BEYOND THE NUMBERS

In Case You Missed It...

This week at CBPP, we focused on health care, the federal budget and taxes, food assistance, the economy, poverty and inequality, family income support, and housing:

-

On health care, Edwin Park reviewed the Congressional Budget Office’s (CBO) analysis finding that the July 20 version of the Senate GOP bill to repeal the Affordable Care Act (ACA) would cause 22 million people to lose coverage. Aviva Aron-Dine explained that the latest CBO analysis shows why the Senate bill not only hasn’t been fixed, but can’t be fixed. She also exposed the flaws in a Department of Health and Human Services presentation claiming the Cruz amendment to the bill would reduce individual market premiums, including for people buying comprehensive coverage. Sarah Lueck pointed out that the core Senate bill, with or without the amendment, would cut back on health coverage and disproportionately increase costs for people with pre-existing conditions.

Tara Straw refuted claims that the Senate bill’s premium tax credit would enable people now in a “coverage gap,” with incomes too high for Medicaid but too low for premium tax credits, to afford the insurance available under the bill. She also determined that most low-income people losing Medicaid expansion coverage due to the Senate bill would end up uninsured. Jesse Cross-Call added that the updated bill would still bar states from adopting the Medicaid expansion in the future.

Jessica Schubel reported that the Senate bill would punish Arizona for its innovative and efficient Medicaid program. Aron-Dine and Hannah Katch updated their paper on why West Virginia would be among the worst-harmed states under the bill.

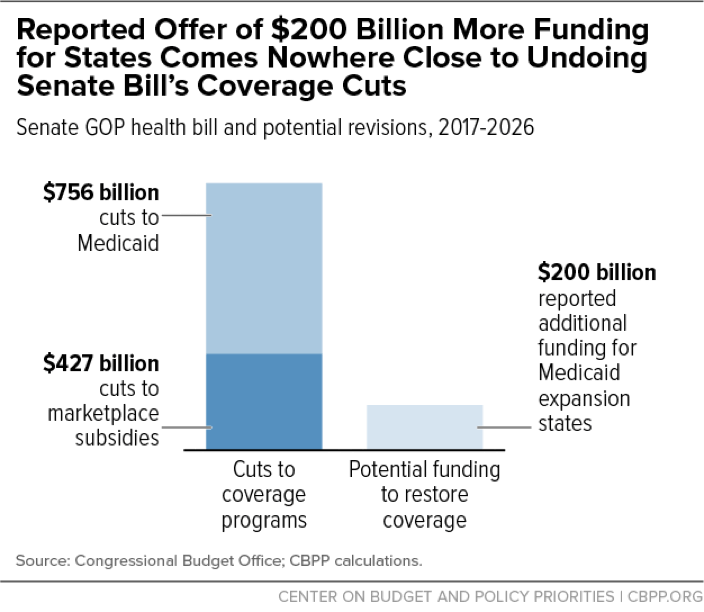

Judy Solomon showed that the $200 billion reportedly being added to the Senate bill is far less than the bill’s huge cuts in Medicaid and marketplace subsidies. She also explained why Medicaid waivers wouldn’t solve the problems caused by the bill’s massive Medicaid cuts, and debunked the claim that Medicaid expansion has increased waiting lists for home- and community-based services. We updated our “Sabotage Watch” tracker of efforts to undermine the ACA.

Jacob Leibenluft warned that repealing most of the ACA without a replacement would be even more harmful than the Senate bill. Shannon Buckingham listed the five key facts about the Senate health debate.

Paul Van de Water reviewed the Medicare changes in the House Budget Committee’s 2018 budget plan.

-

On the federal budget and taxes, Isaac Shapiro previewed the House Budget Committee budget plan, and Sharon Parrott and Joel Friedman explained why the “reconciliation” cuts it would reportedly include would hurt struggling families. After the budget plan’s release, Robert Greenstein charged that it would cause pain to tens of millions of Americans while opening the door for tax cuts geared toward those who already are the most well off. Richard Kogan noted that the budget would shrink non-defense discretionary programs to historic lows as a share of the economy.

Chye-Ching Huang and Brandon DeBot rebutted the Trump Administration’s claim that cutting corporate tax rates would mostly help workers; Huang also summarized the report.

-

On food assistance, Dottie Rosenbaum explained that the House Budget Committee’s budget plan calls for large cuts in SNAP. She also cited new data showing that SNAP caseloads and spending are still falling. We created an interactive map showing that caseloads rose due to the recession but have fallen as the economy has recovered.

Steven Carlson, Zoë Neuberger, and Rosenbaum updated their detailed report showing that participation and costs for the WIC nutrition program are stable.

- On the economy, Jared Bernstein testified before a House subcommittee on the critical importance of an independent central bank.

- On poverty and inequality, Tazra Mitchell and Arloc Sherman discussed the numerous studies showing that economic security programs can help low-income children succeed over the long term. Mitchell highlighted some studies examined in the report. Liz Schott, Ed Bolen, and Will Fischer showed that the Freedom Caucus “welfare reform” bill would strip many poor families of access to basic food assistance, income assistance, and help paying rent.

- On family income support, Ife Floyd, LaDonna Pavetti, and Liz Schott explained why policymakers considering block-granting low-income programs should examine the problems with the Temporary Assistance for Needy Families (TANF) block grant.

- On housing, Douglas Rice estimated that a House funding bill for the Department of Housing and Urban Development would fail to renew 140,000 vouchers that low-income seniors, people with disabilities, and families with children are now using to afford a decent home.

Chart of the Week – Reported Offer of $200 Billion More Funding for States Comes Nowhere Close to Undoing Senate Bill’s Coverage Cuts

A variety of news outlets featured CBPP’s work and experts recently. Here are some highlights:

Here’s What’s In The House Republican Budget (And Why It Matters)

NPR

July 19, 2017

Here’s what health care looks like if Republicans’ Obamacare ‘repeal and delay’ plan succeeds

Washington Post

July 19, 2017

How Trump's repeal push came up short

The Hill

July 18, 2017

GOP’s New Health Care Effort Would Cause 18 Million To Lose Insurance In First Year

Huffington Post

July 18, 2017

Don’t miss any of our posts, papers, or charts — follow us on Twitter, Facebook, and Instagram.