- Home

- Trump’s “Skinny” Budget Omits Most Of Th...

Trump’s “Skinny” Budget Omits Most of the Budget

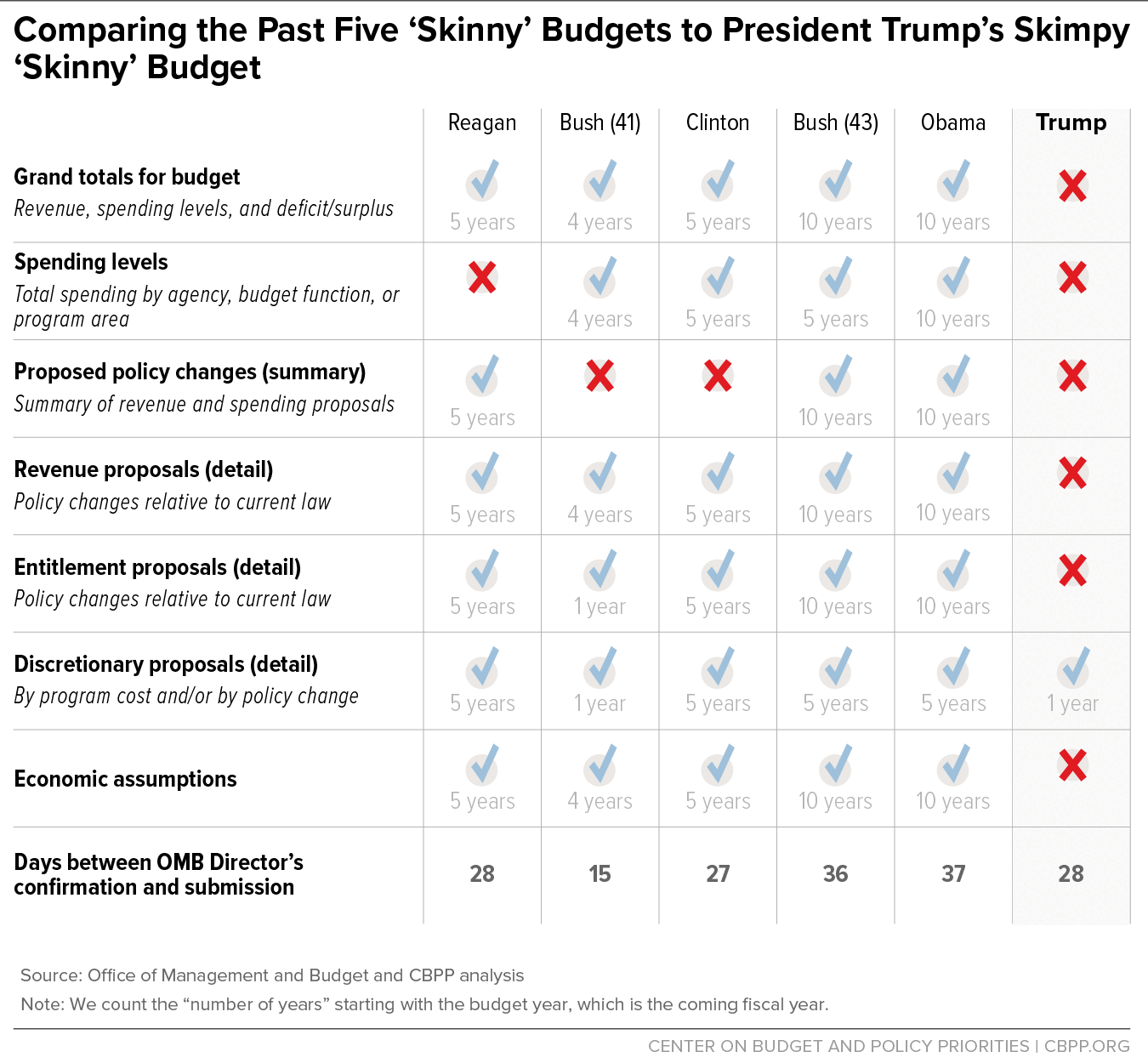

The Trump budget omits any figures on entitlement or mandatory spending, interest payments, revenues, or deficits.President Trump released his so-called “skinny” budget today, and it contains substantially less detail than “skinny” budgets of the last five administrations going back to Ronald Reagan. The Trump budget includes only estimates for fiscal 2018 and only for its proposed changes to discretionary programs (those funded through the annual appropriations process) — even though discretionary programs make up less than one-third of the federal budget. The Trump budget omits any figures on entitlement or mandatory spending (e.g., Social Security, Medicare, Medicaid, federal retirement, or SNAP), interest payments, revenues, or deficits.

In contrast, while all five previous administrations released initial budgets that displayed information in very different ways, they all provided a more complete picture of how their policies affected total spending, revenues, and deficits (or surpluses), and showed them for several years beyond the budget year. All five, for instance, included estimates of total spending, revenue, and deficits (or surpluses) for the coming fiscal year and at least the three subsequent years, and the two most recent administrations (Bush and Obama) covered ten years. Four of the five sorted total spending into different categories and for multiple years — for instance, showing total spending by each federal agency; by budget functions (e.g., health, education, or defense); or by program areas.

All five included details of the budgetary effects of their proposals for entitlement programs, and four of the five provided these details over multiple years. All five included details of the budgetary effects of their proposals on revenue, showing these estimates over multiple years. All five included information on funding for discretionary programs, showing the funding level, the proposed changes, or both, as does the Trump skinny budget; however, four of the five provided these estimates for multiple years, while the Trump provides these figures for only one year. Finally, all five provided information about the economic assumptions they used in preparing these budget estimates, including assumptions about the growth rate of the economy, inflation, and interest rates.

Despite providing far more detail than the Trump Administration, all five previous ones released their budgets by the end of February — and the Trump team had roughly the same amount of time between the confirmation of its budget director (Mick Mulvaney) and the release of its budget.

Appendix: Terms Used In the Table

- Years in the table refer to fiscal years, which start on the prior October 1st and continue to the next September 30th. (The exception is for economic assumptions, which are invariably displayed by calendar year.) The table counts years starting with the budget year, which is the coming fiscal year.

- Agency refers to federal departments and smaller agencies, such as the Department of Defense or the Environmental Protection Agency.

- Budget function refers to any of 21 official, long-standing “budget functional categories” that group individual programs by their main purpose, regardless of which agency administers them and whether they are entitlements or are funded via annual, discretionary appropriations. Examples include Income Security, General Government; Community & Regional Development; and Commerce & Housing Credit.

- Program area refers to any groupings of programs or policies that a new president uses to explain his goals to Congress and the public. For example:

- President Clinton split his “Investment Proposals” table into five areas (with considerable further subdivisions): 1) Rebuild America; 2) Lifelong Learning; 3) Rewarding Work; 4) Health Care; and 5) Private-Sector Incentives.

- The first President Bush split his “Areas of Priority Initiative Spending” into six areas (with further subdivisions): 1) Investing in R&D and Long-Term Productive Capacity; 2) Investing in People; 3) Ending the Scourge of Drugs; 4) A Kinder, Gentler America; 5) Attending to Problems of the Past; and 6) Securing a More Peaceful World.

- Policy changes refer to the increases or decreases in the level of spending or revenue for a given year. For entitlement and revenue policies, the change is measured relative to what would occur in that year if entitlement law or tax law were not changed. For discretionary policies, the change is measured relative to a baseline in which annual appropriations are assumed to remain constant from year to year after accounting for inflation.

- Deficit is the amount by which expenditures exceed revenues (tax receipts) in a fiscal year. In 1998 through 2001, revenues exceeded expenditures; those four years had surpluses.

- Revenues are basically synonymous with tax receipts.

- Spending generally means the amount of expenditures (outlays, disbursements) that occur in a fiscal year. However, in this table, we have used it to also refer to information on funding, which is the amount an agency is permitted to obligate, commit to, contract for, etc., in a fiscal year. The level of expenditures and the level of funding are both useful ways to measure a program’s cost, but the two measurements often differ because expenditures can occur in years after funding is enacted. Funding is typically used as the measure of discretionary programs.

- Entitlement spending is determined outside the annual appropriations process.

- Discretionary funding is determined in the annual appropriations process.