The Provisions in the House Tax Bill for

Married Couples

by James Sly and Isaac Shapiro

| View PDF version If you cannot access the file through the link, right-click on the underlined text, click "Save Link As," download to your directory, and open the document in Adobe Acrobat Reader. |

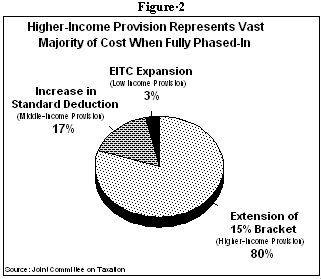

On March 29, the House of Representatives passed H.R. 6, a bill that provides tax cuts for married couples and expands the child tax credit.(1) Although two of the bill's provisions for married couples are focused on middle- or low-income families, the provisions for married couples as a whole are poorly targeted. The proposal's costliest provision would account for four-fifths of the bill's "marriage penalty relief" but would benefit only the one-third of married couples with the highest incomes. In addition, nearly half of the "marriage penalty relief" in the bill would go to families that already receive marriage bonuses. Specifically, the three provisions for married couples in the bill are:

- A provision that would reduce taxes for married couples whose combined income places them in the 28 percent bracket or a higher bracket. This provision provides a tax cut to those couples by raising the income level at which the 15 percent bracket ends and the 28 percent bracket begins. This provision benefits only families with incomes above the income level at which the 15 percent bracket currently ends; only one-third of married couples have incomes this high. When the provisions of H.R.6 are fully in effect, this one provision alone accounts for 80 percent of the "marriage penalty tax relief" in the legislation. (See Figure 1.)

- A provision that would raise the standard deduction for married couples, setting it at twice the standard deduction for single taxpayers. While this provision primarily benefits middle-income families, it represents only 17 percent of the "marriage penalty relief" in the bill.

A modest provision

that would increase the Earned Income Tax Credit for certain low- and moderate-income

married couples with children. This provision accounts for just three percent of the

"marriage penalty relief." The provision is about one-fourth the size of an EITC

marriage penalty proposal that has been advanced by the Heritage Foundation. It would

address only a modest share of the marriage penalties faced by EITC families, whose

marriage penalties can be among the severest of those that any families encounter.

A modest provision

that would increase the Earned Income Tax Credit for certain low- and moderate-income

married couples with children. This provision accounts for just three percent of the

"marriage penalty relief." The provision is about one-fourth the size of an EITC

marriage penalty proposal that has been advanced by the Heritage Foundation. It would

address only a modest share of the marriage penalties faced by EITC families, whose

marriage penalties can be among the severest of those that any families encounter.

The Joint Committee on Taxation estimates the bill as a whole would cost $399 billion over 10 years, of which $223 billion would go for tax cuts exclusively for married couples. The most expensive of these marriage penalty provisions — the proposal to benefit couples whose combined income puts them in the 28 percent bracket or a higher income bracket — would not begin to take effect until 2004 and would not be fully in effect until 2009. Without this slow phase-in, the bill's 10-year cost would be much higher.

When fully in effect, the provisions exclusively for married couples would cost about $39 billion a year. The provision benefitting those in upper-income tax brackets itself would cost about $31 billion a year, about half the cost of the entire bill and, as noted, four-fifths of the cost of the provisions exclusively for married couples. Since only the top one-third of married couples are in the 28 percent bracket or a higher bracket, only they would benefit from this provision.

It is thus not surprising that a distributional analysis of H.R. 6 indicates that the lion's share of its benefits go to higher-income taxpayers and that low-income taxpayers receive only a small share of the benefits. Citizens for Tax Justice has estimated the distributional effects of all of the provisions of H.R. 6, including the child tax credit which is somewhat more evenly distributed than the marriage penalty provisions. CTJ's analysis finds that the bottom 40 percent of taxpayers would receive only six percent of the tax benefits the bill provides; in contrast, the top 20 percent of taxpayers would receive 49 percent of the bill's tax cuts.

The bill's tax reductions are not well targeted for another reason. Under current law, about as many families receive marriage bonuses as receive marriage penalties. The bill would reduce taxes for most married couples, regardless of whether they face a marriage penalty or bonus. In 1999, the Treasury Department examined a tax-cut proposal for married couples somewhat similar to the "marriage penalty" provisions of H.R.6. The Treasury found that only about half of the resulting tax cuts would go to reduce marriage penalties; the rest would go to increase marriage bonuses. Based on this study, we estimate that nearly half of the $223 billion in tax-cut benefits designed to provide marriage penalty relief would go for tax cuts to couples receiving marriage bonuses. That is, H.R.6 would confer tens of billions of dollars of "marriage penalty tax relief" on millions of married couples that already receive marriage bonuses.

End note

1. This short analysis deals exclusively with the proposals specifically for married couples. A companion paper by the Center on Budget and Policy Priorities provides a broader examination of the bill. See "How the House Bill to Expand the Child Credit and Reduce Taxes for Married Couples Would Affect Lower-Income Families," by Robert Greenstein and Isaac Shapiro.