BEYOND THE NUMBERS

This MLK Day, Let’s Remember the Links Between Racial Justice and State Tax Policy

While Dr. Martin Luther King, Jr. is best known for his inspirational leadership in bringing down legal barriers to civil rights for Black Americans and other people of color, he also emphasized the need to reduce poverty and expand opportunity to achieve true racial justice. This MLK Day, we would do well to remember that state tax codes are a critical lever for policymakers not only to reduce poverty and expand opportunity, but to advance racial justice.

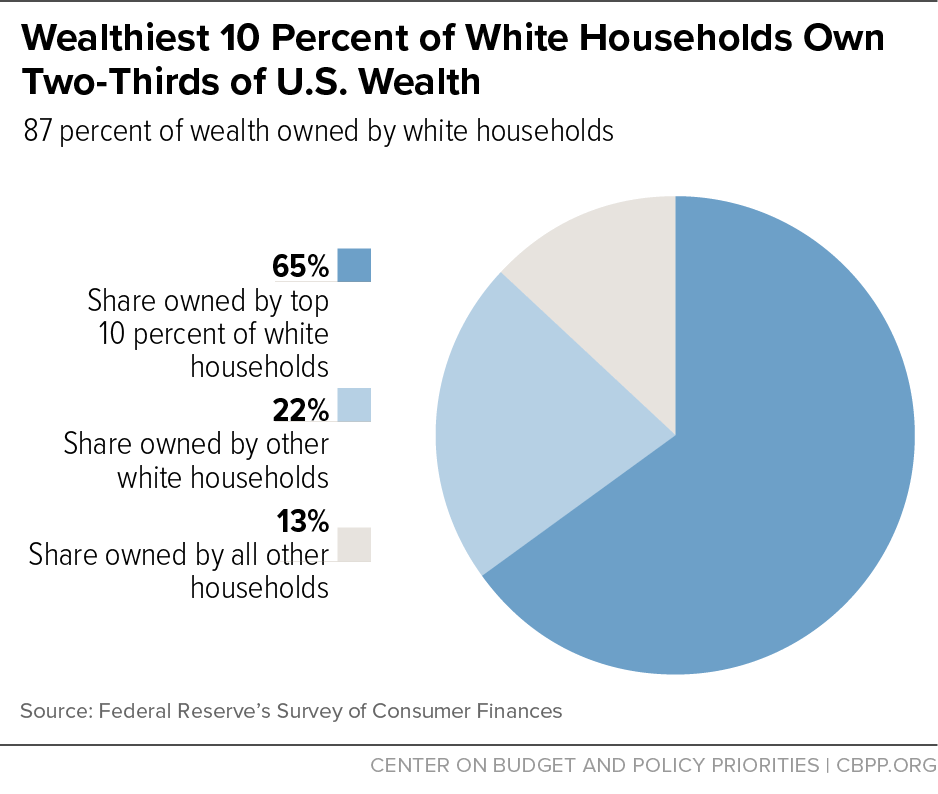

States and local governments account for nearly half of all domestic public-sector spending and most of the funding for education and certain other investments important for economic health. How states and localities raise and spend revenue, including what services they finance, therefore has major implications for racial justice, especially given the extreme income and wealth disparities by race. (See chart.)

People of color have made progress in many areas in recent decades, but state and local tax policies are partly to blame for sustaining racial disparities in power and wealth or even for exacerbating them. Many current policies, such as supermajority requirements to raise revenue (in place in 16 states) and arbitrary limits on property taxes (in place in 44 states), have their origins in explicit, historical efforts to hold back people of color, as we’ve explained. Other policy choices that are not explicitly race based, like an overreliance on regressive sales taxes to fund public services, add to the barriers that people of color can face.

The good news is that states can help overcome these racial inequities by improving their tax codes and better funding public services like schools, health care, and infrastructure. While states’ specific needs may vary, lawmakers should fix upside-down tax codes that ask families with lower incomes to pay a larger share of their income in state and local taxes than their high-income peers; raise sufficient revenue for equitable, sustained public investments; target those investments to best advance equity; and eliminate undemocratic decision-making policies like supermajority requirements and property tax limits.

If states work to improve their tax and budget policies and more adequately finance needed public services, the well-being and productivity of states’ workforces should improve, which in turn should broadly benefit state economies — helping achieve both racial and economic justice for low-income and working people across America.