- Home

- 2017 Tax Law’s Child Credit: A Token Or ...

2017 Tax Law’s Child Credit: A Token or Less-Than-Full Increase for 26 Million Kids in Working Families

The 2017 tax law increased the maximum value of the Child Tax Credit (CTC) — first enacted to help working families offset the cost of raising children — from $1,000 to $2,000 per child, but low-income working families are largely missing out on that full CTC increase. For starters, 11 million children under 17 in the lowest-income working families — who under prior law received only a partial CTC or no credit at all — receive either no improvement in the credit or a token increase of $1 to $75. Another 15 million children in low- and modest-income working families get a CTC increase of more than $75 but less (and in many cases far less) than the full $1,000-per-child increase that families at higher income levels get. Further, the law ends the CTC for 1 million children — overwhelmingly “Dreamers” — in working immigrant families.

The CTC’s changes are an example of how little priority the GOP drafters of the 2017 law placed on addressing the decades-long stagnation of working-class wages across races. Most glaring was that they did nothing to expand the Earned Income Tax Credit (EITC), which is tailor made to address this problem. In fact, the new tax law erodes the credit’s value over time. Instead of focusing on working-class families by making robust improvements to the CTC and EITC, the 2017 law tilted steeply to the wealthy and profitable corporations.

Just $75 or Less for 11 Million Children, Less than the Full Credit for 15 Million More

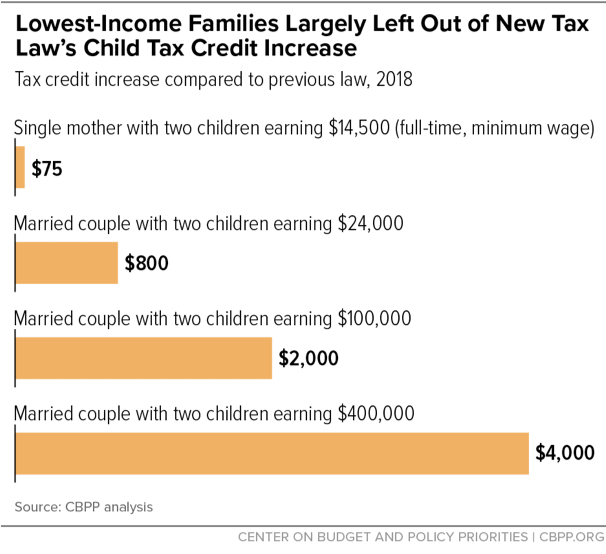

The CTC changes in the 2017 tax law leave many working families largely behind, while doing much more for high-income families:

- Nationally, 11 million children in low-income working families will see a $75 or smaller increase in their CTC. (See map below for state-by-state numbers.) Before the 2017 tax law, the CTC was a maximum tax credit of $1,000 per eligible child under age 17. However, many low- and moderate-income working families could not receive the maximum credit — so increases to the maximum do nothing to help them.

That’s because working families with children under 17 with incomes too low to owe much or any income tax could get only part of the CTC as a tax refund. Before the 2017 tax law, that refundable amount was limited to 15 percent of a family’s earnings over $3,000. The 2017 tax law lowered the threshold so that earnings over $2,500 would count towards earning a CTC. This translates to a CTC increase of just $75 (15 percent of $500) for those families — such as a single mother with two children who works full time at the federal minimum wage and earns $14,500 a year. (See chart.)

- Another 15 million children in moderate-income families still won’t get the full $1,000-per-child increase that higher-income families received. The 2017 law introduced a new cap on the refundable amount of the credit, at $1,400 per child (indexed for inflation), giving millions of children in moderate-income families a CTC increase of no more than $400 per child. For example, a married couple with two children making $24,000 will get an $800 increase in their total CTC — well below the $2,000 maximum.

- The largest CTC increases go to high-income families, since the credit now begins to phase out for married couples making $400,000 a year, compared to $110,000 under prior law. (Under prior law, families with two children and income of more than $150,000 weren’t eligible; now that amount is $480,000).

Working Families Hurt by Credit Cuts

The 2017 tax law also made harmful cuts to the CTC and EITC. It ends the CTC for 1 million children lacking a Social Security number in low-income working families[1] — overwhelmingly “Dreamers” with undocumented status brought to the United States by their immigrant parents.

The law also erodes the value of the EITC for millions of working-class people.[2] Since the law uses the “chained” Consumer Price Index to adjust tax brackets and certain tax provisions each year to account for inflation, the maximum EITC will rise more slowly over time. A married couple making $40,000 with two children will see their federal EITC shrink by $319 in 2027 (from $4,994 to $4,675).

Law Needs Basic Restructuring to Focus on Working Families

The 2017 tax law was an opportunity to make needed improvements to the CTC and EITC, but low- and moderate-income working families — and the tax credits best equipped to help them — were largely an afterthought. For example, negotiators agreed last minute to a deeper cut in the top individual tax rate but rejected calls from Senators Marco Rubio and Mike Lee to deliver more than a token CTC increase to 11 million children in low-income working families. And lawmakers drafting the law apparently didn’t even consider strengthening the EITC.

Instead, the law focuses its tax cuts on those at the top: by 2025 it will boost the after-tax incomes of households in the top 1 percent by 2.9 percent, roughly triple the 1.0 percent gain for those in the bottom 60 percent, the Tax Policy Center found. This is one reason — in addition to its high cost and the opportunities it creates for high-income filers to game the tax system and avoid taxes — that the 2017 tax law should be fundamentally restructured as soon as possible. That restructuring should include substantial boosts in both the CTC and EITC.[3]

End Notes

[1] Jacob Leibenluft, “Tax Bill Ends Child Tax Credit for About 1 Million Children,” CBPP, December 18, 2017, https://www.cbpp.org/blog/tax-bill-ends-child-tax-credit-for-about-1-million-children.

[2] Chuck Marr, “Instead of Boosting Working-Family Tax Credit, GOP Tax Bill Erodes It Over Time,” CBPP, December 21, 2017, https://www.cbpp.org/blog/instead-of-boosting-working-family-tax-credit-gop-tax-bill-erodes-it-over-time.

[3] Chuck Marr, Brendan Duke, and Chye-Ching Huang, “New Tax Law Is Fundamentally Flawed and Will Require Basic Restructuring,” CBPP, April 9, 2018, https://www.cbpp.org/research/federal-tax/new-tax-law-is-fundamentally-flawed-and-will-require-basic-restructuring.