WITH TAXES LOW AND DEFICITS HIGH,

MORE TAX CUTS WOULD BE IRRESPONSIBLE

By

Joel Friedman and Isaac Shapiro

| PDF of full report |

| If you cannot access the files through the links, right-click on the underlined text, click "Save Link As," download to your directory, and open the document in Adobe Acrobat Reader. |

The percentage of income that most categories of taxpayers pay in federal taxes is at the lowest level in decades. Despite this fact — and despite the large current federal budget deficit and the even larger fiscal problems that are projected for coming decades — the Administration and Congress are pushing for additional tax cuts that would worsen these problems.

Overall Federal Tax Burdens Are Low

- Recently released data show that most categories of households paid a smaller percentage of their income in federal taxes in 2002 than in any year on record, with data going back to 1979. These data, from a Congressional Budget Office study that covers the 1979-2002 period, include households’ total federal tax burdens, including income, payroll, excise, and other taxes.[1]

- For example, households in the middle fifth of the income spectrum paid an average of 14.4 percent of their income in federal taxes in 2002, the lowest level for any year between 1979 and 2002. Even in 2000, before the recent tax cuts, these households paid a smaller share of their income in federal taxes than in any year since 1979.

- The top one percent of households paid 32.7 percent of their income in federal taxes in 2002, the lowest since 1992 and lower than in 1979 and 1980, the first years covered in the CBO study. The percentage is higher than in the 1980s and the early 1990s largely due to the effects of the very large tax cuts benefiting high-income households that were enacted in 1981.

- The tax burden has fallen further since 2002, with the phasing in of more of the tax cuts enacted in 2001 and the enactment of additional tax cuts in 2003. In particular, high-income taxpayers have benefited from the reduction of the top rate from 38.6 percent in 2002 to 35 percent today, and the reductions in capital gains and dividend taxes that took effect in 2003.

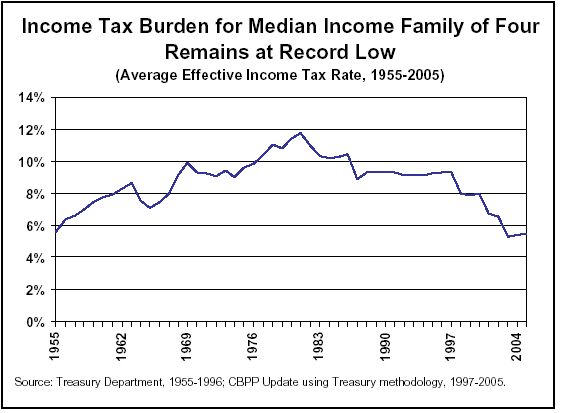

Federal Income-Tax Burdens Have Fallen Significantly

This drop in overall federal tax burdens has been driven by a pronounced decline in income-tax burdens.

The Center estimates that the median-income family of four paid only 5.5 percent of its income in federal income taxes in 2005, roughly the same as in 2003 and 2004. These “effective tax rates” represent the lowest on record, with data going back to 1955. The Center’s estimates were derived by updating a 1998 Treasury Department analysis that examined changes since 1955 in the percentage of income that the median-income family of four pays in federal income taxes.[2]

- Here, too, the downward trend began before the 2001 tax cut. In 2000, the median-income family of four paid a smaller percentage of its income in federal income taxes than in any year since 1966 (except for 1999).

Recent Tax Cuts Have Primarily Benefited High-Income Households

Although middle-income taxpayers, and particularly those with children, have benefited from the tax cuts enacted since 2001, the bulk of the benefits from those tax cuts have accrued not to middle-income families but to those with high incomes.

- Households that make more than $1 million a year are receiving an average tax cut of over $100,000 in 2005 from the 2001 and 2003 tax cuts, according to a new analysis by the Urban Institute-Brookings Institution Tax Policy Center. This is nearly 140 times the size of the average tax cut that families in the middle of the income scale are receiving ($742).

- In 2005, the tax cuts will increase the after-tax incomes of the “millionaire” group by 5.4 percent, more than twice as much as the gain for families in the middle of the income scale (2.6 percent).

- This increase in after-tax income for those at the top of the income spectrum will exacerbate underlying trends that reflect an increasing concentration of income at the top of the income scale. CBO data show, for instance, that the average after-tax income for the top one percent of households grew 111 percent between 1979 and 2002, while households in the middle of the income spectrum experienced an average increase of only 15 percent over this period.[3]

Large Tax Cuts, Large Deficits

In 2005, federal revenues will make up a smaller share of the economy than in any year from the 1960s through the 1990s, according to the Congressional Budget Office. This weakening of the federal revenue base has been a major cause of the stunning fiscal deterioration of the past few years.

In contrast, federal spending is not at particularly high levels as a share of the economy, even with the large increases in spending for Iraq and anti-terrorism efforts. CBO projects that total federal spending in 2005 will be lower as a share of the economy than in any year from 1975 through 1996.[4]

The nation is projected to face persistently large deficits in coming decades that ultimately may do significant damage to the economy. The data presented here thus suggest that policymakers should be considering how to shore up the revenue base and whether the tax cuts adopted in recent years remain affordable. Instead, the budget put forward by the President, as well as the budgets that have been adopted by the House and the Senate, all include further tax cuts. Partly as a result, all three budgets would cause the deficit to be larger than if we simply maintained current policies.

Most immediately, the House is now poised to vote to repeal the estate tax, which would contribute nearly $1 trillion to the deficit in the decade from 2012 to 2021 (when the associated interest payments on the national debt are taken into account).[5] The nation can ill afford such a substantial addition to its debt.

End Notes:

[1] Congressional Budget Office, “Historical Effective Federal Tax Rates, 1979-2002,” March 2005.

[2] Office of Tax Analysis, Department of the Treasury, “Average and Marginal Federal Income, Social Security and Medicare, and Combined Tax Rates for Four-Person Families at the Same Relative Positions in the Income Distribution, 1955-1999,” January 15, 1998. The median-income family of four is in the exact middle of the income spectrum: half of all families of four have higher incomes, while the other half have lower incomes.

[3] Isaac Shapiro, “What New CBO Data Indicate About Long-Term Income Distribution Trends,” Center on Budget and Policy Priorities,” March 7, 2005.

[4] See Ruth Carlitz and Richard Kogan, “CBO Data Show Tax Cuts Have Played Much Larger Role Than Domestic Spending Increases In Fueling The Deficit," Center on Budget and Policy Priorities, revised January 31, 2005.

[5] See Joel Friedman, “House Vote on Permanent Repeal of Estate Tax: Estate Tax Reform Could Preserve Much Needed Revenues and Help Restore Social Security Solvency,” Center on Budget and Policy Priorities, April 12, 2005.