Report

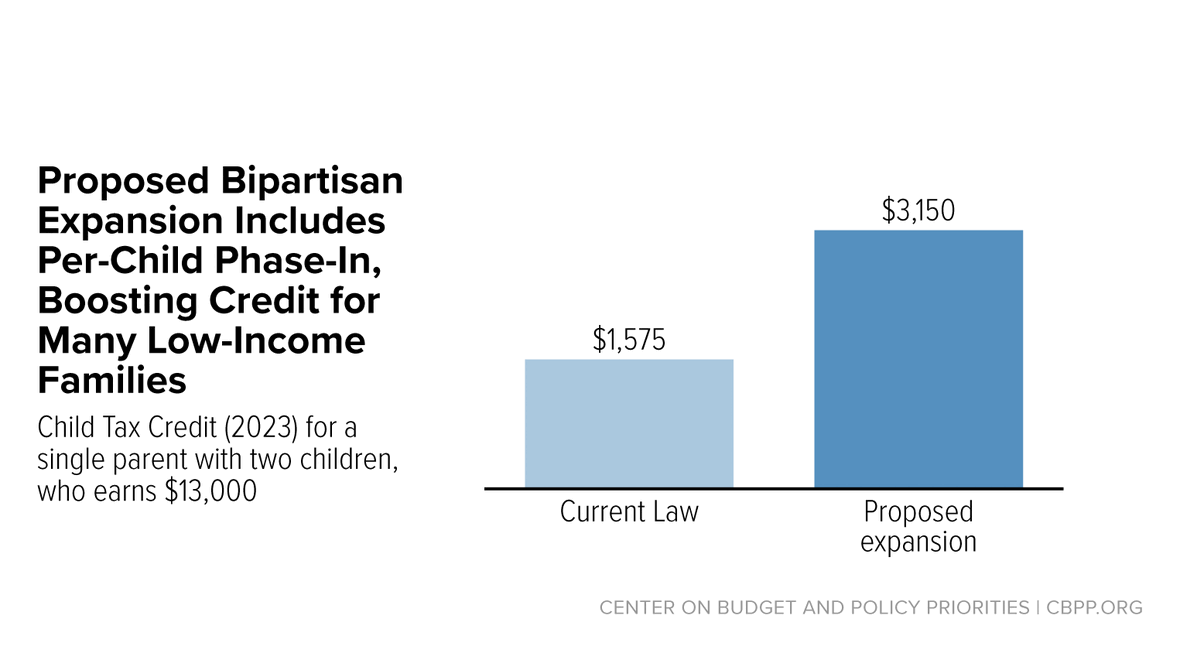

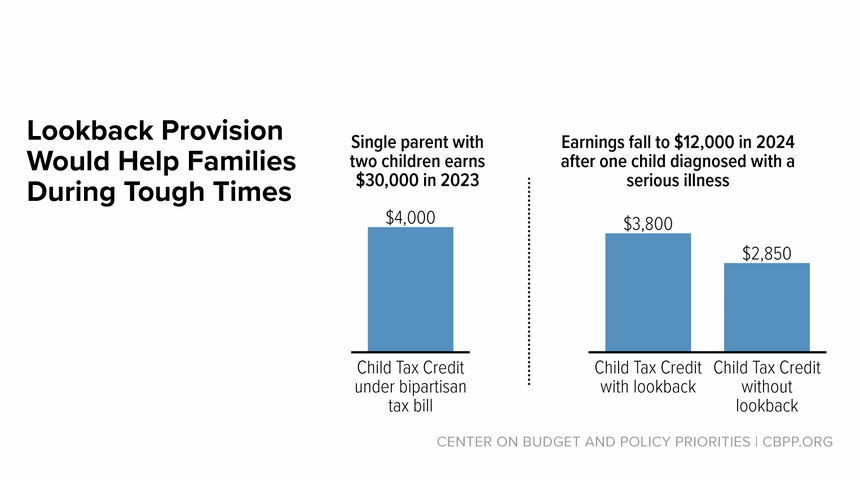

About 16 Million Children in Low-Income Families Would Gain in First Year of Bipartisan Child Tax Credit Expansion

Half a million or more children would be lifted above the poverty line when the proposal is fully in effect in 2025.