- Home

- Federal Tax

- 2017 Tax Law Tilted Toward Wealthy And C...

2017 Tax Law Tilted Toward Wealthy and Corporations

The 2017 tax law not only invites rampant tax sheltering and loses $1.9 trillion over ten years even as the baby boom moves deeper into retirement, but also suffers from a third fundamental flaw: it is heavily tilted in favor of wealthy people and corporations.[1]

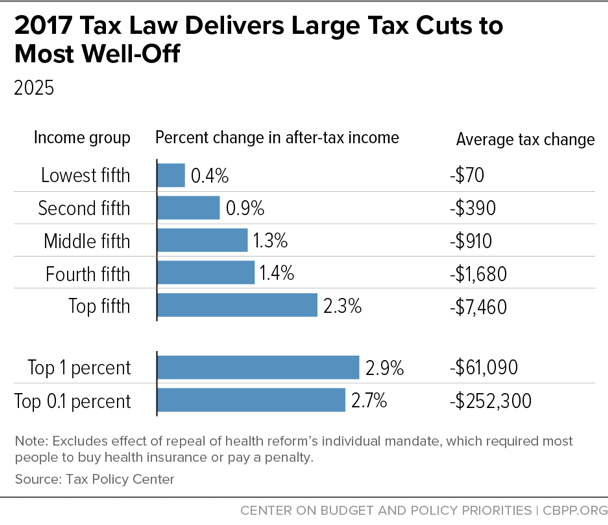

The law ignores decades of stagnant working-class wages and will increase income inequality because it delivers far larger tax cuts to households at the top, as a share of income, than those at the bottom or middle. In 2025, when it will be fully phased in (and before many provisions are slated to expire), it will boost the after-tax incomes of households in the top 1 percent by 2.9 percent, or roughly triple the 1.0 percent gain for households in the bottom 60 percent, according to the Tax Policy Center (TPC). The average tax cut that year for the top 1 percent — those with incomes above $837,800 — will be $61,100 (see first graph). In stark contrast, the bottom 60 percent of households — those making under $91,700 — will receive about $400, on average.

Upward Tilt Reflects Law’s Core Provisions

A handful of the law’s major provisions, which lose considerable revenue while primarily benefiting wealthy households, drive its upward tilt. These include:

- Cutting corporate taxes. The 2017 tax law cuts the corporate tax rate from 35 to 21 percent and shifts toward a territorial tax system, in which multinational corporations’ foreign profits will largely no longer face U.S. tax. Fully one-third of the benefits from cutting corporate rates ultimately flow to the top 1 percent, TPC estimates.

- Creating a 20 percent deduction for pass-through income. This effectively cuts the marginal individual tax rate on pass-through income (income from businesses such as partnerships, S corporations, and sole proprietorships that business owners claim on their individual tax returns) by one-fifth. Not only does a disproportionate share of pass-through income go to high-income households, but pass-through income makes up a much larger share of income for high-income households than for the middle-income households. Also, each dollar of pass-through income that’s deducted is worth more as a tax break for high-income people, because they face the highest regular individual tax rates.

- Doubling the estate tax exemption. The law doubles the amount that the wealthiest households can pass on tax-free to their heirs, from $11 million per couple to $22 million, or many times the lifetime earnings of a typical high school graduate.

- Cutting the top individual income tax rate to 37 percent. The law cuts the top individual income tax rate from 39.6 percent to 37 percent for married couples with over $600,000 in taxable income. By itself, this will give a couple with $2 million in taxable income a $36,400 tax cut. The law also weakens the Alternative Minimum Tax.

Law Does Relatively Little for Working Families

Despite the decades-long stagnation of wages for working-class households, these families seemed largely an afterthought in congressional deliberations over the 2017 tax law. Key tax parameters that affect them change significantly under the law, but often in offsetting ways. For example, the law’s increase in the standard deduction lowers taxes for many families, while its elimination of personal exemptions raises them. Three key issues important to working families stand out:

1. Millions of working families won’t get the full increase in the Child Tax Credit (CTC). Eleven million children under age 17 in low-income working families will receive nothing or a token increase of $75 or less from the law’s CTC expansion. Another 15 million children will get more than $75 but less than the full $1,000-per-child increase that families with higher incomes will receive. Moreover, the law raises the income level at which the CTC begins phasing out from $110,000 to $400,000. As a result, a married couple with two children family making $400,000 will newly qualify for a $4,000 credit, while a single mother of two working full-time at the minimum wage will receive only a $75 increase.

2. Repealing the individual mandate is expected to add millions to the ranks of the uninsured and raise premiums in the individual insurance market by about 10 percent, according to the Congressional Budget Office. Repealing the mandate, which required most people to have insurance or pay a penalty, could also generate further instability in the individual market, especially in the near term, as falling enrollment, increased uncertainty, and growing confusion make it harder for insurers to forecast their costs.

3. The 2017 tax law ignores a critical tool for boosting working-class incomes. Lawmakers who drafted the law appear not to have considered strengthening the Earned Income Tax Credit (EITC). The EITC is well-designed to be at the forefront of addressing stagnant working-class wages: it lifts millions out of poverty and supplements the wages of people who do needed jobs but receive relatively low pay, from truck drivers to cooks to home health aides.

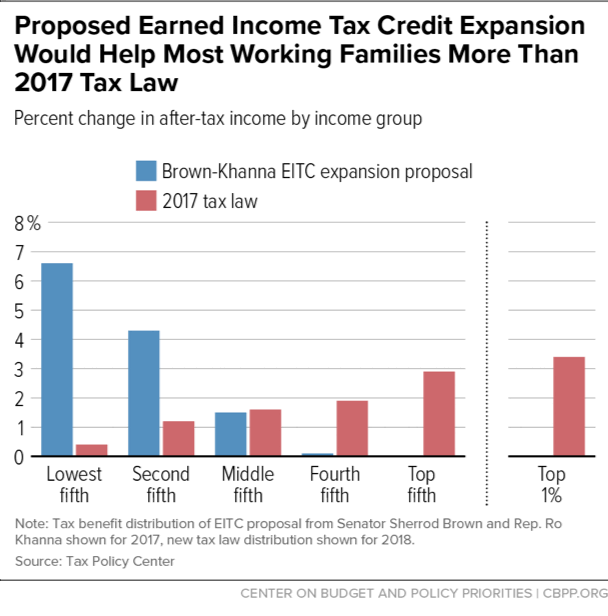

Ambitious EITC proposals are on the table. Senator Sherrod Brown and Rep. Ro Khanna, along with 55 House co-sponsors, have introduced a bill to substantially increase the EITC for childless workers and double it for workers with children, raising the incomes of 47 million households and lifting 8 million people out of poverty (see second graph).

End Notes

[1] For further information, see Chuck Marr, Brendan Duke, and Chye-Ching Huang, “New Tax Law Is Fundamentally Flawed and Will Require Basic Restructuring,” Center on Budget and Policy Priorities, April 9, 2018, https://www.cbpp.org/research/federal-tax/new-tax-law-is-fundamentally-flawed-and-will-require-basic-restructuring.