HELPING MARRIED FAMILIES BY EXPANDING PARENTS' INSURANCE COVERAGE: A FACT SHEET

Three out of every five low-income parents who lack insurance are married. Research indicates that earlier expansions of Medicaid eligibility for children in two-parent families encouraged marriage by helping to assure that parents could maintain their children's insurance coverage when they married. Expanding parents' insurance coverage would reduce the risk that a single parent might lose her insurance if she marries, as well as strengthen insurance coverage among low-income married families.

Insurance Coverage and Marital Status

Data from the Census Bureau's most recent annual survey of the U.S.

population indicate that:

Data from the Census Bureau's most recent annual survey of the U.S.

population indicate that:

- About one-third (34 percent) of low-income parents with children under age 18 are uninsured. (As used here, "low-income" means the family's income is below 200 percent of the poverty line, or $29,260 for a family of three.) Among low-income parents, the percentage of married parents who lack insurance (33 percent) is about the same as the percentage of single parents who lack insurance (34 percent). The number of uninsured married parents is much larger than the number of uninsured single parents, however, since there are more married parents in general.

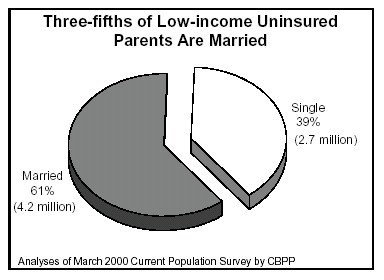

- As the chart shows, 61 percent of low-income uninsured parents — or 4.2 million people — are married. (This includes parents who are uninsured, but whose spouses have coverage.)

- Expansions of Medicaid eligibility for parents would particularly aid married parents. Single-parent families predominate among families with incomes low enough to qualify for Medicaid today in the typical, or median, state. In the typical state, Medicaid eligibility ends when parents have earnings equivalent to 69 percent of the poverty line, or about $10,000 for a family of three. The incomes of low-income married parents are usually somewhat higher, since there is a greater chance that at least one parent is working full-time and the second parent also may have earnings.

- Most states have raised income limits for children's health care coverage to about 200 percent of the poverty line. If income limits for parents were raised to that level, two of every three uninsured parents who would become newly eligible for coverage — 67 percent — would be married parents. (This number is higher than the 61 percent figure shown in the pie chart because the chart also includes parents who are currently eligible for Medicaid but are unenrolled.)

Research on the Relationship Between Marriage and Insurance Eligibility

Research by Aaron Yelowitz, now at the University of Kentucky, found that earlier efforts to expand insurance coverage in two-parent families encouraged marriage.(1) Yelowitz examined the implications of expansions in Medicaid coverage for children that occurred in the late 1980s and early 1990s. Before this time, Medicaid eligibility was primarily linked to welfare, which was mostly confined to single-parent families. That created a disincentive for marriage: if, for example, a single mother married, her children might lose insurance coverage both because she was no longer a single parent and because the family's income might rise above the state's Medicaid eligibility limits if her new husband was working. Because the Medicaid eligibility expansions for children applied to children in single- and two-parent families alike, they reduced this disincentive and, in so doing, increased the probability of marriage.

Similarly, a single parent now on Medicaid who resides in a state that has not expanded eligibility for parents risks losing her own insurance coverage if she marries a man with a modest level of earnings. In many cases, her husband might not have private health insurance or might not be able to afford the additional premiums needed to purchase dependent coverage for his wife. Almost half of workers earning $20,000 or less per year are not offered job-based health insurance, and many of those who are offered insurance cannot afford to pay the premiums.(2) Expanding Medicaid eligibility for low-income parents would reduce the risk that a single parent who marries might consequently lose health insurance and would increase insurance coverage for low-income married families. (3)

References

1. Aaron Yelowitz, "Will Extending Medicaid to Two-Parent Families Encourage Marriage?" Journal of Human Resources, 33(4), 833-65, Fall 1998.

2. Lisa Duchon, Cathy Schoen, Elisabeth Simantov, Karen Davis, and Christina An, Listening to Workers: Challenges for Employer-Sponsored Coverage in the 21st Century, Commonwealth Fund, January 2000.

3. This is a brief discussion of a more complex topic. For more information, see Wendell Primus and Jen Beeson, "Safety Net Programs, Marriage and Cohabitation," prepared for the National Symposium on Just Living Together: Implications of Cohabitation for Children, Families, and Social Policy, Pennsylvania State University, Oct. 2000.