BEYOND THE NUMBERS

In Case You Missed It...

This week at CBPP, we focused on federal taxes, the federal budget, food assistance, state budgets and taxes, health, poverty and inequality, and the economy.

-

On federal taxes, Chuck Marr, Brendan Duke, and Chye-Ching Huang explained why the new tax law is fundamentally flawed and will require basic restructuring. We released four briefs stemming from this analysis that summarized the law’s main flaws, showed how it is tilted toward the wealthy and corporations, pointed out that it shrinks revenue when more revenue is needed, and noted that it invites rampant tax sheltering and gaming. Marr summarized the problems with the law in a series of graphs, and we released numerous social media graphics on federal taxes.

Marr, Yixuan Huang, and Chye-Ching Huang detailed why the Tax Foundation’s figures in its annual “Tax Freedom Day” report do not represent typical households’ tax burdens.

- On the federal budget, Richard Kogan warned that a balanced budget amendment (BBA) could lead to extreme budget cuts and listed five reasons why the amendment is a bad idea. Paul N. Van de Water explained why a BBA would harm Social Security and federal deposit insurance. He also argued that the Congressional Budget Office’s new budget projections are cause for concern but not alarm.

- On food assistance, Robert Greenstein released a statement explaining that House Agriculture Committee Chairman Michael Conaway’s proposed changes to the Supplemental Nutrition Assistance Program (SNAP) would increase food insecurity and hardship. Before the proposal’s release, Elizabeth Wolkomir and Stacy Dean questioned whether it would match Chairman Conaway’s rhetoric. Brynne Keith-Jennings explained how analysis of SNAP participants’ work in an average month understates their work over time.

- On state budgets and taxes, Nicholas Johnson described how states are beginning to turn the tide on tax cuts. Michael Leachman showed that the new federal tax law disproportionately helps the wealthiest in every state. Erica Williams looked at how Earned Income Tax Credits help women in every state and listed our top charts on state taxes.

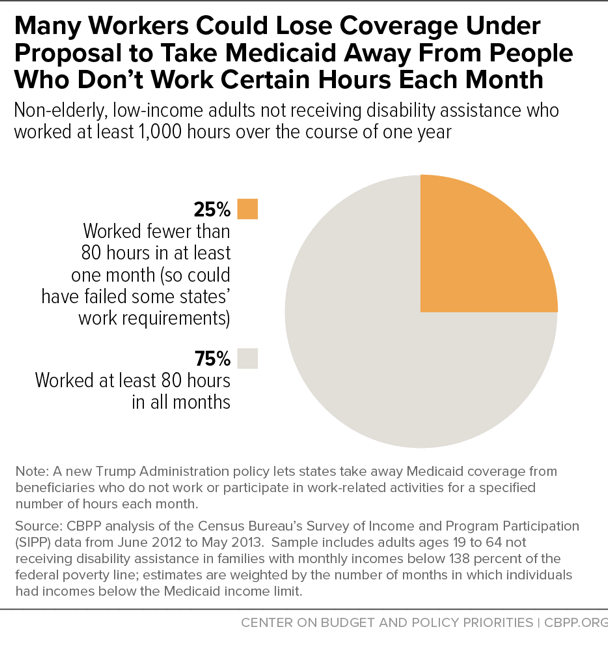

- On health, Aviva Aron-Dine, Raheem Chaudhry, and Matt Broaddus highlighted that many working people could lose health coverage due to Medicaid work requirements. Sarah Lueck, Tara Straw, and Shelby Gonzales found that the health care rule changes from the Centers for Medicare & Medicaid Services will harm consumers. Peggy Bailey detailed how better integration of Medicaid and federal grant funding would improve outcomes for people with substance use disorders. Broaddus pointed out that Alaska’s high unemployment would compound the harm to Alaskans from a Medicaid work requirement. We released two briefs on how Medicaid work requirements will harm low-wage workers and children.

- On poverty and inequality, LaDonna Pavetti pointed to evidence showing that opportunity-boosting job preparedness takes significant investment. She also warned that mandatory work programs are costly and have limited long-term impact.

- On the economy, we updated our chart book on the legacy of the Great Recession.

Chart of the Week – Even Many Workers Who Work Substantial Hours Could Lose Coverage Under Medicaid Work Requirements

A variety of news outlets featured CBPP’s work and experts recently. Here are some highlights:

The Republican war on struggling Americans takes another cruel turn

Washington Post

April 13, 2018

As Deficits Mount, Amendment to Require Balanced Budgets Fails in House

New York Times

April 12, 2018

Working people could still lose health coverage under Medicaid work requirements

Vox

April 11, 2018

President Trump Turns Attention To Welfare Programs

NPR

April 10, 2018

Deficits are rising. What’s to blame? Does it even matter?

Vox

April 10, 2018

Don’t miss any of our posts, papers, or charts — follow us on Twitter, Facebook, and Instagram.