Top 1 Percent of Americans Reaped Two-Thirds of Income Gains in Last Economic Expansion

Income Concentration in 2007 Was at Highest Level Since 1928, New Analysis Shows

End Notes

[1] Piketty and Saez rely on detailed Internal Revenue Service micro-files for available years, extending the full series to 1913 using aggregate data and statistical techniques. Their August 2009 revision incorporates the detailed micro-files for 2007 that just became available. For details on their methods, see Thomas Piketty and Emmanuel Saez, “Income Inequality in the United States: 1913-1998,” Quarterly Journal of Economics, February 2003, or, for a less technical summary, see http://elsa.berkeley.edu/~saez/saez-UStopincomes-2007.pdf. Their most recent estimates are available at http://elsa.berkeley.edu/~saez/TabFig2007.xls.

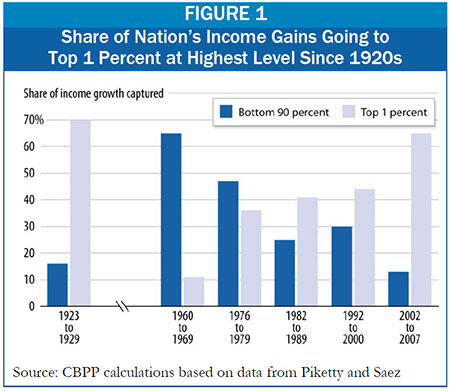

[2] According to the National Bureau of Economic Research, the last economic expansion began in November 2001 and ended in December 2007. However, the real income of the top 1 percent of households did not reach a trough until 2002 and that of the bottom 90 percent until 2003. For the purposes of this paper we measure income growth between 2002 and 2007. If we had chosen 2001 as the base year, the share of income gains accruing to the top 1 percent would have been 76 percent and that of the bottom 90 percent would have been 2 percent. If we had chosen 2003, those respective shares would have been 59 percent and 20 percent.

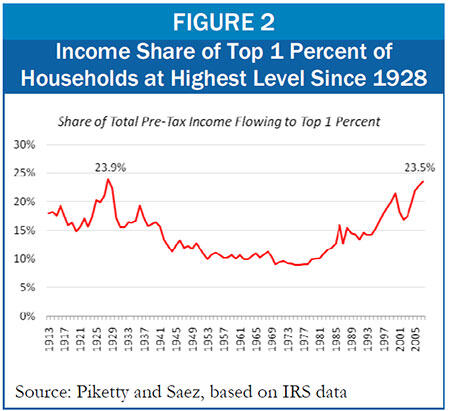

[3] Piketty and Saez present three different data series, each of which uses a different income concept and therefore yields somewhat different estimates of the share of income going to each group. (For example, estimates of the share of income going to the top 1 percent in 2007 range from 18.29 percent in one series to 23.50 percent in the series we rely on here to 20.33 percent in the third series.) We follow the income concept in Saez’s most recent report and focus on the series that includes capital gains income both in ranking households and in measuring the income that households receive. This definition of income corresponds most closely to adjusted gross income (AGI), although it has the disadvantage of fluctuating with the stock market.

Piketty and Saez also present a data series that includes capital gains income but ranks households without capital gains, as well as a series that excludes capital gains altogether. All three data series yield similar results. For example, in 2007, under both income concepts that include capital gains income, the share of income flowing to the top 1 percent was at its highest level since 1928. Under the income concept that excludes capital gains, the income share going to the top 1 percent was at the highest level since 1929.

[4] Different data series show modestly larger or smaller gains for the bottom 90 percent, but all series show a similar discrepancy between the bottom 90 percent and the top 1 percent.

[5] Saez details his prediction for trends in income concentration in the public summary of his work (supra note 1). Katz is quoted in David Leonhardt and Geraldine Fabrikant, “Rise of the Super-Rich Hits a Sobering Wall,” New York Times, Aug. 20, 2009.