- Home

- Medicaid Per Capita Cap Would Shift Cost...

Medicaid Per Capita Cap Would Shift Costs to States and Place Low-Income Beneficiaries at Risk

Some policymakers have recently proposed placing a “per capita cap” on federal Medicaid funding, under which the federal government would no longer cover a fixed share of each state’s overall Medicaid costs but instead would limit each state to a fixed dollar amount per beneficiary.[1] A per capita cap would represent a fundamental change in Medicaid’s financing structure that would shift significant fiscal risks and costs to states and would likely lead states to impose substantial cuts over time on low-income beneficiaries and health care providers.

A per capita cap also could jeopardize successful implementation of the health reform law. It would lock states that adopt the law’s Medicaid expansion into per capita limits that would apply to the new Medicaid beneficiaries they would serve before the states had any experience or data regarding the actual per-beneficiary costs of this population. As a result, it likely would deter many states from taking up the expansion, leaving millions of poor Americans uninsured.

The capped amounts of federal funding per beneficiary that states would receive would be significantly below the level of Medicaid funding the federal government would otherwise provide to states; this hasto be the case if the per capita cap is to produce substantial federal budgetary savings, which is the primary goal of Medicaid per capita cap proposals. Such proposals usually achieve savings for the federal government by having the cap grow more slowly over time than the projected growth in federal Medicaid spending per beneficiary. With each passing year, states would receive less federal funding for each Medicaid beneficiary, relative to current law.

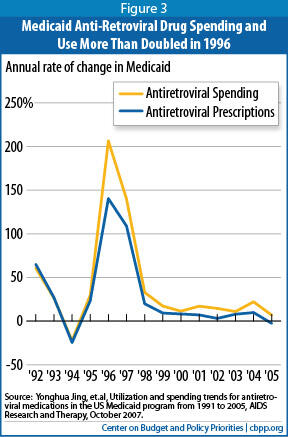

A related issue is that if Medicaid costs per beneficiary rose faster than is currently projected, then states would face even larger federal funding shortfalls and would have to bear all costs above the inadequate cap amounts. History shows that advances in medical technology — such as the development of new treatments and medications that significantly improve health and save lives but increase costs — as well as changes in health care utilization patterns and the onset of epidemics or new illnesses (such as HIV/AIDS) can produce unanticipated increases in health care costs. Demographic changes, especially the aging of the population and, eventually, the movement of the baby-boom generation into “old-old” age (the time when per-beneficiary health costs are highest) also will push up per capita Medicaid costs.

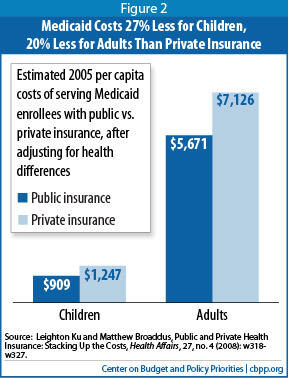

To compensate for both the explicit funding cut reflected in a per capita cap and the higher costs that state Medicaid programs could face as a result of unforeseen increases in health care costs caused by factors beyond their control, states would almost certainly have to contribute substantially more of their own funds to Medicaid or cut their Medicaid spending significantly on a per-beneficiary basis (or both). Cutting per-beneficiary spending without limiting access to needed care would be difficult because Medicaid costs per beneficiary already are well below those of private insurance, and states have already cut both benefits and provider payments in recent years to help close state budget shortfalls.

Millions of low-income individuals and families who rely on Medicaid could be at risk of losing access to needed care. And states likely would have to impose the largest cuts on their highest-cost, most vulnerable beneficiaries — seniors and people with disabilities, who account for nearly two-thirds of Medicaid costs.

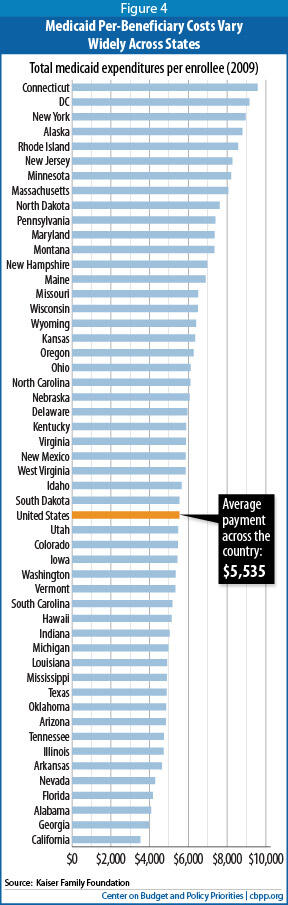

While all states would face substantial reductions in federal funding under a per capita cap, some states likely would be hit particularly hard. Per capita cap proposals typically base each state’s initial funding level on the state’s current per-beneficiary spending level, so states with relatively low Medicaid spending per beneficiary — because they provide relatively narrow benefits, pay health care providers less, have already implemented successful cost-containment measures, or have instituted substantial Medicaid cuts in recent years, for example — would receive less initial funding per beneficiary than other states. States whose future Medicaid costs per beneficiary grow more quickly than other states’ — due to factors such as greater-than-average increases in the incidence of various diseases or in the share of a state’s population that is very old — could also be hurt disproportionately, since per capita cap proposals typically adjust the caps each year in all states by a single national percentage.

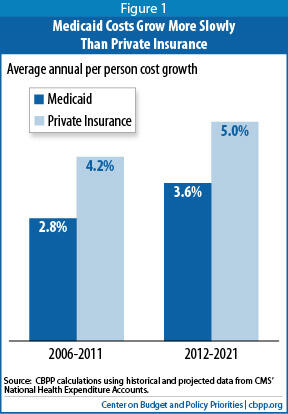

The main argument for a per capita cap — the claim that Medicaid costs are growing out of control due to problems in Medicaid itself — does not bear up well under scrutiny. As noted, Medicaid costs per beneficiary are well below those of private insurance. Moreover, Medicaid cost growth largely mirrors cost growth throughout the U.S. health care system, both public and private. In fact, Medicaid costs per beneficiary have been rising less rapidly than private insurance premiums in recent years and are expected to continue doing so over the coming decade. Trying to address Medicaid in isolation from the rest of the health care system, such as through a per capita cap, would shift costs and risks to states, beneficiaries, and health care providers and be likely to make the U.S. system more of a two-tier health care system based on income.

Per Capita Cap Would Fundamentally Change Medicaid’s Financing Structure

The federal government generally picks up between 50 percent and 75 percent of each state’s Medicaid costs (57 percent, on average); the state is responsible for the remainder.[2] If state Medicaid expenditures increase, the federal government shares in the increased costs. If state Medicaid expenditures decline, the federal government shares in the savings.

A per capita cap would operate differently. The federal government would pay only up to a fixed amount per beneficiary. If actual state Medicaid costs per beneficiary exceeded the cap, states would be responsible for all remaining costs.

Typically, per capita cap proposals call for setting the cap amount on a state-specific basis, based on the state’s historical Medicaid spending per beneficiary. Some proposals set a single cap for all beneficiaries, while others set separate caps for different beneficiary groups (like children, seniors, people with disabilities, and non-disabled adults). The cap amount is typically adjusted each year by the same percentage for all states.

Medicaid Costs Growing More Slowly Than Private Insurance

Critics often claim Medicaid costs are growing out of control and that the current federal financing structure is a prime cause, because the federal government picks up a percentage of states’ allowable Medicaid costs whatever those costs are. They argue that the way to control federal Medicaid spending growth is to convert the program into a block grant (as under the House-passed budget plan) or to impose a cap on federal funding per beneficiary.

This portrayal of the use of Medicaid’s financing challenges is at odds with basic data and research in the field. Over the past 30 years, average annual Medicaid cost growth per beneficiary has essentially tracked health care cost growth systemwide.[3] In fact, Medicaid costs per beneficiary have been rising less rapidly than private insurance premiums in recent years, a trend expected to continue over the next ten years (see Figure 1).[4]

Moreover, Medicaid is a lean program — it costs Medicaid substantially less than private insurance to cover people of similar health status (see Figure 2).[5] This is due primarily to Medicaid’s lower payment rates to providers and lower administrative costs.

Federal Funding Under A Per Capita Cap Would Likely Become Increasingly Inadequate

The primary goal of a per capita cap for Medicaid is to produce substantial federal savings. To accomplish this, the cap must give states significantly less federal funding on a per-beneficiary basis each year than they would receive under the current financing system.

Per capita cap proposals typically accomplish this by increasing annual federal per-beneficiary payments at a slower rate than the projected rate of growth of per-beneficiary Medicaid costs under current law, which reflects expected growth in health care costs and the aging of the population. As a result, over time, states would receive less and less federal funding for each Medicaid beneficiary, relative to current law. (Federal policymakers could produce additional savings, if they chose, by setting the initial cap amounts below a state’s historical level of federal Medicaid spending per beneficiary.)

The actual funding reductions under a per capita cap could turn out to be considerably larger than the official Congressional Budget Office (CBO) cost estimate would project. This is because future health care costs are notoriously difficult to predict accurately. CBO’s original projections of the Medicare Part D drug benefit, for example, significantly overestimated its costs, as spending per beneficiary and enrollment both turned out to be lower than expected.[6] Over the past two decades, CBO baseline projections have both significantly underestimated and overestimated actual Medicaid costs at various times.[7] As discussed below, if actual Medicaid costs per beneficiary turned out to be higherthan expected for a number of legitimate reasons that have little to do with how state Medicaid programs operate and are largely or entirely beyond states’ control, states would be saddled with deeper-than-expected federal funding shortfalls because (unlike under the current Medicaid financing structure) federal funding would not rise automatically to help cover the higher-than-expected costs.

The Risk of Demographic Changes

Over time, the share of Medicaid beneficiaries who are seniors or people with disabilities will rise markedly as the population ages, while the share who are children or non-elderly adults will decline (once the ACA’s Medicaid expansion has taken effect). Seniors and people with disabilities have Medicaid costs about five times higher or more than children and non-elderly adults, on average.[8] This means that as the population ages, Medicaid spending per beneficiary will increase more rapidly than would be the case due to rising health care costs alone, because a smaller share of beneficiaries will be in the low-cost demographic categories and a larger share will be in the high-cost demographic categories.

Assume that a per capita cap proposal sets a single federal funding cap per beneficiary for all beneficiaries, based on current spending levels and adjusted each year by a uniform growth factor. That would effectively lock the current demographic makeup of the Medicaid beneficiary population into the per capita cap structure. State funding shortfalls would grow steadily larger as the beneficiary population aged. States with greater-than-average increases in the share of their populations that are elderly would be affected most severely.

Alternatively, separate per capita caps could be set for seniors, people with disabilities, children and non-elderly adults, as some per capita cap proposals envision. This would not fully eliminate the problem, however. As the baby-boom generation (those born between 1946 and 1964) grows older, a greater share of seniors will move from “young-old” age into “old-old” age. The older elderly are much more likely to be frail, to have serious health problems and multiple health conditions, and to need nursing home care and other long-term care services and supports. In other words, in the decades ahead, the elderly beneficiary population will become considerably more expensive to serve on a per-beneficiary basis, a critical development that no per capita cap proposal addresses.

Finally, as discussed below, the ACA’s Medicaid expansion will add millions of newly eligible low-income parents and childless adults to the program, which will alter the makeup of the non-elderly adult beneficiary population. If separate caps are established for different beneficiary groups and the caps for non-elderly adults are set before the Medicaid expansion has taken full effect, the caps could underestimate the per-beneficiary costs of newly eligible adults. This, too, could result in states facing larger federal funding shortfalls.

States thus would be at substantial risk of greater-than-expected funding shortfalls due to both the aging of the population and the addition of the Medicaid expansion population, whether there was a single per capita cap for all beneficiaries or separate caps for different Medicaid beneficiary groups.

The Risk of Unanticipated Medical Cost Growth

Advances in medical technology, changes in health care utilization patterns, and the onset of epidemics or new illnesses can produce unexpected increases in medical costs. For example, prescription drug spending grew rapidly during the late 1990s and early 2000s throughout the U.S. health care system with the introduction of more effective, but costly, new drugs to treat various conditions such as cardiovascular disease. National health spending on prescription drugs increased by 15 percent in 1998 alone. Drug spending growth accounted for 40 percent of the increase in premiums for employer-sponsored insurance between 1998 and 1999. [10]

During this period, states experienced double-digit increases in their Medicaid prescription drug costs. Medicaid drug spending grew by about 18 percent per year between 1997 and 2002, on average. Prescription drugs were the fastest-growing Medicaid benefit by cost and spurred higher Medicaid cost growth overall. This followed a period in which Medicaid spending growth had slowed due to the strong economic expansion, states’ expanded use of managed care, and the Medicaid savings in the Balanced Budget Act of 1997.[11]

These large increases in prescription drug costs — both in Medicaid and throughout the U.S. health care system — reflected the availability of new “blockbuster” drugs like Lipitor as well as rising prices for existing drugs and greater utilization by beneficiaries.[12]

Over time, state Medicaid programs did manage to achieve some savings by encouraging greater use of generic drugs, instituting more robust drug utilization management strategies (such as the use of prior authorization), and establishing preferred drug lists. In addition, the rate of growth in prescription drug spending through the U.S. health care system has slowed significantly in recent years, as drug manufacturers have marketed fewer new high-cost drugs and as patents have lapsed on some popular drugs, allowing lower-cost generic versions to be made available.[13] However, a new generation of blockbuster drugs to treat various major diseases could, and likely will, emerge in coming years or decades, and past spending patterns on prescription drugs illustrate how state Medicaid programs can experience substantial unexpected growth in medical costs when that occurs.

State Medicaid programs also saw large unexpected cost increases, for example, when the HIV/AIDS epidemic struck in the 1980s and early 1990s. In California, the number of total new HIV cases more than doubled over a single 12-month span between 1992 and 1993.[14] And once new anti-retroviral medications became available to treat HIV/AIDS and the HIV drug cocktail began to be used in the mid-1990s, the number of prescriptions covered by Medicaid for anti-retroviral medications increased from about 170,000 nationwide in 1991 to nearly 2.2 million by 1999, with total annual Medicaid spending on these drugs jumping from $31 million to $718 million over this period (see Figure 3). By 2005, state Medicaid programs were covering 3 million anti-retroviral prescriptions at a cost of nearly $1.6 billion.[15] Had a per capita cap been instituted around 1990, it would have failed to anticipate and reflect these costs for treating HIV-AIDS, and states would have had to bear all of those additional costs themselves (or limit access to these life-saving medications.)

Under a federal per capita funding cap, states would very likely end up bearing all of the costs of covering such new treatments for beneficiaries. They likely would respond by not covering some of the greatly improved treatments or by cutting other parts of Medicaid deeply.

Per Capita Cap Would Disproportionately Harm Some States

While all states would face substantial reductions in federal funding under a per capita cap, some states would likely be hit particularly hard.

- States with relatively low Medicaid spending per beneficiary would receive less initial funding per beneficiary than other states. Under a per capita cap, the formula for setting each state’s initial per-beneficiary funding level typically relies heavily on the state’s current per-beneficiary spending level. Such a cap would effectively lock in the existing wide variations across state Medicaid programs (see Figure 4). In fiscal year 2009, the five lowest-spending states spent about $4,000 per beneficiary, on average, according to the Kaiser Commission on Medicaid and the Uninsured. The five highest-spending states spent more than twice as much, or about $9,000.

States that had relatively narrow Medicaid benefits, low provider reimbursement rates, and/or low overall health care costs at the time that the per capita cap was instituted would receive fewer funds than other states. Such states would have to finance any subsequent improvements to their Medicaid programs entirely with their own funds, as no additional federal funds beyond the per capita amount would be available.

In addition, those states that have been more aggressive in implementing effective cost-containment strategies that lower per-beneficiary costs, while preserving access to care, would be given lower per capita caps. For example, a state that has instituted efficiencies in prescription drug coverage or successfully experimented with delivery system reforms like medical homes would receive lower funding per beneficiary. It is questionable whether such a state could do much more to lower costs to stay within its per capita cap over time without impairing access to needed health-care services. - A per capita cap would effectively lock in harsh Medicaid cuts that some states have instituted on a temporary basis in recent years to help balance their budgets during the economic downturn. Most states have made substantial Medicaid cuts in the last few years to help close the budget shortfalls that emerged as a result of the recession and slow recovery.[16] These reductions in benefits and provider payment rates have lowered states’ per-beneficiary costs and would be built into the base used to determine a state’s initial per capita cap. This could pose particular problems in states that imposed especially severe restrictions on critical health services or provider reimbursement cuts that may not be sustainable indefinitely.

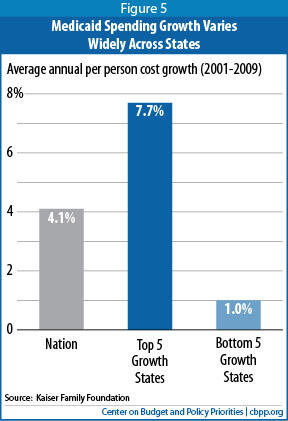

- States whose future Medicaid costs per beneficiary grow relatively quickly would face greater funding reductions. As noted, per capita cap proposals typically adjust the caps each year in all states by a single national percentage. States that experience higher-than-average growth in Medicaid costs per beneficiary would consequently face deeper Medicaid funding cuts over time than other states.Image

Growth in per-beneficiary Medicaid costs varies considerably by state. Between 2001 and 2009, for example, costs rose 7.7 percent per year, on average, in the five states with the highest cost growth, compared to just 1 percent per year in the five states with the slowest growth (see Figure 5). Such variation can reflect a number of factors, such as differences in cost growth for various health care services and in health care utilization, as well as differences across states in the rate of change in the organization and delivery of health care.

Over any time period, some states will experience higher-than-average Medicaid cost growth due to factors largely beyond their control, including a greater-than-average increase in the share of a state’s population that is elderly or in the share of a state’s elderly population that consists of “old-old” people. Under a per capita cap, those states would be especially likely to face highly inadequate federal funding, because their federal allocations would not rise in accordance with the larger-than-average cost increases they would face.

Per Capita Cap Would Undermine Health Reform’s Medicaid Expansion

Under the recent Supreme Court decision upholding the Affordable Care Act, states can choose whether to implement the law’s Medicaid expansion. The Medicaid expansion is designed to be a good financial deal for states; the federal government will pay nearly all of the expansion costs — 93 percent over the first nine years (2014 through 2022), according to CBO. (The federal government will pick up 100 percent of the cost of the expansion to newly eligible individuals for the first three years and no less than 90 percent of that cost on a permanent basis.) CBO estimates also show that under the expansion, states will spend only 2.8 percent more on average on Medicaid from 2014 to 2022 than they would have spent in the absence of health reform.[17]

But a per capita cap designed to produce federal savings would alter this equation and require states to bear more — potentially substantially more — of the Medicaid expansion’s cost. States would almost certainly receive less federal funding for each newly eligible beneficiary than under current law. In addition, if the state per capita cap amounts were set now, before the Medicaid expansion takes effect in 2014, each state’s funding cap would be established before policymakers knew the health status and the health care costs of the newly eligible enrollees. If the per-beneficiary costs for newly eligible enrollees in a state turned out to be higher than what federal policymakers had guessed those costs would be when they set the state’s per capita cap, the state would have to bear a larger share of the cost of covering those beneficiaries.

For these reasons, a per capita cap would likely discourage many states from taking up the Medicaid expansion. Millions of poor Americans now lacking health coverage consequently could remain uninsured. (Some states that went ahead with the expansion might enroll fewer eligible individuals than they otherwise would because they would receive less federal funding for each newly eligible individual they enrolled. States could be less aggressive in their outreach efforts and in simplifying enrollment procedures to reach a larger share of the newly eligible people.)

States Would Almost Certainly Have to Impose Large Cuts, Likely Reducing Access to Needed Care

Some states may believe they can make up for the reduced federal funding under a per capita cap withoutunduly cutting benefits or provider payments by exercising the increased flexibility that such proposals typically give them over Medicaid. Such hopes would likely prove illusory.

To compensate for the explicit funding reduction included in a per capita cap, as well as the higher costs that could occur as a result of unforeseen increases in medical costs, states would either have to contribute substantially more of their own funds to Medicaid or significantly shrink their Medicaid spending on a per-beneficiary basis.

Per Capita Cap Would Be Very Different from Caps Under Medicaid Waivers

To ensure that Medicaid demonstration projects, usually called “waivers,” are budget neutral to the federal government, the federal government typically estimates how much it would otherwise spend on the group of beneficiaries affected by the waiver (usually on a per-beneficiary basis) and caps the state’s funding for those beneficiaries at that level for the duration of the waiver. These per-beneficiary caps, however, are very different from a Medicaid per capita cap.

- A per-beneficiary cap under a waiver is intended to give a state the same amount of federal funding as it would receive without a waiver. In contrast, a Medicaid per capita cap is designed to reduce federal funding to states in order to shrink the deficit.

- State and federal officials can negotiate the details of a waiver’s per-beneficiary cap, and can work out agreement on a cap amount and an annual rate by which that amount will increase that is specific to the state and its demonstration project, in order to try to ensure that the cap and the annual rate are adequate and reflect conditions in the state. In contrast, under per capita cap proposals, the state caps would not be negotiated. States would have no say in the amount of their cap or in how the caps are adjusted each year; those decisions would be prescribed by a formula written into federal law. Moreover, as noted, the annual adjustment would very likely be a uniform national percentage, not a figure that takes each state’s individual circumstances into account.

- At the end of a waiver (usually five years), the state can discontinue the waiver; if so, the per-beneficiary cap ceases to apply. In contrast, a Medicaid per capita cap would be permanent. Moreover, the federal funding cut under a per capita cap would grow steadily over time because the cap would increase more slowly year by year than actual health expenditures.

- Under waivers, states facing unanticipated costs can renegotiate their budget neutrality caps during the course of the waiver, as well as when a waiver is renewed. If medical costs rise faster than anticipated, for example, states can seek to have the per-beneficiary caps increased. Under a Medicaid per capita cap, if costs per beneficiary rise faster than expected, the state is responsible for all unanticipated cost increases.

- Waivers are used to facilitate demonstration projects that test ways to improve state Medicaid programs, such as approaches to coordinating care for “dual eligibles” and Medicaid delivery system reforms. From a federal standpoint, however, a Medicaid per capita cap has a very different purpose: to substantially lower federal Medicaid costs by shifting costs to states.

Cutting per-beneficiary spending substantially without limiting access to needed care would likely prove difficult. As noted above, Medicaid costs per beneficiary already are well below those of private insurance. In addition, states already exercise considerable flexibility over their per-beneficiary Medicaid costs; about 30 percent of state Medicaid spending goes for health benefits that federal law does not require states to cover.[18] (Federal law does not require coverage for services such as prescription drugs, prosthetics, personal care and targeted case management.) States also have significant control over reimbursement rates for providers, and many states have acted in recent years to cut both benefits and provider rates to help close state budget shortfalls. Instituting even deeper cuts in benefits and provider rates would carry a significant risk of impairing low-income individuals’ access to needed care.

Medicaid provides certain benefits that private insurance typically does not offer, in order to meet the needs of certain especially vulnerable beneficiaries — particularly people with severe disabilities, who traditionally have been excluded from the private insurance market. Such services, including case management, therapy services, and mental health care, are important for many poor people with serious disabilities, but are expensive. States facing the funding limits under a per capita cap could well conclude they had little choice but to curtail these services.

In addition, children could lose access to a comprehensive pediatric benefit currently required under federal law known as EPSDT (Early Periodic Screening, Diagnostic, and Treatment), which is designed to ensure that low-income children receive preventive medical screening and treatment for health problems they are found to have. Private insurance typically does not provide such comprehensive pediatric coverage. This broader coverage is critical for poor children, particularly those with special health care needs, who often go without preventive care and advanced medical treatments they need if their insurance doesn’t cover those services; their parents often can’t afford to pay for such services on their own.

Medicaid also ensures that coverage is affordable by generally not charging premiums and keeping co-payments modest. Research has found that premiums and cost-sharing disproportionately lead poor households to forgo needed care or to remain uninsured. Under a per capita cap, states likely would be permitted to begin charging substantial premiums, which the research indicates would discourage enrollment and leave more poor people uninsured, and to impose deductibles and co-payments at levels that research suggests would reduce access to needed care among the poor. These are the kinds of steps that many states would likely feel compelled to adopt to squeeze per-beneficiary costs below the cap.

In addition, because spending per beneficiary already is very low for children and non-disabled adults, states likely would have to make the largest cuts to their higher-cost, most vulnerable beneficiaries — low-income seniors and people with disabilities. In 2009, average Medicaid spending per beneficiary was $13,186 for seniors and $15,453 for persons with disabilities, compared to just $2,313 for children and $2,926 for non-disabled, non-elderly adults.

This would be the case even if separate per capita caps were set for each beneficiary group (children, non-disabled adults, people with disabilities, and seniors) — because of the large cost differential between seniors and people with disabilities on the one hand and children and other adults on the other. Seniors and people with disabilities now account for nearly two-thirds of Medicaid costs, a percentage that will rise higher in coming years as the population ages.

A per capita cap could also allow states to shift beneficiaries into private insurance, offering them a voucher to purchase coverage on their own. However, since Medicaid costs substantially less per beneficiary than private insurance does, shifting beneficiaries into private insurance would increase state costs — unless the vouchers purchased considerably less coverage than Medicaid provides. As a result, many who received a voucher likely would be left underinsured (i.e., without coverage for certain important health care services or facing premiums, deductibles, or co-payments they have difficulty affording).

States facing inadequate per capita funding also would almost inevitably conclude they had to cut provider reimbursement rates further. Such rate reductions likely would apply not only to hospitals, community health centers, nursing homes, physicians, and pharmacies in Medicaid fee-for-service but also to managed care plans that currently serve low-income children and their parents. That, in turn, could cause some providers and plans to withdraw from Medicaid, jeopardizing beneficiaries’ access to needed care, particularly in communities — such as rural areas — that already are medically underserved.

Finally, while per capita cap proposals may preserve the individual entitlement (under current law, all eligible individuals who apply for Medicaid must be allowed to enroll) and could be designed to require states to continue to cover the same groups that federal law requires them to cover today, per capita cap proposals also could be structured to allow states to cap Medicaid enrollment. States that instituted an enrollment cap could leave significant numbers of eligible low-income people uninsured, especially during economic downturns. States could also be given the flexibility to cut eligibility for some or all “mandatory populations,” including low-income children as well as seniors and people with disabilities who live on modest checks from the Supplemental Security Income (SSI) program, which raises elderly individuals to only about three-quarters of the poverty line.

Conclusion

A per capita cap would result in substantial cost shifts to states, which would place pressure on state budgets and likely lead over time to substantial Medicaid reductions affecting millions of beneficiaries and the health-care providers that serve them. For a per capita cap to produce significant federal savings, it would have to give states less federal funding for Medicaid than they would receive under current law. The squeeze on states — and ultimately on beneficiaries and providers — would be intensified if new treatments or medications emerged that made progress in combating key diseases but added to overall health care costs, as well as by the aging of the population, especially when the baby boomers move into old-old age. While federal funding would still increase if Medicaid enrollment rose, funding would not respond to medical cost growth that turned out to be higher than had been predicted due to legitimate reasons beyond states’ control. A per capita cap also would be likely to discourage states from taking up the Medicaid expansion under the Affordable Care Act and thereby likely would lead to millions of poor Americans remaining uninsured.

End Notes

[1] See, for example, H.R. 5979 (the Medicaid Accountability and Care Act of 2012), introduced by Representative Bill Cassidy (R-LA).

[2] These figures represent the regular Medicaid matching rates. As noted below, the federal government will apply a substantially higher matching rate for the Affordable Care Act’s Medicaid expansion.

[3] See, for example, Richard Kogan, Kris Cox, and Jim Horney, “The Long-Term Fiscal Outlook Is Bleak,” Center on Budget and Policy Priorities, December 16, 2008.

[4] John Holahan et al., “Medicaid Spending Growth over the Last Decade and the Great Recession, 2000-2009,” Kaiser Commission on Medicaid and the Uninsured, February 2011 and John Holahan and Stacey McMorrow, “Medicare and Medicaid Spending Trends and the Deficit Debate,” New England Journal of Medicine, 367:393-395, August 2, 2012.

[5] Leighton Ku and Matthew Broaddus, “Public and Private Insurance: Stacking Up the Costs,” Health Affairs (web exclusive), June 24, 2008. See also Jack Hadley and John Holahan, “Is Health Care Spending Higher Under Medicaid or Private Insurance?,” Inquiry 40: 323-342, Winter 2003/2004.

[6] Edwin Park and Matthew Broaddus, “Lower-than-Expected Medicare Drug Costs Mostly Reflect Lower Enrollment and Slowing of Overall Drug Spending, Not Reliance on Private Plans,” Center on Budget and Policy Priorities, May 14, 2012.

[7] See, for example, Figure 1 in Edwin Park and Matt Broaddus, “Medicaid Block Grant Would Shift Financial Risks and Costs to States,” Center on Budget and Policy Priorities, February 23, 2011.

[8] Kaiser Commission on Medicaid and the Uninsured and Urban Institute estimates based on data from FY 2009 MSIS and CMS-64 reports, 2012 at http://statehealthfacts.org/comparemaptable.jsp?ind=183&cat=4.

[9] CBPP analysis of FY 2009 MSIS data.

[10] See Kaiser Family Foundation, “Prescription Drug Trends,” September 2000.

[11] Linda Elam, Brian Bruen, and Jane Tilly, “Medicaid and the Prescription Drug Benefit,” September 2002 and Brian Bruen, “Medicaid Prescription Drug Spending and Use,” Kaiser Commission on Medicaid and the Uninsured, April 2004.

[12] See Mark Merlis, “Explaining the Growth in Prescription Drug Spending: A Review of Recent Studies,” U.S. Department of Health and Human Services, August 2000.

[13] In addition, with the establishment of the Medicare drug benefit, Medicare took over the bulk of drug costs for already eligible beneficiaries.

[14] Cindy Mann and Joan Alker, “Federal Medicaid Waiver Financing: Issues for California,” Kaiser Commission on Medicaid and the Uninsured, July 2004.

[15] Yonghua Jing et al., “Utilization and spending trends for antiretroviral medications in the U.S. Medicaid program from 1991 to 2005,” AIDS Research and Therapy, 4:22, October 2007.

[16] Vernon Smith et al., “Moving Ahead Amid Fiscal Challenges: A Look at Medicaid Spending, Coverage and Policy Trends,” Kaiser Commission on Medicaid and the Uninsured, October 2011.

[17] January Angeles, “How Health Reform’s Medicaid Expansion Will Impact State Budgets,” Center on Budget and Policy Priorities, revised July 25, 2012.

[18] See, for example, Kaiser Commission on Medicaid and the Uninsured, “Medicaid: An Overview of Spending on ‘Mandatory’ vs. ‘Optional’ Populations and Services,” June 2005.

More from the Authors