Statement: Chad Stone, Chief Economist, on the March Employment Report

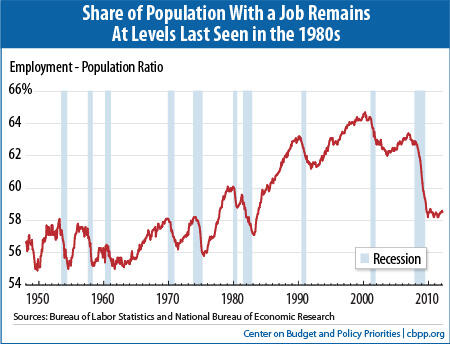

Today's jobs report disappointed expectations, with employers adding only 120,000 jobs in March, making clear that a strong jobs recovery remains elusive. The unemployment rate dipped to 8.2 percent, but that decline reflected people leaving the labor force, not finding jobs. The combination of high unemployment and depressed labor force participation leaves the share of Americans with a job at levels last seen in the mid-1980s (see chart). Though the economy could use a boost through monetary or fiscal policy, that's not likely to occur, further dampening hopes of strong job growth any time soon.

Analysts had expected the stronger job growth of recent months to continue into March and for people to continue returning to the labor force because they sensed improving job prospects. Instead, job growth fell to a level barely sufficient to keep up with population growth and the labor force shrank largely because some of the unemployed stopped looking for jobs and left the labor force entirely.

When employers first begin to add jobs at a strong rate, people who were not looking for work because job prospects seemed so dismal should start returning to the labor force. Not all of them will find jobs immediately and they will be counted as unemployed until they find jobs. But instead of accelerating, the jobs recovery fell backward and a dip in the unemployment rate associated with a shrinking labor force is nothing to cheer about.

Unfortunately, most private forecasters, the Congressional Budget Office, and the Federal Reserve expect relatively modest growth for the rest of the year and no significant fall in unemployment. The economy surely could use some fuel injection from either monetary policy, fiscal policy, or both, but that's not in the cards — and that's a bad sign for job growth and for boosting people's confidence that they can find a job.

About the March Jobs Report

Job growth was disappointing in March and a strong jobs recovery remains elusive.

- Private and government payrolls combined rose by 120,000 jobs in March. Private employers added 121,000 jobs. Modest losses in local government jobs and state jobs outside of education were partly offset by modest gains in state education jobs. Overall, the drag from state and government job losses, which has been significant for the past few years, was minimal in March.

- This is the 25th straight month of private-sector job creation, with payrolls growing by 4.1 million jobs (a pace of 162,000 jobs a month) since February 2010; total nonfarm employment (private plus government jobs) has grown by 3.6 million jobs over the same period, or 143,000 a month. The loss of 474,000 government jobs over this period was dominated by a loss of 348,000 local government jobs.

- Despite the 25 months of private-sector job growth, there were still 5.2 million fewer jobs on nonfarm payrolls in March than when the recession began in December 2007 and 4.8 million fewer jobs on private payrolls. Payroll job growth in March was a disappointing step backward from the pace of job creation in recent months, and we remain well short of the sustained growth of 200,000 to 300,000 jobs or more that is typical of a robust jobs recovery.

- The unemployment rate edged down to 8.2 percent in March, and the number of unemployed Americans dropped slightly to 12.7 million. The unemployment rate was 7.3 percent for whites (2.9 percentage points higher than at the start of the recession), 14.0 percent for African Americans (5.0 percentage points higher than at the start of the recession), and 10.3 percent for Hispanics or Latinos (4.0 percentage points higher than at the start of the recession).

- The recession and lack of job opportunities drove many people out of the labor force, and we have yet to see a sustained return to labor force participation (people aged 16 and over working or actively looking for work) that would mark a strong jobs recovery. The decline in the labor force in March was discouraging. The number of people with a job fell by 31,000 and the number of people looking for a job fell by 133,000, for a total decline in the labor force of 164,000 people. The labor force participation rate edged down to 63.8 percent. Except for January's 63.7 percent, however, that's its lowest level since 1983.

- The share of the population with a job, which plummeted in the recession from 62.7 percent in December 2007 to levels last seen in the mid-1980s and has been below 60 percent since early 2009, edged down to 58.5 percent in March.

- Finding a job remains very difficult. The Labor Department's most comprehensive alternative unemployment rate measure — which includes people who want to work but are discouraged from looking and people working part time because they can't find full-time jobs — was 14.5 percent in March, down from its all-time high of 17.4 percent in October 2009 in data that go back to 1994, but still 5.7 percentage points higher than at the start of the recession. By that measure, almost 23 million people are unemployed or underemployed.

- Long-term unemployment remains a significant concern. Over two-fifths (42.5 percent) of the 12.7 million people who are unemployed — 5.3 million people — have been looking for work for 27 weeks or longer. These long-term unemployed represent 3.4 percent of the labor force. Before this recession, the previous highs for these statistics over the past six decades were 26.0 percent and 2.6 percent, respectively, in June 1983.

The Center on Budget and Policy Priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants.