BEYOND THE NUMBERS

New state fact sheets on federal rental assistance overall and Housing Choice Vouchers give data on the many households they help, the many needy households they don’t reach due to limited funding, and the impact of recent funding cuts, as well as figures on homelessness. The data cover ten different programs, but just three — Housing Choice Vouchers, Section 8 Project-Based Rental Assistance, and public housing — provide 90 percent of federal rental aid.

While each state is unique, the fact sheets highlight four national trends.

-

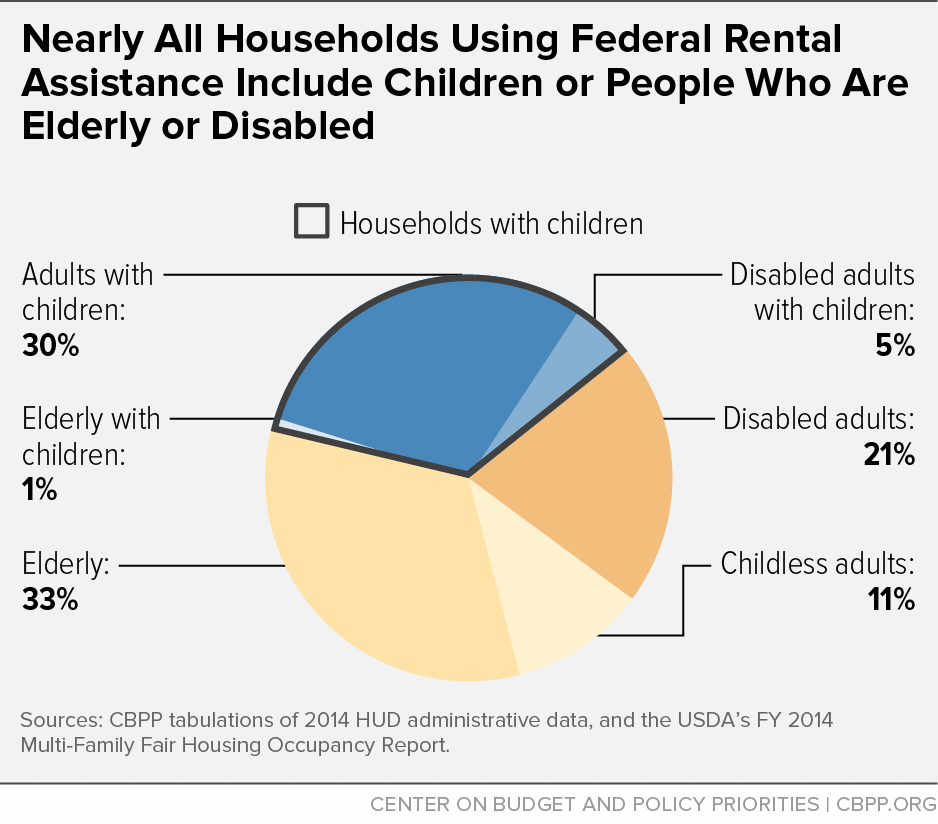

Federal rental assistance mostly serves the elderly, disabled, and families with children. Roughly 60 percent of assisted families are elderly or disabled; another 30 percent are families with children. (See graph.)

- Most adults using federal rental assistance who are not disabled or elderly work. Nearly two-thirds of non-elderly, non-disabled households receiving rental assistance were working in 2014 or had worked recently. In half the states, the share was even higher.

- Vouchers are the most common form of rental assistance in 43 states. Housing Choice Vouchers help over 5 million people in 2.1 million low-income households rent housing in the private market. In six states — California, Nevada, Oregon, Texas, Utah, and Washington — vouchers help more low-income households than all other forms of federal rental assistance combined.

Federal rental assistance reaches only a fraction of low-income households struggling to pay their rent. Federal rental assistance helps 5 million households annually. But, due to funding limitations, fewer than one out of four low-income renter households receive this help. Meanwhile, the number of unassisted renter households with “worst case” housing needs — meaning they pay more than half of their incomes for housing or live in severely substandard housing — rose by 30 percent between 2007 and 2013.

Among low-income renter households paying more than half their income for housing, roughly half of those that aren’t elderly or disabled include a working member but still struggle to pay their rent. They have little left at the end of the month to pay for basic necessities like food or transportation, let alone to weather economic shocks like a medical emergency or the loss of a job. These severely rent-burdened households face a significant risk of homelessness.

Unfortunately, cuts to rental assistance have prevented thousands of low-income Americans from receiving the help needed to escape housing instability and possible homelessness. Due to sequestration cuts in 2013, 85,000 fewer households were using vouchers in December 2014 than two years earlier. Also, annual funding for public housing has fallen by $1.66 billion over the past four years. The recent House funding bill for the Department of Housing and Urban Development doesn’t restore any lost vouchers or public housing funding.

This downloadable Excel spreadsheet has the data from the fact sheets, plus supplemental tables.