|

May 19, 2008

GAO STUDY AGAIN CONFIRMS HEALTH SAVINGS ACCOUNTS

PRIMARILY BENEFIT HIGH-INCOME INDIVIDUALS

By Edwin Park

A

new Government Accountability Office (GAO) report indicates that Health Savings

Accounts are used disproportionately by affluent households. Its findings also

suggest that HSAs are being used extensively as tax shelters.

What Are Health Savings Accounts and Why Are They Attractive as

Tax Shelters?

Established by the 2003 Medicare drug legislation, Health Savings Accounts

(HSAs) are accounts in which individuals with a high-deductible health insurance

policy can save money to pay for out-of-pocket health expenses. In tax year

2008, someone who enrolls in a health plan with a deductible of at least $1,100

for individual coverage and $2,200 for family coverage may establish an HSA.

HSA contributions are tax deductible. In 2008, individuals may contribute

up to $2,900 for individual coverage and $5,800 for family coverage. These

tax-preferred contributions may be placed in stocks, bonds, or other investment

vehicles, with the earnings accruing tax free. Withdrawals also are tax

exempt if used for out-of-pocket medical costs.

HSAs thus have a unique tax structure. No other savings vehicle in the federal

tax code offers both tax-deductible contributions and tax-free

withdrawals, as HSAs do. Moreover, because the value of a tax deduction

rises with an individual’s tax bracket, HSAs provide the largest tax benefits to

high-income individuals. In addition, higher-income individuals generally

can afford to contribute more money into HSAs each year than lower-income

people. And since there are no income limits on HSA participation, very

affluent individuals whose incomes who are too high for them to qualify for IRA

tax breaks, or who have “maxed out” their 401(k) contributions, can use HSAs to

shelter additional funds.

As a result, many health and tax policy analysts

have warned that HSAs are likely to be used extensively as tax shelters by

high-income individuals. The Bush Administration and other HSA proponents

have repeatedly dismissed this concern and argued that HSAs will not have such

effects.

What the GAO Report Shows

About HSA Use

In

2006, the GAO issued a groundbreaking study analyzing, for the first time, data

from the Internal Revenue Service on all Americans who made HSA contributions in

tax year 2004.

The study also examined three large employers who offered HSA-eligible high

deductible plans, as well as data on enrollment in HSA-eligible plans from

several national surveys of employers. In that report, the GAO determined that

tax filers who make contributions to HSAs were disproportionately high-income

individuals, and that among HSA users, those with high incomes made the largest

contributions and received the largest tax benefits. The GAO also found initial

indications that HSAs are being used as tax shelters.

The GAO’s new report on the use of Health Savings Accounts examines IRS data for

tax year 2005, as well as employer surveys. The findings bolster those from the

GAO’s earlier study.

The new report’s principal findings include:

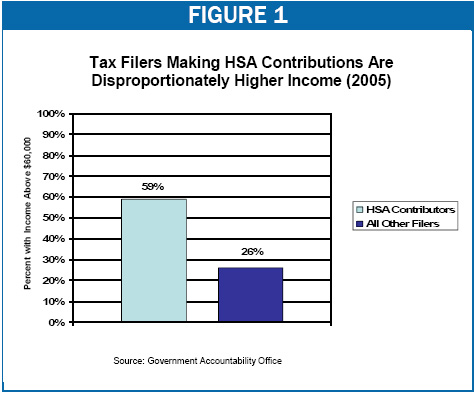

- HSA participants are

disproportionately high-income. In tax year 2005, some 59 percent of tax

filers making HSA contributions

had adjusted gross income of $60,000 or more, even though only 26 percent of all

other adult tax filers under age 65 had incomes this large (see Figure 1). At

the other end of the income scale, people with adjusted gross income of less

than $30,000 made up 50 percent of all other tax filers in 2005 but only 15

percent of all HSA participants.

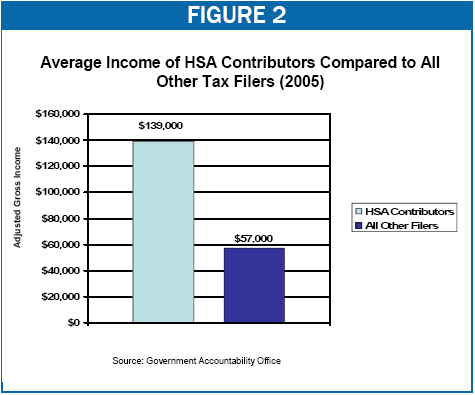

The average adjusted gross income of tax filers who made HSA contributions in

2005 was $139,000, as compared to $57,000 for all other tax filers under age 65

(see Figure 2).

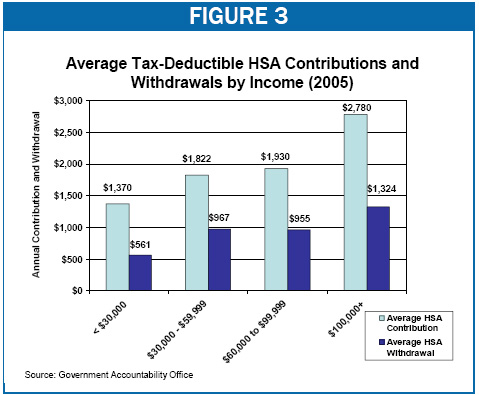

- Affluent HSA participants

contribute much more to the accounts than other participants. HSA

participants with incomes over $100,000 contributed an average of $2,780 to

their accounts in 2005, as compared to an average contribution of $1,370 for HSA

participants with incomes below $30,000 (see Figure 3). The fact that

higher-income individuals not only are more likely to have HSAs but also

contribute more to their accounts further skews the tax benefits of HSAs to

high-income households, as does the fact that the higher one’s tax bracket, the

greater the subsidy that HSAs provide.

- Many HSA participants appear to be

using their accounts purely or primarily as a tax shelter rather than paying for

out-of-pocket health care costs. The GAO found that a stunning 41 percent

of tax filers reporting HSA contributions in 2005 did not withdraw any

funds from their accounts at any time during the year.

In recent Congressional testimony, the GAO stated that this was consistent with

the view held by industry experts that many HSA users are people who primarily

use their HSAs as a tax-advantaged savings vehicle.

Overall, the average HSA contribution in 2005 was $2,100, more than double the

average HSA withdrawal of $1,000. As one would expect, tax filers with

incomes over $100,000 had the largest net contributions to their HSA

contributions, contributing an average of $2,780 and withdrawing an average of

$1,324 in 2005, for a net increase in their HSA balance of $1,456 (see Figure

3).

-

Many employers offering

high-deductible health insurance plans and HSAs did not contribute to

their workers’ HSAs. The GAO reported that a series of employer

surveys conducted in 2005, 2006 and 2007 found that more than one-third of large

employers offering HSA-eligible plans made no contribution to their employees’

HSAs. GAO also cited another survey finding that nearly half of small and

large employers offering high-deductible plans made no HSA contributions for

their employees in 2007. This may mean that some lower-income workers who

cannot make substantial HSA contributions on their own, and whose employers make

no contributions on their behalf, may be unable to afford the high deductibles

required under HSA-eligible plans when they or their families need health care.

Health and tax policy analysts have long warned that HSAs could be used

extensively as tax shelters by high-income individuals. The GAO’s latest

analysis of HSAs again lends strong credence to these concerns.

End Notes:

Government

Accountability Office, “Health Savings Accounts: Participation Increased and

Was More Common among Individuals with Higher Incomes,” April 1, 2008.

Government

Accountability Office, “Consumer-Directed Health Plans: Early Enrollee

Experiences with Health Savings Accounts and Eligible Health Plans,” August

8, 2006.

See Government

Accountability Office (2006), op cit and Edwin Park and Robert

Greenstein, “GAO Study Confirms Health Savings Accounts Primarily Benefit

High-Income Taxpayers,” Center on Budget and Policy Priorities, September

20, 2006.

Government

Accountability Office (2008), op cit.

Contributions

include those made by individual tax filers as well as those made by

employers or other individuals on their behalf, but do not include funds

transferred from Medical Savings Accounts, precursors to Health Savings

Accounts that are established as part of a demonstration project in 1996.

It is likely

that there are a number of individuals in this income range who may be

enrolled in HSA-eligible high-deductible health plans but have not

established or contributed to a HSA. According to GAO’s examination of

employer surveys, more than 40 percent of individuals enrolled in a

high-deductible health insurance plan eligible for a HSA did not open an

HSA. Reasons cited by survey respondents included lack of information, lack

of need and a belief that they could not afford to put money in the

accounts. Government Accountability Office (2008), op cit.

Health policy

analysts and economists have expressed significant concern that

high-deductible plans attached to HSAs risk “adverse selection.” Adverse

selection occurs when healthy and less-healthy individuals separate into

different health insurance arrangements, and the average cost of insurance

for the less-healthy group rises significantly, because these people are no

longer being pooled with healthier individuals who are less expensive to

insure. When that occurs, premium costs for the less-healthy can rise

sufficiently high that those individuals are put at risk of becoming

uninsured or underinsured.

High deductible plans attached to HSAs are

likely to be disproportionately attractive to healthier individuals who do

not need much health care and thus are less concerned about the higher

out-of-pocket costs that can result under a high-deductible plan in

comparison to a more traditional lower-deductible plan. If healthier

individuals move to HSA-eligible plans in large numbers over time while less

healthy individuals remain in traditional plans, that could drive up health

insurance premiums for the more traditional plans and make them increasingly

unaffordable over time. The fact that a large proportion of individuals

contributing to HSAs make no withdrawals may indicate not only that these

individuals are using HSAs as tax shelters but also that they may be

healthier, on average, and therefore have less utilization of health care

services. This deepens the concern over adverse selection. For a

discussion of why Health Savings Accounts may spur adverse selection, see

Edwin Park and Robert Greenstein, “Latest Enrollment Data Still Fail to

Dispel Concerns About Health Savings Accounts,” Center on Budget and Policy

Priorities, Revised January 30, 2006.

John Dicken,

“Health Savings Accounts: Participation Grew, and Many HSA-Eligible Plan

Enrollees Did Not Open HSAs while Individuals Who Did Had Higher Incomes,”

Testimony before the Subcommittee on Health, House Ways and Means Committee,

Government Accountability Office, May 14, 2008. The GAO also noted that

only 22 percent of tax filers making HSA contributions withdrew as much or

more than their reported contributions. According to the GAO, industry

experts viewed this minority population as consistent with HSA account

holders who are “spenders” and who actually use these accounts to pay for

out-of-pocket health care costs, rather than as a tax-preferred savings

vehicle.

|