- Home

- Obama Budget Reduces Deficit By $900 Bil...

Obama Budget Reduces Deficit by $900 Billion Compared to Current Budget Policies

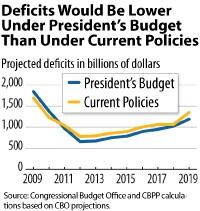

Contrary to some claims, President Obama’s 2010 budget would reduce federal deficits by about $900 billion over the next ten years compared to current budget policies. The $900 billion is the difference between deficits over the next decade under the President’s budget, as estimated by the Congressional Budget Office (CBO), and projected deficits under a realistic assessment of current budget policies. (See figure below.)

Some critics charge that Obama’s budget is fiscally irresponsible, and they cite CBO’s estimate that, under it,

In fact, deficits would be $900 billion higher over the next decade under current policies than in Obama’s budget. That’s because, in the budget plan that he released in late February, the President includes a package of spending and tax proposals that reduce future deficits by that amount.

Official Baseline Is Unrealistic

Discussions of the budget outlook typically begin with the budget “baseline,” which serves as a benchmark against which to compare the spending and revenue effects of proposed legislation. In building the baseline, CBO follows rules that the Administration and Congress originally agreed upon in 1990. The baseline rules generally assume that current laws affecting taxes and mandatory spending will continue without change.

Sometimes, however, current law diverges from current budget policies. This year, the official budget baseline incorporates several especially unrealistic assumptions. In particular, the latest baseline assumes that Congress will allow the 2001 and 2003 tax cuts, relief from the Alternative Minimum Tax, and other temporary tax provisions all to expire. It also assumes that the reductions in physician fees called for under Medicare’s sustainable growth rate formula — including a 20 percent reduction in 2010 — will actually take effect, even though Congress has stepped in to prevent such reductions since 2003. Finally, the baseline extrapolates enacted defense appropriations for 2009, which represent only a portion of the amount needed for operations in Iraq and Afghanistan this year and in coming years. (The baseline understates these costs because a substantial amount of the funding required for Iraq and Afghanistan in 2009 has not yet been enacted — the President has requested a supplemental appropriation — and is thus omitted from baseline projections of future spending.)

Budget experts have been saying for a number of years that the official baseline departs sharply from reality. In projecting future budgetary costs, deficits, and debt, such institutions as the Concord Coalition, the Committee for a Responsible Federal Budget, analysts at the Brookings Institution, and the Government Accountability Office — along with the Center on Budget and Policy Priorities — have used more realistic baselines that reflect the continuation of current budget policies. [1] This analysis continues that practice.

Budget Reduces Projected Deficits Compared to Realistic Baseline

In February 2009, CBO issued alternative budget scenarios that offered a more accurate representation of current budgetary policy. [2] We rely here on elements of those alternative budget projections and have updated them to be consistent with CBO’s new March 2009 baseline, which incorporates new economic and technical estimating assumptions. [3]

In our projection of the deficit under current budget policies, we adjust the official CBO baseline by:

- Extending the 2001 and 2003 tax cuts and other temporary tax provisions and indexing the alternative minimum tax for inflation,

- Increasing fees paid to physicians under Medicare by 1 percent annually, and

- Providing defense funding that allows the number of troops deployed in Iraq and Afghanistan to be phased down to 75,000 by 2013.

These adjustments are detailed in the appendix table. Cumulatively, they point to deficits of $10.2 trillion over the next 10 years — our starting point for measuring the impact of President Obama’s budget proposals.

President Obama’s proposed 2010 budget represents an ambitious effort to tackle many of the nation’s toughest and most pressing challenges: spurring economic recovery in the near term, reforming the health care system, reducing the threat of catastrophic climate change, and devoting more resources to other important national needs. Under his budget, health reform and climate-change legislation would be deficit-neutral. Other proposed tax cuts and increases in spending would be more than paid for (relative to the realistic baseline) by curtailing low-priority programs, closing tax loopholes, and rolling back tax breaks for taxpayers with incomes over $250,000. CBO estimates that the cumulative deficit from 2010 to 2019 under the President’s proposals would total $9.3 trillion. Compared to our realistic baseline, the President’s proposals would reduce projected deficits by about $900 billion over the 2010-2019 period. [4] The deficit would be higher in 2009 and 2010, however, because the budget sets aside an additional $250 billion for stabilization of financial markets.

Although the President’s policies would reduce the deficit compared to continuation of current policies, they are not sufficient to prevent debt held by the public from continuing to grow as a share of gross domestic product. Thus, when the economy strengthens, policymakers will need to undertake additional deficit reduction efforts, as President Obama noted at his fiscal summit on February 23.

| APPENDIX TABLE: | ||||||||||||

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | Total 2010-2019 | |

| CBO’s Official Baseline Deficit | -1,667 | -1,139 | -693 | -331 | -300 | -310 | -282 | -327 | -312 | -325 | -423 | -4,441 |

| Adjustments: Extend Expiring Tax Provisions and Index AMT* | -1 | -32 | -262 | -364 | -410 | -440 | -471 | -502 | -535 | -568 | -604 | -4,187 |

| Increase Medicare’s Physician Payment Rates by 1% a Year | 0 | -10 | -14 | -19 | -23 | -29 | -35 | -41 | -48 | -56 | -62 | -335 |

| Phase down to 75,000 troops in Iraq and Afghanistan by 2013 | -26 | -50 | -63 | -44 | -21 | -7 | -1 | 3 | 6 | 6 | 6 | -165 |

| Additional Debt Service Costs | 0 | -1 | -6 | -19 | -42 | -72 | -103 | -138 | -176 | -218 | -263 | -1,038 |

| Total Adjustments | -27 | -93 | -344 | -446 | -495 | -547 | -610 | -677 | -753 | -836 | -924 | -5,725 |

| Deficit under Current Policies | -1,694 | -1,231 | -1,037 | -777 | -795 | -858 | -893 | -1,004 | -1,065 | -1,160 | -1,347 | -10,167 |

| *CBPP has scaled CBO’s February estimate in each year by the change in CBO’s projection of gross domestic product. AMT = Alternative Minimum Tax Sources: Congressional Budget Office and CBPP calculations based on CBO projections. | ||||||||||||

End Notes

[1] For example, Concord Coalition, The Concord Coalition Plausible Baseline, January 2009. Available at http://www.concordcoalition.org/learn/budget/concord-coalition-plausible-baseline .

[2] Congressional Budget Office, Letter to the Honorable Nancy Pelosi and the Honorable John M. Spratt, Jr., February 23, 2009.

[3] Congressional Budget Office, A Preliminary Analysis of the President’s Budget and an Update of CBO’s Budget and Economic Outlook , March 2009.

[4] The Administration has described its budget as achieving $2.3 trillion in cumulative deficit reduction over the 2010-2019 period. The Administration shows greater deficit reduction primarily because it compares its policies to a budget projection in which spending for the wars in Iraq and Afghanistan and for anti-terrorism activities continues indefinitely at the amounts provided in 2008.