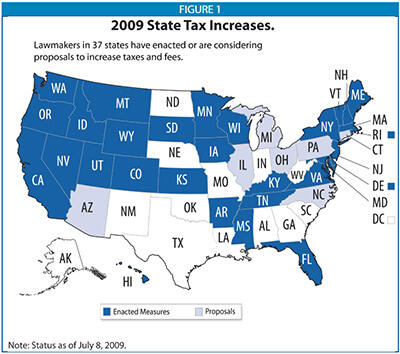

With the recession continuing to widen the gap between shrinking revenues and residents’ increasing need for services, a growing number of states are adopting a balanced approach to their budgets that includes revenue increases as well as spending cuts. Since January 1, 30 states have raised taxes and another seven states are considering doing so.

These steps are in addition to revenue actions taken by 10 states in late 2007 and 2008 as the recession’s effects began to be felt. Although some of these measures are relatively small in terms of the amount of revenue raised, others — such as packages in California, New York, and Oregon — are very significant.

The great majority of states have cut services to families and individuals, including services that benefit vulnerable families. But these cuts have not been sufficient to solve state budget shortfalls; their size is too great for a cuts-only strategy. Were states to rely on spending cuts alone to close their gaps, it would require unprecedented reductions in such essential public services as health care, education, and assistance for the elderly and disabled.

By July 1, the start of the fiscal year in all but four states, most states will have employed a combination of budget solutions that also involves drawing down reserve funds, maximizing the use of federal dollars, and raising taxes. A number of prominent economists have pointed out that budget cuts are more harmful to state economies during a recession than properly structured tax increases, so it is good policy to use tax increases to fill a substantial portion of deficits that exceed the amount that can be closed with reserves or federal funds.

Historically, raising taxes in a recession is a common response by states. During the recession of the early 1990s, 44 states raised taxes by a significant margin (at least 1 percent). In the recession of 2001, 30 states did so. These actions increased annual revenue collections by tens of billions of dollars. (States often go in the opposite direction during periods of strong economic growth: 36 states cut taxes from 1994 to 2001.)

Contrary to what some consider common wisdom, a tax increase can be good policy during a recession. Tax increases are a better option than deep spending cuts — better both for families already suffering due to the recession and for state economies. Tax increases can be designed in such a way that they impose relatively little or no costs on the most vulnerable families; this can be done, for example, by targeting the increase on households with the highest incomes or on profitable corporations. Moreover, as the economists Joseph Stiglitz and Peter Orszag (among others) have noted, tax increases take less money out of the economy than spending cuts, for reasons described more fully below.

One major factor that is reducing, though not eliminating, the need for tax increases in this recession is the American Recovery and Reinvestment Act (ARRA). Enacted in February 2009, it provides substantial money for state governments that includes roughly $140 billion to help alleviate budget shortfalls through funding for education, health care, and other government services. New York, for instance, scaled back the size of a proposed tax increase package by about $1.3 billion after the ARRA funding was announced.

Tax Increases in the Current Recession

So far this year, at least 30 states have enacted tax increases, and (as of July 8) another seven are considering such measures. [1] (See Figure 1.)

State tax increases began with the recession’s onset in late 2007, in order to preserve education, health care, and other services in the face of flattening or declining revenues. At least 10 states enacted tax and revenue measures in late 2007 or 2008. These included major revenue packages in Maryland, Michigan, and New York, and somewhat narrower measures in Alabama, California, Delaware, Massachusetts, New Hampshire, New Jersey, and Rhode Island. Many of those states have enacted or are considering further measures in 2009, reflecting the worsening of the recession.

Enacted Tax Increases In 2009

Tax increases enacted so far in 2009 include increases in personal income taxes (at least 11 states), sales taxes (12 states), business taxes (11 states), tobacco and alcohol taxes (15 states), motor vehicle taxes and fees (12 states), and others (15 states). Many states are raising more than one tax in order to diversify the new revenue sources and distribute the additional revenue collections more broadly.

Personal Income Taxes

Eleven states have enacted measures that will increase revenues from the personal income tax in fiscal year 2010. These changes include rate increases, the addition of new upper-income tax brackets, and reductions in various credits, exemptions, and deductions. Major income tax increases enacted in 2009 include:

- Along with cutting services by $14.9 billion, California enacted a 0.25 percentage point increase in each of the state’s income tax brackets. A tax credit for dependents was also reduced. Income tax measures are expected to increase tax revenues by more than $5 billion in the coming fiscal year.[2]

- Colorado ended taxpayers’ ability to deduct capital gains income derived from assets or businesses located within the state. This change will generate about $15.8 million per year in new income tax revenues.

- Delaware increased the top marginal tax rate by one percentage point to 6.95 percent on income over $60,000. This change will generate about $28.3 million in new revenues this year. Also, Delaware eliminated an exemption from taxes for lottery winnings.

- Faced with a $682 million shortfall in the 2010 fiscal year, Hawaii adopted a measure temporarily creating three new state income tax brackets. Beginning in tax year 2009, for married couples the rates will be 9 percent on income between $300,000 and $350,000; 10 percent between $350,000 and $400,000; and 11 percent rate for income above $400,000. Additionally, the state’s standard deduction and the personal exemption were each raised by 10 percent, which will lower tax bills for low- and moderate-income families. All of these changes are set to expire after tax year 2015. Hawaii’s previous top tax rate was 8.25 percent on all income over $96,000. All of these provisions are expected to increase tax revenues by nearly $100 million during the fiscal year 2009-2011 biennium.

- New Jersey temporarily increased income taxes on households with incomes above $400,000. For one year, the tax rate on joint filers with incomes between $400,000 and $500,000 will rise to 8 percent from 6.37; the rate on income between $500,000 and $1 million will increase to 10.25 percent from 8.97 percent; and a 10.75 percent rate will apply to income over $1 million. These changes will generate about $1 billion in fiscal 2010.

- New York State also faced a sizable gap — 29 percent — in the state’s fiscal 2010 budget. As part of a budget-balancing package that included both cuts in services and tax increases, in April New York enacted two new temporary income tax rates levied on the highest-income filers. For households with taxable income above $500,000, regardless of filing status, the tax rate rises to 8.97 percent from 6.85 percent; for those with taxable income below $500,000 but above $200,000 for single individuals, $250,000 for heads of households, and $300,000 for married couples filing joint returns, the rate increases to 7.85 percent from 6.85 percent.

In addition, New York placed limits on itemized state income tax deductions for taxpayers making over $1 million and reduced a state-funded credit on New York City’s personal income tax. The changes are projected to raise more than $5 billion a year. - The Oregon legislature approved and the governor has indicated his intention to sign a measure adding two brackets at the top of the state’s income tax structure. Married couples will pay 10.8 percent on income between $250,000 and $500,000; and 11 percent on income over $500,000. These rates will be in effect through 2011. After 2011, the top rate will fall to 9.9 percent for joint filers with incomes over $250,000. These changes are projected to generate more than $230 million in each of the next two fiscal years. Oregon’s previous top rate was 9 percent on all income over $15,200. However, if enough valid signatures are gathered the measures will not go into effect unless approved by the voters in January 2010.

- Rhode Island enacted legislation that will treat capital gains income as ordinary income for tax purposes. Previously, capital gains were given preferential treatment, taxed at rates as low as 0.83 percent.

- Vermont enacted a budget that includes several major changes to the state’s income tax structure. Although all income tax rates were lowered, net revenue will increase. This is for two reasons. One, the package eliminated a 40 percent exemption on capital gains income, replacing it with a flat exemption of $2,500. This new exemption will rise to $5,000 beginning in tax year 2011. And, two, lawmakers capped the amount of state and local income taxes that can be deducted from federal adjusted gross income at $5,000. On net, income tax provisions in Vermont will raise $9 million in new revenue in fiscal year 2010.

- By restructuring a credit for land preservation, Virginia raised income tax revenues by $75 million per year.

- Wisconsin enacted a new 7.75 percent income tax bracket on all income over $300,000 for married couples and $225,000 for individuals and heads of households. And the exclusion for capital gains income was lowered to 30 percent from 60 percent. These changes will generate about $280 million in fiscal 2010.

Sales Taxes

In 2009, 12 states have increased sales tax revenues by such means as raising rates, expanding the tax base to cover previously untaxed goods and services, and administrative changes. The following sales tax increases occurred:

- California enacted a temporary 1 percentage point increase in the sales tax rate, which is expected to generate about $4.5 billion in fiscal 2010.

- The sales tax was extended to the sale of tobacco products in Colorado. The state also enacted legislation temporarily reducing the rate at which it reimburses retailers for collecting sales taxes. These measures will generate nearly $70 million in the coming fiscal year.

- Kentucky extended the state’s sales tax to include alcoholic beverages. The change will generate about $52 million each year.

- As part of a large package of tax changes, Maine expanded the sales tax to include amusement parks and sporting events and a range of maintenance and service transactions including auto repair and dry cleaning. (The package also replaced the state’s graduated income tax structure with a flat 6.5 percent rate plus a 0.35 percentage point surcharge on income over $250,000.) In total, compared to current law, tax revenues will be modestly higher in fiscal 2010 as a result of these changes.

- Massachusetts raised about $760 million in fiscal 2010 by increasing the sales tax rate by 1.25 percentage points to 6.25 percent. An exemption on alcoholic beverages was eliminated, generating about $79 million in new revenues this year.

- In Nevada, the sales tax rate was temporarily increased to 6.85 percent from 6.5 percent. This change will raise revenues by $280 million over the next two years.

- New York raised sales tax revenues by about $35 million by taxing a broader range of companies previously selling tax-free over the Internet, and certain types of transportation services like limousine and car hires.

- Rhode Island enacted legislation requiring certain companies to collect sales taxes on goods purchased over the Internet.

- Tennessee extended the sales tax to include software maintenance contracts and limited an exemption on computer software. These changes will generate about $10.5 million per year in new revenues.

- Vermont expanded the sales tax to include liquor and digital downloads, raising over $3 million in new revenues in fiscal 2010.

- Washington State eliminated a sales tax exemption on hybrid vehicles and enacted legislation designed to curtail abuse of certificates that allow businesses that buy products for resale to avoid paying the retail sales tax. These measures will increase sales tax revenues by about $70 million.

- Wisconsin entered the multi-state Streamlined Sales and Use Tax Agreement (SSUTA) — a compact that simplifies sales tax collections for participating businesses. The state also altered its method for taxing prewritten computer software and expanded the sales tax to include digital products, such as music and video downloads and subscriptions to online periodicals. The amount of sales tax revenues that retailers are allowed to retain for administrative expenses was capped at $1,000. The state eliminated the ability of certain parent companies to avoid paying sales taxes on purchases made by subsidiaries. Sales tax revenues will rise by nearly $60 million in fiscal 2010 as a result of these actions.

Business Taxes

At least 11 states have enacted business tax increases:

- Delaware increased the maximum corporate franchise tax to $180,000 from $165,000 and raised numerous business and occupation gross receipts tax rates. The public utilities gross receipts tax was extended to include direct-to-home satellite services.

- Iowa placed limits on the size of five costly business tax credits, saving the state about $18 million in fiscal year 2010.

- Kansas suspended its film production credit for two years. For dozens of other credits, the state temporarily reduced the amount firms can claim by 10 percent. In the next fiscal year, these changes will increase revenues by over $10 million.

- Maryland tightened the cap on corporate income tax credits for mined coal, which will increase business tax revenues by $9 million in fiscal 2010.

- Nevada altered its business payroll tax, generating $346 million in new revenue in the fiscal 2010-2011 biennium. For non-financial businesses, the tax rate on the first $250,000 in payroll is lowered to 0.5 percent from the flat rate of 0.63 percent. The tax rate on payroll over $250,000 rises to 1.17 percent.

- The interest and dividends tax in New Hampshire was extended to include profits of limited liability companies and other types of entities. The state’s business profits tax filing threshold was changed; all businesses, regardless of their income level, are now required to file a return. These changes will increase business tax revenues by about $21 million each year.

- New York imposed a new fee on certain business partnerships and restructured the business tax benefits administered through the “Empire Zone” program.

- In Oregon, the legislature approved and the governor has indicated his intention to sign a measure creating a second, 7.9 percent corporate income tax rate on businesses with taxable income above $250,000. This rate will be in effect for 2009 and 2010, and will fall to 7.6 percent for 2011 and 2012. After 2012, the 7.6 percent rate will be applied to all taxable income over $10 million. The minimum corporate income tax was increased depending on the amount of sales in Oregon. For a firm with more than $100 million in Oregon sales, the minimum tax is now $100,000. Previously, the minimum tax was $10. These changes will increase business tax revenues by more than $300 million in the fiscal 2010-2011 biennium. However, if enough valid signatures are gathered the measures will not go into effect unless approved by the voters in January 2010.

- Tennessee increased franchise and excise tax revenues by eliminating an exemption on rental income earned by certain non-corporate businesses. This change increased revenues by more than $25 million per year.

- The corporate income tax in Virginia was expanded to include investment income from Real Estate Investment Trusts (REITs). About $5 million in new revenues will be generated as a result of this change.

- Wisconsin instituted “combined reporting,” which increases revenue by requiring companies with subsidiaries to calculate their profits as one sum instead of allowing various entities to report separately and claim numerous deductions. One result is that in-state and multi-state corporations will be taxed more equivalently. Under combined reporting, corporate income tax revenues will increase by over $75 million in fiscal 2010. The state also generated about $45 million per year in new tax revenues by adopting a “throwback rule” — a provision of state corporate income tax laws that ensures that profits made in a state in which a corporation may be exempt from income tax are taxed instead by its home state.

Tobacco and Alcohol Excise Taxes

At least 15 states have increased excise taxes on tobacco and alcoholic beverages.

- Arkansas raised the cigarette tax by 56 cents, to $1.15 per pack. The tax on other tobacco products was increased to 68 percent from 32 percent of the wholesale price. These changes are expected to generate over $85 million per year in new tax revenue.

- Delaware increased the tax on cigarettes to $1.60 from $1.15 per pack.

- Florida enacted legislation adding a $1 surcharge to the tax on each pack of cigarettes. A surcharge equal to 60 percent of the wholesale price also was imposed on other tobacco products. These surcharges will increase tax revenues by nearly $1 billion in the coming fiscal year.

- Hawaii increased the cigarette tax by 2 cents per pack. The state also increased taxes on other tobacco products by various levels. Depending on the product, taxes on tobacco other than cigarettes will range up to 70 percent of wholesale price; the previous rate was 40 percent of the wholesale price. These changes will increase tax revenues by nearly $50 million in the upcoming fiscal 2010-2011 biennium.

- Kentucky doubled its cigarette tax to 60 cents per pack from 30, which will raise more than $106 million a year.

- Maine changed how it taxes smokeless tobacco products. Previously, the state taxed them at 78 percent of the wholesale price. Beginning in fiscal 2010, taxes on smokeless tobacco will be based on weight, at a rate of $2.02 per ounce. Tobacco tax revenues will increase by about $2 million in the upcoming fiscal year.

- Mississippi increased the cigarette tax to 68 cents per pack from 18 cents, which is expected to raise more than $100 million in fiscal 2010.

- New Hampshire increased the cigarette tax to $1.78 from $1.33 per pack — a change that will increase revenues by $35.2 million in fiscal 2010.

- New Jersey increased the cigarette tax by 12.5 cents to $2.70 per pack and increased the tax on alcoholic beverages, excluding beer, by 25 percent. These changes will generate about $50 million in new tax revenues this year.

- New York raised $14 million in new revenue by increasing the state excise tax on beer and wine to 30 cents per gallon from 18.9. The method for taxing cigars was changed to generate about $10 million in fiscal 2010.

- Oregon added surcharges of 50 cents on distilled liquor and 25 cents on miniature bottles through June 2011, increasing revenues by about $24 million in fiscal 2010.

- Rhode Island increased its cigarette tax by $1 to $3.46 per pack.

- The cigarette tax in Vermont was increased by 25 cents, to $2.24 per pack from $1.99. The tax on other tobacco products rises to 92 percent from 41 percent of the wholesale price. These changes will increase tax revenues by about $6 million in fiscal 2010.

- Wisconsin increased the cigarette tax by 75 cents to $2.52 per pack and changed the method of taxing moist snuff. These changes will increase revenues by about $170 million each year.

- Wyoming changed its method for taxing moist snuff tobacco, basing it on net weight. This is expected to generate about $820,000 in new tax revenues each year.

Motor Vehicle License Fees & Gasoline Taxes

Twelve states have increased various fees and taxes related to motor vehicles and fuels:

- California temporarily increased vehicle license fees to 1.15 percent of value from 0.65 percent, raising about $1.7 billion in new revenues each year in fiscal years 2010 and 2011.

- Colorado raised several fees, fines, and surcharges to support transportation improvements and instituted a $2 per day rental car fee. These changes will generate about $250 million in new tax revenues in fiscal 2010. Additionally, a motor vehicle fee to support local emergency services was increased to $2 from $1.

- Florida increased a variety of vehicle registration and license fees, raising over $1 billion in new revenues each year.

- Idaho added fees for driver’s licenses, vehicle title transfers, copying records, and replacing registration stickers. Additionally, a 2.5 cent per gallon tax exemption for biodiesel and gasohol was removed. These changes will generate about $30 million in new revenues beginning in fiscal 2010.

- Montana removed an exemption valued at 0.0401 cents per gallon on motor fuels blended with ethanol. The measure will raise about $6.4 million in new revenues each year.

- Nevada altered the rate at which vehicles depreciate in value for purposes of the registration tax. The minimum vehicle registration tax was increased to $16 from $6. These changes will increase revenues by about $94 million in fiscal 2010.

- By temporarily increasing a number of fees related to motor vehicle and trailer registrations, New Hampshire will increase revenues by more than $40 million in fiscal years 2010 and 2011. Fees charged to insurance agents for obtaining vehicle records were increased along with fees for vanity license plates. These changes will generate about $5 million per year in new revenues.

- New York added an auto rental excise tax which will generate up to $8 million in fiscal 2010.

- In Oregon, the legislature approved and the governor has indicated his intention to sign a measure increasing the excise tax on gasoline by 6 cents to 30 cents per gallon and raising a range of fees — including on motor vehicle registrations and titles, road assessment, identification cards, and others. These changes will increase revenues by more than $400 million in the fiscal 2010-2011 biennium. However, if enough valid signatures are gathered the measures will not go into effect unless approved by the voters in January 2010.

- Rhode Island increased the tax on gasoline by 2 cents to 33 cents per gallon.

- In South Dakota, about $4.2 million in new annual revenues was generated through a $1 increase in commercial and noncommercial vehicle license fees.

- Utah increased some motor vehicle fees by $20, which will generate about $53 million per year.

Other Taxes and Fees

- Colorado increased hospital provider fees, generating about $390 million each year to expand medical assistance programs.

- Florida increased fees on slot machine licenses, park admission, and off-shore fishing licenses, among other transactions and activities.

- Hawaii increased the motel room tax by one percentage point to 9.25 percent. The state also increased conveyance tax rates on property transfers worth more than $1 million.

- Iowa increased a number of court fees, including those for divorce filings and real estate title transfers. This is expected to generate about $17 million in fiscal year 2010.

- Maine increased license fees for hunting, fishing, and archery. Several residential and business property tax credits were reduced.

- Massachusetts imposed a five percent excise tax on satellite broadcast services. This will increase revenues by nearly $26 million in fiscal year 2010.

- Minnesota reduced a property tax refund for low- and moderate-income renters, saving the state $51 million in the upcoming fiscal biennium. [3]

- Montana changed laws requiring tax information agents to report certain real estate transactions, which will generate about $900,000 in fiscal 2011.

- New Hampshire increased the excise tax on hotels and meals to 9 percent from 8 percent and extended the tax to campsites. A new 10 percent tax on gambling winnings was enacted. These changes will increase revenues by about $40 million per year.

- New Jersey increased the insurance premium tax to 1.35 percent from 1.05 percent, increasing revenues by $15-17 million in fiscal 2010. A new 5 percent tax on lottery winnings over $10,000 was enacted.

- New York eliminated a property tax rebate for homeowners with incomes below $250,000. This will save the state about $1.4 billion per year.

- In Oregon, the legislature approved and the governor has indicated his intention to sign a measure creating a one percent assessment on certain health insurance premiums and on capitation payments to Medicaid managed care organizations, generating over $306 million in new revenues for the fiscal 2010-2011 biennium.

- In Tennessee, the gross receipts tax on health maintenance organizations (HMOs) was increased to 5.5 percent from 2 percent, a change that will increase revenues by more than $136 million each year.

- South Dakota increased its gross receipts tax on gaming proceeds to 9 percent from 8 percent. Additionally, several excise taxes on activities related to tourism — motel stays, event tickets, and campsite fees — were temporarily increased. These increases will generate about $4 million in new revenues each year in fiscal 2010 and 2011.

- Wisconsin is imposing hospital assessment taxes based on gross patient revenues The state also increased the nursing home assessment to $170 from $75 per bed. Annually, this will increase revenues by over $330 million.

Tax Increases under Consideration

In addition to the 30 states that have enacted tax increases, policymakers in another seven states had before them proposals to do so as of early July. As budget deliberations continued, these states had on the table tax increases that were either included in executive budget proposals or supported by legislative leaders: Arizona, Connecticut, Illinois, Michigan, North Carolina, Ohio, and Pennsylvania.

Tax Increases in Past Recessions

For states to raise taxes in this recession is consistent with the experience of the past two recessions.

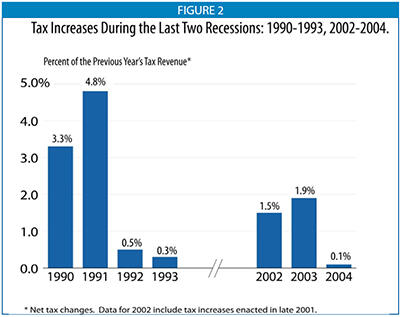

- In response to the recession of 1990-91, 44 states increased taxes significantly.[4] From 1990 to 1993, 26 states increased personal income taxes or corporate income taxes and 37 increased sales or excise taxes. In aggregate, states enacted more than $25 billion in net tax increases. The new taxes raised total state tax revenues by about 8.9 percent during the period. (See Figure 2.)

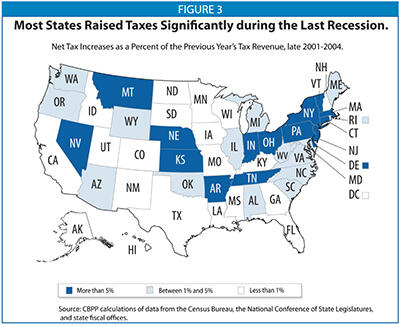

- In the wake of the recession of 2001, 30 states raised taxes. In 15 of them, tax increases were very significant, with revenue increases of more than 5 percent. Another 15 states enacted tax increases of between 1 percent and 5 percent of total state revenues. In total, states increased net revenues by about 3.5 percent, or about $18.6 billion, from late 2001 to 2004. Of the 30 states with significant tax increases during this period, 10 raised personal income taxes, 16 raised taxes on businesses and corporations, 16 increased sales tax rates or broadened the base to include more goods and services, and 29 raised excise taxes on tobacco products or alcohol.

The tax increases occurred in a diverse group of states. States raising taxes during each of those periods included those with Democratic governors or legislatures and those led by Republicans. States in all regions of the country raised taxes. By most standards, the recessions of 1990-91 and 2001 were relatively mild. Had the recessions been more severe, the tax increases likely would have been greater.

Is It Good Policy for States to Raise Taxes in a Recession?

During a recession, unemployment rises, families have a harder time paying for necessities, and many either lose or can no longer afford health coverage. By raising taxes, states can help ensure that those families and individuals hurt most by the recession do not face even more difficulties because of cuts in government programs and services they need, including those involving assistance with housing and health care, or access to higher education. Unfortunately, many of the spending cuts that states have enacted or are considering would have the most harmful impact on low- and moderate-income families and others hit hard by the recession. Tax increases can avert such cuts.

Tax increases have another advantage over spending cuts: they are often better for a state’s economy. During recent deliberations in New York over how to close a growing budget gap, Governor Paterson and the legislature received a letter from 120 economists in the state. Citing “economic theory and historical experience,” the letter observed that “raising taxes during a downturn — particularly taxes that affect only higher-income families — is generally better for a state’s economy, and better for its citizens, than sharp budget cuts.”

The letter went on:

“The reasons are simple. Almost every dollar that states and localities spend on aid for the needy, salaries of public employees, and other vital services enters the local economy immediately. So if states cut their spending in these areas, overall demand suffers at a time when demand is already too low and support services are most needed.

“The alternative — raising taxes — also reduces spending, but by less than budget cuts of comparable size. And by targeting these taxes appropriately, their negative effects can be minimized. For example, high-income households typically spend only a fraction of their income and save the rest. As a result, each $1 increase on taxes on high-income households will reduce their spending by much less than $1.” [5]

The letter echoed the conclusions of a paper written during the last recession by Columbia University professor and Nobel Prize winner Joseph Stiglitz and Peter Orszag, now director of the U.S. Office of Management and Budget, asserting that spending cuts can be more harmful for a state’s economy in a recession than tax increases.[6]

The Recent Economic Experience of States That Raised Taxes in Recession

The recession of 2001 hit some states harder than others. As a result, some states raised taxes while others did not. But there is no evidence that tax-raising states were any faster or slower to recover from the recession than those that did not raise taxes. States that raised taxes were just as fast to rebound from the recession as states that did not, even though they were typically climbing out of a deeper hole.

| TABLE 1: | ||

| Average Annual Growth Rates | ||

| Indicator | States that Increased Taxes Significantly | National Average |

| Total Personal Income | 6.1% | 6.2% |

| Employment | 1.6% | 1.7% |

| Median Wage | 3.1% | 3.1% |

| Source: Bureau of Labor Statistics, Bureau of Economic Analysis, and CBPP calculations of data from the NCSL and state revenue departments. Note: States were grouped according the amount of gross tax increases between late 2001 and 2004. States that increased taxes significantly are those | ||

As Table 1 shows, states that had enacted significant tax increases (more than 1 percent of revenues) in the 2002-04 period saw growth rates in personal income, employment, and the median wage from 2004 to 2007 that closely matched national averages. Furthermore, a number of states that enacted significant tax increases during the early 2000s subsequently experienced above-average growth in these key economic indicators.

- North Carolina, for example, raised taxes by about 3.5 percent of revenues during the last downturn. From 2004 to 2007, total personal income in the state grew by about 6.7 percent each year compared to the nationwide rate of 6.2 percent during this period. North Carolina experienced faster-than-average growth in employment following the last recession, growing about 2.5 percent each year from 2004 to 2007. Nationwide, employment grew at an annual rate of 1.7 percent during this period.

- Similarly, growth in total personal income and employment from 2004 to 2007 exceeded national averages in South Carolina, Virginia, and Washington — all of which enacted significant tax increases during the recession of the early 2000s.

On the other hand, a number of states that did not raise taxes, or cut them, during the last recession subsequently saw slower-than-average economic growth. Among them are Iowa, Kentucky, Minnesota, Missouri, New Hampshire, and Wisconsin. Those states’ decision to avoid tax increases (and, in some cases, to enact large cuts in services) failed to protect them from below-average growth in both personal income and employment during the subsequent period.

In short, neither economic theory nor experience supports the idea that states should shy away from raising taxes in a recession for fear of harming their economic performance.

Federal Economic Recovery Act Funding Is Reducing But Not Eliminating the Need for Tax Increases

In the current recession, state budget shortfalls are projected to exceed $350 billion over the next two-and-a-half years. Even with assistance from the federal stimulus legislation (the American Recovery and Reinvestment Act), states will continue to face large budget gaps. The $135 billion to $140 billion that ARRA provides states to help balance budgets is expected to cover only about 40 percent of aggregate shortfalls. [7] The remaining shortfalls are still too large to close with budget cuts alone; tax increases should remain on the table in most states. Indeed, most of the tax increases described earlier in this paper were proposed and/or enacted after passage of ARRA.

There is another reason that states may wish to consider raising revenues in tandem with using ARRA funds. Tax increases can be structured to be a recurring revenue source. By contrast, the ARRA funds that states can use to balance their budgets generally are available only until state fiscal year 2011, so federal aid to states likely will return to pre-ARRA levels starting in 2012. States that increase taxes to close a portion of their 2010 and 2011 gaps will find it easier to adjust to the loss of federal revenues in 2012 because they will have the recurring tax revenues to fall back on.

Funding For States in Economic Recovery Package Will Close Less Than Half of State Deficits

End Notes

[1] This analysis attempts to capture states that have enacted or are considering measures that will increase net tax revenues relative to current law. Because some states have yet to adopt their budget for fiscal year 2010, these results are subject to change. A previous version of this analysis included Georgia as having enacted tax increases. Since then, Georgia enacted a number of tax cuts, resulting in a net decrease in total tax revenues, and was removed from the current analysis.

[2] These measures were enacted in February with the goal of balancing the state’s FY 2010 budget. The deepening recession, however, has thrown the budget out of balance again, necessitating additional spending cuts and/or revenue increases (probably both).

[3] The reduction in the property tax refund was not passed by the Minnesota legislature, but is scheduled to take effect in FY2010 through a process known as “unallotment,” a constitutional provision allowing Minnesota’s governor to make unilateral cuts when the state faces a budget deficit.

[4] Nicholas Johnson and Daniel Tenny, “The Rising Regressivity of State Taxes,” Center on Budget and Policy Priorities, January 15, 2002, https://www.cbpp.org/sites/default/files/atoms/files/1-15-02sfp.pdf. A “significant” tax increase is one that exceeds 1 percent of a state’s tax revenue.

[5] See letter dated December 13, 2008, available on the Fiscal Policy Institute website, www.fiscalpolicy.org.

[6] Peter Orszag and Joseph Stiglitz, “Budget Cuts vs. Tax Increases at the State Level: Is One More Counter-Productive than the Other during a Recession?” Center on Budget and Policy Priorities, revised November 6, 2008, https://www.cbpp.org/sites/default/files/atoms/files/10-30-01sfp.pdf. Of course, it would be preferable if states had to neither make large spending cuts nor raise taxes, but that is not an option for most states.

[7] Nicholas Johnson, Iris J. Lav, and Elizabeth McNichol, “Funding For States in Economic Recovery Package Will Close Less Than Half of State Deficits,” Center on Budget and Policy Priorities, February 20, 2009, www.cbpp.org/2-20-09sfp.htm.

More from the Authors

Recent Work: