BEYOND THE NUMBERS

Steven Mnuchin, President-elect Trump’s nominee for Treasury Secretary, expressed concern today about "farmers who worry about the death tax wiping out the family farms." Estate tax opponents frequently call for repealing the tax because, they say, it’s a burden for small businesses and family farms. But the data on who actually pays the tax debunk this myth. In fact, only 50 small businesses and family farms in the United States will face any estate tax in 2017, Tax Policy Center (TPC) estimates show. And, on average, these few estates will owe less than 6 percent of their value in tax.

These findings are consistent with a 2005 Congressional Budget Office (CBO) study that found that most of the few farm and family business estates that would owe estate tax would have sufficient liquid assets (such as bank accounts, stocks, bonds, and insurance) to pay the tax without having to touch the farm or business. Today’s current estate tax rules are even more generous than those that CBO assumed in its analysis. Special estate tax provisions also allow those who might have trouble paying the tax immediately to spread their payments over a 15-year period at low interest rates. In short, the very few small farm and business estates that do pay the tax are extremely unlikely to be "wiped out," as Mr. Mnuchin suggested today.

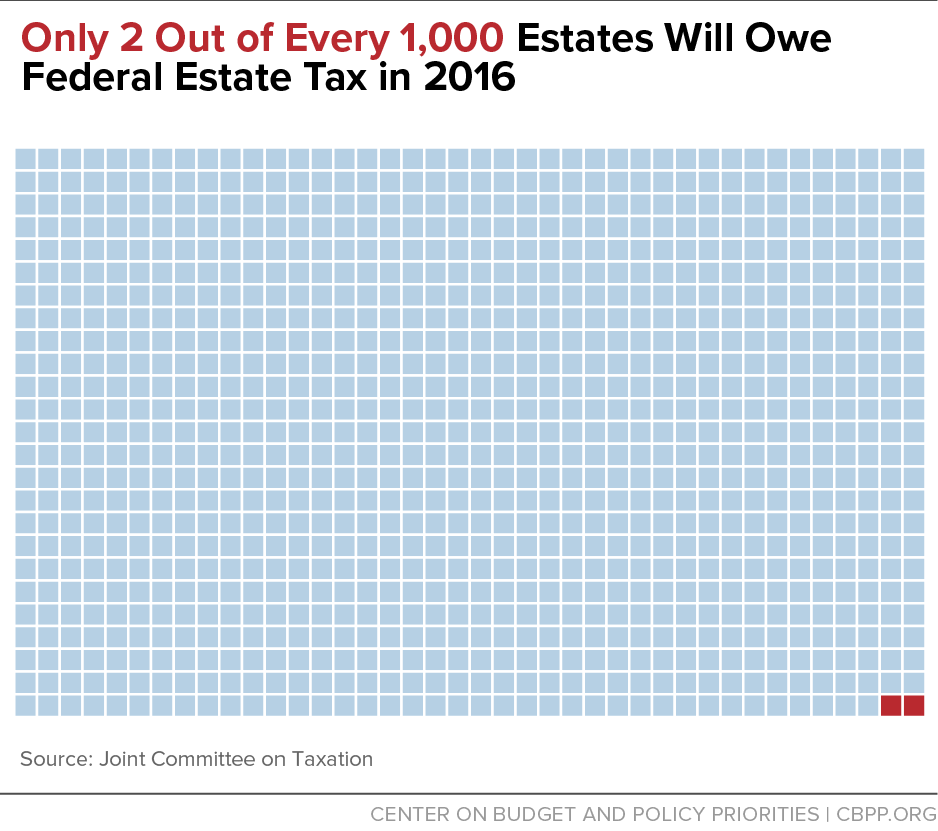

The estate tax is the federal tax code’s most progressive component. Only the very wealthiest 0.2 percent of estates pay any estate tax because the first $5.49 million of assets per person ($10.98 million per couple) are exempt from the tax (see chart). Repealing the estate tax, as the President-elect has proposed, would produce windfall tax cuts for these very wealthy estates and exacerbate inequality — while ignoring the real needs of small family farms and businesses.