BEYOND THE NUMBERS

Tax return audit rates, especially among high-income individuals and large corporations, continued a multi-year decline in 2017, IRS data show. That’s largely due to deep cuts in IRS funding and staffing since 2010, as former IRS Commissioner John Koskinen noted. At $4.9 billion, the IRS’s 2018 enforcement funding is $1.5 billion (23 percent) below its 2010 level in inflation-adjusted terms. That’s particularly concerning given that the agency needs to start implementing and enforcing the new tax law — which creates massive new opportunities for tax avoidance — this year, with essentially no new enforcement resources.

The new data show:

- Overall audit rates for both individuals and corporations continue to decline. Overall, the IRS audited only 1 in 161 individual returns in 2017, down from its recent peak of 1 in 90 in 2011. Likewise, the agency audited just 1 in 101 corporate returns in 2017, down from 1 in 61 in 2012.

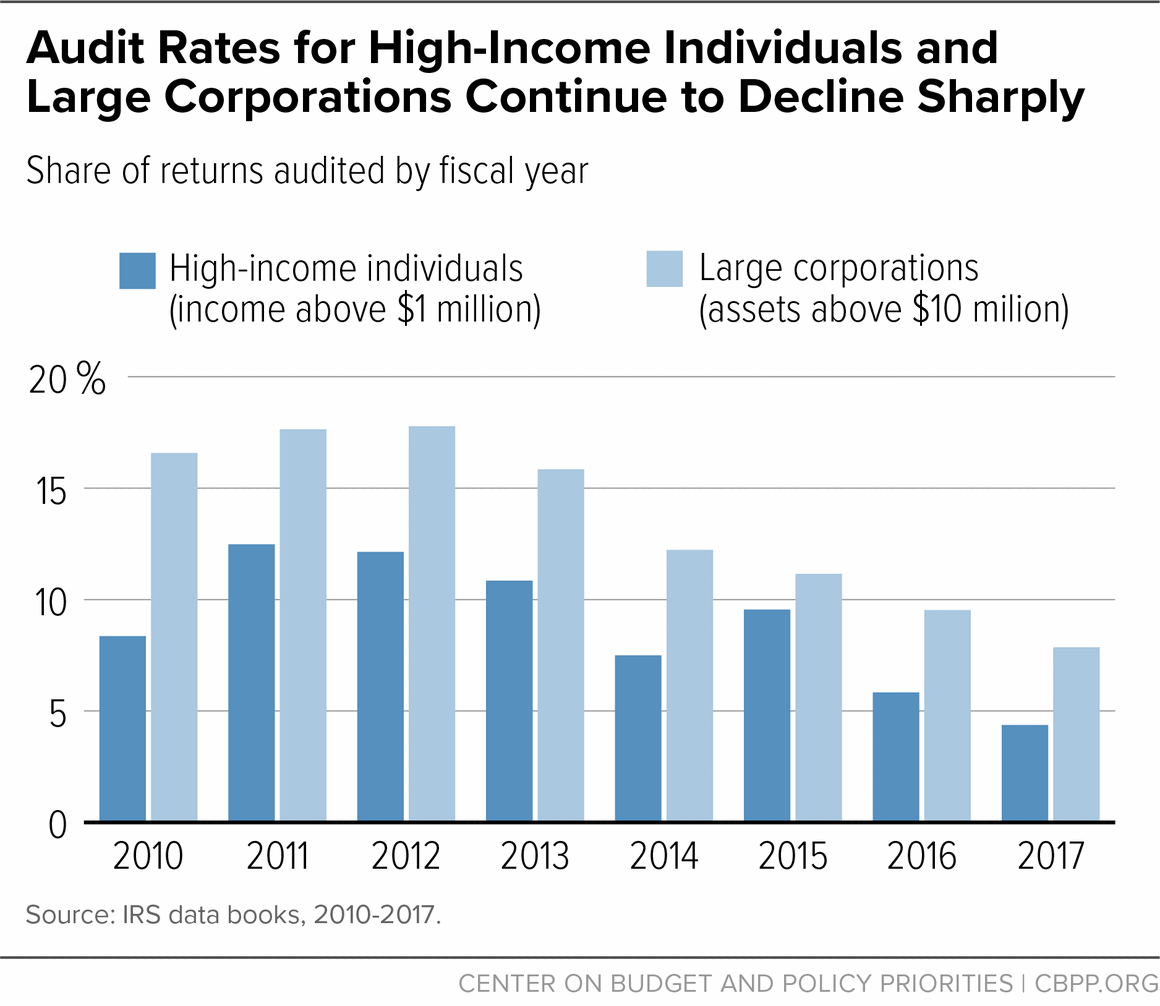

- Audit rates for high-income individuals and large corporations have fallen especially sharply in recent years. The audit rate for individuals with over $1 million in income fell from 12.5 percent in 2011 to 4.4 percent in 2017. And the audit rate for large corporations (which the IRS defines as those with assets over $10 million) fell from 17.8 percent in 2012 to 7.9 percent in 2017. (See chart.)

Tax enforcement for high-income individuals and corporations will be particularly important in the coming years, since the new tax law introduces several new opportunities to game the tax system. It establishes new, hard-to-enforce distinctions between income types and taxes them differently, generating a strong incentive for wealthy individuals and profitable corporations to recharacterize their income to generate significant tax savings.

If the IRS can’t prevent this type of gaming, the tax cuts could be both costlier and more tilted to the wealthy than official estimates now show. But despite the new tax law’s once-in-a-generation enforcement challenge, the 2018 government funding bill funded enforcement at roughly last year’s level. The combination of new gaming opportunities and an underfunded, overworked IRS may well encourage the wealthy to push the boundaries of the new law.

Ultimately, underfunding enforcement jeopardizes the integrity of the tax system. If the public doesn’t believe that the government is enforcing the nation’s tax laws fairly and credibly, compliance with them — and the IRS’s ability to collect the revenues that fund our key investments, including public safety, education, economic security programs, and defense — is at risk. As acting IRS Commissioner David Kautter testified, “there is a point at which the cuts in enforcement and the reduction in enforcement will have a dramatic effect on revenue.” Policymakers should protect the integrity of the tax system by restoring IRS enforcement funding and giving the agency the resources it needs to effectively enforce the new tax law.