Report

Entering Their Second Decade, Affordable Care Act Coverage Expansions Have Helped Millions, Provide the Basis for Further Progress

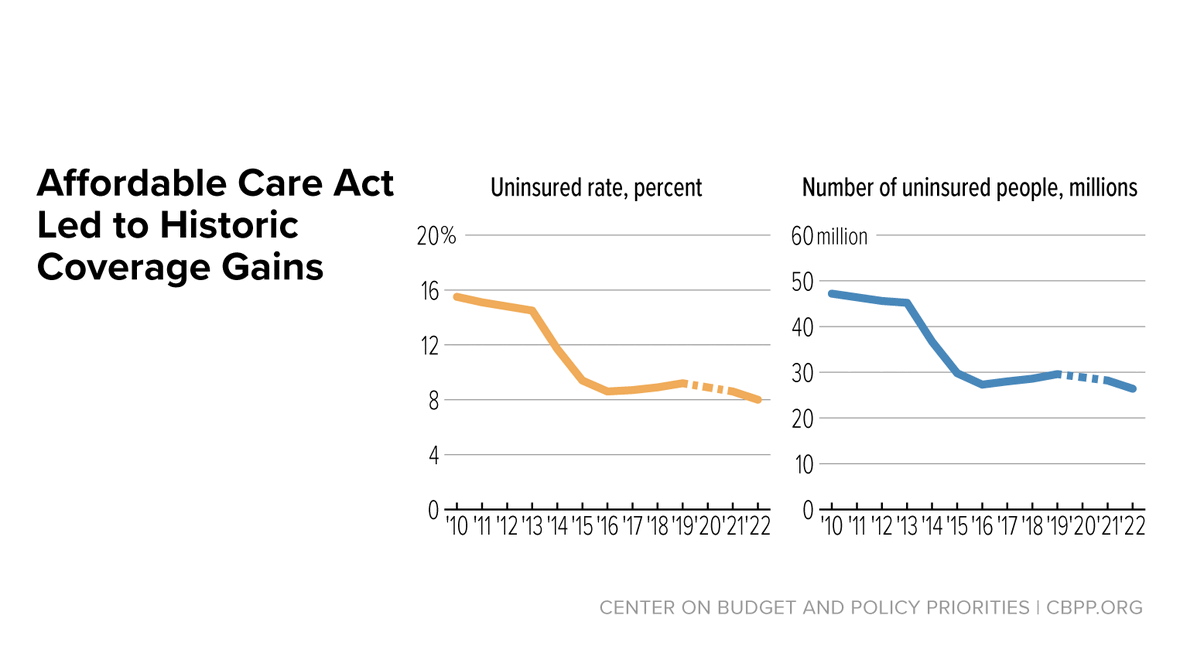

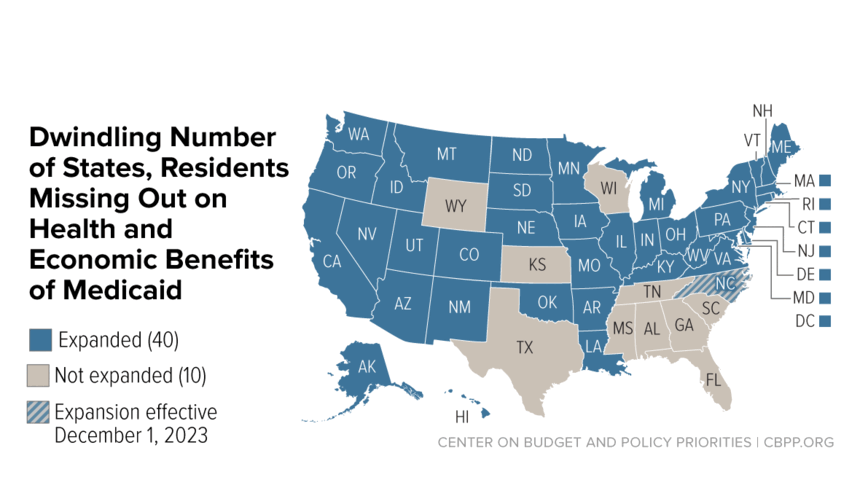

The Affordable Care Act (ACA) expanded eligibility for affordable health coverage.