más allá de los números

Trump, House GOP Health Savings Account Proposals Would Mostly Help Wealthy, Not Uninsured

For his alternative to the Affordable Care Act (ACA), which he would repeal, President-elect Trump proposes to rely on Health Savings Accounts (HSAs). That’s consistent with the health plans of House Speaker Paul Ryan and other congressional Republicans, which would expand HSAs in ways that would mainly benefit high-income taxpayers and likely do little for those losing their health coverage if the ACA were repealed.

Under current law, individuals in a high-deductible health plan (with a deductible of at least $1,300 for individuals and $2,600 for families) that meets other federal requirements may establish an HSA to save money for out-of-pocket health expenses. The accounts offer unprecedented tax-sheltering opportunities for high-income taxpayers:

1. contributions are tax deductible (participants can contribute up to $3,350 for individual coverage and $6,750 for family coverage in tax year 2016);

2. participants may put their contributions in stocks, bonds, or other investments, with the earnings accruing tax free; and

3. withdrawals are tax exempt if used for out-of-pocket medical or long-term care costs.

No other savings vehicle offers all three tax benefits. For example, 401(k) contributions and earnings are tax-free but withdrawals are taxed.

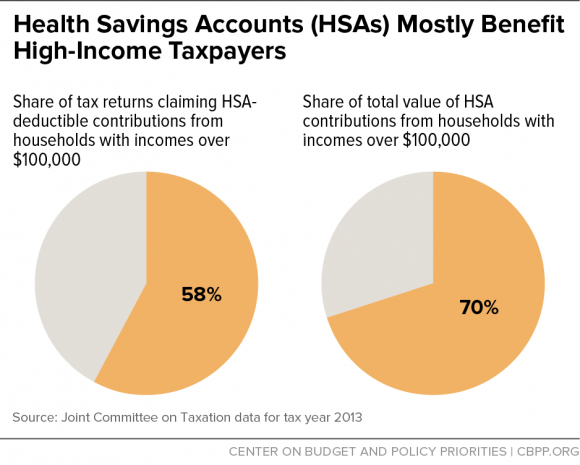

Because a tax deduction rises in value with an individual’s tax bracket, HSAs provide the largest tax benefits to high-income individuals. In addition, research shows that high-income people are likelier to make the maximum annual contributions to HSAs. Since there are no income limits on HSA participation, affluent people whose incomes are too high to qualify for individual retirement accounts (IRAs) or who have “maxed out” their 401(k) contributions can use HSAs to shelter more funds. Households with incomes of at least $100,000 account for most tax returns claiming an HSA deduction and the large majority of the total amount of HSA contributions (see chart).

How might President-elect Trump propose to expand HSAs? Speaker Ryan’s plan, a House-passed bill, and the House Republican Study Committee (RSC) health plan would nearly double the maximum annual HSA contribution, dramatically expanding higher-income taxpayers’ ability to shelter income. If it were in effect in tax year 2016, taxpayers with family coverage could contribute up to $13,100 that year alone.

The RSC plan would also let taxpayers transfer withdrawals they must start making at age 70½ from certain retirement accounts (including IRAs and 401(k) plans), which are treated as taxable income, into their HSAs on a tax-free basis. If those transferred funds were later used for out-of-pocket medical expenses, they would never be taxed. That would swell the cost of HSAs in coming decades, as people make tax-free withdrawals on income on which they otherwise would have paid tax.

Many other congressional Republican HSA expansion proposals (including the RSC plan) would also allow HSA funds to pay health insurance premiums. Because HSA contributions are tax-deductible, this would effectively create a tax deduction for the premium costs of a high-deductible plan in the individual health insurance market. But it would do little or nothing to help the uninsured. Research shows that at least 90 percent of the uninsured before the ACA were in the 0, 10, or 15 percent tax bracket, so they would receive an income tax benefit of no more than 15 cents for every $1 they can deduct — not enough to make coverage affordable. Those with no federal income tax liability would receive zero benefit.