BEYOND THE NUMBERS

In Case You Missed It...

This week at CBPP, we focused on policies taking public benefits away for not meeting work requirements, health, federal taxes, state budgets and taxes, the federal budget, and the economy.

-

We highlighted a report that cites behavioral science showing why taking public benefits away for not meeting work requirements doesn’t work. Ife Floyd provided an overview of the report, Judith Solomon noted how it showed Medicaid work requirements can’t be fixed, and Ed Bolen focused on SNAP’s (food stamps) three-month time limit, which is flawed by design.

-

On health, Sarah Lueck warned that a Kansas bill would harm people with pre-existing conditions. We released frequently asked questions on proposals to couple Medicaid expansion with work requirements and on “partial” Medicaid expansions.

-

On federal taxes, Chuck Marr, Brendan Duke, Yixuan Huang, Jennifer Beltrán, Vincent Palacios, and Arloc Sherman explained that the recently released Working Families Tax Relief Act would raise incomes of 46 million households and reduce child poverty. We also released a summary concluding that the bill would cut both poverty and deep poverty. Janne Huang pointed out our new tool to help the self-employed calculate their estimated tax payments, and thanked the volunteers at free tax preparation sites who helped millions of Americans file their taxes this year. Marr, Kathleen Bryant, and Chye-Ching Huang cautioned that the Tax Foundation’s “Tax Freedom Day” figures do not represent typical households’ tax burdens and could mislead policymakers, journalists, and the public. Marr and Roderick Taylor applauded the bipartisan support for a budget mechanism to boost IRS enforcement as a promising first step. Brendan Duke compiled top federal tax charts for Tax Day 2019. We also updated our backgrounder on the Child Tax Credit.

-

On state budgets and taxes, Samantha Waxman noted that Virginia missed a chance to advance racial equity when it failed to expand its state Earned Income Tax Credit. Wesley Tharpe compiled top state tax charts for Tax Day 2019.

-

On the federal budget, Robert Greenstein analyzed the House Budget Committee’s bill raising funding caps.

-

On the economy, we updated our backgrounder on how many weeks of unemployment compensation are available.

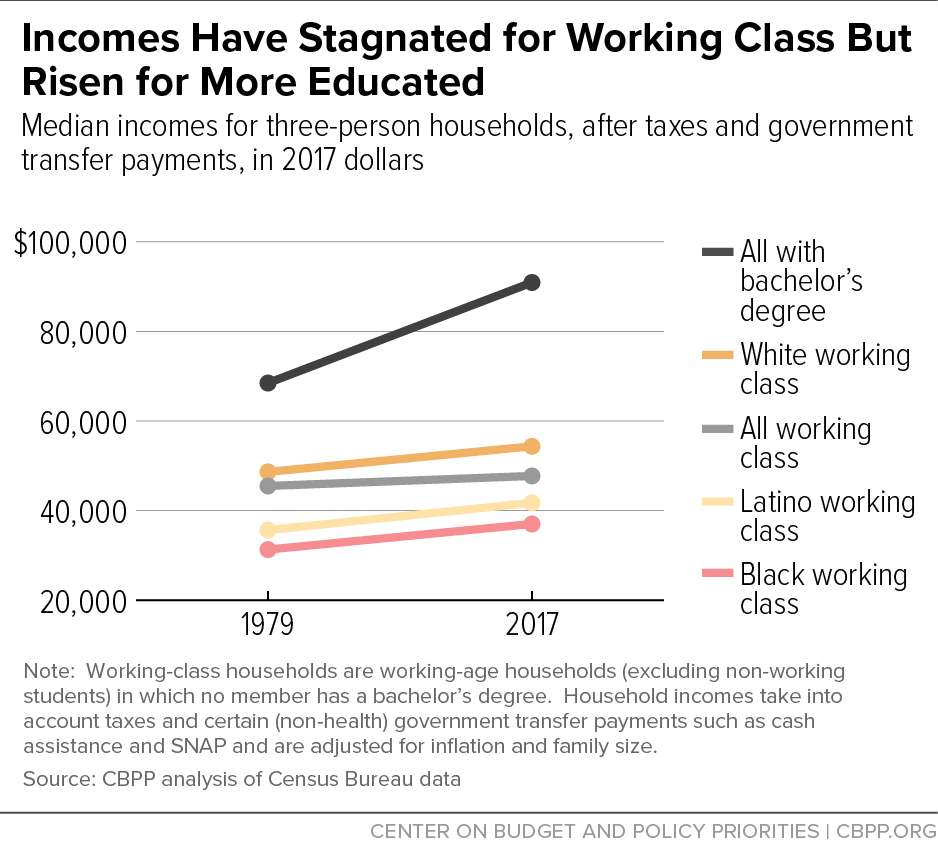

Chart of the Week – Incomes Have Stagnated for Working Class But Risen for More Educated

A variety of news outlets featured CBPP’s work and experts recently. Here are some of the highlights:

Gridlocked over Puerto Rico, Congress heads to 2-week break without disaster aid deal

CBS News

April 12, 2019

Why States Want Certain Americans to Work for Medicaid

The Atlantic

April 12, 2019

The Democrats’ new tax plan is their clearest, most efficient blueprint yet

Washington Post

April 11, 2019

Senate Democrats have coalesced around a big plan to expand tax credits

Vox

April 10, 2019

The historic strikes and protests by teachers across the country aren’t over

Washington Post

April 10, 2019

Don’t miss any of our posts, papers, or charts – follow us on Twitter, Facebook, and Instagram.