Temporarily expanding both the Child Tax Credit for low-income families currently denied the full credit and the Earned Income Tax Credit (EITC) for adults not raising children in the home (“childless adults”) would benefit an estimated 10.4 million rural (non-metro) residents across the country (as well as tens of millions in metropolitan areas), delivering well-timed, high bang-for-the-buck stimulus when people file their taxes in early 2021.[1]

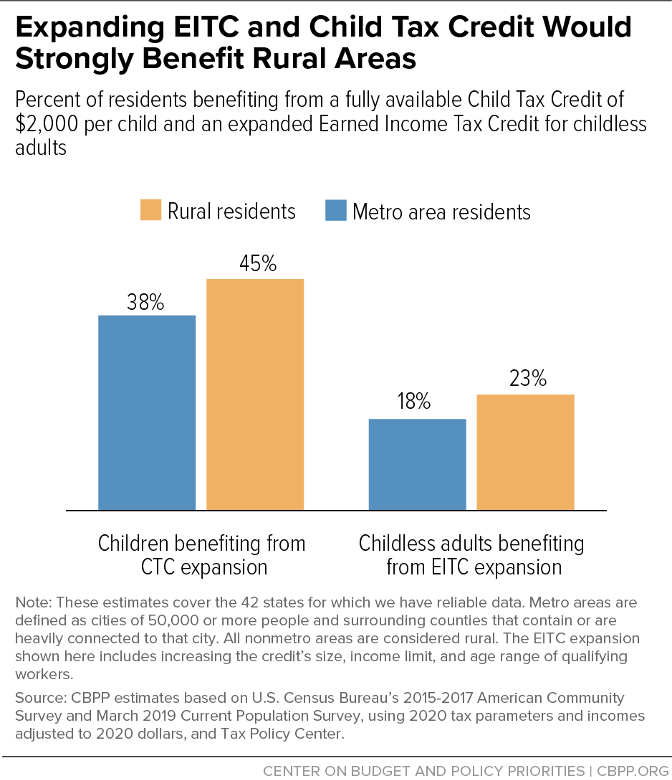

Forty-five percent of children from rural areas would benefit from a fully available Child Tax Credit of $2,000 per child, compared to a still sizable 38 percent in metro areas. Similarly, expanding the EITC for childless adults would disproportionately benefit rural workers, benefiting 23 percent of childless adults in rural areas, compared to 18 percent of those in metro areas. (See Figure 1.) That these measures would benefit higher percentages of children and childless adults in rural areas is not surprising, because incomes are generally lower there than in metro areas.[2]

Rural communities are diverse,[3] and so are the rural residents who would benefit from these expansions: about two-thirds are white, 14 percent are Black, 14 percent are Latino, 1 percent are Asian, and 6 percent are American Indian, Alaska Native, Native Hawaiian or other Pacific Islander or identify with more than one race. For each of these groups, higher shares of rural residents than metro residents would benefit. For example, white rural residents are more likely to benefit than white metro residents, just as Black, Latino, and Asian rural residents are more likely to benefit than Black, Latino, and Asian metro residents.[4]

These Child Tax Credit and EITC expansions are part of the House-passed Heroes Act. Including them in the stimulus legislation now being negotiated would strengthen the package.[5]

The current Child Tax Credit is worth up to $2,000 per child and is available to households well up the income scale, only beginning to phase out for married couples when their incomes surpass $400,000. But 27 million children nationwide, including millions in rural areas, receive either no or only a partial credit because their parents lack earnings or their earnings are too low.[6] That’s because the low-income, or refundable,[7] component of the Child Tax Credit:

- Does not begin to phase in until a household’s earnings surpass $2,500, so households with earnings below that level receive no credit;

- Phases in not on a per-child basis but rather at 15 cents per dollar of household earnings, so the credit for a family’s second child does not begin to phase in until earnings reach $11,833 (the earnings needed to qualify for the maximum refundable credit for one child). The credit for the third child does not begin to phase in until earnings exceed $21,167; and

- Is capped at $1,400 per child.

Consider a mother with a 2-year-old daughter and 7-year-old son who works part time as a home health aide, earning $9,000 a year. Her family receives a Child Tax Credit of $975, or less than $500 per child. The Heroes Act would, for tax year 2020, make the full per-child credit (now $2,000-per-child) available to low-income families like hers, raising the credit for her two children to $4,000 — a gain of over $3,000.[8]

A group of prominent conservatives recently called on Congress to expand the Child Tax Credit and EITC as part of the nation’s response to the COVID-19 pandemic. As they explained:

[The Child Tax Credit] reduces poverty while fostering some of our nation’s most critical investments: those that parents make for their children. At a time when family budgets are under great stress and many parents have stopped working to care for their children, enlarging the child credit would offer much needed relief.[9]

While the Child Tax Credit is important to families in both rural and metro areas, the low-income portion of the credit is particularly important to rural workers because jobs in rural areas typically provide lower pay. The median yearly wage for year-round workers is roughly 19 percent lower in rural areas than in metro areas.[10] People living and working in rural areas are thus more likely to claim the low-income portion of the credit: 13.5 percent of rural filers claim it, compared to 11.5 percent in metro areas.[11]

Accordingly, making the credit fully available at $2,000 per child to low-income children would disproportionately benefit rural families with children. Fully 45 percent of children in rural areas — nearly 4.3 million children — would benefit, versus (a still sizable) 38 percent of children in metro areas. (See Table 1.) In 12 states, half or more of children in rural areas would benefit: Arizona, Mississippi, Florida, Kentucky, Louisiana, New Mexico, South Carolina, Arkansas, Georgia, Missouri, North Carolina, and West Virginia.

| TABLE 1 |

|---|

| |

Children in rural areas benefiting |

Of children living in rural areas, percent benefiting |

Of children living in metro areas, percent benefiting |

|---|

| National (42-state) total* |

4,287,000 |

45% |

38% |

| Alabama |

121,000 |

49% |

42% |

| Alaska |

24,000 |

39% |

29% |

| Arizona |

54,000 |

63% |

44% |

| Arkansas |

132,000 |

53% |

44% |

| California |

71,000 |

45% |

40% |

| Colorado |

52,000 |

38% |

30% |

| Connecticut |

6,000 |

19% |

27% |

| Florida |

79,000 |

56% |

42% |

| Georgia |

207,000 |

52% |

40% |

| Hawaii |

23,000 |

41% |

28% |

| Idaho |

54,000 |

39% |

33% |

| Illinois |

121,000 |

40% |

35% |

| Indiana |

138,000 |

42% |

37% |

| Iowa |

90,000 |

32% |

30% |

| Kansas |

78,000 |

36% |

31% |

| Kentucky |

214,000 |

55% |

42% |

| Louisiana |

97,000 |

54% |

45% |

| Maine |

39,000 |

39% |

25% |

| Michigan |

153,000 |

44% |

39% |

| Minnesota |

89,000 |

33% |

26% |

| Mississippi |

210,000 |

57% |

45% |

| Missouri |

170,000 |

51% |

34% |

| Montana |

47,000 |

34% |

37% |

| Nebraska |

61,000 |

40% |

33% |

| Nevada |

20,000 |

36% |

42% |

| New Hampshire |

22,000 |

25% |

21% |

| New Mexico |

87,000 |

53% |

48% |

| New York |

119,000 |

46% |

38% |

| North Carolina |

230,000 |

50% |

40% |

| Ohio |

214,000 |

42% |

39% |

| Oklahoma |

136,000 |

46% |

41% |

| Oregon |

59,000 |

44% |

34% |

| Pennsylvania |

112,000 |

40% |

34% |

| South Carolina |

84,000 |

53% |

41% |

| Tennessee |

153,000 |

49% |

42% |

| Texas |

342,000 |

48% |

42% |

| Utah |

34,000 |

36% |

27% |

| Vermont |

23,000 |

32% |

27% |

| Virginia |

92,000 |

46% |

28% |

| Washington |

65,000 |

44% |

30% |

| West Virginia |

68,000 |

50% |

42% |

| Wisconsin |

98,000 |

32% |

32% |

The EITC is widely recognized as a highly effective tax credit; numerous studies find it boosts incomes and reduces poverty among families with children while encouraging work. Like the low-income portion of the Child Tax Credit, it is disproportionately important to people in rural areas because it provides a wage subsidy for people who work for relatively low wages, and the median yearly wage for year-round workers is lower in rural areas than in metro areas, as noted above.

As a result, people living and working in rural areas are more likely to receive the EITC than people in metro areas. Nationally, 20.5 percent of tax filers in rural areas claim the credit, compared to 17.3 percent in metro areas; in states such as Arkansas, Texas, Kentucky, South Carolina, and Georgia, one-quarter or more of rural tax filers claim the EITC.[12]

Even higher shares of filers, in both rural and metro areas, would qualify for the EITC if not for a flaw in the credit’s design. The EITC for childless adults is meager — a fraction of the EITC for families with children — and phases out quickly as their earnings rise. As a result, 5.8 million childless adults aged 19-65 who work in low-wage jobs are literally taxed into, or deeper into, poverty by federal payroll and income taxes.[13]

Consider, for example, a 25-year-old man who works roughly 35 hours a week throughout 2020 as a packer at a grocery store, earning just under $8 an hour. (The federal minimum wage is $7.25.) His annual earnings of $13,700 are just above the poverty line of $13,621 for a single individual. But federal taxes push him into poverty:

- Some $1,048 (7.65 percent of his earnings) is withheld from his paychecks for Social Security and Medicare payroll taxes.

- When filing his tax return, he can claim a $12,400 standard deduction, which leaves him with $1,300 in taxable income. Since he is in the 10 percent tax bracket, he owes $130 in federal income tax.

- Thus, before considering the EITC, his combined federal income and payroll liability is $1,178 ($1,048 + $130). He is eligible for a small EITC of $160. So, his net federal income and payroll tax liability is $1,018.

- In other words, federal taxes push this young man making poverty-level wages about $940 below the poverty line.

The Heroes Act would address this flaw on a temporary basis. For 2020 only, it would raise the maximum EITC for childless adults from roughly $530 to roughly $1,500 and raise the income limit to qualify for the credit from about $16,000 to just above $21,000. It also would expand the range of childless workers eligible for the credit from those aged 25-64 to those aged 19-65, except for full-time students aged 19-24.

In the example above, the Heroes Act expansion would increase this worker’s EITC from $160 to $1,145, raising his income after federal income and payroll taxes to $46 above the poverty line. He would no longer be taxed into poverty. Moreover, his tax refund would arrive early next year, a time when the Congressional Budget Office projects the economy will still be weak, with unemployment still above 9 percent.[14] And because his income is relatively low, he would likely spend most every dollar of his enlarged EITC. In this way, strengthening the EITC for childless workers for tax year 2020 would provide well-timed stimulus for the economy.

The Heroes Act’s expansion of the EITC for childless workers would disproportionately help rural areas: 23 percent of childless adults in rural areas would benefit, compared to 18 percent of those in metro areas. Overall, more than 2.4 million working people in rural areas would benefit.[15] (See Table 2.)

| TABLE 2 |

|---|

| |

Childless workers in rural areas benefiting |

Of childless workers living in rural areas, percent benefiting |

Of childless workers living in metro areas, percent benefiting |

|---|

| National (42-state) total* |

2,407,000 |

23% |

18% |

| Alabama |

60,000 |

25% |

22% |

| Alaska |

14,000 |

20% |

15% |

| Arizona |

19,000 |

31% |

20% |

| Arkansas |

63,000 |

27% |

21% |

| California |

51,000 |

26% |

17% |

| Colorado |

38,000 |

18% |

16% |

| Connecticut |

7,000 |

12% |

13% |

| Florida |

43,000 |

27% |

21% |

| Georgia |

92,000 |

25% |

19% |

| Hawaii |

13,000 |

18% |

14% |

| Idaho |

34,000 |

26% |

23% |

| Illinois |

73,000 |

20% |

15% |

| Indiana |

73,000 |

20% |

20% |

| Iowa |

63,000 |

18% |

17% |

| Kansas |

49,000 |

20% |

17% |

| Kentucky |

98,000 |

26% |

20% |

| Louisiana |

45,000 |

29% |

23% |

| Maine |

35,000 |

23% |

18% |

| Michigan |

110,000 |

25% |

20% |

| Minnesota |

61,000 |

18% |

15% |

| Mississippi |

80,000 |

25% |

23% |

| Missouri |

92,000 |

26% |

18% |

| Montana |

47,000 |

24% |

24% |

| Nebraska |

31,000 |

17% |

16% |

| Nevada |

14,000 |

19% |

18% |

| New Hampshire |

24,000 |

16% |

12% |

| New Mexico |

45,000 |

29% |

22% |

| New York |

73,000 |

21% |

16% |

| North Carolina |

118,000 |

23% |

19% |

| Ohio |

125,000 |

21% |

19% |

| Oklahoma |

69,000 |

25% |

20% |

| Oregon |

38,000 |

24% |

20% |

| Pennsylvania |

81,000 |

21% |

16% |

| South Carolina |

44,000 |

27% |

21% |

| Tennessee |

81,000 |

25% |

19% |

| Texas |

154,000 |

24% |

17% |

| Utah |

15,000 |

23% |

17% |

| Vermont |

22,000 |

18% |

14% |

| Virginia |

59,000 |

23% |

15% |

| Washington |

40,000 |

22% |

15% |

| West Virginia |

36,000 |

24% |

21% |

| Wisconsin |

76,000 |

18% |

16% |