BEYOND THE NUMBERS

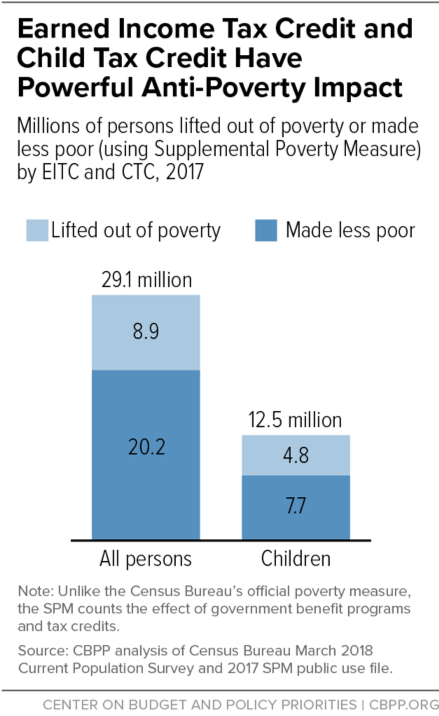

The Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) together boosted the incomes of 29.1 million poor Americans in 2017, lifting 8.9 million above the poverty line and making 20.2 million others less poor, our analysis of new Census data shows. These totals include 12.5 million children, 4.8 million of whom were lifted out of poverty and another 7.7 million made less poor. The figures use the Census Bureau’s Supplemental Poverty Measure, which — unlike the official poverty measure — accounts for the impact of taxes and non-cash benefits as well as cash income.

Even these figures likely understate the credits’ anti-poverty effects. That’s because while boosting incomes directly, the EITC also encourages work, raising people’s earnings. This additional anti-poverty effect, which isn’t part of Census’ poverty reduction figures, nearly doubled the number of people that the EITC lifted out of poverty in families with a single mother aged 24-48 without a college degree in the 1990s, researchers find. (Researchers haven’t studied the CTC to the same extent, but it shares key design features with the EITC, so it likely has similar pro-work effects.)

Also, a growing body of research links income from these tax credits to better infant health, improved school performance, higher college enrollment, and projected increases in earnings in adulthood. As a result, the tax credits may reduce poverty not only in the near term, but also in the next generation.

The Census estimates also don’t account for the impacts of state EITCs that 29 states and the District of Columbia provided in 2017. These state credits build on the success of the federal credit, further reducing poverty and inequality. (Starting in 2019, Puerto Rico will also have its own EITC.)

These figures are for 2017 and therefore don’t account for changes in the two credits that were included in the 2017 tax law, which took effect in 2018. That law may have modest impacts on the credits’ anti-poverty effects. It doubled the CTC’s maximum value, from $1,000 to $2,000 per child, but denied many low- and moderate-income working families a full, or even substantial, credit increase. Families that include 11 million children will get token CTC increases of $75 or less, and families with another 15 million children will get more than $75 but less than the full $1,000-per-child increase.

The 2017 law also erodes the value of the EITC for millions of working-class families over time. It switches from the regular Consumer Price Index (CPI) to the “chained” CPI to adjust tax brackets and certain tax provisions for inflation each year. Since that index rises more slowly over time than the regular CPI does, the maximum EITC will also rise more slowly.

More troubling for many families is the law’s provision ending the CTC for about 1 million children lacking a Social Security number. This group overwhelmingly consists of so-called “Dreamers” — young people with undocumented status who were brought to the United States by their immigrant parents.

Policymakers are expected to take a close look at the 2017 tax law and offer proposals to restructure the law, which is heavily tilted toward the nation’s highest-income people and largely ignores a wide swath of low-wage workers who struggle to meet the basic needs for their families. Improving the EITC and CTC should be top priorities of any restructuring effort.