BEYOND THE NUMBERS

States can help reverse the harmful legacy of racism and racial discrimination by changing how they raise and spend money. Robust public investments in schools, health care, and infrastructure can create more opportunities for people of color. One way states can raise the needed revenue is by creating or strengthening “millionaires’ taxes” – higher tax rates at high income levels, as our recent report explained.

Most state tax systems deepen racial and ethnic inequities because they fall harder on lower-income households, which are disproportionately households of color. Twenty-two percent of the nation’s households are Black or Latinx, but they make up 28 percent of the nation’s poorest households. And in 45 states, lower-income households pay a larger share of their income in state and local taxes than high-income households.

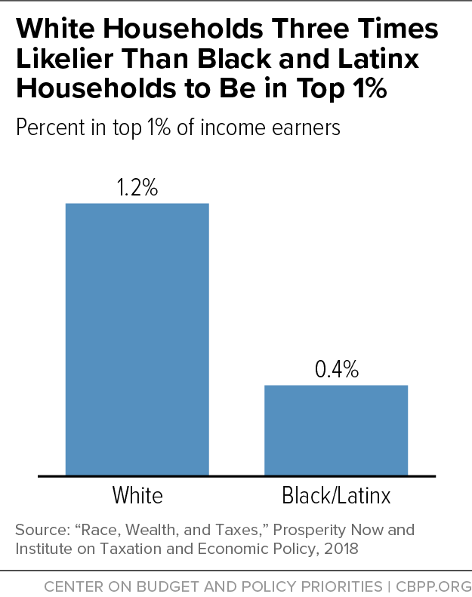

Millionaires’ taxes can help address this problem. They can raise substantial revenue for public services by asking more of those at the top, a group that’s disproportionately white. White families are three times likelier than Black and Latinx families to be in the top 1 percent, according to a report by Prosperity Now and the Institute on Taxation and Economic Policy (see graph).

Wealth accumulates over time and over generations, so its current distribution partly reflects the cumulative impact of longstanding racial discrimination. The wealthiest 10 percent of white households own nearly two-thirds of the nation’s wealth; people of color comprise 35 percent of all households but own just 13 percent of the wealth.

States can reduce these racial disparities by making their tax codes more equitable with a millionaires’ tax. A dozen states have done so since 2000, and several others may do so in the near future. Lawmakers in Illinois, Maine, New Jersey, New Mexico, and New York are all considering raising personal income tax rates on top earners.

Targeted tax increases can provide funds to improve schools in low-income communities of color, strengthen safer water systems and other public infrastructure (which is often neglected in these communities), expand access to affordable health care, and make other investments that reduce racial and ethnic inequities and help build an economy whose benefits are more widely shared.

One example is Minnesota, which in 2013 adopted a new income tax rate on high incomes and used part of the revenue to help more low-income children attend high-quality preschool, disproportionately benefiting families of color.

And in California, a millionaires’ tax that voters approved in 2012 generated billions in new revenue for public schools. When paired with the state’s innovative reform to its K-12 funding formula, the funds bolstered investment in communities of color and districts with many disadvantaged students, particularly English learners, foster youth, and students from low-income families.