Private Health Coverage Unstable for Middle Class

In One-Fourth of Middle-Income, Privately Insured Families, Someone Loses Coverage Within Four Years

End Notes

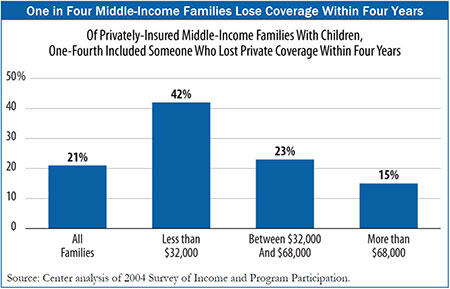

[1] Center on Budget and Policy Priorities analysis of the 2004-2007 Survey of Income and Program Participation (SIPP). In this analysis, family members who switch directly from private insurance to Medicare, typically at age 65, are counted as if they were privately insured.

[2] The figures in this analysis may be conservative due to data limitations. On the advice of Census Bureau staff, we excluded loss of insurance coverage in the first 24 months of the survey for children younger than 15 years due to data problems in the 2004-2007 SIPP Panel, which reduced our estimates of lost coverage. Without this exclusion, the share of middle-income, privately insured families losing coverage would likely increase from about one-fourth to about one-third. In addition, data from the earlier 2001-2003 SIPP panel, which according to Census staff are not affected by these problems, show that more than one in three middle-income, privately insured families lost private coverage during the three-year study.

[3] One study using data from the 2006-2007 Medical Expenditure Panel Survey (MEPS) found that 32 percent of the non-elderly population was uninsured at some point during the two-year period. Jeffrey Rhoades and Steven Cohen, “The Long-term Uninsured in America, 2003-2006: Estimates for the U.S. Civilian Non-Institutionalized Population Under Age 65,” Agency for Healthcare Research and Quality, August 2008. SIPP data produce similar results.

[4] A Center analysis of the 2006-2007 MEPS found that 19 percent of middle-income, privately insured families lost coverage over those two years. MEPS data are not available for the full four years covered by SIPP, but an analysis of just the 2006-2007 SIPP data yields a comparable figure of 18 percent.

[5] Kaiser Family Foundation and the Health Research and Educational Trust, Employer Health Benefits, 2009 Annual Survey, 2009.

[6] The 2004-2007 SIPP figures are likely to be conservative because of some data limitations. Our analysis does not count the loss of private insurance among children age 0-14 during the first two years of the survey, because of a possible problem identified by Census Bureau staff in the processing of the survey data for young children during those months.

[7] Bureau of Labor Statistics (www.bls.gov).

[8] Kaiser Commission on Medicaid and the Uninsured, “Medicaid, SCHIP and Economic Downturn: Policy Challenges and Policy Responses,” April 2008.

[9] Joseph Sudano and David Baker, “Intermittent Lack of Health Insurance Coverage and Use of Preventive Services,” American Journal of Public Health, January 2003, Volume 93, Number 1.

[10] Institute of Medicine, “America’s Uninsured Crisis: Consequences for Health and Health Care,” February 2009.

[11] See Statement by Robert Greenstein, Executive Director, on the President’s Health Reform Proposal, Center on Budget and Policy Priorities, February 23, 2010.