BEYOND THE NUMBERS

State and local tax systems can be a powerful tool for boosting economic opportunity, creating broadly shared prosperity, and building equitable state economies. But in nearly every state, they’re reinforcing and often worsening inequality, as the Institute on Taxation and Economic Policy shows in a new report.

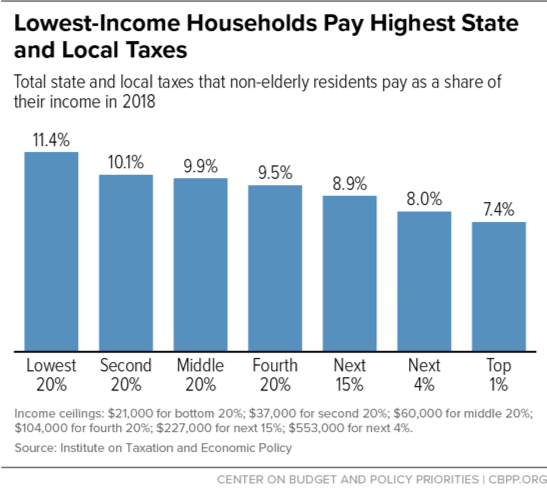

The new study of the state and local tax systems of all 50 states and the District of Columbia finds that 45 of them tax low-income families more heavily than wealthy families. Nationally, the poorest fifth of households pay a much higher share of their income in state and local taxes than the richest 1 percent, on average. (See chart.) Not only does this worsen economic inequality, but it also reinforces and deepens racial inequities, since households of color are likelier to have low incomes.

In some states, this disparity is even starker. The poorest fifth of households pay over three times more than the top 1 percent of households, as a share of income, in eight states — and more than five times in Washington, Florida, and Nevada.

Two drivers of state tax inequity are the lack of a graduated personal income tax and relying too much on sales and excise taxes. Seven of the 10 states with the most upside-down systems — that is, where the lowest-income households pay the most relative to the wealthiest — don’t have a broad-based personal income tax, and the other three have a flat or virtually flat personal income tax. Six of these 10 states derive roughly half to two-thirds of their tax revenue from sales and excise taxes — the most regressive of the major state revenue sources — when the national average is about one-third.

As the new report makes clear, however, state tax policy can help dismantle barriers to opportunity and reduce inequities. In California, D.C., Vermont, Delaware, Minnesota, and New Jersey, state and local tax systems somewhat narrow the gap between low-income and wealthy households (though none of them sharply reduce inequality through their tax systems). State policymakers nationwide should copy their colleagues in these states by designing tax policies that help level the playing field, not make it even more uneven.