BEYOND THE NUMBERS

New Mexico policymakers are strengthening communities and families with their new budget and tax plans. Governor Michelle Lujan Grisham signed tax reforms into law last week that reduce tax breaks for multistate corporations and the wealthiest New Mexicans, boost incomes for 200,000 low-income households, and reduce the state’s overreliance on volatile oil revenues. Policymakers paired the tax package with a budget that, buoyed by a nearly $1 billion revenue surplus, substantially reinvests in children and infrastructure and advances racial, ethnic, and gender equity.

Among the key features of their tax and budget plans, policymakers:

- Adopted “combined reporting,” which requires that multistate corporations combine their profits from all subsidiaries in determining their taxable income in the state, to prevent them from artificially shifting income to other states to avoid taxes. New Mexico becomes the 28th state (plus the District of Columbia) to adopt this policy among the 45 with corporate income or similar business taxes.

-

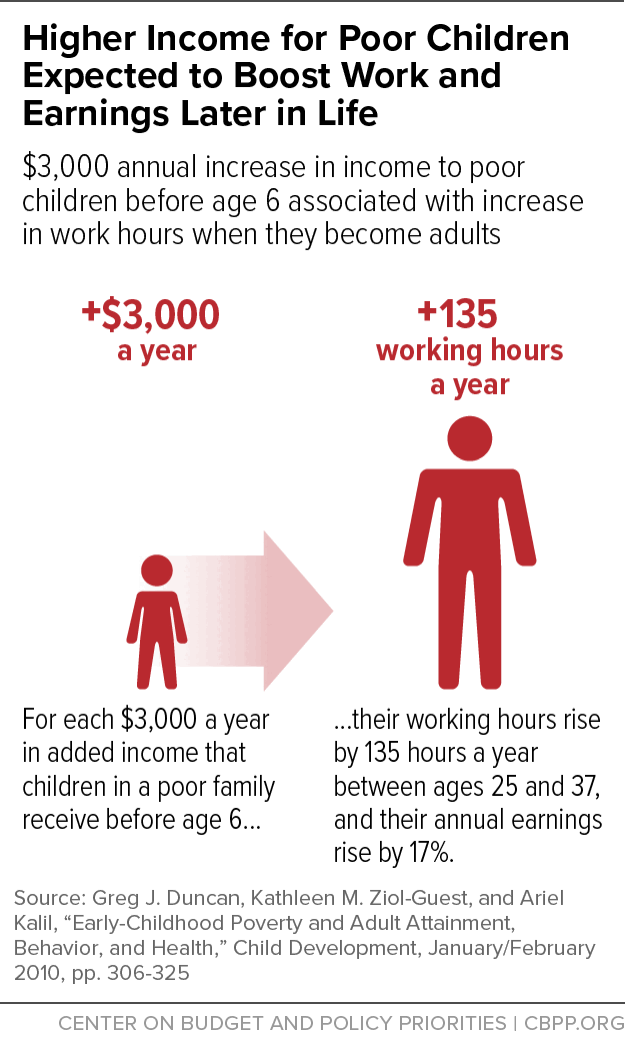

Boosted the state’s Earned Income Tax Credit (EITC) from 10 percent to 17 percent of the federal credit, putting about $40 million more into the pockets of 200,000 individuals and families. Children receiving additional income such as from the EITC are likelier to see their employment and earnings prospects improve. (See graphic.)

- Increased the state minimum wage, which is already rising from $7.50 to $9 per hour as of January 2020, to $12 per hour by 2023. Women and people of color will especially benefit because they’re overrepresented in low-paid work.

- Raised pay for school employees by 6 percent and other state workers by 4 percent.

- Invested $450 million in K-12 schools to address a court finding that the state isn’t meeting school resourcing obligations, especially in communities of color and those struggling economically.

- Provided full funding for Medicaid, including by enacting a new hospital provider tax to improve health care provider reimbursement rates.

- Invested $250 million in roads and highways.

- Boosted reserves that protect the state’s investments, especially during economic downturns, to 20 percent of the state’s general fund budget.

- Scaled back a tax break for the very wealthiest New Mexicans by reducing from 50 percent to 40 percent the portion of capital gains — the profits that an investor realizes when selling shares of stock, mutual funds, real estate, or artwork that has risen in value — that are exempt from taxation.

- Leveled the playing field between brick-and-mortar stores and online retailers by adopting an internet sales tax and applying the state’s gross receipts tax to online sales — raising new revenue for the state and localities.

State policymakers also set a trigger for the top marginal income tax rate to rise to 5.9 percent in 2021 if revenues grow at less than 5 percent in the next year. While they abandoned an automatic increase to that rate in their final negotiations, the state is currently expected to hit the trigger anyway.

The tax changes and increased investments reverse a decade of tax cutting and austere budgets, and they will help reduce high poverty, poor child well-being, and barriers to opportunity for communities of color — all of which have prevented the state from reaching its full potential.