Revised March 31, 2003

MANY GOVERNORS ARE

PROPOSING TAX INCREASES

AND OTHER REVENUE MEASURES

Increases Are Necessary to

Protect Basic Services[1]

| PDF of full report |

| If you cannot access the files through the links, right-click on the underlined text, click "Save Link As," download to your directory, and open the document in Adobe Acrobat Reader. |

The enacted increases and proposals in those 25 states include increases in income taxes, sales taxes, corporate taxes, and/or excise taxes, and they include both raising rates and broadening tax bases. The 25 governors proposing or enacting tax increases include Republicans and Democrats in all regions of the country. In addition to Massachusetts, Connecticut, and Wyoming, the states include Alaska, Arkansas, California, Delaware, Georgia, Idaho, Iowa, Kentucky, Maine, Maryland, Michigan, Missouri, Nebraska, New Jersey, Nevada, New York, North Dakota, Ohio, Pennsylvania, Rhode Island, South Dakota, and West Virginia.

The enacted and proposed tax increases in those states would raise close to $18 billion in the next fiscal year. That amount exceeds the revenue currently being raised by the total tax increases enacted in 2001 and 2002 combined.

If other types of revenue-increasing measures — such as fee increases, postponements of previously enacted tax increases, expansions of gambling, and others — are included, then at least 38 of the 48 governors’ budgets submitted so far rely on some revenue actions to help achieve balance in state budgets. States whose governors have proposed revenue-raising measures other than tax increases to help balance their budgets include Arizona, Florida, Hawaii, Indiana, Kansas, Minnesota, New Mexico, North Carolina, Oklahoma, Oregon, Utah, Virginia, and Wisconsin.

Why Are Governors Proposing Tax Increases?

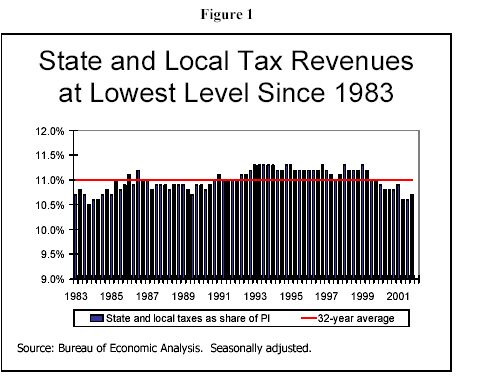

In 2001 and 2002, state revenue collections declined sharply as a result of the recession and the sharply lower stock market. Although the revenue decline is expected to level off in most states this year, revenues remain below the level necessary to support state services. Total state and local tax collections have fallen to 10.6 percent of personal income, the lowest level in nearly 20 years. (See Figure 1.) Meanwhile, the costs of providing public services have remained constant and in many areas have risen due to inflation, rising health care costs, increasing numbers of people seeking public services, and other factors.

As a result, states face budget shortfalls totaling $70 billion to $85 billion for the coming fiscal year, an average of 14.5 percent to 18 percent of general fund spending. To close those gaps will be extremely challenging. The kinds of relatively easy maneuvers that states used in the first 15 months since revenues began to decline to close some of the deficits — drawdowns of rainy day funds, postponements of spending obligations, accelerations of revenues, financing capital projects with bonds instead of operating funds, transfers from other units of government, canceling certain administrative expenses, and others — now are largely exhausted.

Beyond drawdowns and transfers, state policymakers have sought to address the budget crisis in large part by cutting spending. In 22 states, some 1.7 million individuals either are losing Medicaid coverage as a result of cuts already approved or would lose health insurance coverage under current budget proposals. Millions more are facing reductions in the kinds of health care services that are covered under Medicaid. State support for higher education, public schools, child care, and other areas of spending is also being cut, resulting in higher university tuition, larger class sizes, fewer child care subsidies, and many other reductions in public services. States are trimming workforces through layoffs, hiring freezes, early retirement programs, and other mechanisms. The number of state employees outside of education has declined by roughly 20,000 over the last year, according to the Bureau of Labor Statistics.

But there are limits to how far governors can — or want to — cut spending. Some 70 percent of state and local government spending pays for schools, health care, and public safety; the remaining 30 percent includes the operation of parks, roads, licensing, courts, and other public functions, as well as payments on public debt. For most governors, there is a point beyond which they do not believe further spending cuts are in the state’s best interests. When governors propose tax increases, it is often because they believe spending cuts have reached that point.

What Kinds of Tax Increases Are Being Proposed?

Personal income taxes. Five governors to date have proposed higher personal income taxes, particularly for high-income families. California Gov. Grey Davis would reinstate income tax brackets of 10 percent and 11 percent on married couples with incomes above $272,000 and $544,000 respectively. Gov. Bob Holden of Missouri would apply a 5 percent surcharge on tax liability for families with taxable income of $200,000 or more. Kentucky Gov. Paul Patton would eliminate a pension exemption for high-income senior citizens. Gov. John Rowland in Connecticut has approved an increase in the state’s income tax rate of one-half of one percentage rate for both middle- and upper-income families (Rowland previously supported an income tax increase targeted on higher-income families only). Rowland has also approved scaling back a property tax credit. Pennsylvania Gov. Edward Rendell proposes increasing the state’s flat personal income tax rate.

General sales taxes. Three governors would raise state sales tax rates, and another seven would broaden the bases of their sales taxes. Governors in Arkansas, California and Idaho would raise sales tax rates by five-eighths of a cent, one cent, and 1.5 cents respectively. In addition, Gov. George Pataki in New York would repeal a sales tax exemption for clothing items under $110. Gov. Kenny Guinn in Nevada would levy a 7.3 percent sales tax on admissions and amusements. Gov. Bob Taft in Ohio would broaden the sales tax base to include dozens of now-exempt services, including storage facilities, parking, personal care, cable television, sports admissions, movie tickets, amusement park admissions, lobbying, interior and landscape design, dry cleaning, real estate services, delivery charges, limousines and taxicabs, debt collection, and local telephone service. Gov. Paul Patton in Kentucky similarly would broaden the base of the sales tax to include more services. Gov. Mike Rounds in South Dakota would levy sales tax on interstate phone calls, and Maine Gov. John Baldacci would tax broadcast stations. The tax increase negotiated by the legislature and Gov. Rowland in Connecticut includes expanding the sales tax to include some advertising related services, health clubs, and newspaper and magazine subscriptions, and scaling back the exemption for clothing and footwear. Rowland also has proposed levying sales tax on computer and data processing services at a 1 percent rate, and canceling a sales tax holiday.

Corporate income taxes and other business taxes. Gov. Mitt Romney in Massachusetts has signed into law this month a package of corporate tax changes designed to require tax on corporate income that is now tax-exempt. Gov. Rowland in Connecticut has signed a 20 percent surtax on corporate income taxes for 2003 and is proposing a 10 percent surtax for 2004, along with repealing various business tax credits. Gov. Holden in Missouri would increase corporate income tax revenue by eliminating a number of exemptions and special provisions and broadening the tax base, while lowering the overall tax rate. Gov. Jennifer Granholm in Michigan has proposed eliminating a number of business tax exemptions and credits. Both Gov. Holden and Gov. Tom Vilsack in Iowa would require corporations to include income of out-of-state subsidiaries in their corporate tax returns. Gov. Minner in Delaware proposes increasing taxes and fees paid by corporations by an average of 17 percent. Gov. Guinn in Nevada proposes tripling the state’s business license fee — presently set at $100 per employee — and implementing a business gross receipts tax. Gov. Taft in Ohio would broaden the base of the state’s corporate franchise tax. Kentucky’s Gov. Patton would raise substantial new revenue by replacing the state’s corporate income tax with a business activity tax. Maryland Gov. Robert Ehrlich and Alaska Gov. Frank Murkowski have proposed increasing their states’ minimum filing fees for corporations.

Excise taxes. A 48-cent cigarette tax increase was enacted in Wyoming, and a 40-cent increase is in the Connecticut tax package supported by the governor. Cigarette tax increases have been proposed by 12 other governors. The states in which increases have been proposed are Delaware (26 cents), Georgia (46 cents), Idaho (34 cents), Kentucky (37 cents), Missouri (55 cents), Nebraska (20 cents), New Jersey (40 cents), Nevada (70 cents), North Dakota (55 cents), Ohio (45 cents), South Dakota (30 cents), and West Virginia (38 cents). Alcohol tax increases have been proposed in Georgia, Nevada, Ohio, and South Dakota.

Other taxes. Gov. Jim McGreevy in New Jersey would levy a 7 percent tax on hotel rooms. Gov. Patton in Kentucky would raise telecommunications taxes and freeze state property taxes that are otherwise scheduled to decline. Connecticut Gov. Rowland increased its real estate conveyance tax. In Maryland, Gov. Robert Ehrlich proposed raising the state property tax rate. Alaska Gov. Murkowski proposes either a tax on workers’ first paycheck each year, or a seasonal sales tax aimed at tourists.

Other revenue-raising measures. Among those governors that have submitted budget proposals that do not include tax increases, many nonetheless are relying on other kinds of revenue-raising measures to balance their budgets. For instance, Indiana Gov. Frank O’Bannon proposes postponing a property tax cut. Oregon Gov. Ted Kulongoski proposes extending a cigarette tax increase that is now scheduled to expire. North Carolina Gov. Mike Easley proposes extending several tax measures scheduled to expire and postponing scheduled tax cuts. In Virginia, Gov. Mark Warner’s budget proposal — actually a set of proposed adjustments to the current two-year budget — relies on suspension of a vehicle property tax reduction and of a sales tax cut on groceries.[6] At least four governors, Jeb Bush in Florida, Brad Henry in Oklahoma, Kathleen Sebelius in Kansas and Mike Leavitt in Utah, are proposing redirecting tax revenue away from dedicated trust funds into the general fund to help balance budgets. Wisconsin Gov. Jim Doyle would raise new revenue from Indian casinos. Gov. Janet Napolitano in Arizona proposes to raise new revenue from health care provider taxes and from a tax amnesty, while Gov. Bill Richardson in New Mexico proposes to raise new revenue with increased tax enforcement. Gov. Linda Lingle in Hawaii, along with Henry, Sebelius and others, are proposing new revenue from increased fees, such as motor vehicle fees. Ehrlich, Bush, Minnesota Gov. Tim Pawlenty, and other governors are recommending or assuming tuition increases at state universities.

Some of these measures, such as new gambling revenues and motor vehicle fee increases, are often considered tax increases, although they are not categorized as such in this analysis.

Tax cuts. A few governors are proposing new tax cuts. In most cases, these reductions are part of a broader revenue-raising package, and are intended to offset the burden of the new taxes on certain taxpayers. For instance, Gov. Kempthorne in Idaho proposed an increase in the state’s sales-tax credit as part of an overall sales tax increase, and the governors of Missouri and Ohio proposed corporate income tax rate cuts as part of overall corporate tax changes that will substantially increase revenue from corporate taxes. Gov. Patton in Kentucky proposed exempting low-income families from income tax and repealing the state’s tax on personal property as part of an overall revenue-positive tax reform package. In a few states, including Florida, Hawaii, New Hampshire, New Mexico and Vermont, governors are proposing only tax reductions and no tax increases. The tax cuts in those states are relatively modest (such as brief sales-tax holidays for specific items in several states) and typically are financed in whole or in part with other kinds of revenue-raising measures, such as increased fees and stepped-up revenue enforcement, as described above.

How Big Are The Tax-Increase Proposals?

The proposals of governors to date suggest that state tax increases in 2003 could be the largest since the early 1990s. Many of the proposed tax increases are quite substantial. In FY 2004, the tax increases in California are projected to raise $8 billion, those in Ohio would raise about $1 billion, those in Missouri would raise about $700 million, and those in Georgia would raise about $400 million. The Connecticut tax increase is projected to raise about $300 million in FY 2003 and another $621 million in FY 2004; the Massachusetts increase adds $138 million in the coming year. Tax and fee increases in New York combined would raise $1.3 billion in 2004. Pennsylvania’s proposed tax increases could raise close to $3 billion, although a significant portion of that amount would be set aside for property tax relief. Nevada’s proposed tax increase would raise about $1 billion over its two-year budget cycle. Add in the other 16 states where tax increases have been proposed to date, and the total nationwide approaches $18 billion.

Those proposals would make this the biggest tax-raising year since the early 1990s. Last winter, governors submitted budget proposals that included just $2.4 billion in tax increases. When fiscal conditions worsened, legislatures added additional tax increases; the total amount of tax increases enacted in the fiscal year 2003 budget process totaled $8.3 billion. Some 16 states enacted net tax increases exceeding 1 percent of state tax revenue; in just six of those 16 states — Indiana, Kansas, Massachusetts, Nebraska, New Jersey and Tennessee — the tax increases exceeded 3 percent of state tax revenue.

Despite their magnitude, the tax increases enacted for FY 2003, even when combined with the tax increases for FY 2004 proposed by governors, still fall short of the tax cuts that states enacted in the mid- and late 1990s. Those tax cuts are costing states more than $40 billion per year. The governors’ tax increase proposals to date, combined with the tax increases enacted last year, total only about $23 billion.

The tax increase proposals also fall far short of closing states’ budget gaps. In California, for instance, where the budget gap is estimated at about $26 billion, the proposed tax increase would close roughly one-quarter to one-third of the gap. In New York, the proposed revenue measures totaling $1.3 billion would close less than one-sixth of the gap. The Ohio revenue measures would close about one-half of the $2 billion budget gap. In Connecticut, the tax increase package agreed to by the governor and legislators addressed only about half of the budget gap for the current fiscal year, with the remainder to be covered by service cuts and employee layoffs; Connecticut expects an additional budget gap of several hundred million dollars — even after the recently enacted the tax increase and spending cuts are counted — that will have to be addressed when the budget for FY2004 is developed.

End Notes:

[1] Washington Post, January 9, 2003.

[2] State of the State Address, January 14, 2003.

[3] Budget Address, January 30, 2003.

[4] Statement issued January 30, 2003.

[5] Las Vegas Sun, January 21, 2003.

[6] Suspension of the Virginia tax cuts was triggered by revenue estimates from the governor’s office.