BEYOND THE NUMBERS

The 2024 annual reports of the Social Security and Medicare trustees, released yesterday, show mostly small improvements in the programs’ financial outlook.

The trustees project that the reserves of the combined Social Security trust funds will be depleted in 2035 and Medicare’s Hospital Insurance (HI) trust fund in 2036. For HI, that’s five years later than in last year’s report. For Social Security, it’s one year later.

Changes in economic, private health plan, and other estimating assumptions have also improved the programs’ long-term financial picture. While these improvements are welcome, they do not change the outlook for Social Security and Medicare in a fundamental way and could easily be reversed in future years.

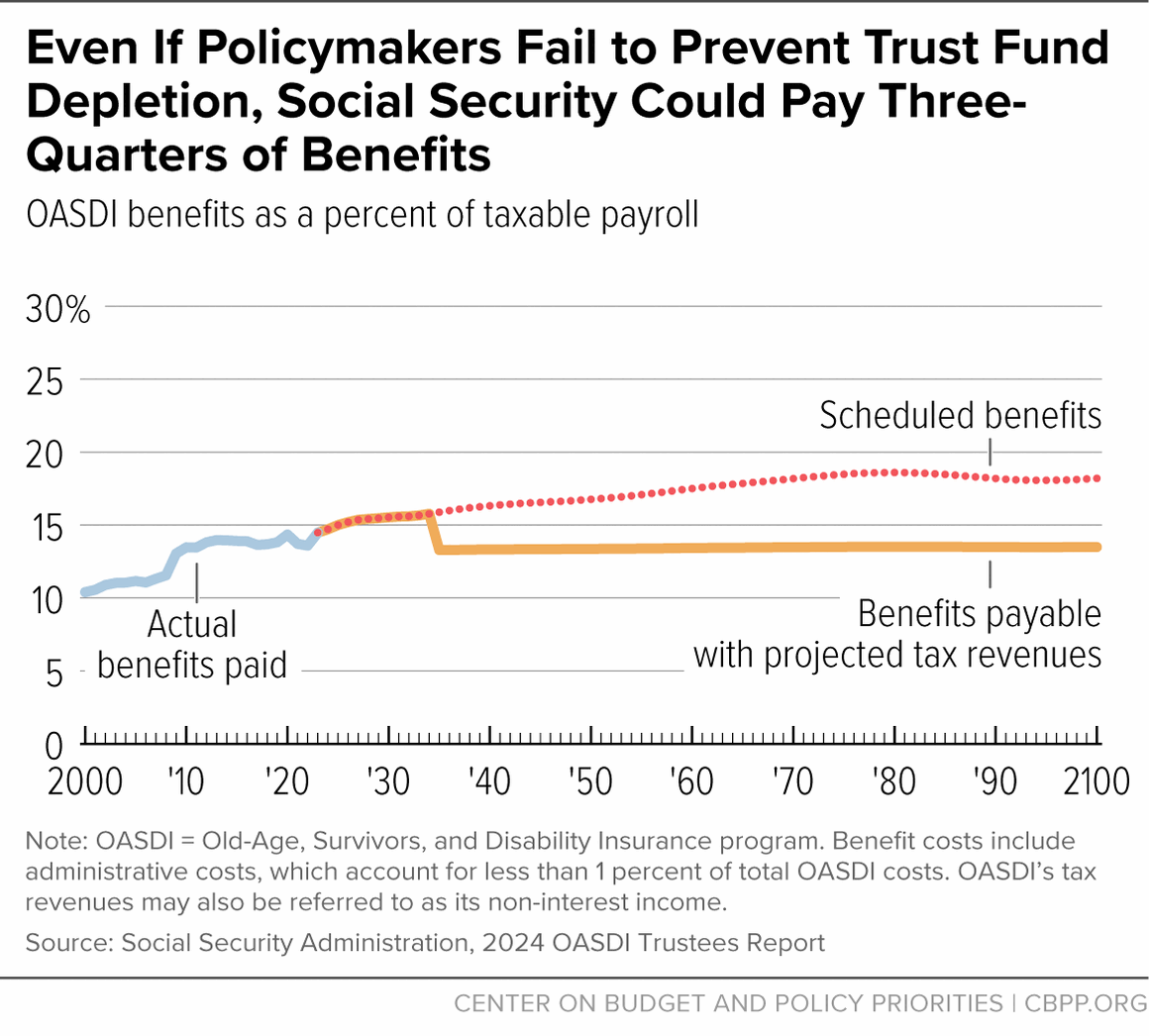

The trustees’ new projections, like those of the Congressional Budget Office, show a long-run financing problem that needs to be addressed, but the programs are not “bankrupt,” as some critics charge. Even if Congress took no action and allowed the trust fund reserves to be depleted, Social Security could still initially pay about 83 percent of scheduled benefits using its annual tax income (see figure), and Medicare HI could pay about 89 percent. Benefits would not stop, but trust fund depletion would trigger large across-the-board cuts. (Medicare’s programs for physician and outpatient costs and prescription drugs cannot run short of funds because beneficiary premiums and general revenue contributions are automatically set to cover costs.)

Although Social Security and Medicare do not face an immediate financing crisis, policymakers must act to avoid trust fund depletion and assure payment of full benefits. Such action would reduce uncertainty, cool overheated rhetoric, bolster public confidence, and allow changes to be phased in more gradually or with more advance notice to beneficiaries and taxpayers.

Because Social Security and Medicare are the principal source of income and health coverage for most beneficiaries and are not overly generous, policymakers will need to raise revenues to improve the programs’ fiscal outlook and protect beneficiaries. Social Security and Medicare will require an increasing share of our nation’s resources as the population ages and health care costs rise. Polls show a widespread willingness to support them through higher taxes.

President Biden’s 2025 budget contains Medicare proposals that would permanently close the projected shortfall in the HI trust fund, remove the threat of across-the-board cuts, and simultaneously reduce federal deficits and debt. For households with over $400,000 in income, the budget would close a loophole that allows some business income to escape both the HI payroll tax and the net investment income tax (NIIT). It would raise the HI payroll tax and NIIT rates from 3.8 percent to 5.0 percent and dedicate the proceeds of the NIIT to the HI trust fund. And it would further reduce Medicare prescription drug prices and credit the savings to HI.

The President’s budget does not lay out a specific plan for strengthening Social Security, but it does set out several principles, including the need to raise revenues and prevent benefit cuts.

The trustees’ reports contain a treasure trove of information about Social Security and Medicare beyond the headline-grabbing depletion dates. Of interest are the estimates of the uncertainty of the projections and their sensitivity to changes in particular assumptions. For example, additional immigration improves Social Security’s long-run financial position. The cost of Social Security as a percentage of taxable payroll “decreases with an increase in total net immigration because immigration occurs at relatively young ages,” the trustees write, “thereby increasing the number of covered workers earlier than the number of beneficiaries.”

As the trustees’ reports confirm, policymakers must take steps to strengthen Social Security and Medicare’s financing. But they should not be driven to make harmful benefit cuts — such as raising the ages of eligibility — based on misleading claims that such actions are necessary to shore up their financing. Sound revenue options and reductions in Medicare payments to providers are available.