BEYOND THE NUMBERS

In Case You Missed It…

This week at CBPP, we focused on federal taxes, the federal budget, state budgets and taxes, health, food assistance, housing, and the economy.

- On federal taxes, we tracked the congressional tax debate. Chye-Ching Huang assessed the Joint Tax Committee’s most recent estimates of the Senate GOP’s tax bill, finding that millions of households face tax increases or no tax benefits under the bill. Huang noted that the Senate tax bill supporters are hiding the bill’s true impacts. Sharon Parrott, Joel Friedman, and Richard Kogan warned that the “trigger” in the Senate tax bill that would reportedly activate corporate tax increases if the promised positive economic effects of the bill do not materialize is flawed, inadequate, and unrealistic. Jacob Leibenluft and Huang described how the GOP process is designed to obscure the tax plan’s effects.

Huang pointed out that the Senate Finance Committee’s tax bill would provide an even larger share of its tax benefits to the wealthy than the tax cuts enacted under President George W. Bush. Huang, Guillermo Herrera, and Brendan Duke analyzed the Joint Tax Committee’s earlier estimates of the amended Senate tax bill, and found that it skews benefits to the top earners while hurting many low- and middle-income Americans. Huang argued that President Trump favors larger corporate tax cuts over more help for children in low-income working families. Arloc Sherman explained that many veterans wouldn’t fully benefit from the Senate tax bill’s Child Tax Credit increase.

- On the federal budget, Spiros Protopsaltis and Libby Masiuk explained why the Trump Administration should heed the history of bipartisan efforts to protect taxpayers’ investments in higher education.

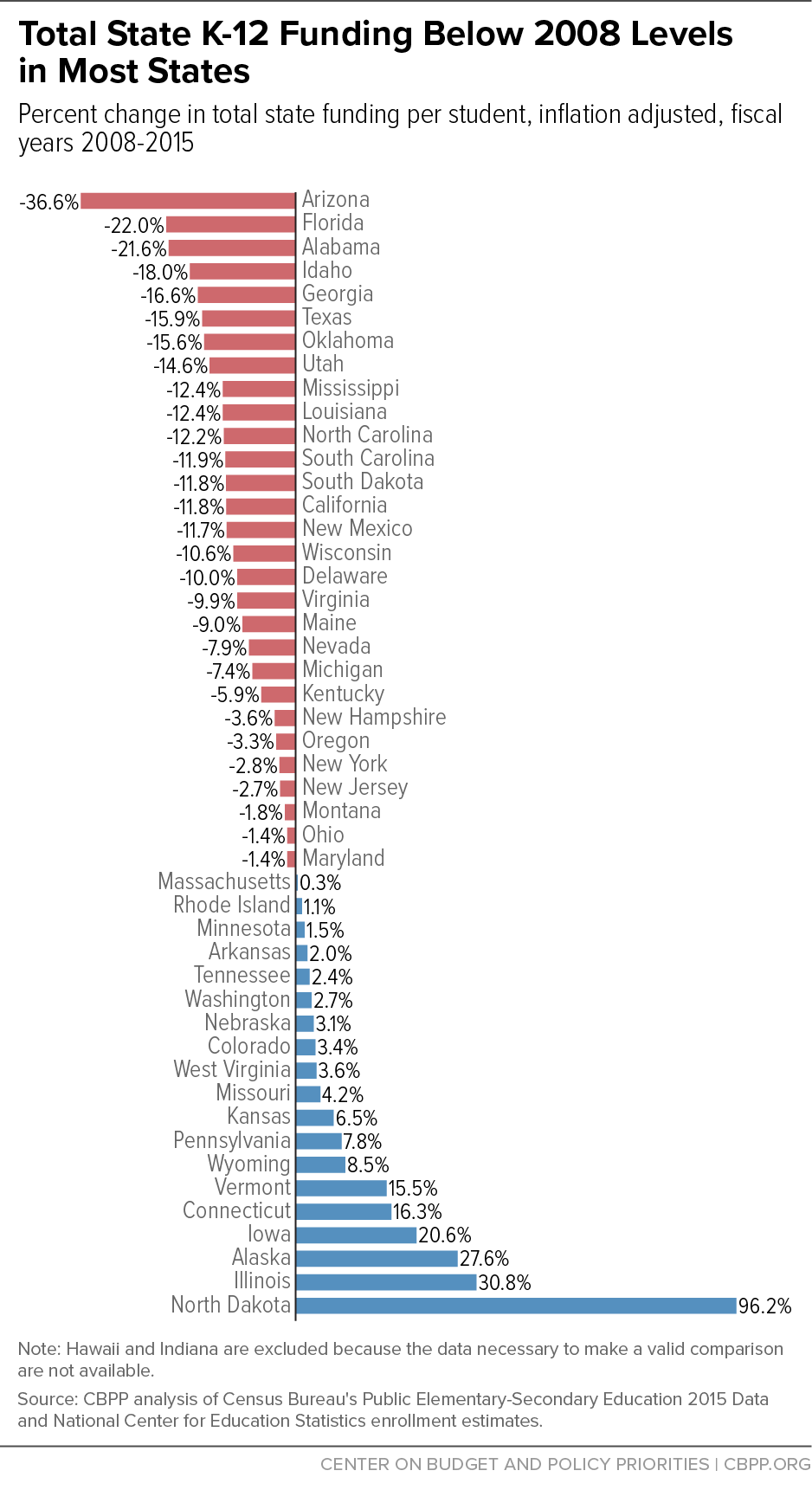

- On state budgets and taxes, Michael Leachman, Kathleen Masterson, and Eric Figueroa found that public investment in K-12 schools has declined dramatically in a number of states over the last decade. Leachman detailed how K-12 education funding in some states is still far below pre-recession levels.

- On health, Aviva Aron-Dine explained why the proposal from Senators Susan Collins and Bill Nelson to provide temporary funding for state reinsurance programs can’t fix the damage that repealing the individual mandate would cause. Sarah Lueck explained why President Trump’s health care executive order would destabilize insurance markets and weaken coverage for millions of Americans.

- On food assistance, Elizabeth Wolkomir examined how food assistance is different in Puerto Rico than in the rest of the United States.

- On housing, Douglas Rice and Lissette Flores calculated the additional federal funding that’s needed to prevent 2018 housing voucher cuts.

- On the economy, we updated our chart book on the legacy of the Great Recession.

Chart of the Week – Total State K-12 Funding Below 2008 Levels in Most States

A variety of news outlets featured CBPP’s work and experts recently. Here are some highlights:

Tax bill could trigger significant Medicare cuts

Politico

December 1, 2017

Senate takes up tax reform: Here's what the plan looks like

Fox News

November 30, 2017

The Senate Is Rushing to Pass Its Tax Bill Because It Stinks

New York Times

November 29, 2017

Even With ‘Fixes,’ The GOP Tax Cut Plan Would Likely Damage Health Care

Huffington Post

November 29, 2017

Marco Rubio, Mike Lee push plan to raise corporate tax rate, give benefits to the poor

Washington Post

November 29, 2017

Study finds that for many states, public education funding still hasn’t come back to pre-Recession levels

Marketplace

November 29, 2017

Don’t miss any of our posts, papers, or charts — follow us on Twitter, Facebook, and Instagram.