BEYOND THE NUMBERS

In Case You Missed It...

This week at CBPP, we focused on the federal budget, health, federal taxes, state budgets and taxes, and the economy.

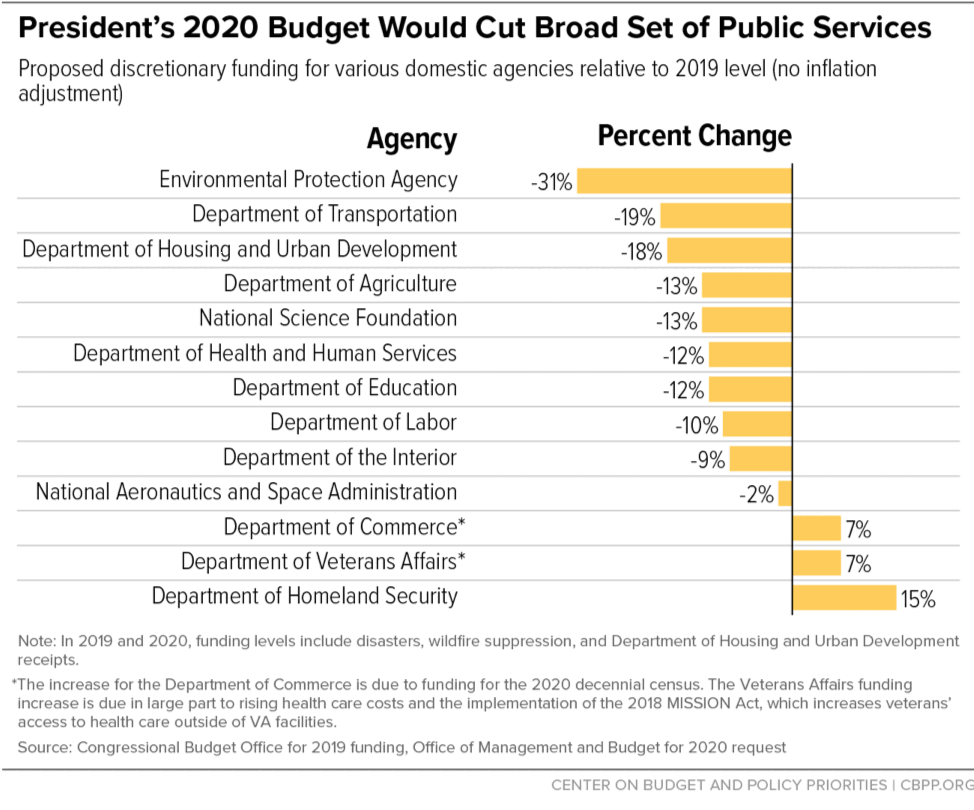

- On the federal budget, Robert Greenstein warned that President Trump’s fiscal 2020 budget proposal presents a deeply troubling vision for the nation. Paul N. Van de Water, Joel Friedman, and Sharon Parrott explained why the 2020 Trump budget would make poverty more widespread, widen inequality and racial disparities, and increase the ranks of the uninsured. Friedman noted that the budget actually proposes to cut 2020 funding for non-discretionary programs by double what the Administration said it would. We also rounded up our budget analyses.

- On health, Hannah Katch warned that Trump’s budget would take away Medicaid from people nationwide who don’t meet a work requirement as well as cut access to care for HIV and substance use disorders. She noted that a Medicaid bill that Montana lawmakers are considering would eliminate coverage for thousands. Jennifer Wagner updated her analysis underscoring that Arkansas’ Medicaid waiver is taking coverage away from people who are in fact eligible for the program. Judith Solomon signaled that if policymakers fail to act, married couples with Medicaid home- and community-based services would lose critical protections. Tara Straw described how “direct enrollment” in marketplace coverage lacks protection for consumers and summarized the risks it poses for consumers.

- On federal taxes, Paul N. Van de Water noted that policymakers shouldn’t repeal or further delay the “Cadillac tax.” Chye-Ching Huang testified before the House Ways and Means Subcommittee on Select Revenue Measures that the 2017 tax law left unfinished business that creates uncertainty and instability. As the IRS-sponsored Volunteer Income Tax Assistance celebrates 50 years, Roxy Caines described how the program fulfills four critical tax preparation needs.

- On state budgets and taxes, Wesley Tharpe explained why a proposal to replace Illinois’ regressive flat tax system with a graduated rate structure is right for the state. Cortney Sanders noted that state millionaires’ taxes can advance racial justice.

- On the economy, we updated our backgrounder on how many weeks of unemployment compensation are available and our chart book on the legacy of the Great Recession.

Chart of the Week- President's 2020 Budget Would Cut Broad Set of Public Services

A variety of news outlets featured CBPP’s work and experts recently. Here are some the highlights:

Broker Websites Expand Health Plan Shopping Options While Glossing Over Details

Kaiser Health News

March 14, 2019

Montana Republicans, Democrats Square Off Over Medicaid Expansion’s Future

Montana Public Radio

March 14, 2019

This tax policy change could transform American lives

CNN

March 14, 2019

The GOP Crusade Against Obamacare Is Shifting to State Capitals

HuffPost

March 14, 2019

Trump’s 2020 budget proposal seriously cuts the nation’s safety net

Vox

March 11, 2019

Trump’s budget is heartless and whackadoodle

Washington Post

March 11, 2019

Don’t miss any of our posts, papers, or charts – follow us on Twitter, Facebook, and Instagram.