|

January 8, 2008

FOOD STAMP IMPROVEMENTS FOR MORE THAN 10 MILLION PEOPLE

WOULD DISAPPEAR IN 2013 UNDER SENATE-PASSED FARM BILL

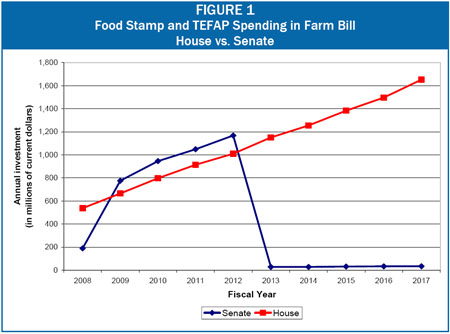

The nutrition titles of the House- and Senate-passed farm bills are very similar over the first five years that the farm bill would be in effect (2008 through 2012). The House bill invests $3.9 billion — and the Senate $4.1 billion — over five years in food stamps and the Emergency Food Assistance Program (TEFAP). In addition, the policy changes that the two bills would make are very similar — ending erosion in the purchasing power of food stamps, supporting work and savings, and increasing federal support for commodity purchases for food banks and emergency feeding organizations. The Senate bill also includes a few additional proposals, such as raising the asset limit and several useful program simplifications with modest costs.

There is, however, a profound difference between the House and Senate nutrition titles. The House bill would make these provisions permanent law. Under the Senate bill, all the major benefit improvements would terminate after 2012, and policies would return to today’s law, cutting benefits to millions of poor families, seniors and people with disabilities. (See Figure 1.)

Unless Congress later took action to extend the policies, more than 10 million recipients would experience benefit cuts in 2013, and more than 300,000 low-income people would be cut off food stamps altogether under the Senate approach.

In particular:

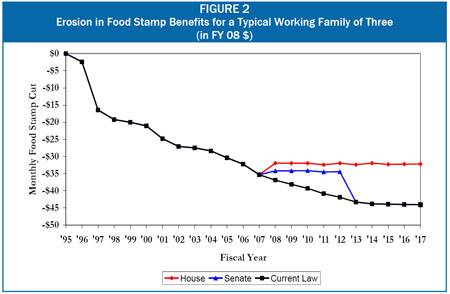

- The standard deduction would return to $134, the same level as in 1995. Ten million people would lose benefits. A typical working family of three would receive about $120 a year less in 2013 than if the policy were extended. Food stamps’ purchasing power would not simply begin to erode again from their 2012 level. Rather, benefits in 2013 would fall the full way back to today’s levels and erode in purchasing power from that level in years after 2013 — as though the 2007 farm bill’s improvements had never occurred.[1] (See Figure 2, which shows the reduction in benefits from 1995 to the present as a result of the erosion in the standard deduction and a reduction in the program’s maximum benefit amount, which were enacted in 1996, and what would transpire in the years ahead under the House and Senate farm bills.)

- Reimposing the cap on the dependent care deduction would cut food stamps for about 100,000 households. The average working family affected by reimposition of the cap would lose $540 a year ($45 a month) starting in 2013. Households that spend more than $175 a month for child care ($200 for infants) in order for a wage-earner to work would see their food stamp benefits cut sharply.

- The minimum benefit would drop from $18 a month back to $10 a month, which would cut food stamps by almost 50 percent for 650,000 households (or 780,000 people), most of whom are seniors or people with disabilities.

- Beginning to count IRAs as a resource again would end food stamp assistance for about 100,000 people. The average affected individual would lose about $125 a month. Moreover, to the extent that people had saved more over the 2008 to 2012 period as a result of the new policy in the farm bill, more people would lose food stamps in 2013 or else have to liquidate their retirement savings. Incentives for low-income workers to save for retirement would be undercut as a consequence.

- Returning the asset limits to $2,000 and $3,000 would end food stamp assistance for more than 200,000 people in 2013. To the extent that people saved more after 2007 as a result of the policy in the farm bills, more would lose benefits when the new policy terminated. Here, too, it is likely that some families would liquidate these savings to retain food stamps.

- A state option for Transitional Food Stamps would end, cutting some people from food stamps and reducing benefits for thousands of others who had worked their way off state-funded welfare programs. Changing this policy also would complicate state administration — just the fact that the option would end would make states less likely to adopt either Transitional Food Stamps or a state-funded cash assistance program, because they would be reluctant to adopt a policy they knew they might not be able to maintain.

- Undoing the Senate’s simplification of the policy regarding eligibility criteria for unemployed childless adults would cut off about 10,000 people, who would lose about $150 a month, on average. It also would increase complexity on state agencies.

- The amount of commodities available to TEFAP would drop back to $140 million in 2013 from $250 million in 2012. This would be a 44 percent cut.

Conclusion

The budget context in 2012, when Congress would face these cuts, is not likely to make it any easier to extend the policies. Either the Congress would still be following pay-as-you-go rules, in which case offsets would still be needed and likely would be even scarcer than today, or Congress and President would have broken the pay-as-you-go rules in order to extend or enact large, unpaid for tax cuts or spending increases, in which case the deficit would be larger and pressures to reduce spending greater. Furthermore, in either case, the onset of the retirement of the baby boomers and continued increases in health care costs would likely result in more unfavorable budget environment.

Low-wage families, however, will be in no less need of help purchasing an adequate diet after 2012. The highest priority for the farm bill conference in the nutrition area is to make the 2008 to 2012 benefit improvements permanent.

End Notes:

[1] Legislation enacted in 1996 froze the food stamp standard deduction at the 1995 level of $134 a month. Food stamp benefits currently average only about $1 per person per meal. As a result of this freeze food stamp benefits for most households do not keep pace with need. For more information see Families’ Food Stamp Benefits Purchase Less Food Each Year, at https://www.cbpp.org/3-6-07fa.htm. |