ACA Repeal Is a Key Trump Tax Policy

End Notes

[1] During his inauguration speech, President Trump proclaimed, “Every decision on trade, on taxes, on immigration, on foreign affairs, will be made to benefit American workers and American families.” See Donald Trump, “The Inaugural Address,” The White House, January 20, 2017, https://www.whitehouse.gov/inaugural-address, for the full speech.

[2] During an interview on CNBC’s Squawk Box in November, Treasury Secretary Steven Mnuchin stated, “Any reductions we have in upper-income taxes will be offset by less deductions so that there will be no absolute tax cut for the upper class.” For this clip, see Chye-Ching Huang, “ACA Repeal’s Tax Cut to the Very Top Colliding with ‘Mnuchin Test,’” Center on Budget and Policy Priorities, January 13, 2017, http://bit.ly/2lPxWCZ.

[3] For a roundup of our analyses of the tax impacts of ACA repeal, see “Roundup: ACA Repeal Isn’t Just Bad Health Policy, It’s Also a Huge Tax Cut for the Wealthiest and Bad Tax Policy,” Center on Budget and Policy Priorities, January 31, 2017, http://bit.ly/2jMbtBn.

[4]Paul Demko, “Exclusive: Leaked GOP Obamacare replacement shrinks subsidies, Medicaid expansion,” Politico, February 24, 2017, http://www.politico.com/story/2017/02/house-republicans-obamacare-repeal-package-235343.

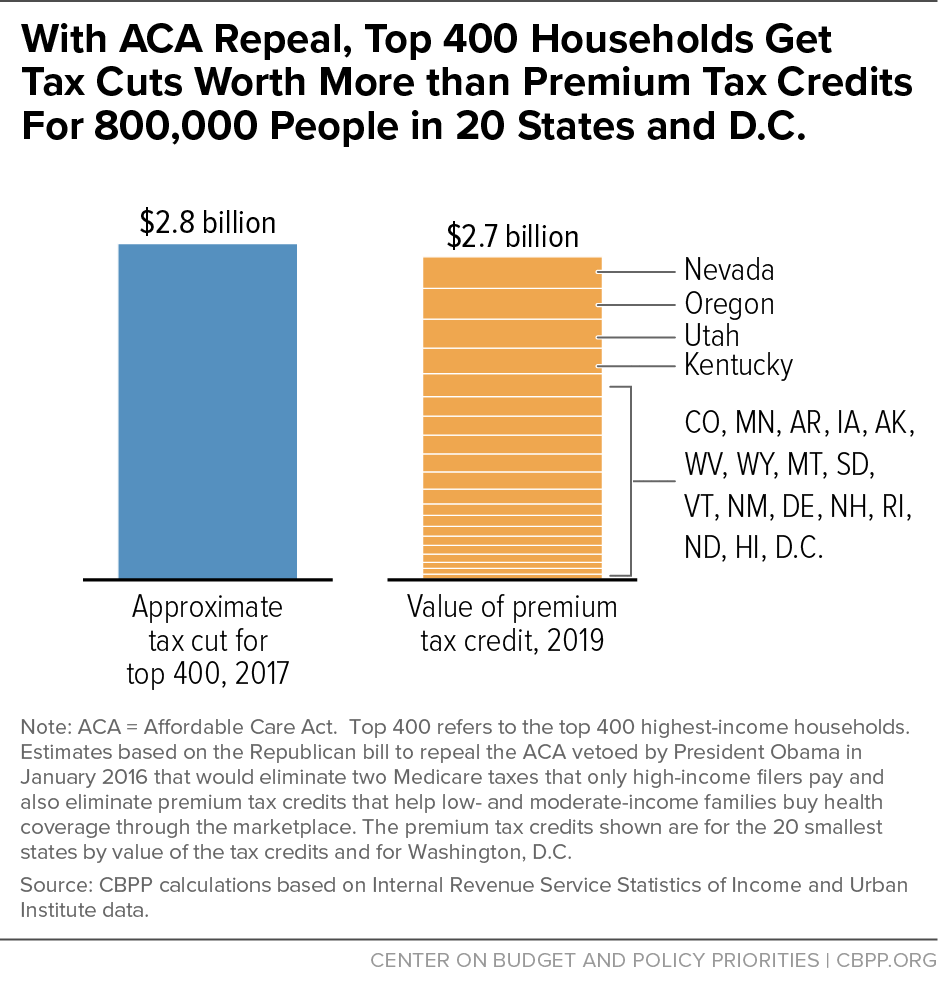

[5] Brandon DeBot, Chye-Ching Huang, and Chuck Marr, “ACA Repeal Would Lavish Medicare Tax Cuts on 400 Highest-Income Households,” Center on Budget and Policy Priorities, January 12, 2017, http://bit.ly/2jzK2uI.

[6] Chye-Ching Huang, Chuck Marr, and Emily Horton, “Eliminating Two ACA Medicare Taxes Means Very Large Tax Cuts for High Earners and the Wealthy,” Center on Budget and Policy Priorities, January 11, 2017, https://www.cbpp.org/research/federal-tax/eliminating-two-aca-medicare-taxes-means-huge-tax-cuts-for-high-earners-and-the.

[7] Chye-Ching Huang and Paul N. Van de Water, “Millionaires the Big Winners From Repealing the Affordable Care Act, New Data Show,” Center on Budget and Policy Priorities, December 15, 2016, https://www.cbpp.org/research/federal-tax/millionaires-the-big-winners-from-repealing-the-affordable-care-act-new-data.

[8] Chye-Ching Huang and Paul N. Van de Water, “ACA Repeal Means Tax Cuts for Drug Companies and Health Insurers,” Center on Budget and Policy Priorities, January 12, 2017, http://bit.ly/2ii9yIR.

[9] Chye-Ching Huang, “ACA Repeal Would Embolden Tax Avoidance,” Center on Budget and Policy Priorities, January 23, 2017, http://bit.ly/2jKdP5h.

[10] See our ACA roundup, http://bit.ly/2jMbtBn..

[11] Jacob Leibenluft et al., “House Republicans Would Reverse ACA Coverage Gains and Radically Overhaul Medicaid, New Talking Points Confirm,” Center on Budget and Policy Priorities, February 17, 2017, https://www.cbpp.org/research/health/house-republicans-would-reverse-aca-coverage-gains-and-radically-overhaul-medicaid.