- Home

- Republican Plans To Cut Taxes Now, Cut P...

Republican Plans to Cut Taxes Now, Cut Programs Later Would Leave Most Elderly People Worse Off

Congressional Republicans this fall are poised to launch step one of a likely two-step tax and budget agenda: enacting costly tax cuts now that are heavily skewed toward wealthy households and profitable corporations, then paying for them later through program cuts mostly affecting low- and middle-income families. Most of the elderly would lose more from the program cuts than they would gain from the tax cuts.

Congress appears headed toward crafting a tax-cut bill that would largely benefit the top 1 percent of households and profitable corporations, while increasing deficits by $1.5 trillion over the next decade. (And the true cost, with no budget gimmicks, could be even higher.) Tax cuts will lead to larger deficits — claims that tax cuts pay for themselves fly in the face of decades of experience and credible, mainstream economic research.

When deficits rise, those who supported the tax cuts will likely label these deficits as unacceptable and point to spending as the culprit. When that happens, they presumably will call for the kinds of deep cuts they’ve already proposed in their long-range budget plans, which would hit key health care, nutrition, housing, and community services programs that many elderly people count on. Those cuts could happen as soon as next year.

Congressional leaders could have chosen to write a single bill with both the tax cuts they favor and the program cuts or tax increases to pay for them. This would have enabled the public and policymakers to evaluate the tradeoffs and make an informed decision. Instead, they have chosen to obscure this tradeoff by splitting their agenda into two parts. But this doesn’t change the reality: the wealthy would win large tax cuts while everyone else would pay the tab.

When Tax Cuts Must Be Paid For, Elderly Likely to Bear Significant Burden

President Trump and congressional leaders have been very clear on the areas they want to cut. The Trump and congressional budget plans for the next decade would cut basic assistance and health care for millions of low- and moderate-income seniors, making it harder for them to afford the basics and get health care. Indeed, the Administration and congressional leaders have already pointed to existing projected deficits — even before $1.5 trillion in deficit-increasing tax cuts are made — to justify these cuts.

For example, materials accompanying an earlier budget plan put forward in the House claimed that spending rates for programs like Medicare, Medicaid, and Social Security “are unsustainable and the key drivers of our nation’s fiscal challenge,” even as the GOP tax plans call for large tax cuts for the wealthy and profitable corporations. Once a tax bill becomes law and deficits grow, many of the same policymakers who supported the tax cuts will likely argue that the resulting higher deficits make cutting programs that support the elderly even more urgent.

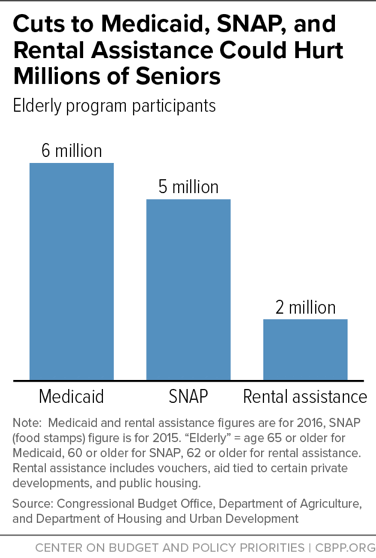

- Medicaid. The Trump and congressional budget plans call for cutting Medicaid and subsidies to purchase coverage through the Affordable Care Act marketplaces by between $1.3 trillion and $1.9 trillion over the next decade, with most of the cuts coming from Medicaid. The cuts would grow over time. For example, under the Trump plan, Medicaid alone would be cut by 47 percent in 2027. Six million seniors receive health coverage through Medicaid and the program is the nation’s main payer for long-term care, including both nursing home care and home- and community-based services. Steep cuts in federal Medicaid funding would likely lead states to curtail services that enable seniors to remain in their homes, forcing many into institutional care.

- Medicare. The congressional budget plan would cut Medicare by nearly $500 billion over ten years. The House Budget Committee has previously identified several specific cuts, including replacing Medicare’s guarantee of health coverage with a flat premium-support payment (or voucher), raising the eligibility age from 65 to 67, increasing cost sharing, and raising premiums for higher-income people. (The congressional budget plan itself does not provide such specifics.)

- Food assistance. The Trump budget would cut SNAP (formerly food stamps) by at least $140 billion over the decade; the cuts would reach 30 percent in 2027. The congressional budget plan deeply cuts the budget area that funds SNAP but provides fewer specifics. SNAP provides basic food aid to nearly 5 million seniors and benefits are already modest — on average, households with an elderly member receive only around $30 per week. Deep SNAP cuts would thus inevitably increase hunger and hardship for many elderly people.

-

Social and community services. President Trump and congressional Republicans have targeted programs that provide social and community services to older people for cuts. For example, the Trump budget proposed eliminating the Social Services Block Grant (SSBG), which helps states meet the specialized needs of their most vulnerable populations, such as preventing elder abuse and helping seniors stay in their homes by supporting adult day programs and other services. The congressional budget plan provides fewer specifics but cuts the part of the budget that includes SSBG. The Trump budget also would eliminate the Community Service Employment Program, which connects 70,000 low-income, unemployed people aged 55 or older with part-time work each year.

-

Key investments. The Trump and congressional budget plans would deeply cut non-defense discretionary (NDD) funding, the budget area that supports important programs for seniors, including housing assistance and the funding to administer Social Security. These cuts would come on top of cuts imposed since 2010. By 2027, under the congressional plan, overall NDD funding would be 18 percent below its 2017 level and 29 percent below its 2010 level, after adjusting for inflation. The cuts under the Trump plan are even deeper. Under both budget plans, by 2027 NDD spending would fall as a share of the economy to levels likely not seen since the Hoover Administration.

While the congressional budget plan doesn’t say where these cuts would come from, early evidence comes from areas where Congress has proposed cuts for 2018 and from the President’s proposed 2018 budget:

-

Housing assistance. The Trump and congressional budget plans would likely result in large cuts to rental assistance — including vouchers, aid tied to certain private developments, and public housing — with cuts growing deeper over time. For example, by 2027, more than 900,000 households would lose rental aid under the congressional budget plan, if housing programs bear a proportional share of the budget’s NDD cuts. The impact on seniors could be significant — some 24 percent of households currently receiving vouchers include an elderly person.

-

Social Security Administration (SSA). President Trump, the House, and the Senate have all proposed woefully inadequate funding for operating the SSA in 2018, which would substantially weaken customer service, hurting seniors and people with disabilities. For example, the Senate appropriations bill would cut SSA’s operating budget by $400 million in 2018. Despite its growing workload, SSA has faced years of budget cuts, leading to long waits on the phone and in field offices, as well as record-high disability backlogs. Further cuts would force the agency to freeze hiring, furlough employees, shutter more field offices, or further restrict field office hours, leading to yet longer wait times for taxpayers and beneficiaries who need help.

-

The Bottom Line: Program Cuts Would Outweigh Tax Cuts for Most Seniors

Many seniors already struggle to afford the basics, such as decent housing, adequate food, and quality health care. The GOP tax framework released in late September and the tax bill proposed by House Ways and Means Chairman Kevin Brady would do little for these people. They would provide very large tax cuts to wealthy households and profitable corporations, while most low- and moderate-income households would receive only a modest benefit or none at all. Worse, when Congress turned its attention to paying for those tax cuts, elderly people could lose health care, housing and nutritional assistance, and educational services that they need to thrive now and in the future.