BEYOND THE NUMBERS

Republican congressional leaders point to Joint Committee on Taxation (JCT) and Congressional Budget Office (CBO) estimates of the pending Senate GOP tax bill to say that every income group would get a tax cut from it. But they use these estimates in highly selective and extremely misleading ways. They focus on the average tax change for an income group, which obscures the millions of filers within the group who would face tax increases; ignore the fact that the bill would get far worse after 2025, when all of its individual income tax cuts would expire; and ignore the impact from the bill’s repeal of a key health reform provision.

(1) Averages obscure the millions of households facing tax increases. Republican leaders cite estimates of the total and average tax changes across different income groups. But if an income group gets a tax cut on average, that doesn’t mean that every household in it gets a tax cut. In fact, the bill raises taxes on large numbers of households every year it’s in effect.

JCT hasn’t yet estimated how many households in each income group would face tax increases. But the Tax Policy Center (TPC), whose average estimates are very close to JCT’s, estimates that in 2025, the bill would raise taxes on 19 million households with incomes below $200,000 and on 22 million households overall. And those estimates don’t account for the bill’s “sunsetting” of many of its tax cuts after 2025 or the bill’s impact on health coverage, discussed below.

(2) The bill would get worse over time. Some Republican senators have highlighted estimates of the bill’s impact before 2025. But at the end of 2025, almost all of its individual income tax provisions – including all of its individual income tax cuts – would expire. Its deep corporate rate cuts would stay in place, permanently. To help pay for those corporate rate cuts, the bill permanently adopts a slower measure of inflation for adjusting tax brackets and other tax provisions each year, which would raise taxes across the board (by gradually pushing middle-income filers into higher tax brackets, for example).

As a result, TPC estimates that in 2027:

- the bill would raise taxes on 87 million households with incomes below $200,000 and on 94 million households overall — or more than half of all households; while

- 85 percent of millionaires would get tax cuts, averaging more than $35,000 apiece, because investors and high-paid executives would reap most of the benefits of the bill’s permanent corporate tax cuts.

And even these figures don’t include the bill’s impact on health coverage.

(3) The bill would hurt millions of people by repealing a key health reform provision. It repeals the Affordable Care Act’s individual mandate, the requirement that most people get health insurance or pay a penalty. And it keeps that repeal in place permanently to pay for its permanent corporate rate cuts.

All of the savings from repeal ($53 billion in 2027, for example) would come because fewer people would be insured, which would lower federal costs for Medicaid and for tax credits that help people buy insurance. CBO estimates that by 2027, repeal would increase the number of uninsured by 13 million and raise premiums in the individual market by 10 percent, on average.

Claims from some Republicans that these losses should be ignored because they’re “voluntary” don’t hold water. Some people would lose coverage because they couldn’t afford the premium increases that repeal would cause. Others would become uninsured because they wouldn’t realize they were eligible for Medicaid or marketplace financial assistance. Awareness of the mandate is what leads some people to explore their coverage options and learn that they’re eligible for Medicaid, or for tax credits to help afford premiums in the individual marketplace. Coverage losses that occur because people never learn about programs or financial assistance for which they’re eligible aren’t “voluntary” in any meaningful sense.

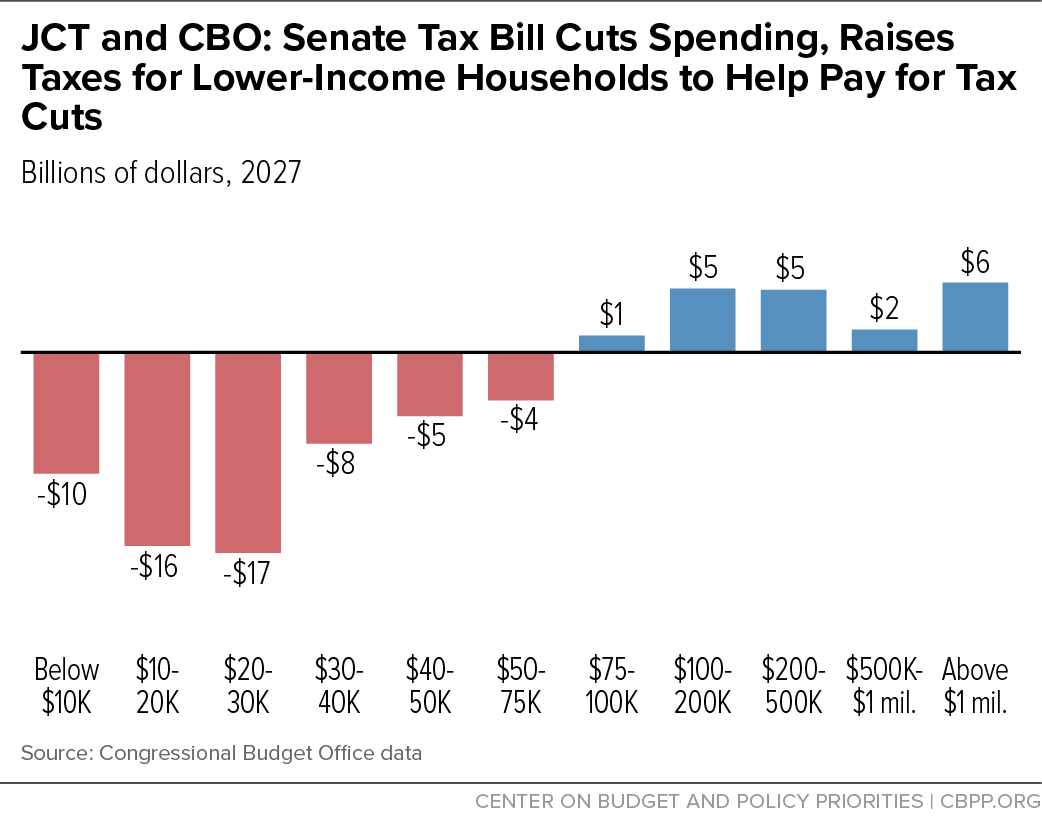

CBO and JCT have estimated the bill’s impact in 2027 including the tax increases resulting from the lower inflation measure and households’ losses from repealing the individual mandate. Even on average, every income group with incomes below $75,000 would face losses (see graph).