Statement: Chad Stone, Chief Economist, on the January Employment Report

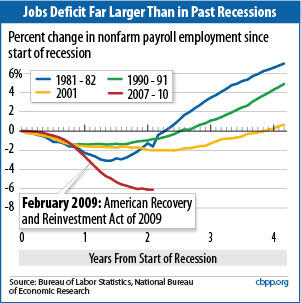

Today’s jobs report shows that job losses have slowed to a trickle compared with what they were in the months just before President Obama and Congress enacted the American Recovery and Reinvestment Act (ARRA) last February. But it also highlights the huge jobs deficit that remains the legacy of the longest and most severe recession since the Great Depression. Temporary recovery measures that extend or expand on ARRA remain vital to putting the economy on a path that will close that jobs deficit.

Although nonfarm payroll employment was essentially unchanged in January, revisions to the jobs data going back to 2008 raised the estimated cumulative job losses since the start of the recession in December 2007 to 8.4 million. The current jobs deficit is much larger than in previous recessions (see chart). The economy would have to create an average of 350,000 jobs a month for two years just to return to the December 2007 level of employment — and even more to restore full employment, since the population and potential labor force are now larger. Most forecasters expect the economy to grow much more slowly than that, especially as ARRA winds down.

The President’s fiscal year 2011 budget, which he released on Monday, proposes $266 billion of additional temporary recovery measures to stimulate the economy. They include an extension of the ARRA measures providing extra weeks of unemployment insurance and subsidized COBRA health insurance coverage for unemployed workers and fiscal relief for states facing severe budget shortfalls, as well as $100 billion for new jobs initiatives. These measures are designed to have their maximum impact on the economy over the next two years, and like ARRA, they are temporary measures that do not add significantly to the long-run budget deficit.

Such temporary recovery measures are needed when there is a significant jobs deficit that is not closing quickly. Once a sustainable recovery is underway, policymakers must restore fiscal discipline and reduce the budget deficit to sustainable levels in order to promote long-term growth and prosperity. But too much deficit reduction too soon could derail the recovery and be counterproductive to those long-term goals.

About the January Jobs Report

While the labor market is stabilizing after a long deterioration, conditions remain harsh for job-seekers.

- Private and government payrolls combined shrank by 20,000 jobs in January. Revisions to the payroll employment data back to April 2008 show that the economy shed 1.4 million more jobs through December 2009 than previously reported. The new data show that net job losses since the recession began in December 2007 total 8.4 million. (Private sector payrolls have shrunk by 8.5 million jobs over the period.)Image

- The pace of job losses has slowed markedly — to an average of just 35,000 per month over the past three months, compared with an average of 732,000 jobs per month over the period of greatest job losses (November 2008 through March 2009).

The unemployment rate dropped unexpectedly to 9.7 percent in January and is under 10 percent for the first time since September 2009. That, however, is still 4.7 percentage points higher than at the start of the recession. - More people entered the labor force than left it in January and the labor force participation rate edged up to 64.7 percent. The combination of an increase in labor force participation and a drop in the unemployment rate resulted in a rise in the percentage of the population with a job from 58.2 percent to 58.4 percent. Nevertheless, both the labor force participation rate and the percentage of the population with a job remain near lows that were last seen in 1985.

- The Labor Department’s most comprehensive alternative unemployment rate measure — which includes people who want to work but are discouraged from looking and people working part time because they can’t find full-time jobs — fell from 17.3 to 16.5 percent in January. That figure is still very high but nearly a point below the 17.4 percent reached in October 2009.

- Long-term unemployment remains a significant concern. Over two-fifths (41.2 percent) of the 14.8 million people who are unemployed have been looking for work for 27 weeks or longer. That’s the highest percentage on record in data going back to 1948. Regular unemployment insurance benefits typically run out after 26 weeks.

The Center on Budget and Policy Priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants.