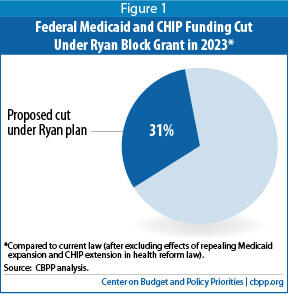

The Medicaid block grant proposal in the budget plan proposed by House Budget Committee Chairman Paul Ryan, which the House of Representatives passed on March 21, would cut federal Medicaid (and the Children’s Health Insurance Program, or CHIP) funding by 31 percent by 2023, because the funding would no longer keep pace with health care costs or with expected Medicaid enrollment growth as the population ages (see Figure 1). These cuts would come on top of repealing the health reform law’s Medicaid expansion.

Cuts of this magnitude would substantially — and negatively — affect millions of low-income Americans’ ability to secure health coverage and access needed health-care services. Medicaid cannot readily withstand cuts of this depth without harmful results for low-income families and individuals. The program already costs significantly less per beneficiary than private insurance does, because it pays health providers much lower rates and has considerably lower administrative costs. In addition, its per-beneficiary costs have been rising more slowly than private insurance premiums for the past decade, and they are expected to grow no faster than private insurance over the next ten years.

In analyzing a similar block grant from last year’s House budget plan, the Congressional Budget Office (CBO) concluded that unless states increased their own Medicaid funding very substantially to make up for the Ryan plan’s deep Medicaid funding cuts, they would have to take such steps as cutting eligibility, which would lead to more uninsured low-income people; cutting covered health services, which would lead to more underinsured low-income people; and/or cutting the already-low payment rates to health care providers, which would likely cause more doctors, hospitals, and nursing homes to withdraw from Medicaid and thereby reduce beneficiaries’ access to care. The Urban Institute estimated that last year’s block grant proposal would lead states to drop between 14.3 million and 20.5 million people from Medicaid by 2022 (in addition to the up to 17 million people who could no longer gain coverage because of the repeal of the health reform law’s Medicaid expansion, assuming that all states take up the expansion). This year’s proposal likely would result in cuts that would be just as draconian.

Under the Ryan budget’s proposal to replace Medicaid with a block grant, the federal government would no longer pay a fixed share of states’ Medicaid costs.[1] States would instead receive a fixed dollar amount that would rise annually with the general inflation rate and the percentage increase in the size of the U.S. population.[2]

The 2014 Ryan plan provides even less detail about its Medicaid block grant proposal than the past two House budgets did. [3] Starting in fiscal year 2015, states would receive a fixed dollar amount of Medicaid funding. Federal funding that would otherwise be available to states under CHIP would be merged into the block grant as well.[4] The combined block grant amounts for subsequent years would be based on the prior year’s amount, adjusted for inflation and U.S. population growth.

Because the block grant funding levels would not keep pace with health care costs or the expected increase in the number of Medicaid beneficiaries — especially the growth in the number of elderly beneficiaries, who cost more to serve — the block-grant funding levels would fall further behind need with each passing year. The percentage increase in the block-grant funding level from one year to the next would average about three percentage points less per year than what CBO expects to be the Medicaid program’s average growth rate over the coming decade under current law.

According to the Ryan budget, the block grant proposal would shrink federal Medicaid and CHIP funding by $810 billion — or 21 percent — over the next ten years, relative to current law.[5] This does not count the loss of the additional federal Medicaid funding that states would receive under the health reform law’s Medicaid expansion and the two-year extension of the CHIP program with corresponding funding increases, which the Ryan budget would both repeal. (The reductions to CHIP funding, compared to baseline funding levels, would likely constitute only a tiny share of these cuts due to its very small size relative to the Medicaid program.)

By 2023, the federal Medicaid and CHIP funding cut would be $150 billion for that year alone, an estimated reduction of 31 percent compared to what states otherwise would receive for that year under current law (see Table 1 for the year-by-year funding reductions).[6] This percentage would grow larger each year after that.

Table 1

Federal Medicaid and CHIP Spending Cuts Required by Ryan Block Grant

In billions of dollars |

| | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2014-2023 |

| Federal Medicaid and CHIP Baseline Spending * | 293 | 306 | 326 | 344 | 361 | 383 | 407 | 432 | 458 | 489 | 3,797 |

| Medicaid Spending Cuts under Ryan Block Grant ** | n/a | -40 | -50 | -60 | -70 | -90 | -100 | -120 | -130 | -150 | -810 |

| Percentage Cut | n/a | -13% | -15% | -18% | -19% | -24% | -25% | -28% | -28% | -31% | -21% |

*Excludes spending related to the Medicaid expansion and the two-year extension of CHIP for 2014 and 2015 under the Affordable Care Act, which would both be repealed.

**As specified under Table S-4 of the Ryan budget plan.

Source: CBPP analysis using Congressional Budget Office baseline estimates and House Budget Committee, “The Path to Prosperity: A Responsible Balanced Budget,” revised March 13, 2013. Figures may not sum due to rounding. |

These funding cuts would be even larger in years when enrollment or per-beneficiary health care costs rise faster than is currently projected. Unlike under the current Medicaid program, where federal funding rises automatically in response to a recession or unanticipated costs from epidemics or medical breakthroughs, states would have to bear all such added costs themselves.

Under the block grant, states would be given expansive new flexibility in their Medicaid programs in areas such as eligibility and benefits. As CBO concluded when it analyzed the similar Medicaid block grant from last year’s House budget plan, while states may be able to use this flexibility to improve efficiency of those programs:

[T]he magnitude of the reduction in spending . . . means that states would need to increase their spending on these programs, make considerable cutbacks in them, or both. Cutbacks might involve reduced eligibility for Medicaid and CHIP, coverage of fewer services, lower payments to providers, or increased cost-sharing by beneficiaries — all of which would reduce access to care.[7]

In other words, unless states come up with rather massive new sums to offset the very large losses in federal funding, they would be compelled to institute deep cuts.

States almost certainly would reduce eligibility, coverage, or both, for beneficiaries as well as payments to health care providers. These reductions would be deepest in periods such as recessions when states face significant revenue declines and have the hardest time contributing any additional state funding, yet the number of people in need of Medicaid increases. The cuts could include some or all of the following types of measures.

- States could cap Medicaid enrollment and turn eligible families and individuals away — in contrast to current law, under which all eligible individuals who apply must be allowed to enroll. The Urban Institute estimated that the similar Medicaid block grant in last year’s House budget plan would cause states to shrink the number of low-income people receiving health coverage through Medicaid by between 14.3 million and 20.5 million people by 2022, which would constitute an enrollment reduction of 25 percent to 35 percent.[8]

- Medicaid covers certain services typically not available through private insurance that are tailored to meet the needs of especially vulnerable beneficiaries — particularly low-income people with severe disabilities — who traditionally have been excluded from the private insurance market. Such services, including case management, therapy services, and mental health care, are important for poor people with serious disabilities, but expensive. Faced with very large federal funding cuts, states likely would curtail many of these services.

- The reductions in federal funding would likely cause many states to scale back coverage for low-income seniors and people with disabilities, especially for long-term care. Low-income seniors and people with disabilities make up one-quarter of Medicaid beneficiaries but account for about two-thirds of all Medicaid expenditures (because of their greater health care needs and because Medicaid is the primary funder of long-term care). This could mean that fewer seniors and people with disabilities with long-term care needs would receive coverage for services and supports they need to remain in the community.[9]

- States also could charge low-income beneficiaries substantial premiums, deductibles, and co-payments. Medicaid currently ensures that coverage is affordable for low-income people by not charging premiums and keeping cost-sharing charges modest; research has found that premiums and cost-sharing lead many low-income households to remain uninsured or to forgo needed care. Under a block grant, however, states could begin charging substantial premiums, which could discourage enrollment. States also could begin requiring substantial deductibles and co-payments, which could prove unaffordable for some beneficiaries, including people with serious medical conditions that are costly to treat. This would reduce beneficiaries’ access to care.

- States also could use the block grant to shift beneficiaries into private insurance, offering them a voucher to purchase coverage on their own. Since Medicaid costs substantially less per beneficiary than private insurance, however (largely due to its lower provider reimbursement rates and administrative costs, as noted above), shifting beneficiaries into private insurance would raise states’ per-beneficiary costs unless the vouchers were set at levels that covered considerably fewer health services and treatments than Medicaid does today. Because the block grant would provide states significantly less federal funding, and private insurance costs substantially more per beneficiary, a state’s adoption of a voucher system for Medicaid enrollees would likely result in fewer beneficiaries being covered or in beneficiaries being covered for substantially fewer health care services and treatments. Many of those receiving a voucher could end up underinsured — lacking coverage for certain needed health care services or facing premiums, deductibles, or co-payments they could have considerable difficulty affording.

- States facing shrunken block grant funding would likely scale back their provider reimbursement rates, which already are significantly lower than reimbursement rates under Medicare and private insurance and have been cut substantially in recent years by states coping with budget shortfalls. The Urban Institute estimated that the similar block grant in last year’s House-passed budget would likely result in reductions in reimbursements to health care providers and plans of more than 30 percent by 2023.[10]

These reductions in provider reimbursement rates likely would apply not only to hospitals, nursing homes, physicians, and pharmacies but also to managed care plans that currently serve low-income children and their parents through Medicaid and CHIP. That, in turn, could cause some providers and plans to stop serving low-income beneficiaries, which could jeopardize some beneficiaries’ access to care, particularly in communities that already are medically underserved, such as rural areas. It also would place greater pressure on providers such as community health care centers and safety net hospitals, which now rely on Medicaid funding but would likely face substantially increased patient loads, because of increased numbers of uninsured and underinsured individuals as a consequence of the Medicaid cutbacks.[11]

House Budget Chairman Paul Ryan argues that his block grant proposal would allow states to tailor their Medicaid programs to better fit their needs and to provide Medicaid beneficiaries more choices and better access to care. Yet there can be no question that the block grant proposal would result in severe cuts in federal funding for state Medicaid programs. To compensate for funding cuts of this magnitude, states would have little choice but to institute deep cuts to eligibility, benefit coverage, and/or provider payment rates. The almost-inevitable result would be that millions more low-income individuals and families would end up uninsured or underinsured, with reduced access to needed medical care.