BEYOND THE NUMBERS

Recovery Legislation’s Housing Voucher Investments Would Make Major Progress in Cutting Homelessness, Housing Instability

Legislative language the House Financial Services Committee released yesterday as part of the economic recovery package includes historic investments in key affordable housing programs, among them the highly effective Housing Choice Voucher program. These investments would help create a path toward ending homelessness and significantly reducing housing instability for households with the lowest incomes, including families with children, people with disabilities, and seniors.

More than 580,000 people in communities nationwide were staying in homeless shelters or living on the street in January 2020, even before the pandemic. Thirty states at that time reported a rise in homelessness, and the number of individuals living on the streets — including youth and young adults, seniors, people with disabilities, and working adults — exceeded the number of individuals living in shelters for the first time since the Department of Housing and Urban Development started gathering these data.

At the same time, some 24 million people in low-income renter households — 62 percent of whom are people of color — paid more than half of their income for rent and utilities. But due to inadequate funding, only 1 in 4 eligible households receives rental assistance, and many who do get it wait years.

The need to enact the committee’s significant affordable housing investments is clear.

The programs that would get the highest funding levels are those designed to help people with the lowest incomes afford housing: $80 billion to repair public housing, $37 billion to increase the supply of affordable housing through the national Housing Trust Fund, and $90 billion for rental assistance to increase affordability through the Housing Choice Voucher and Project-Based Rental Assistance programs.

These investments would preserve our nation’s public housing stock, significantly increase the supply of affordable and supportive housing nationwide, and make rents affordable for as many as a million more families and individuals with the lowest incomes after the expansion is fully phased in. And they would significantly benefit families with children and decrease disparities for historically marginalized populations for years to come.

The proposed rental assistance investments are particularly noteworthy. While the Administration’s American Jobs Plan devoted only $2 billion of its overall housing investments to rental assistance, the Financial Services Committee included $90 billion in its package for two key rental assistance programs:

- Project-Based Rental Assistance ($15 billion), which can be combined with capital investments through the national Housing Trust Fund and other programs to ensure that newly developed properties are affordable for households with the lowest incomes for at least 20 years; and

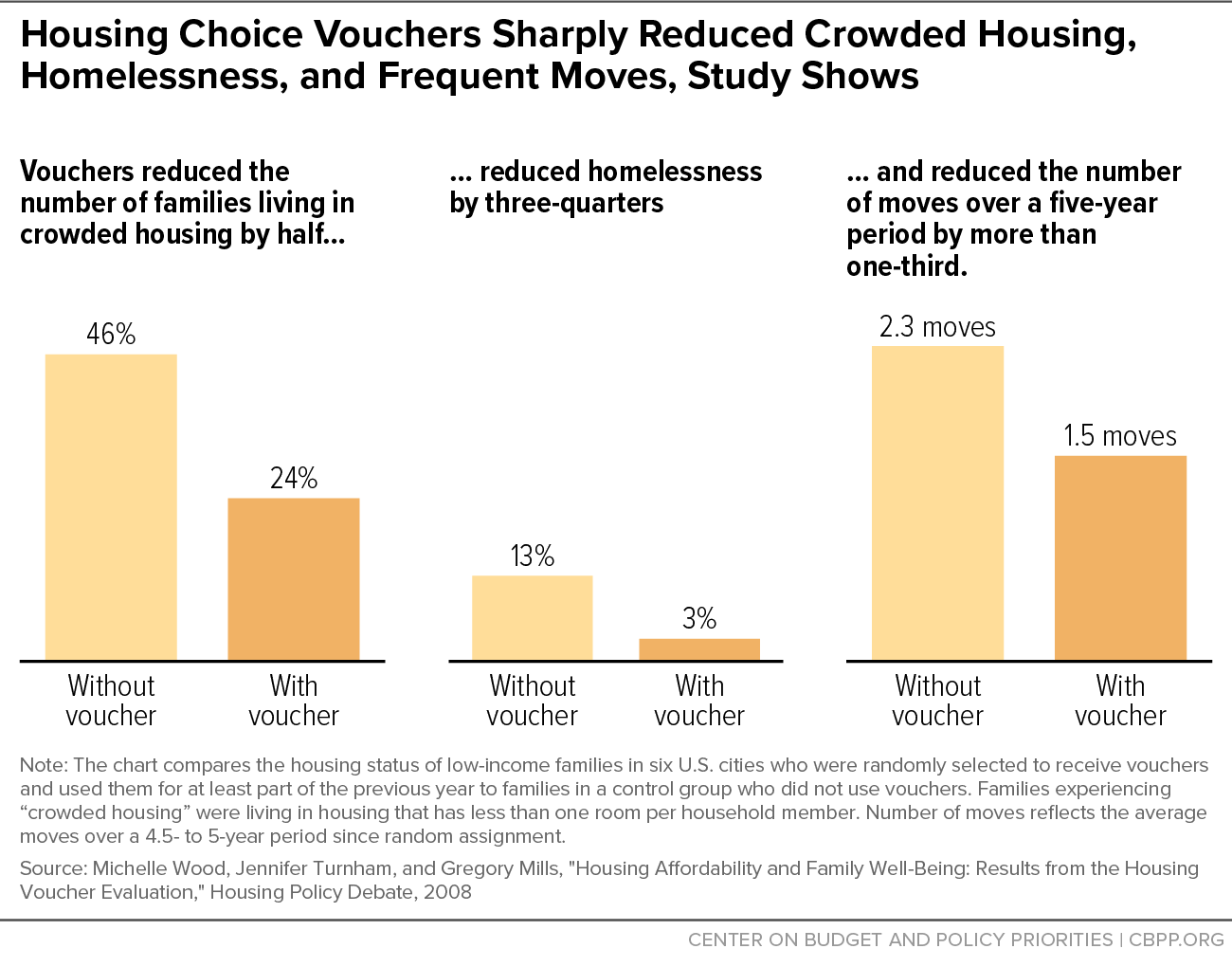

- Housing Choice Vouchers ($75 billion), which extremely low-income households can use to rent units of their choice. This includes up to $25 billion devoted to serving families and individuals experiencing homelessness or at imminent risk of homelessness and survivors of domestic violence and human trafficking, and would be the largest-ever single investment to address our nation’s homelessness crisis. The rest of this voucher funding would target households with extremely low incomes — below 30 percent of median income — who struggle to afford housing and frequently find themselves at risk of eviction. These funds will help them avoid housing instability, evictions and related crises, and disruptive moves that can interrupt children’s educational progress.

The committee’s proposed investments would begin to address the full range of affordable housing needs across the country and significantly benefit the lives of children and people who have been historically marginalized, including people of color, people with disabilities, LGBTQ people, and people experiencing homelessness. Housing investments are also key to ensuring that recovery legislation gets the most out of its other important investments.

As the economic recovery package moves forward in the House and the Senate, it’s imperative that lawmakers retain this critical, historic down payment toward safe and affordable housing for all.