Policymakers need to replenish the Social Security Disability Insurance (DI) trust fund by late 2016. That necessity comes as no surprise and does not pose a crisis, and policymakers can address it with a simple, time-honored solution: boosting DI’s share of the Social Security payroll tax, which also funds retirement benefits. Congress has reapportioned payroll tax revenues many times in the past on a bipartisan basis, in both directions.[1] That essential step, called reallocation or rebalancing, would avert a sudden, one-fifth cut in benefits to a group of severely impaired and vulnerable Americans.

Some critics have begun to spread the claim that raising DI’s share of the payroll tax would harm retirees.[2] Such claims and related attempts to arouse fear among senior citizens are misguided for several reasons:

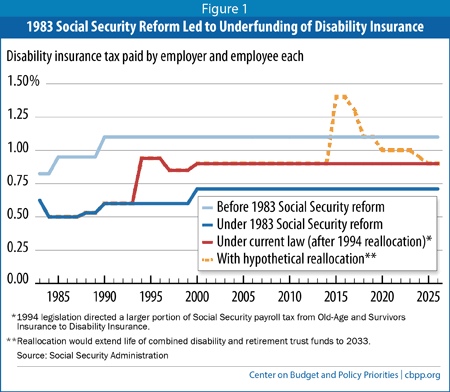

- The last two reallocations have shortchanged DI, underfunding it when compared with Social Security’s retirement program. In 1983, with DI in relatively strong financial shape but Social Security’s retirement fund close to insolvency, Congress shifted payroll tax revenues out of DI toward the retirement fund. (Congress only partly reversed that shift in 1994.) If DI’s tax rate had remained at its pre-1983 level, we would not need to replenish the fund today. The 1983 and 1994 actions remind us that policymakers have traditionally rebalanced the retirement and disability programs’ funding as warranted, and with little ado.

- A reallocation now would have only a tiny effect on the retirement program’s solvency. Rebalancing the trust funds so they both remain solvent until 2033 would postpone DI’s projected depletion by 17 years (from 2016 to 2033) while advancing the depletion of the much larger Old-Age and Survivors Insurance (OASI) trust fund by only one year (from 2034 to 2033). And action to shore up the Social Security retirement program (and the rest of Social Security) will be needed by then, anyway.

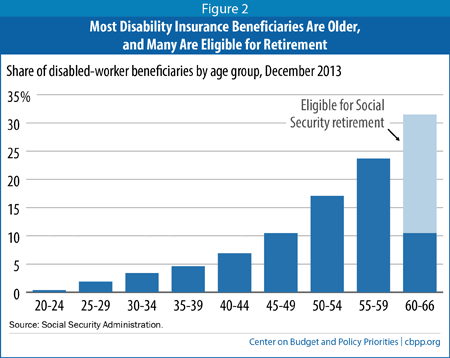

- Most DI payments go to older beneficiaries, including many who are near or even over Social Security’s early-retirement age. Seventy percent of disabled workers are age 50 or older.

It would be deeply unfortunate for seniors (and for all Americans) if the spurious claim that reallocation hurts retirees made headway. It pits groups against each other when, in fact, seniors, people with disabilities, and today’s workers share a common interest in ensuring the long-term stability of all of Social Security.

The Social Security payroll tax is 6.2 percent of wages up to $118,500 in 2015, paid by both employers and employees. Of this total, 5.3 percent of covered wages goes to the OASI trust fund and just 0.9 percent goes to the DI trust fund. (The two trust funds are legally separate.) Workers’ paychecks simply show a deduction for the overall Social Security tax, and few know — or have reason to care — how that amount is apportioned.

Traditionally, lawmakers have divided the total payroll tax between OASI and DI according to the programs’ respective needs. Congress has reallocated payroll tax revenues many times — sometimes from OASI to DI, sometimes in the other direction — to maintain the necessary balance. There have been 11 reallocations, enacted in six separate laws, since 1968.

After the latest such measure (enacted in 1994), the Social Security trustees estimated that the DI fund would become depleted in 2016, OASI in 2031, and the combined funds in 2030. In this year’s report, the trustees put those dates at 2016, 2034, and 2033, respectively. Thus, despite some fluctuations in the meantime, the projections made after the last reallocation have proven remarkably accurate; the DI shortfall is not a surprise.

Nor is the DI shortfall a symptom of a program grown “out of control.” Indeed, most of the increase in DI spending in recent years reflects demographic and other factors that are well understood and largely foreseen. They include the aging of the baby boomers into their 50s and early 60s, the years of peak risk for disability; women’s rising labor force participation, which has enabled more women to qualify for DI when they become disabled (previously, many women could not qualify for DI because they lacked sufficient years in the paid labor force); and the increase in Social Security’s full retirement age, which pushes back the age at which DI recipients are moved to the OASI rolls (thereby shifting costs from OASI to DI).[3]

DI’s anticipated trust-fund depletion does not indicate that the program is bankrupt; it could still pay about 80 percent of benefits if policymakers took no action. But cutting benefits by nearly one-fifth for an extremely vulnerable group of disabled Americans should not be acceptable. For an average DI beneficiary, who receives about $1,146 a month (in 2014 dollars), that loss would equal nearly $220 a month. Even if policymakers take other steps soon to improve Social Security solvency, boosting DI’s share of the Social Security tax will still be necessary to avert that sharp benefit cut.

Here’s why it’s wrong to say that modestly boosting DI’s share of the payroll tax would hurt retirees.

-

Past reallocations have left DI underfunded. The last major Social Security reform occurred in 1983. At the time, DI was in relatively strong financial shape, while OASI faced insolvency within a few months. The Social Security Amendments of 1983, which primarily addressed the OASI shortfall, raised DI costs slightly and cut DI’s share of the payroll tax significantly. The reallocations enacted in 1994 only partly mitigated that financial harm to DI. (See Figure 1.)

The drafters of the 1983 amendments did not deliberately underfund DI. They used the best information available at the time, but in doing so they underestimated DI’s future costs. If DI’s tax rate had been 1.1 percent for the last quarter-century, as it would have been without the 1983 amendments, we would not need to replenish the fund today. Yet no one says that OASI “robbed” DI in 1983, and it would be equally inappropriate to say that rebalancing in the opposite direction now would “rob” retirees. Traditionally, such adjustments to address the two programs’ respective needs have not been controversial.

- Reallocating would have only a minimal effect on OASI solvency. A reallocation that rebalanced the Social Security trust funds so they both remain solvent until 2033 would postpone DI’s projected depletion by 17 years (from 2016 to 2033) while advancing OASI’s depletion by only one year (from 2034 to 2033).[4] The reason is simple: OASI is much bigger than DI, so a small reallocation barely dents OASI. A one-year difference 20 years from now is well within the margin of error for these projections.[5] And before then, policymakers will almost surely address Social Security solvency in a comprehensive fashion.

-

Most DI recipients are older people, so helping DI helps seniors. The risk of disability rises with age, and most DI beneficiaries are older — even though they happen to be labeled “disabled workers” rather than “retirees.” Seventy percent of disabled workers are age 50 or older, 30 percent are 60 or older, and 20 percent are 62 or older and would actually qualify as early retirees under Social Security rules. (See Figure 2.) Furthermore, those percentages will inch up as Social Security’s full retirement age — the age when retirees can collect an unreduced benefit — rises from 66 to 67 between 2017 and 2022, meaning that beneficiaries will eventually stay on the DI rolls for an extra year.[6]

Rather than allow DI benefits to fall by nearly one-fifth, policymakers should temporarily redirect a larger share of the 6.2 percent Social Security tax to DI, thus continuing both funds through 2033, while renewing efforts to achieve solvency for the entire Social Security system for decades to come.

Social Security’s disability, retirement, and survivor programs are closely linked, so Congress ought to address DI’s finances as part of a long-term solvency package for Social Security as a whole. Surveys find that Americans of all ages, incomes, and parties support Social Security and will pay to preserve and strengthen it for future generations.[7] Tackling DI in isolation would leave policymakers with few — and unduly harsh — options and require them to ignore the strong interactions between Social Security’s disability and retirement components. But even if policymakers make progress toward a well-rounded solvency package before late 2016, which seems unlikely, any changes in DI benefits or eligibility would surely phase in gradually and hence do little to replenish the DI fund immediately. Consequently, reallocating payroll tax revenues between the two programs would still be necessary.

Reallocation isn’t a “patch” or “kicking the can down the road,” as some contend — descriptions appropriate for the recent law to extend the Highway Trust Fund by ten months, or Congress’s repeated one-year delays in implementing scheduled cuts in Medicare payments to doctors, or the many fixes to the Alternative Minimum Tax between 2001 and 2012. A payroll tax reallocation, by contrast, will keep Social Security’s disability and retirement programs solvent for another 15 to 20 years.

Policymakers should resist efforts to pit different categories of Social Security beneficiaries against each other and instead focus on maintaining a strong and solvent system for all.