Annual TANF Expenditures Remain $2 Billion above Block Grant

by

Zoë Neuberger

|

PDF

of this report Related TANF Analyses |

| If you cannot access the files through the links, right-click on the underlined text, click "Save Link As," download to your directory, and open the document in Adobe Acrobat Reader. |

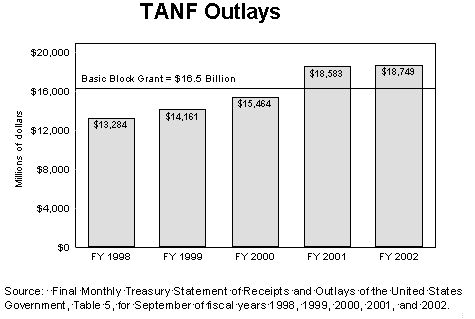

Data recently released by the Department of Treasury show that in fiscal year 2002 — as in fiscal year 2001 — states spent $2.2 billion more than they received from the basic Temporary Assistance for Needy Families block grant and $1.6 billion more than their total TANF funding, including the supplemental grants and performance bonuses some states receive.(1) TANF outlays were $18.7 billion in fiscal year 2002, an increase of $166 million over outlays in fiscal year 2001, according to the Treasury data.(2) Although the Treasury report does not break down outlays by state or by the types of programs and services supported with TANF funds, these are the first available data on state TANF spending for the complete 2002 fiscal year. These new data suggest that states have come to rely on a level of federal TANF funding well above the annual block grant level to support a range of programs for low-income families, including initiatives to help parents find jobs and supports for working families, such as child care.

Between fiscal years 1997 and 2000, annual TANF expenditures were below the $16.5 billion provided to the states annually in the basic TANF block grant. Cash assistance caseloads fell rapidly and states needed time to adjust to the flexibility of the block grant funding structure. Expenditures increased gradually each year as states adapted to TANF's expanded mission — to help parents find jobs and provide help to low-income working parents struggling to make ends meet.

The increase in state TANF spending between fiscal year 2000 and fiscal year 2001 was substantially greater than any prior growth; in fiscal year 2001 states spent $2 billion more than the basic annual TANF block grant. States were able to spend at this level by drawing down unspent funds from prior years. This expenditure level persisted in fiscal year 2002 as states continued to draw heavily on their unspent funds from prior years.

Reserves of unspent funds have now dwindled, however, and many states will not be able to maintain their current TANF spending levels over the next couple of years. In fact, some states already have made cuts in TANF-funded programs.(3)

Although data on how states used the TANF funds expended in fiscal year 2002 are not yet available, in fiscal year 2001 states devoted only 38 percent of their state and federal TANF funds to cash assistance — down from 60 percent in fiscal year 1998. Thirty percent of TANF funds used in fiscal year 2001 were devoted to child care and other supports for low-income working families as well as programs to help families find jobs. If final TANF reauthorization legislation does not provide states with additional resources, many states will be forced to scale back these work support efforts and other initiatives when they can no longer rely on unspent reserves from prior years.

Technical Appendix

More detailed TANF expenditure information will be reported to HHS by the states in mid-November. The data that states are required to report to HHS, however, are not exactly comparable to the outlay data reported by the Treasury Department. States have been permitted to transfer up to 30 percent of the TANF grant each year to the Child Care and Development Fund or the Social Services Block Grant, with no more than 10 percent permitted to be transferred to SSBG. Once these funds are transferred, the state has three years to spend CCDF funds and two years to spend SSBG funds. When transferred funds are actually spent, they appear in the Treasury data as TANF outlays.

In contrast, when states report on their spending to HHS, they include the total amount of funds that have been transferred to CCDF and SSBG without specifying whether those funds have been spent. As a result, funds that are shown as having been "expended" in HHS's data (and the Center's analyses of data reported to HHS) are actually a combination of funds spent through the TANF program and funds transferred to CCDF and SSBG that may or may not yet have been spent. This anomaly is not present in the Treasury data.

Based on HHS data, in fiscal year 2001 states spent a total of $14.9 billion in federal funds in their TANF programs and transferred $2.7 billion. Treasury data show that $18.6 billion was spent in fiscal year 2001. If $14.9 billion was spent directly in TANF programs, the remaining $3.7 billion represents expenditures of transferred funds. Since states transferred only $2.7 billion in fiscal year 2001, spending of transferred funds exceeded transfers in fiscal year 2001 by $1 billion. This $1 billion consists of funds that states had transferred to CCDF and SSBG in prior years but had not spent until fiscal year 2001.

Until the state-by-state data reported to HHS become available, it is impossible to distinguish what portion of the $18.7 billion in outlays reported by Treasury for fiscal year 2002 was spent directly in TANF programs and how much was spent out of transferred funds. Nonetheless, the Treasury data are consistent between years, so data from earlier years also include expenditures of funds from prior-year transfers.

End Notes:

1. The 1996 welfare legislation that created the TANF program provides a total of $16.5 billion each year in the basic TANF block grant, which is allocated among the states. Some states also have received supplemental grants or performance bonuses; these grants and bonuses totaled $600 million in fiscal year 2002, as they did in fiscal year 2001.

2. Final Monthly Treasury Statement of Receipts and Outlays of the United States Government for Fiscal Year 2002, available at http://www.fms.treas.gov/mts/index.html.

3. See Zoë Neuberger, States Are Already Cutting Child Care and TANF-Funded Programs, Center on Budget and Policy Priorities, May 16, 2002, https://www.cbpp.org/5-16-02wel.htm.