- Home

- Very Few Small Business Owners Would Fac...

Very Few Small Business Owners Would Face Tax Increases Under President's Budget

Vast Majority Would Benefit from Other Key Proposals

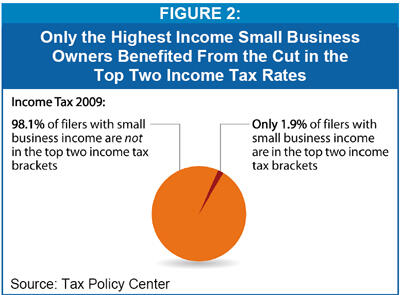

Some critics of the President’s budget charge that his proposals to roll back tax breaks for taxpayers with incomes over $250,000 would harm small businesses. In fact, only 8.9 percent of people with any small business income have incomes of over $250,000 and, thus, would even potentially be affected by these provisions. (See Figure 1.) And that figure substantially overstates the percentage of people with small business income who would actually be affected by these provisions; for example, only 1.9 percent of people with such income currently are in a tax bracket with a rate higher than 28 percent. As a result, the percentage of people with small business income who would be affected by proposals to increase the top two tax rates or limit the value of itemized deductions to 28 percent of deductable expenses would be extremely small.

Furthermore, even these estimates, from the Urban Institute-Brookings Institution Tax Policy Center, may overstate the impact of these provisions because they are based on the previous administration’s definition of “small businesses,” which includes investors in small businesses who have little or no role in managing them.[1] (For more on this point, please see the box below.)

Indeed, the vast majority of small business owners and their employees would benefit from proposals in the budget to cut taxes for middle-class taxpayers, such as extending the Making Work Pay tax credits enacted on a temporary basis earlier this month in the American Recovery and Reinvestment Act. In addition, most small businesses and their employees are likely to benefit from non-tax proposals in the budget, particularly the President’s proposal to reform the health care system by expanding health insurance coverage and making health care more affordable.

In the face of some critics’ dire predictions of how the President’s budget would affect small businesses, this paper examines the likely actual impact on small business of his proposals to: (1) allow the top two individual income tax rates to return to the levels in law before 2001, (2) limit itemized deductions claimed by high-income taxpayers, (3) eliminate a special tax break for private equity firm managers, and (4) reform the health care system and to help expand the availability of credit for small businesses.

Restoring the Top Two Tax Rates

The President’s budget proposes allowing the tax cuts enacted in 2001 and 2003 that lower the top two individual income tax rates to expire at the end of 2010 as scheduled, but only for families earning more than $250,000 per year or single filers earning more than $200,000 per year.

Restoring the top two tax rates as proposed would affect fewer than 1.9 percent of filers with any small-business income in 2009 (see Figure 2 and box on page 4).[2] This is less than the percentage of small business filers with cash income of more than $250,000 per year, because many filers with income greater than $250,000 in cash income do not face either of the top two tax rates. This measure would save tax revenues of $339 billion over ten years.

Limiting Deductions and Exemptions for High-Income Taxpayers

The President’s budget also proposes to cap the tax benefit from itemized deductions taken by families with incomes over $250,000 a year (and single filers with incomes over $200,000) at 28 percent of deductible expenses. The revenues this provision would produce would be dedicated to helping fund health care reform. The President’s budget would also restore two provisions enacted as part of 1990 bipartisan deficit reduction legislation: a provision placing certain limits on the value of itemized deductions for high-income taxpayers (known as the “Pease” provision), and a phase-out of the personal exemption at high-income levels (known as the PEP provision). The 2001 tax cuts gradually eliminated these two provisions. The President’s budget would reinstate these provisions after 2010 but modify them so they apply only to families making over $250,000 (and single filers making over $200,000).

These provisions would affect very few taxpayers — and even fewer small business owners. According to Tax Policy Center estimates, only about 9 percent of taxpayers who have any small business income have cash incomes greater than $250,000 and would even potentially be affected by these provisions, and as noted above the percentage actually affected would be smaller.

Together, the new limitation on the benefits of itemized deductions and the restoration and modification of the Pease and PEP provisions would save an estimated $496 billion over ten years.[3]

Eliminating Unwarranted Tax Break for Hedge-Fund Managers

The President’s budget would no longer allow private equity fund managers with multi-million-dollar incomes to pay a lower tax rate on their earnings than most middle-income Americans. Despite some claims to the contrary, this proposal would have virtually no impact on small businesses.

Currently, executives who manage investment funds are able to receive a portion of their compensation in the form of “carried interest” (i.e., a share of the profits of the investment fund) and pay tax on it at the capital gains tax rate, which is typically much lower than the marginal income tax rate they pay on wages, salaries, and other earnings. This loophole is unwarranted. While these executives’ compensation is calculated as a percentage of the investment fund’s profits, the executives cannot be viewed as receiving capital gains on money they have invested — because they have not contributed their own capital to the fund.

The President’s budget would tax carried interest compensation at the same rates as ordinary income.[4] This would affect only individuals who provide investment management services and are paid in the form of carried interest. It would have no effect on small-business proprietors or individuals starting up small businesses (except for people who set up and run investment management firms). Indeed, when the director of Congress’s Joint Committee on Taxation was asked about a similar proposal’s impact on “mom and pop” operations, he jokingly replied, “mom and pop private equity firms?

This provision would save about $24 billion over ten years.

Health Reform and Other Provisions Will Benefit Small Businesses

The Administration’s efforts to make health insurance universal and affordable should benefit small businesses and their employees. At present, small employers pay more and get less for their health insurance dollars. The administrative costs of health insurance are considerably greater for small businesses than for large firms. If an employee or dependent incurs unusually high health expenses, a small employer may find that health insurance is unavailable or is priced out of reach. As a result, small firms are much less likely than large firms to offer health benefits to their workers.

When they do offer health benefits, the plans are generally less comprehensive and have higher deductibles. Workers with family coverage in small firms contribute significantly more to the cost of insurance than workers with family coverage in large firms. A reformed health care system would help ensure that small businesses will no longer be at a disadvantage in providing affordable, comprehensive coverage to their workers.

Number of Small Business Owners Affected Likely Even Smaller Than Estimates Suggest

As noted in footnote 1, the Tax Policy Center estimates cited in this paper use the previous administration’s expansive definition of “small business owners,” which includes taxpayers with income from investments in small businesses who play no role at all in the management or operation of the business.These taxpayers include a number of wealthy investors who receive only a small portion of their total income from their small business investments. Excluding such passive investors would lower the percentage of “small business owners” affected by the proposals in the President’s budget that are targeted on high-income taxpayers.

It also should be noted that the TPCestimate cited here that 8.9 percent of people with small business income have incomes over $250,000 is an overstatement of the percentage of small businesses that might be potentially affected by the proposals in the President’s budget that are targeted on high-income tax payers.The proposals in the President’s budget affect only families with adjusted gross income (AGI) of more than $250,000 and single filers with AGI of more than $200,000 The TPCestimates, however, use a broader measure of income called cash income, which includes contributions to tax-deferred retirement accounts and other types of income that are not part of AGI. Thus, TPC’s estimates of the number of tax units with cash income above $250,000 include a number of filers who have AGIof less than $250,000, and consequently would not be affected by the President’s proposals.

The Administration is also taking several steps to expand the availability of credit for small businesses and help them survive the current credit crunch. The Small Business and Community Bank Lending Initiative — part of the Administration’s Financial Stability Plan — will finance the purchase of Small Business Administration (SBA) loans to unfreeze secondary markets for those loans. The recently enacted economic recovery legislation increases the guarantee of SBA loans to 90 percent to help encourage lenders to make those loans. In addition, the President’s 2010 budget would provide $28 billion in SBA loan guarantees.

Finally, the Administration’s budget proposes to eliminate capital gains taxation on small businesses at a cost of $7 billion over ten years.

Conclusion

Despite claims to the contrary, the President’s proposals concerning the top two income tax rates, limitations on itemized deductions and personal exemptions, and the carried interest tax break would affect only a very small fraction of small business owners. In fact, most small businesses would benefit substantially — from proposals to provide tax cuts to lower- and middle-income tax payers in the form of the Making Work Pay tax credit and to reform the health care system.

Moreover, the proposals to roll back tax breaks for high-income taxpayers would address regressive, costly, and in some cases unwarranted tax expenditures. Given the nation’s serious long-term budget problems, tax expenditures of this sort must be “on the table” for reductions as part of efforts to restore fiscal responsibility.[5]

End Notes

[1] The statistics cited in this paper adopt the Bush Administration’s definition of a small business as any tax unit that receives any income (or loss) from a sole proprietorship, farm proprietorship, partnership, S corporation, or rental income. For reasons why this definition is overbroad, see Chye-Ching Huang and James R. Horney, “Big Misconceptions about Small Business and Taxes,” Center on Budget and Policy Priorities, Updated February 2, 2009. As discussed in that paper, that definition of “small businesses” is more likely to include high-income taxpayers who do not conform to the typical conception of a “small business owner” than it is to erroneously count low-income taxpayers, due to the increasing prevalence of passive investment income at higher income levels.

[2] Urban Institute and Brookings Institution Tax Policy Center estimates.

[3] For a more detailed explanation of the PEASE and PEP provisions and their distributional impacts, see Aviva Aron-Dine and Robert Greenstein, “Two High Income Tax Cuts Not Yet Fully In Effect Will Cost Billions Over the Next Five Years,” Center on Budget and Policy Priorities, February 1, 2007.

[4] For a detailed discussion of the proposal to tax carried interest compensation at regular income tax rates, see Aviva Aron-Dine, “An Analysis of the ‘Carried Interest’ Controversy”, Center on Budget and Policy Priorities, revised August 1, 2007.

[5] Chye-Ching Huang and Hannah Shaw, “New Analysis Shows ‘Tax Expenditures’ Overall are Costly and Regressive: Findings Highlight Need to Restrain Tax Subsidies As Part of Solution to Long-Term Budget Problems,” February 23, 2009.

More from the Authors

Areas of Expertise