A BRIEF UPDATE ON STATE FISCAL

CONDITIONS

AND THE EFFECTS OF FEDERAL POLICIES ON STATE BUDGETS

| PDF of analysis |

| If you cannot access the files through the links, right-click on the underlined text, click "Save Link As," download to your directory, and open the document in Adobe Acrobat Reader. |

Although state tax revenues have begun to rise again, the severe fiscal problems of the past several years continue to dominate the budget landscape. This paper very briefly discusses key aspects of the fiscal crisis and the outlook for 2005 and beyond; more detailed information can be found in the reports cited at the start of each section.

States Continue to Grapple with Large Deficits for 2005[1]

Following eight consecutive quarters of declines, state revenue growth returned to relatively normal levels in fiscal year 2004. As a result, there was less need for mid-year budget cuts during fiscal year 2004 in most states than in the previous two years.

However, many states — including Alaska, California, Illinois, Louisiana, Nebraska, New Jersey, and New York — faced large budget shortfalls for fiscal year 2005. In 30 states where shortfalls were identified, the amounts reached levels of $35 billion to $40 billion, or about 7 percent to 8 percent of those states’ expenditures. As a result, many states continued to enact cuts in spending, revenue increases, new borrowing, and/or reserve-fund transfers for fiscal year 2005. Several states, including California, Maryland and Wisconsin, already are projecting large deficits in 2006 and beyond.

The 2005 deficit amounts were on top of the estimated $78 billion shortfall that states faced when they enacted their fiscal year 2004 budgets, as well as large deficits that were addressed in fiscal years 2002 and 2003. The National Conference of State Legislatures estimates that over the last four years, states have had to close a cumulative budget gap exceeding $200 billion.

State Budget Cuts Are Affecting a Wide Range of Programs[2]

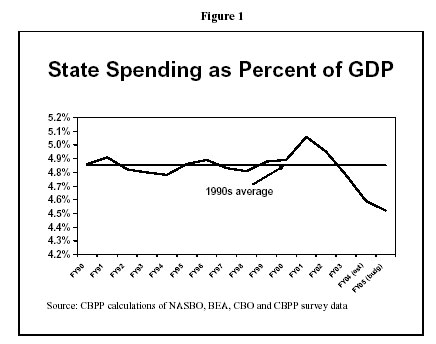

During the fiscal crisis, states have closed budget gaps more by cutting spending than by raising taxes. Indeed, spending cuts have been three times as large as tax increases. As a result of these spending cuts, total state spending has shrunk significantly since 2001 as a share of the economy. In FY 2004, spending was 4.6 percent of the Gross Domestic Product (GDP), the lowest level in almost 15 years and well below the level to which it dropped during the economic downturn of the early 1990s. State spending is projected to decline still further as a share of GDP in 2005.

States have made cuts in a wide range of programs, including:

- Some 34 states have cut eligibility for public health insurance. The Center estimates that these cuts have caused 1.2 million to 1.6 million low-income people — including 490,000 to 650,000 children and large numbers of parents, seniors, and people with disabilities — to lose publicly funded health coverage.[3] Although some modest restorations have occurred, the great majority of those people remain without coverage, and major additional cuts are planned in Mississippi and Tennessee.

- At least 23 states have cut eligibility for child care subsidies or otherwise limited access to child care. In about half the states, low-income families who are eligible for and need child care assistance are either not allowed to apply or are placed on a waiting list. More than 280,000 children are on waiting lists in California alone.

- Real per-pupil aid to school districts for K-12 education declined in 34 states between 2002 and 2004. Effects of the cuts include new or higher fees for textbooks and courses, shorter school days, reduced personnel, and reduced transportation.

- States across the country are cutting higher education, leading to double- digit increases in college and university tuition and reduced course offerings. In 2005, funding shortfalls for higher education are requiring tuition increases or service reductions in California, Maine, Maryland, Massachusetts, and Texas.

Cutbacks also are occurring in various other areas, such as state aid to localities, substance abuse treatment, programs for the mentally ill, and homeless shelters.

States Face Immediate and Long-term Revenue Shortages[4]

The main cause of the state fiscal crisis is flagging state revenues. Total state tax collections for the 12 months ending in June 2003 (the period that corresponds to fiscal year 2003 in most states) were about $21.6 billion less, in nominal terms, than for the 12-month period ending in June 2001, according to the U.S. Census Bureau. When adjusted to compensate for inflation and population growth, revenues in this 12-month period were $56.9 billion less than in 2001. Revenue growth in fiscal year 2004 only partially closed this gap.

State taxes now make up a smaller share of the economy than at any time in the last thirty years, with the exception of the double-dip recession of the early 1980s.

The decline in state revenue would have been even worse had not a majority of states raised taxes. Since late 2001, about 31 states have expanded their tax bases or increased tax rates to lessen the decline in revenues. Such tax increases have been enacted in states with Republican leadership, Democratic leadership, and bipartisan leadership. These net tax increases are raising some $20.2 billion annually, about 3.6 percent of total state tax collections.

Nevertheless, the tax increases enacted during this downturn are far fewer and smaller than the tax cuts enacted during the economic expansion of the 1990s. From 1994 to 2001, some 44 states enacted significant tax cuts. The economic boom of the late 1990s, and in particular the large increase in capital gains during those years, temporarily offset the revenue loss resulting from those tax cuts. Those temporary economic conditions have ended. Yet most of the tax cuts of the 1990s remain in place and are costing states some $40 billion or more per year.

It also is worth noting that while most of the tax cuts of the 1990s were in progressive taxes (taxes that fall most heavily on higher-income households), most of the recent tax increases have been in regressive taxes. In other words, lower-income households benefited less from the tax cuts of the 1990s and now are being hurt more by the tax hikes of 2001-2004.

States’ revenue problems are likely to persist even after the economy fully recovers. In coming years, state costs will increase for such services as education, corrections, and health care (the last a reflection of the ageing of the population). In most states, though, tax revenues are not expected to keep pace with those costs because of widely recognized flaws in state tax systems. These flaws include an inability to tax Internet purchases fully, excessive reliance on excise-tax revenues, expanded use of tax loopholes by corporations, and a failure to apply sales taxes to most purchases of services, which are becoming an increasing share of all economic activity.

In 2002, 2003 and 2004, some states strengthened their tax systems in ways that will help address both their immediate and longer-term revenue problems, such as increasing income tax rates, closing corporate tax loopholes, and broadening sales tax bases to include more services. A larger number of states, however, raised revenues in ways that will only deepen the structural flaws in their tax system by increasing the state’s reliance on revenue sources that will not grow at the same pace as the economy, such as excise taxes.

Federal Policies Are Worsening the State Fiscal Crisis[5]

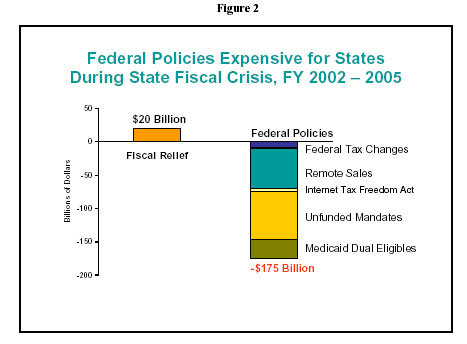

Federal policies are contributing significantly to the state fiscal crisis by reducing state revenues and imposing additional costs on states. We estimate that federal policies are costing states and localities more than $175 billion over the four-year course of the fiscal crisis (state fiscal years 2002-2005). These policies include:

- Tax cuts. Some of the federal tax cuts enacted since 2001 are reducing state revenues because of linkages between the federal and state tax codes.

- Restrictions on state taxation. For example, the federal Internet Tax Freedom Act, first enacted in 1998, bars states from taxing the access fees that people pay for Internet service. In addition, two Supreme Court cases prevent state and local governments from collecting sales taxes on most catalog or Internet purchases, even though sales taxes apply when the very same items are purchased in retail stores. Federal legislation has recently been introduced to correct this problem but has not garnered significant support from Congress or the Administration, and its passage is not expected anytime soon.

- Unfunded mandates. In several policy areas, such as special education and the No Child Left Behind education initiative, the federal government has placed requirements on state and local governments without adequately funding them.

- Shifting health care costs. For more than a decade, the cost of health care for low-income elderly and disabled people (in other words, people who are eligible for both Medicare and Medicaid) has been shifting from Medicare to Medicaid. A prominent reason is the increasing use of prescription drugs, which Medicaid covers but Medicare has not. Because Medicare is fully federally funded, while states pay nearly half of all Medicaid costs, this shift in costs from Medicare to Medicaid has increased the financial pressure on states.

The recently enacted Medicare drug bill will leave states responsible for the bulk of these drug costs even after the new Medicare drug benefit takes effect. Under the drug bill, seniors and disabled individuals eligible for both Medicare and Medicaid will receive drug coverage through Medicare. But, while this will produce significant savings for state Medicaid programs, states will be required to return most of these savings to the federal government.

These federal policies have hit the poorest states especially hard. This is partly because the populations of these states have the greatest need for government services, and partly because these states are the least able to raise their own funds to pay for services.

The $20 billion in fiscal relief Congress provided in 2003 has helped states cope with the fiscal crisis, but it pales in comparison to the size of the problem, and the large deficits faced by the federal government prevent it from doing more. It is worth noting that a significant part of the projected federal deficits is caused by the 2001, 2002 and 2003 tax cuts, which primarily benefit households least in need of assistance. For example, as a result of the tax cuts, households making over $1 million a year are receiving an average tax cut in 2004 of $124,000 each, according to the Urban Institute-Brookings Tax Policy Center.

Conclusion

Having closed large budget deficits for three consecutive years through spending cuts and tax increases (as well as a variety of budget gimmicks), many states are facing continuing budget problems in fiscal year 2005 and beyond. The duration of the fiscal crisis means states are being forced to take increasingly painful steps, such as cutting back on important services on which many low- and middle-income families rely — cutting child care and health care programs, raising college tuitions, and the like.

The federal government could alleviate the state fiscal crisis by scaling back the costly tax cuts of the past few years and using the freed-up funds to support more positive policies toward states. Otherwise, the low- and middle-income families that are subject to state tax increases and service cuts will, in essence, be paying for the very generous federal tax cuts for the highest-income Americans.

End Notes:

[1] See Nicholas Johnson and Bob Zahradnik, State Budget Deficits Projected for Fiscal Year 2005, Center on Budget and Policy Priorities, revised February 2004. (This Update contains data not available at the time of that report.)

[2] See Elizabeth McNichol, States’ Heavy Reliance on Spending Cuts and One-Time Measures to Close their Budget Gaps Leaves Programs at Risk, Center on Budget and Policy Priorities, July 2004; Elizabeth McNichol and Makeda Harris, Many States Cut Budgets as Fiscal Squeeze Continues, Center on Budget and Policy Priorities, April 2004; and Elizabeth McNichol, Fiscal Crisis Is Shrinking State Budgets, Center on Budget and Policy Priorities, Revised February 2004.

[3] Leighton Ku and Sashi Nimalendran, Losing Out: States Are Cutting 1.2 to 1.6 Million Low-Income People from Medicaid, SCHIP and Other State Health Insurance Programs, Center on Budget and Policy Priorities, December 2003.

[4] See Nicholas Johnson, Jennifer Schiess, and Joseph Llobrera, State Revenues Have Fallen Dramatically, Center on Budget and Policy Priorities, revised November 2003.

[5] See Iris J. Lav and Andrew Brecher, Passing Down the Deficit: Federal Policies Contribute to the Severity of the State Fiscal Crisis, Center on Budget and Policy Priorities, May 2004.