Contrary to the concerns that some lawmakers have expressed, there is no evidence that the Section 8 rental assistance programs for low-income families — the Housing Choice Voucher and Project-Based Rental Assistance programs — are crowding out spending on other HUD programs.

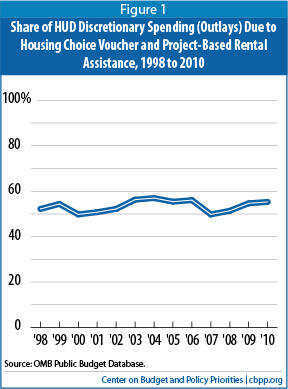

In 2010, the most recent year for which data are available, total outlays (i.e., actual spending) for these programs constituted 55 percent of the HUD budget — less than in the 2003-2006 period and just above the 54 percent average between 1998 and 2010 (see Figure 1).

Since the late 1990s, in other words, spending on the Section 8 programs has grown at about the same rate as aggregate spending in other HUD programs.

Nevertheless, it is worth asking why Section 8 costs have increased in recent years and what policymakers can do to improve the programs in ways that also will constrain costs. To answer the first question, we analyzed Housing Choice Voucher program data from 2005 to 2011, a period in which the cost of the program increased by $3.6 billion, or 24 percent. We found that this increase primarily reflected two factors:

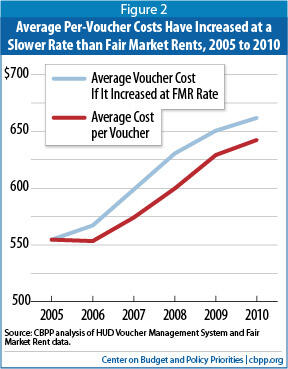

- The widening gap between the incomes of assisted households and housing costs, which raised per-voucher costs. The average per-voucher housing assistance payment increased by 15 percent from 2005 to 2010. This increase, however, was smaller than the increase in private rental housing costs over that period, as measured by HUD’s Fair Market Rents (FMRs) (see Figure 2). This fact indicates that state and local housing agencies have done a good job of controlling per-voucher costs.

-

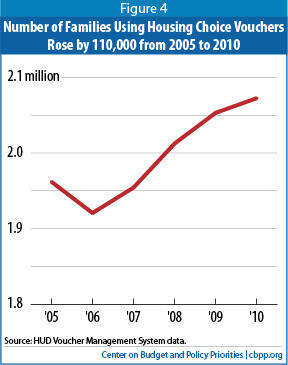

An increase in the number of low-income families using vouchers. Most of this growth reflected the issuance of new “tenant protection” vouchers to prevent low-income families and communities from losing affordable housing when public housing or other federally assisted housing was demolished or otherwise lost.

Analysis of Section 8 Project-Based Rental Assistance program data suggests that recent spending increases in that program are explained entirely by the widening gap between the incomes of assisted households and housing costs. (Data indicate that the number of units funded by the program declined modestly over the same period.)

The second question — how to reduce costs in Section 8 programs — has become critically important, especially since many lawmakers are seeking deep cuts in discretionary spending to reduce budget deficits. Congress can improve the Section 8 programs and reduce costs by:

- Enacting Section 8 reform legislation to simplify the rules for determining tenant rents, streamline housing inspection requirements, and support work. CBO has estimated that provisions similar to those in the draft Section 8 Savings Act (SESA) issued June 16, 2011 by Rep. Judy Biggert, the chair of the House Financial Services Subcommittee on Insurance, Housing and Community Opportunity, would reduce costs by more than $700 million over five years (that is, the level of new budget authority required to sustain current levels of housing assistance would be reduced by this amount).

- Improve SESA by adding provisions to make the housing voucher funding system still more efficient, enabling the program to serve more families with available funds and providing Congress and HUD with new tools to constrain program costs. Congress should require HUD to use the so-called “recent-cost” voucher funding formula, which bases agencies’ annual renewal funding on their actual voucher usage and costs in the prior year. It also should require HUD to reduce each agency’s renewal funding eligibility by the amount of its “excess” reserves (those above 6 percent of the agency’s annual renewal funding eligibility). And Congress should give HUD the authority to reallocate any renewal funds not needed to meet 100 percent of agencies’ funding eligibility under the renewal formula to agencies that will use those funds to assist more low-income families.

Approximately 3.3 million low-income families use either Housing Choice vouchers or Section 8 Project-Based Rental Assistance (PBRA) to help them obtain affordable housing. Housing Choice vouchers are used today by 2.1 million low-income families to rent a modest unit of their choice in the private market. Under the PBRA program, HUD provides subsidies to private or non-profit owners of housing developments to compensate them for leasing 1.2 million housing units to low-income tenants at rents that are affordable to those tenants.

The families helped by these programs represent more than two-thirds of all the low-income families that receive HUD-funded rental assistance, but they constitute only a fraction of the number who are eligible and in need of assistance. More than half of the households using Section 8 rental assistance are elderly or people with disabilities; the rest are mostly families with children. On average, households assisted under the Section 8 programs have annual incomes of just $12,000, well below the poverty line.

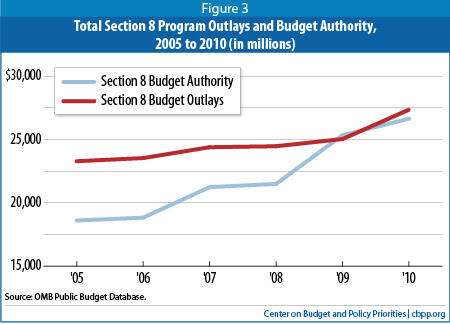

Those who have expressed concerns about the impact of Section 8 costs on the HUD budget — and therefore on other HUD housing and community development programs — usually point to changes in the programs’ annual budget authority. Total budget authority for the Section 8 programs increased by $9 billion, or 49 percent, from 2005 to 2011.

However, these budget authority data are a misleading indicator of actual program spending (outlays) for the programs. This is because much of the recent increase in budget authority for the two Section 8 programs was due to three factors that have little to do with actual program costs:

- Expiration of long-term Section 8 PBRA contracts. Several decades ago, when HUD signed the original contracts with development owners to participate in the PBRA program, Congress provided sufficient budget authority to make rental assistance payments throughout the contracts’ 20- to 40-year terms. As the contracts began to expire in the mid-1990s, however, Congress directed HUD to replace them with contracts funded annually through appropriations. Each year, contracts governing roughly 20,000 to 30,000 units of Section 8 housing expire and HUD replaces them with contracts funded under annual appropriations. This conversion process, which is expected to continue over the next decade as the remaining 20 percent of the original contracts expire, increases the new budget authority required for renewals by roughly 1 to 2 percent every year but has little effect on actual program spending.

- Restoration of 12-month funding of Section 8 PBRA renewals. In 2007, HUD advised Congress that it had been systematically “short-funding” PBRA contracts at renewal. Previously, HUD had renewed PBRA contracts on a rolling basis throughout the year, setting aside 12 months’ worth of budget authority for each renewed contract. Under the practice of “short-funding” renewals, HUD committed budget authority for only part of the subsequent year —typically enough to cover the rest of the federal fiscal year. Although short-funding has no impact on annual outlays, it temporarily reduces the amount of new budget authority required for renewals (which is almost certainly the reason HUD initiated the practice). That practice, plus HUD budget miscalculations, precipitated a serious renewal funding shortfall in 2007. Consequently, Congress directed HUD to restore the policy of funding PBRA contracts for a full 12 months at renewal. Based on HUD’s estimate of the additional budget authority required to restore full-year renewals, Congress provided $2 billion in emergency funding for the program in the 2009 Recovery Act.

- Decline in rescissions of unspent budget authority from previous years. From 1998 to 2009, Congress rescinded $1.8 billion in Section 8 funds per year, on average, mostly from original long-term PBRA contracts where the amount originally budgeted turned out to exceed the costs of the contracts. These rescissions reduced the amount of new budget authority required each year, but, for the most part, had no effect on actual program expenditures (i.e., on outlays). For various reasons, the pool of Section 8 funds available for rescission has shrunk considerably in recent years. As a result, while Congress rescinded $1.6 billion in Section 8 funds in 2005, the rescission amounts have been much smaller since then, and Congress rescinded no Section 8 funds in 2010 — the first year in more than a decade there was no rescission — or 2011. HUD has needed increases in budget authority in 2010 and 2011 to replace the budgetary room that was opened up in prior years by these rescissions, and thereby to sustain the available funding for the program and avoid cuts in the number of assisted families. The necessary increases in budget authority here, as well, have no effect on actual program spending levels.

Data limitations make it difficult to determine precisely how much each of these factors drove the recent increase in budget authority for PBRA. But the overall effects are clearly visible in a comparison of outlays and budget authority for the two Section 8 programs. As Figure 3 shows, the gap between the two has sharply diminished over time as HUD has replaced long-term contracts with contracts requiring annual budget authority, as Congress reduced and then eliminated annual rescissions of Section 8 budget authority, and as it restored full-year funding of Section 8 contract renewals.

As the gap between budget authority and outlays closes, the growth rate of budget authority flattens out.

Budget authority data thus create a highly misleading impression of actual Section 8 program spending. Program outlays — actual spending — provide a much more accurate picture. As Figure 1 shows, the Section 8 programs’ share of total HUD discretionary outlays has remained largely unchanged since the late 1990s. There is no evidence that Section 8 spending is crowding out spending on other HUD programs.

While claims about the impact of Section 8 program costs on the HUD budget are overblown, it remains legitimate to ask why costs have increased in recent years, and what can be done to reduce them. The following sections address those important questions.

As noted above, Housing Choice Voucher program costs increased by $3.6 billion from 2005 to 2011. Our analysis shows that three-fifths of this increase reflected an increase in per-voucher costs — the result of a widening gap between the incomes of assisted households and market housing costs — while nearly 30 percent represented an increase in the number of low-income families using vouchers (see Table 1).

Low-income families using vouchers use roughly 30 percent of their income to rent housing in the private market; the voucher assistance payment fills the gap between this contribution and actual housing costs, within limits set by HUD and state and local housing agencies. The size of the gap between housing costs in the private market and tenant incomes thus determines the cost of each voucher.

From 2005 to 2010, the average cost per voucher increased by 15.1 percent. Our analysis assumes that costs in 2011 will rise an additional 0.7 percent, the average of the inflation factors used by HUD in determining agencies’ renewal funding eligibility for 2011. This total increase of 15.8 percent in per-voucher subsidy costs from 2005 to 2011 accounts for $2.2 billion, or 61 percent, of the $3.6 billion increase in Housing Choice Voucher budget authority over the period.

It is important to note that per-voucher costs have risen more slowly than housing costs in the private market. As Figure 2 shows, HUD’s Fair Market Rents (FMRs) increased by 19 percent from 2005 to 2010, while average per-voucher costs increased by 15 percent. This is striking because the incomes of assisted households rose more slowly than market housing costs — by about 10 percent from 2005 to 2010, on average. Because vouchers fill the gap between tenant contributions and housing costs, and tenant contributions are based on a percentage of the tenant’s income, one would expect per-voucher costs to increase faster than housing costs if incomes rise more slowly than housing costs. The most probable explanation is that housing agencies controlled voucher costs through their ability to set payment standards, which determine the maximum allowable voucher assistance payment. On average, voucher payment standards declined in relation to Fair Market Rents from 2005 to 2010.

Table 1:

Causes of the Increase in Housing Choice Voucher Program Costs, 2005 to 2011 |

| | Dollars | Percentage |

| Total Increase in Housing Choice Voucher Budget Authority, 2005 to 2011 | $3.6 billion | 100% |

| | Widening gap between assisted family incomes and market housing costs | $2.2 billion | 61% |

| Increase in number of families assisted | $1.0 billion | 29% |

| Administrative expenses and other factors 1 | $361 million | 10% |

Source: CBPP analysis of HUD data.

1 The remaining increase is explained by increased funding for the administrative expenses of housing agencies, including for the Family Self-Sufficiency program, and for the Transformation Initiative. |

From 2005 to 2010, Congress provided funding for more than 180,000 new Housing Choice vouchers (see Table 2). Nearly 130,000 of these new vouchers were “tenant protection” vouchers that Congress authorized to prevent low-income tenants and communities from losing affordable housing when public housing was demolished or private owners of project-based Section 8 housing chose not to renew their contracts. The rest of the new vouchers were “incremental” vouchers approved for special purposes, such as to assist homeless veterans and people with disabilities, unify families with children that are separated or are at risk of becoming separated because they are unable to afford adequate housing, and provide assistance to low-income families on the Gulf Coast in light of the large-scale destruction of housing in that region by hurricanes.

The number of families actually using Housing Choice vouchers increased by 110,000, or nearly 6 percent, from 2005 to 2010. Increases in the number of families served account for $1 billion of the $3.6 billion increase in Housing Choice Voucher program budget authority from 2005 to 2011.

To summarize, almost all of the increase in renewal costs in the Housing Choice Voucher program from 2005 to 2011 reflects rising per-voucher costs — which have risen more slowly than costs in the private housing market — and decisions by Congress to serve more families under the program, largely to offset the loss of other forms of housing assistance. These cost trends are precisely what one should expect for a well-managed program that is structured as a public-private partnership to maximize efficiency and flexibility and relies on the participation of private owners of rental housing to meet its goals.

Table 2:

Congress Funded 180,000 New Housing Choice Vouchers from 2005 to 2010 |

| | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | Total |

| Tenant Protection Vouchers | 26,540 | 23,099 | 25,292 | 19,605 | 16,951 | 17,726 | 129,213 |

| Incremental Vouchers | 0 | 0 | 0 | 14,578 | 28,084 | 9,510 | 52,172 |

| | Veterans (VASH) | | | | 10,110 | 10,290 | 9,510 | 29,910 |

| Family Unification | | | | 2,551 | 2,543 | | 5,094 |

| Non-Elderly Disabled | | | | 1,917 | 5,249 | | 7,166 |

| Gulf Coast | | | | | 10,002 | | 10,002 |

| Total New Vouchers | 26,540 | 23,099 | 25,292 | 34,183 | 45,035 | 27,236 | 180,385 |

| Source: Federal Register and HUD documents. Figures represent new vouchers awarded in each year. |

Section 8 PBRA program spending (or outlays) increased by $946 million, or 11 percent, from 2007 to 2010. Over the same period, per-unit assistance costs also increased by 11 percent, while data suggest that the number of units assisted remained fairly steady. As in the Housing Choice Voucher program, per-unit assistance costs are determined by the gap between the tenant’s contribution and actual housing costs, as determined by each owner’s contract with HUD. This suggests that a widening gap between household incomes and housing costs explains the entirety of the increase in program spending from 2007 to 2010.

Finally, per-unit costs in the Section 8 PBRA program rose at about the same rate as housing costs in the private market over the period, as measured by HUD Fair Market Rents (FMRs).

As demands grow to reduce the federal budget deficit, stakeholders have raised legitimate concerns about the outlook for HUD affordable housing and community development programs. These concerns are especially urgent because significant increases in funding for HUD programs — particularly for the three major rental assistance programs — will likely be required to prevent reductions in the number of low-income families receiving federal rental assistance.

Although future cost trends are difficult to predict, recent experience indicates that rent and utility costs in the private market will continue to rise over the coming decade. If this occurs, the cost of renewing rental assistance for families assisted under the two Section 8 programs also will grow, as these costs track those in the private rental housing markets (with adjustments for growth in the number of families assisted under the Housing Choice Voucher program). In addition, public housing — the third major rental assistance program, which provides affordable housing for about 1.1 million low-income families — faces a $26 billion backlog in capital repairs needed to prevent the deterioration of living conditions. Funding for such repairs comes largely through annual appropriations.

The deep cuts in funding for discretionary programs that some lawmakers are proposing would thus risk the loss of rental assistance for large numbers of low-income families. Alternatively, if Congress chooses to protect vulnerable families from losing federal rental assistance — which should be a high priority in any strategy to reduce the budget deficit — then other housing and community development programs could face even deeper cuts.

Fortunately, Congress and HUD can make the Section 8 programs even more cost effective without reducing assistance to needy families, increasing their housing costs to unaffordable levels, or discouraging private owners from participating in the programs. Two steps can achieve these goals.

- Enact Section 8 reform legislation that would simplify the rules for determining tenant rents, streamline housing inspection requirements, and support work by making modest adjustments to the income targeting limits and strengthening the Family Self-Sufficiency program. These reforms all are part of the draft Section 8 Savings Act (SESA), which is a revised version of the Section 8 Voucher Reform Act (SEVRA) that the House Financial Services Committee approved in 2009.

Last year, the Congressional Budget Office (CBO) estimated that provisions similar to those in SESA would reduce costs in the three major rental assistance programs by more than $700 million over five years (that is, the level of new budget authority required to sustain current levels of housing assistance would be reduced by this amount). Moreover, SESA would reduce administrative costs in other ways not reflected in the CBO estimate that could amount to several hundred million dollars more in savings over five years, such as through a reduction in the number of housing inspections that agencies must perform and the required frequency of rent recertifications for families with fixed incomes. Policymakers could use these savings to extend assistance to more families, mitigate the impact of budget cuts on other housing and community development programs, or reduce the deficit. - Strengthen SESA to further improve the efficiency of housing voucher renewal funding policy. The draft SESA legislation includes important improvements. But additional provisions would further enhance the voucher program’s efficiency and effectiveness.

- First, SESA should require HUD to use a renewal formula that bases each agency’s funding eligibility on its actual voucher usage and costs in the prior year, with adjustments for factors such as inflation. Such a “recent cost” formula, which Congress has used in the annual appropriations acts since 2007, distributes funds more efficiently than the alternatives HUD has tried, thereby reducing the funding required to ensure that no low-income family loses rental assistance due to agency funding shortfalls. It also makes funding more reliable for agencies, giving them confidence that their renewal funding will be adequate to meet their obligations to low-income families and landlords. And it reduces funding to agencies that serve fewer families, thereby creating an incentive to improve voucher utilization and increase the number of families served with available funds.

By adding a requirement to use the “recent cost” formula to the authorizing statute, Congress would eliminate a significant source of uncertainty about funding policy that is created by the existing process of authorizing the policy every year in appropriations acts. While this change would not directly lower program costs, it would improve the performance of agencies in using available funds to assist low-income families. - Second, SESA should require HUD to reduce each agency’s annual renewal funding eligibility by the amount of its “excess” reserves. Housing agencies must be allowed to maintain modest funding reserves in order to meet their immediate commitments to low-income families and landlords in the event of renewal funding shortfalls or unanticipated cost increases. SESA would, for the first time, set a clear and consistent policy allowing agencies to maintain funding reserves equal to at least 6 percent of their annual renewal funding eligibility. (SESA would allow HUD to set a higher level.)

But SESA fails to clarify the status of funding reserves that exceed the 6 percent level. Allowing such funds to remain unused would squander scarce resources. By making clear that HUD will reduce (or “offset”) agencies’ renewal funding by an amount equal to any excess funds, policymakers would give agencies a powerful incentive to use any reserves above the 6 percent level to assist additional families. In addition, whenever housing agencies’ renewal funding eligibility is reduced under the reserve offset policy, this also reduces the amount of new budget authority and outlays required to fully renew vouchers in use, thereby providing Congress and HUD with an important tool to constrain program costs in a way that does not harm the low-income families that use vouchers to secure affordable housing. - Third, SESA should require HUD to reallocate any renewal funds that are not needed to meet 100 percent of agencies’ funding eligibility under the renewal formula. The current policy provides each agency — including those with considerable unspent funds in reserve — with a pro-rata share of any renewal funds that remain. These funds would be used more efficiently if HUD could distribute them to agencies that are very likely to use them.