EXEMPTING CORPORATE DIVIDENDS FROM INDIVIDUAL

INCOME TAXES

By Joel Friedman and

Robert Greenstein

Executive Summary

| PDF of this report |

| If you cannot access the files through the links, right-click on the underlined text, click "Save Link As," download to your directory, and open the document in Adobe Acrobat Reader. |

As the centerpiece of its “growth package,” the Bush Administration proposes a large reduction in the taxes that individuals pay on dividend payments they receive from corporations. According to Administration estimates, this tax cut reduces revenues by $364 billion, representing more than half of the package’s $674 billion cost through 2013. This proposal to eliminate the taxes on dividends raises a number of major questions, however. It would do little to stimulate the economy in the near term. In addition, its high cost over the next decade and beyond would result in further damage to the federal budget, increasing deficits and thereby reducing national savings and imposing long-term costs on the economy.

Furthermore, the proposal represents unbalanced tax policy. The proposal’s advocates argue that this tax cut would help the economy by lightening the tax burden on corporate investments and ending the so-called “double taxation” of corporate dividends, which can face taxation at both the corporate and individual levels. But if it is argued that a portion of corporate dividends are taxed twice, it should be acknowledged that large amounts of corporate profits are not even taxed once. In recent years, corporate tax avoidance has increased as firms have engaged in more aggressive strategies to shield income from taxation through tax shelters and other means.

- A recent analysis published by the National Bureau of Economic Research found that the gap between what corporations report as profits to their shareholders and the profits these companies report to the IRS for tax purposes has grown sharply over the past decade. It finds that $154 billion — or over half of the gap in 1998, the latest year covered by the study — cannot be explained by traditional accounting differences, indicating higher levels of sheltering activity.

- Citizens for Tax Justice estimates that in 2002 less than half of corporate profits were subject to the corporate income tax.

The Administration’s proposal seeks to curb the double taxation of dividends at a substantial cost to the Treasury. But much corporate income is subject to “zero taxation,” as a result of aggressive tax-avoidance schemes employed by corporations. The proposal does not include measures to close down corporate tax shelters that could offset the cost of the dividend proposal and consequently would result in increases in budget deficits for years to come. Changes in the taxation of corporate dividends should be considered only as part of an overall package of corporate tax reforms where the savings from curbing corporate tax avoidance and closing unproductive tax shelters and loopholes could pay for a reduction in dividend taxes. Such an approach could strive for a corporate tax reform designed to ensure that all corporate profits are taxed once, rather than having some earnings taxed twice and some not at all, as is currently the case. Such a reform could improve tax equity and efficiency without resulting in long-term revenues losses that would plunge the budget deeper into deficit for many years.

|

Details of the Administration’s Proposal

Still Emerging Since this report was initially written, additional details have become available from the Administration on its plan to eliminate the taxation of corporate dividends at the individual level. Some of these details are discussed in this report (see below). A full analysis will not be possible until more information is available. |

Proposal Likely To Have Little Effect as Economic Stimulus

Even though the current weakness in the economy is used as justification for the proposal, reducing or eliminating the taxation of dividends would be ineffective at stimulating the economy now while it is weak. Indeed, most investors would not receive a tax cut from this proposal until well over one year from now, when they file their 2003 taxes in early 2004.

According to the Administration’s estimates, exempting dividends entirely from individual income taxes would cost $364 billion over the next decade. About 95 percent of this hefty cost would not occur until after 2003, by which time the economy is expected to have recovered from the current downturn.

Adding to the proposal’s inefficiency as a stimulus mechanism is the fact that it would put cash primarily into the hands of high-income individuals, a group that is likely to save rather than spend a larger portion of any additional funds it receives than middle- and lower-income families. Yet only if funds are spent will they have the desired effect of stimulating the economy now. The Congressional Research Service found that “dividends are concentrated among higher income individuals who tend to save more” and that overall “using dividend tax reductions to stimulate the economy is unlikely to be very effective.”[1]

Benefits Would Be Heavily Concentrated At the Top

It should also be noted that any claims that the benefits of this tax cut would be spread broadly across a growing “investor class” would be misleading (see Appendix). Many middle-income families are more likely to do their investing in the context of tax-deferred retirement accounts, such as 401(k)s and Individual Retirement Accounts. Yet only dividends paid from stocks held in taxable accounts would be affected by this proposal.

According to preliminary estimates by the Urban Institute-Brookings Institution Tax Policy Center:

- Nearly two-thirds of the benefits of exempting corporate dividends from the individual income tax would flow to the top five percent of the population, because these taxpayers own the lion’s share of stocks. (The top five percent includes tax filers with incomes over $140,000; these filers have average income of $350,000.)

- The top one percent of tax filers — a group whose incomes start at $330,000 and that has average income of about $1 million — would receive 42 percent of the benefits.

- Those with incomes over $1 million — the top 0.2 percent of tax filers, with an average income that exceeds $3 million — would receive nearly one-quarter of the tax-cut benefits.

- In fact, the group with incomes over $1 million — which consists of about 226,000 tax filers in 2003 — would receive roughly as much in benefits as the 120 million tax filers with incomes below $100,000. Stated another way, the top 0.2 percent of tax filers would receive nearly as much from this tax cut as the bottom 90 percent of filers combined.

The dollar value of the benefits of this tax cut for different income groups is also illustrative. Exempting all corporate dividends from the individual income tax would yield an average annual tax savings of $27,100 for tax filers with incomes over $1 million, according to preliminary Tax Policy Center estimates. In contrast, those with incomes between $30,000 and $40,000 would see an average annual benefit of $42. Those with incomes between $40,000 and $50,000 would see an average annual benefit of $84.

The high-income taxpayers who would reap the vast majority of these tax-cut benefits have experienced far more substantial income gains over the past two decades than families lower down on the economic spectrum. Moreover, this high-income group is also the primary beneficiary of the tax-cut package enacted in 2001. Those with incomes over $1 million can expect an annual tax cut of over $130,000 when all of the income-tax changes enacted in 2001 are fully in effect, and this figure does not even include the benefits this group would receive from repeal of the estate tax. The benefits of a dividend tax cut would come on top of this amount.

State Budget Deficits Would Be Enlarged

Exempting dividends from the individual income tax also would undercut other federal efforts to bolster the economy by worsening the dire fiscal situation in the states, which are facing a $60 billion to $85 billion budget gap in the next fiscal year, the largest shortfall in the last half-century. As states cut spending and raise taxes to meet their balanced budget requirements, they are placing a drag on the economy. Cutting the individual tax on dividends would reduce state revenues, because of the linkages between state and federal tax codes. Eliminating the tax could reduce state revenues by approximately $4 billion a year.[2] In general, states will have to raise taxes or cut expenditures by one dollar for each dollar of revenue loss, further undermining the proposal’s effectiveness as economic stimulus.

|

Impact of a Dividend Exemption on the Elderly Supporters of exempting dividends from individual taxation are stressing the impact of this tax cut on the elderly. And indeed, preliminary Tax Policy Center estimates indicate that about 41 percent of the benefits of a dividend exemption would go to those over age 65. But while the elderly as a group would receive a large relative share of the tax cut, these benefits would flow predominately to those elderly individuals who have high incomes.

By citing a statistic showing that a large share of the benefits from the dividend exemption would go to the elderly, some proponents of this tax cut appear to be trying to foster the impression that it would benefit the average or typical elderly person. This is not the case. Most elderly have fairly low incomes and would receive little or nothing from this tax cut. The benefits of the proposal would flow predominately to a small group of individuals with high incomes, and a disproportionate share of these high-income taxpayers happen to be elderly. That this is so does not alter the fact that most elderly people would not benefit significantly from it. In fact, many elderly could be adversely affected if the tax cut resulted in fewer resources being available for programs upon which ordinary elderly people rely. |

States would also be hard hit by the anticipated increase in interest rates expected to result from this proposal. The proposal will draw funds away from the bond market, as corporate stocks become more attractive investments following the tax cut. To compete for investor dollars with stocks paying dividends that are fully or partially exempt from taxation, entities that issue bonds — including state and local governments — would have to offer higher interest rates. In addition, the cost of reducing or eliminating taxes on dividends for individuals would enlarge the deficit and increase government borrowing. As government borrowing needs crowd out other borrowers, interest rates can rise. Overall, higher interest rates increase the cost of borrowing for states, putting further strain on their budgets.

Positive Effects On The Stock Market Appear To Be Exaggerated

Claims that this tax cut, by making stocks more valuable, would significantly buoy the stock market and thereby bolster consumer confidence and help the economy are likely to be exaggerated. A more muted response seems more likely than a strong reaction when one considers that over half of dividends would be not be directly affected by the proposal (because they are paid to tax-exempt accounts, such as pension funds). Moreover, corporate investments would be negatively affected by the higher interest rates that would likely result from this tax cut.

Furthermore, trying to induce an increase in the stock market is an indirect and rather inefficient way to encourage consumers to spend more and thus stimulate the economy. The Congressional Research Service concluded that the link between a stock market increase and consumer spending “is weaker, more uncertain, and perhaps more delayed, than a direct stimulus to the economy via spending increases or cuts in taxes aimed at lower income individuals.”[3] In addition, cutting dividends taxes to manipulate the market in an effort to aid investors hurt by the recent downturn is questionable public policy. As Brookings Institution economists William Gale and Peter Orszag have noted, “having the government bail out investors who voluntarily accepted risks by investing in the stock market would set a dangerous precedent.”[4]

Potential Negative Impact On Certain Sectors Of The Economy, Including Small Businesses

As the economy adjusts to lower taxes for corporate dividends, some sectors of the economy would likely be disadvantaged, at least in the short run. This tax cut would make stocks a more attractive investment in terms of their after-tax returns, prompting investors to pull funds out of some other investments and shift these dollars to corporate stocks.

As noted above, the tax cut would draw funds away from the bond market, which would result in higher interest rates. These higher rates not only raise costs for state and local governments and business investment but also for home mortgages and car loans. Similarly, one would also expect the non-corporate sector, which is comprised primarily of small businesses, to be affected adversely, as investment dollars shift into corporate stocks.

Effect on Economy Over the Long Run

The high cost of ending the taxation of dividends would likely mitigate any beneficial long-term impact the proposal might have on the economy. Supporters tout the positive effects of cutting dividend taxes on encouraging more investment in corporations. They often ignore the negative effects associated with the tax cut’s long-term cost, however, and the resulting increase in the federal deficit. Although a one-time increase in the current deficit to pay for stimulus can be good economic medicine, permanently increasing future deficits as this proposal would do would have a corrosive effect on the economy. The preponderance of economic research indicates that sustained budget deficits reduce national savings, which results in less investment and ultimately lowers the nation’s income in the future. So while the proposal may improve the efficiency of the allocation of investment dollars, it would also shrink the pool of investment dollars available by increasing the deficit. In the end, it is the combination of these positive and negative effects that will determine the overall impact on the economy.

Other Proposals Would Be More Effective Stimulus

And

Do Less Fiscal Damage Over The Long Run

Other proposals would be far more effective at providing immediate economic stimulus by directing funds to individuals and businesses that would spend the money — and thereby bolster the economy now when it is weak. A generous extension of unemployment benefits, for instance, would put money into the hands of families who are out of work and likely facing cash-flow constraints. Similarly, fiscal assistance to the states would pump money directly into the economy by helping states avoid making deep program cuts or increasing taxes, which would otherwise place a drag on the economy. A tax cut aimed at lower- and moderate-income working families would also offer considerably more stimulus for each dollar of cost in the ten-year budget window — than a cut in taxes on dividends.

Although a temporary increase in the deficit can be justified as providing economic stimulus in the short run, a permanent increase in the deficit is much harder to defend given the deterioration in the fiscal outlook and the knowledge that, just over the horizon, the retirement of the baby boomers will place a huge burden on the federal budget. Despite the need to begin to take steps now to reduce, or certainly not to worsen, future deficits — as well as the need to pay for the ongoing fight against terrorism at home and abroad and the generally agreed-upon need for a prescription drug benefit for seniors — this proposal would produce a substantial drain on the Treasury. These revenue losses would come on top of the massive revenue losses the 2001 tax cut will cause when it is fully in effect. Overall, a costly proposal to eliminate or reduce sharply individual taxes on corporate dividends seems particularly inappropriate.

Supporters of this tax cut are pushing for it to be part of an economic stimulus package, despite its being ineffective and inefficient as stimulus. By doing so, they may seek to create a belief that its high, permanent cost does not have to be offset. Including this proposal in a stimulus package that is said to warrant rapid congressional action avoids linking the proposal to broader consideration of corporate tax reforms that would address the “zero taxation” of much corporate income resulting from the proliferation of corporate tax avoidance and tax sheltering schemes. Any proposal to lighten the tax burden on corporate dividends should be considered, however, only in the context of a deficit-neutral package of corporate reforms, where the range of issues related to corporate taxation can be addressed together.

This analysis is divided into three sections. The first section looks at the cost and distribution of proposals to reduce or eliminate the tax on corporate dividends. The second assesses the impact on the economy of such a tax change. The final section examines the concept of the “double taxation” of corporate dividends and its relevance to the current debate.

Reducing or Eliminating the Tax on Corporate Dividends

A corporation can use dividends as a way to distribute earnings to its shareholders, with dividends being paid out of its after-tax income.[5] In other words, a corporation makes dividend payments to its shareholders out of the earnings that remain after corporate income taxes have been paid. Shareholders include these dividend payments in their income for tax purposes. To the extent that shareholders are subject to the individual income tax, they pay tax on their dividend income.

The Urban Institute-Brookings Institution Tax Policy Center estimates that in 2000, corporations paid $201 billion in dividends out of their after-tax incomes. More than half of these dividends were paid to tax-exempt entities — such as pension funds, individual retirement accounts, and non-profit foundations — or to individuals that owed no income tax. As a result, only about 46 percent of the dividends paid by corporations to individuals (or $93 billion in dividends) were subject to the individual income tax in 2000.[6]

Over the years, various options to eliminate the taxation of corporate dividends have been proposed. Some proposals would exempt from the corporate income tax all earnings paid out in dividends. Such proposals would be more costly than making dividends tax free for individuals, because of the large share of dividends flowing to tax-exempt accounts not currently subject to individual income taxes.

The Administration Proposal

The Administration proposes to eliminate the taxation of corporate dividends in the individual income tax, and estimates that this tax cut would reduce federal revenues by $364 billion over the next 11 fiscal years, 2003 through 2013. When the associated interest costs that result from the increase in the debt are included, the total 11-year cost rises to over $460 billion. The benefits of this tax cut would accrue primarily to those with the highest incomes, because they own so much of the outstanding capital stock.

According to preliminary estimates prepared by the Urban-Brookings Tax Policy Center:

- Nearly one-quarter of the benefits from exempting all corporate dividends from the individual income tax would flow to the 0.2 percent of tax filers who have annual incomes of over $1 million. The average tax cut for these tax filers would be $27,100.

- The top one percent of tax filers — who have incomes of more than $330,000 and whose average income is about $1 million — would receive 42 percent of the benefits of such a tax cut.

- The top five percent of tax filers, who have incomes in excess of $140,000 and average income of $350,000, would receive nearly two-thirds of the benefits of this tax cut.

- The group with incomes over $1 million — which includes about 226,000 tax filers in 2003 — would receive roughly as much in tax-cut benefits as the 120 million tax filers with incomes below $100,000. That is, the benefits that would flow to the top 0.2 percent of tax filers would nearly equal the total amount received by the bottom 90 percent of filers.

Following the general release of the Administration’s stimulus package, some new details about its tax cut for dividends have become available. Based on this information, some of which was provided by the Council of Economic Advisers and some of which reflects statements by Administration officials reported in the press, not all dividends paid to individuals would be exempt from taxation.[7] Under the Administration’s plan, dividends would receive tax-free treatment as long as they are paid out of corporate income that has been previously subject to the corporate income tax. Dividend payments would continue to be treated as taxable income to the shareholder and subject to the individual income tax if the corporation paid the dividend out of income that was not subject to the corporate income tax.

The Administration’s proposal for the tax treatment of dividends would also affect — and lower — capital gains taxes. Under the Administration’s plan, a shareholder would get a capital gains tax cut if a corporation (after paying the corporate income tax) reinvests its after-tax profits in the corporation rather than paying these funds out in dividends. If these after-tax profits are reinvested rather than distributed as dividends, then the corporation would adjust the shareholder’s “basis” in the stock upward in order to reduce the shareholder’s capital gains tax if he or she sells the stock at some point in the future. (The basis reflects the price that the shareholder paid for the stock.) The Administration refers to this as a “deemed dividend.” The goal of this approach, according to the Administration, is ensure that shareholders who own stock in companies that tend to retain earnings rather than distribute dividends are not placed at a disadvantage.

For instance, assume that a shareholder owns shares of stock in a company and paid $20 for each share. If the corporation pays corporate income tax and has after-tax income of $5 a share, it could either distribute this amount to the shareholder in the form of a tax-free dividend or reinvest the funds in the company, providing the shareholder a “deemed dividend.” Under the latter approach, the company would adjust the shareholder’s basis in the stock to reflect the $5 a share deemed dividend, such that the basis would increase from $20 to $25 per share. As a result of this adjustment, if the shareholder were to sell his or her shares at a price of $40, the shareholder would have to pay capital gains only on $15 per share (the difference between $40 and $25) rather than on $20 per share (the difference between $40 and $20), as is the case under current law.

Press reports indicate that there are significant questions being raised by policymakers and financial experts about the complexity of the proposal, whether it can be implemented effectively, and in particular whether it creates new opportunities for tax avoidance. Further, some have questioned the accuracy of the Administration’s estimates of the cost of the proposal. Although the Administration’s estimates reportedly reflect the reductions in both dividend and capital gains taxation, some observers have indicated that, given the potential effects of the proposal on capital gains taxes, the revenue losses could be more substantial, particularly in the long run.

Previous Dividend Exclusions

Between 1954 and 1986, the income tax code included an exclusion up to a specified dollar level for dividend income; in some years, the code also provided a further credit for a percentage of dividend income in excess of the excluded amount. [8] Starting in 1954, the first $50 of dividend income — $100 for married couples — was excluded, with a further tax credit provided equal to four percent of dividend income above the exclusion amount. Beginning in 1965, only a fixed-dollar exclusion was retained. Before it was repealed in 1986, the dividend exclusion was set at $200 per couple.

Capping the dividend exemption would substantially reduce the costs of the Administration’s proposal and improve the distribution of the tax-cut benefits. By capping the amount of dividends that can be excluded from income tax, such an approach would limit the otherwise extremely large benefits for those with the greatest amounts of dividend income, typically very high-income tax filers. Supporters of eliminating taxes on dividends argue, however, that a capped exemption would do little to change incentives for large investors and improve the allocation of resources, and the Administration rejected this approach.

The exclusions for dividend income that were in the tax code for more than 30 years ultimately were eliminated as part of the 1986 tax reform. At the heart of that reform was a trade-off between lower rates and a broader base for individual income taxes. To achieve this trade-off, various exclusions and exemptions were eliminated, including the preferential treatment provided to dividends and capital gains income. The Senate Finance Committee report on the 1986 reforms stated, “On balance, the committee believes it is preferable to eliminate the [dividend] exclusion and use the revenues to reduce the rates.”[9] Since 1986, the elements of this trade-off have been eroded, as special exemptions and deductions have been added to the tax code and the top rates have moved somewhat higher (although they remain far below the 70 percent levels from the 1970s and the 90 percent levels of the 1950s). Restoring an exemption for dividends and narrowing the income tax base would further undo the work of the 1986 tax reform, which made significant rate reductions possible.

Economic Impact of Eliminating the Individual Taxation of Dividends

The Treasury Department released a comprehensive report on various options to reduce the taxation of dividends in 1992.[10] Although the different options had varying effects, the Treasury Department concluded that all of the options — including ending taxes on dividends at the individual level — would have a positive impact on the economy. It concluded such a tax change “will encourage capital to shift into the corporate sector” and “stimulate improvements in overall economic well-being.” But the Treasury report was able to reach these positive conclusions in large part because it assumed that the cost of the tax cuts would be fully offset. That is, the Treasury options were assessed assuming they had no net impact on the deficit. This assumption is in sharp contrast to the Bush Administration’s anticipated tax-cut proposal, which is not expected to be offset and would result in higher deficits. These different assumptions are crucial to understanding the long-term effects of the proposals on the economy, because of the negative impact of budget deficits on future economic growth.

The Long-term Effect — More Efficient Investments but Less Invested

Brookings Institution economists William Gale and Peter Orszag recently undertook an exhaustive review of the available economics literature on the impact of budget deficits on the economy.[11] They found a broad consensus among economists that “declines in budget surpluses (or increases in budget deficits) reduce national savings and thus reduce future national income.” They also found that a wide variety of perspectives, from empirical research and leading macroeconomic models to the views of numerous leading academics and policy institutions, “all indicate that increases in expected future deficits raise long-term interest rates.” Although the link between future deficits and long-term interest rates has received the most attention in the media, their paper makes the important point that because sustained budget deficits reduce national savings, they have a negative impact on the economy regardless of their effect on interest rates.[12]

As Gale and Orszag point out in their paper, an increase in the budget deficit and the resulting reduction in national savings mean the nation has less to invest. Lower investment leads to a smaller stock of capital assets and lower economic growth in the future. Exempting dividends from individual taxation may encourage a more efficient allocation of resources — that is, it may encourage more investments in those areas that will yield the highest returns for economic growth. But if the revenue losses generated by the tax cut are not offset and result in larger deficits, there will be lower national savings and thus less to invest. So even though the proposal may promote more efficient investment of the capital that is available, there will be a lower level of investment overall. It is the combined effect of these factors — more efficient investments, but less invested — that ultimately will determine the long-term impact of the proposal on the economy.

In Short Run, Tax Cut Offers Little To Boost Economy

Although the long-term impact of the proposal would be modest at best, its effects in the short term are clearer. The proposal is particularly ineffective economic stimulus, offering little “bang for the buck.”

- The benefits of eliminating individual taxes on corporate dividends would flow primarily to those with higher incomes. This higher-income group, however, is likely to save more and spend less of any additional funds it receives than low- and moderate-income families would. Funds must be spent if they are to stimulate the economy in the near term.

- Despite the hefty ten-year cost of the proposal, only a small portion of the revenue losses would result in an immediate increase in spending. This undermines the proposal’s effectiveness as a mechanism to deliver immediate stimulus to the economy. More than 90 percent of the revenue losses over the next ten years would occur after 2003, in years when the economy is expected to have recovered.

- The tax cut also is poorly designed to put money into the hands of consumers quickly, because most tax-cut recipients would not begin receiving the bulk of their annual tax-cut benefits until they filed their 2003 tax returns in early 2004. To receive the benefits earlier, taxpayers would have to adjust their withholding or estimated payments for the remainder of this year, a step that few — particularly those with only modest levels of dividends — would be likely to take, given the difficulty individuals would have estimating the impact of the tax cut and their fear of penalties in the event of underpayment.

- A tax cut for dividends would reduce state revenues because of the linkages between state and federal tax codes, worsening the state fiscal crisis that is imposing a drag on the economy. Preliminary estimates by the Center on Budget and Policy Priorities indicate that exempting dividends from individual income tax could cost states of about $4 billion a year. Given the large budget deficits that states face and the requirements that they balance their budgets, states would be forced to make up for these revenue losses with dollar-for-dollar expenditure reductions or tax increases. Such actions by the states counteract federal efforts to stimulate the economy.[13]

- The proposal also could have a negative impact on the economy in the near-term because of its effects on long-term interest rates. As Gale and Orszag explain in their analysis, financial markets are forward looking and take into account today changes that are expected to occur in the future. Thus, a costly proposal to eliminate or substantially reduce the taxation of dividends would create the expectation of higher future deficits, which in turn could exert upward pressure on long-term interest rates today. These higher long-term rates could dampen prospects for current economic growth, because individuals and businesses make fewer large purchases when the long-term interest rates they pay on the funds they borrow to make the purchases rise to higher levels.

It also is worth noting that in the short run, a proposal to eliminate or reduce substantially the individual taxation of corporate dividends would create winners and losers — that is, it would benefit some sectors of the economy and some firms at the expense of others.

- With a tax cut for corporate stocks that pay dividends, the after-tax returns of this type of investment would rise. While more money would flow to these stocks, these funds would be drawn away from other sectors.

- Funds would likely flow out of the non-corporate sector and into corporate stocks. In the analysis it conducted in 1992, the Treasury Department concluded that the proposal would result in “the reallocation of physical capital (and other real resources) from the rest of the economy into the corporate sector.” Thus, the non-corporate sector — typically comprised of small businesses, including sole proprietors — would likely experience a loss of investment funds.

- Similarly, by making equities a more attractive investment, the proposal would make bonds relatively less attractive. Interest rates on bonds would rise under these circumstances, as the bond market would have to offer higher interest rates to attract investors. This result, plus the effect on interest rates stemming from the increase in the deficit the tax cut would engender, could place significant upward pressure on rates. Higher interest rates would not only affect business investment and borrowing by state and local governments, but would also impact consumers by increasing rates on home mortgages and car loans, for instance.

Positive Impact on the Stock Market Likely Exaggerated

Eliminating individual taxes on dividends would make dividend-paying stocks more valuable in terms of their after-tax return. Supporters of this tax cut maintain that investors would seek out these higher returns, thereby bidding up the price of these stocks and boosting the stock market as a whole. This improvement in the stock market would, in turn, have a salutary effect on the economy, they argue, as consumers, heartened by the increase in their portfolios, would react by increasing their spending. This analysis is flawed in a number of respects.

It is far from clear that the proposal would lead to a significant rise in the stock market. As noted previously, about half of all dividends are not subject to individual income tax, primarily because they flow to tax-exempt pension funds, retirement accounts, and non-profit foundations. None of the investment decisions made by these groups would be directly affected by the elimination of the individual tax on corporate dividends, because they are not subject to the tax. Further, corporate investments would be negatively affected by the higher interest rates that likely would follow from this deficit-increasing tax cut.

While one might expect to see stock prices rise modestly in reaction to the proposed tax cut, it would likely be a one-time increase that primarily yielded a windfall for current holders of dividend-paying stocks, who purchased their stocks at prices that reflected the current tax treatment of dividends. University of Michigan tax expert Reuven Avi-Yonah recently wrote that “it is doubtful that cutting the tax on dividends will have a significant impact on the stock market. And even if it did, current holders of the stock, wealthy individuals who bought the stock at a discounted price anticipating that they would be taxed on future dividends, would get an unjustified windfall.”[14] Similarly, the Daily Tax Report issued by the Bureau of National Affairs cites economists from the investment firm Credit Suisse First Boston as predicting that cutting dividend taxes would have only a “mildly positive” effect on stock prices.[15]

The key question in assessing the stimulative effect of such changes in stock prices is whether a modest increase in the market would be sufficient to increase consumer spending enough to have a meaningful impact on the economy; most estimates — including those of the Federal Reserve — indicate that consumers boost their spending by only a few cents for each dollar increase in their wealth. If the goal is to get consumers to spend more, encouraging such spending through a rise in the stock market consequently is an indirect and inefficient method of achieving that goal. Other proposals, such as extending and strengthening unemployment benefits and providing fiscal assistance for states, would have far more “bang for the buck” in terms of stimulating the economy. As the Congressional Research Service recently concluded, the link between higher stock prices and increased consumer spending “is weaker, more uncertain, and perhaps more delayed, than a direct stimulus to the economy via increases in spending or cuts in taxes aimed at lower income individuals.”[16]

"Double Taxation" of Corporate Dividends

Supporters of eliminating the taxation of corporate dividends typically argue that such a change is necessary to end the “double taxation” of these dividends. Double taxation arises because, in theory, corporations pay dividends out of their after-tax earnings, and these payments are subsequently taxed as part of the shareholders’ income. Thus, these corporate earnings are taxed twice — once at the corporate level and again at the individual level.

In reality, not all corporate dividends are taxed twice; some are only taxed once and some not at all. As noted above, on the individual side, more than half of all corporate dividends flow to entities, such as tax-exempt retirement funds, that are not subject to individual income tax. Further, some corporate earnings distributed to shareholders are not subject to the corporate income tax, as corporations make use of available tax preferences and other less scrupulous tax avoidance techniques to lower or eliminate their tax bills.

Significant Corporate Profits Escape Corporate Income Tax

To be taxed twice, corporate profits first have to be subjected to the corporate income tax. Yet there is significant evidence that corporations are aggressively employing tax avoidance strategies that have resulted in a growing share of corporate profits escaping corporate taxation altogether. In recent years, the Treasury Department, the congressional tax-writing committees, academics and journalists have raised concerns over the rise in corporate tax sheltering activities.

As evidence of this trend, recent studies have shown a growing divergence in the amount of profits that corporations report to their shareholders (known as book income) and the amounts that these companies report to the Internal Revenue Service for purposes of paying corporate income taxes.[17] Harvard economist Mihir Desai concludes that the traditional link between these two measures of corporate profits has “broken down” and that “the patterns of the deteriorating link between tax and book income are consistent with increased levels of sheltering over the decade.” For instance, Desai found that $154 billion, or more than half of the gap between corporate book and tax income in 1998, the latest year covered in his study, could not be explained by the traditional accounting differences between these two measures.

On a related front, the Institute on Taxation and Economic Policy examined the books of 250 large companies between 1996 and 1998.[18] Together these companies pay about 30 percent of all federal corporate income taxes.

- Over that three-year period, ITEP found that 41 companies — or about one in six of the total sample — paid “less than zero” in federal corporate taxes in at least one year. Despite reporting nearly $26 billion in profits to their shareholders over the period, these companies not only paid no corporate income tax but actually received rebate checks from the federal government totaling $3 billion. This list includes companies such as General Motors, ChevronTexaco, Goodyear and CSX.

- Building on these findings, Citizens for Tax Justice currently estimates that in 2002, less than half of corporate profits were subject to the corporate income tax. As are result, CTJ concludes that only a little more than half of corporate profits were subject to tax at any level, corporate or individual.[19]

In a New York Times article on January 5, 2003, Times business columnist Gretchen Morgenson concluded that “companies are paying less and less in taxes each year, making the 35 percent corporate tax rate a fiction.”[20] Morgenson reported, for example, that Bristol-Myers Squibb’s effective tax rate fell to 15.4 percent in 2001 from 25.2 percent in the previous year. (A firm’s effective tax rate is the percentage of the firm’s profits paid in taxes.) Similarly, in a recent article, Robert McIntyre, executive director of Citizens for Tax Justice and an expert in corporate tax avoidance, points out that CSX, despite having U.S. profits of more than $930 million over the past four years, paid no federal corporate income taxes over the period and instead received refunds totaling $164 million.[21]

Taxing Dividends Twice Not Relevant Equity Issue

The moniker “double taxation” tends to raise the specter of some group — in this case, individuals who receive dividends — being treated unfairly by the tax system, because part of their income is being taxed twice. On its editorial page, for example, the Wall Street Journal has argued that the policy of taxing dividend income twice should be ended as a matter of equity.[22]

But for economists, whether this income is taxed once or twice is not the relevant equity issue. As McIntyre aptly noted, “Who wouldn’t feel better, for instance, about paying two taxes of 10 percent each rather than a single tax of 40 percent?”[23] Moreover, many forms of income are taxed more than once. An obvious example is wages. While corporate dividends are theoretically double taxed first at the corporate level and then at the individual level, an individual’s wages are immediately subject to both payroll and income taxes.

Equity, in the context of taxes, is about whether taxpayers in similar circumstance pay similar amounts of tax and about how the burden of taxes is borne by different income groups, not about the number of times a particular type of income is taxed. The current federal tax system as a whole (including the taxation of dividends, and also including payroll and excise taxes) is modestly progressive.[24] The most significant equity issue related to the taxation of dividends is whether eliminating the tax on dividends and thereby reducing the level of progressivity in the tax system is a desirable step.

Concerns That Dividend Taxation Distorts Investment Decisions

The more significant concern raised by many economists is that the current tax treatment of corporate dividends may interfere with the efficient allocation of the nation’s resources by directing investments into less productive, but more lightly taxed, areas. In a dynamic market economy, such as in the United States, investment funds flow to those areas that yield the highest after-tax return — other factors, such as risk, being equal. Consequently, investors may be deterred from investing in the corporate sector because the after-tax return of a corporate investment would be lower than the after-tax return of a non-corporate investment that is taxed only as part of an individual’s income tax return.[25] Although it might offer a higher after-tax return, the non-corporate investment could be a less productive use of investment dollars (as measured by its pre-tax return) and thus be less beneficial for overall economic growth.

Furthermore, within the corporate sector, some economists believe the current tax treatment of dividends can distort corporate financing decisions. Corporations raise funds to finance capital investment through essentially three methods: debt (i.e., issuing bonds); equity (i.e., issuing new shares of stock); and retained earnings (i.e., reinvesting after-tax earnings rather than distributing them to shareholders in the form of dividends). The concern is that current tax law biases corporate investment decisions against issuing new equity and toward debt financing and retaining earnings, which are both more lightly taxed than dividends.[26] As a result, corporations may not be using an optimal mix of these three financing mechanisms, which would ultimately be less efficient for the economy.

There is a large body of academic work examining the impact on the economy of having separate corporate and individual income taxes. Many of these studies conclude that, for the efficiency reasons discussed above, the economy would benefit if the corporate and individual taxes were integrated. The 1992 Treasury study reached this conclusion and, to that end, proposed a deficit-neutral dividend exclusion at the individual level. There is not unanimous agreement on this issue among economists, however, particularly when international economic issues are taken into account. As University of Michigan international tax expert Reuven Avi-Yonah recently wrote, the case for corporate tax integration in a globalizing world “is much shakier than is commonly thought,” with many of our trading partners now moving away from the full exclusion of dividends from taxation.[27]

Conclusion

As short-term stimulus, exempting all or a portion of corporate dividends from individual income taxes is ill-conceived. It fails to meet the basic requirements of any stimulus proposal, which are that such a proposal be temporary and be targeted in a way that encourages as much new spending as possible in the short term. The proposal to reduce or eliminate the taxation of dividends is clearly intended to be permanent, and its benefits would flow primarily to those with the highest incomes, a group likely to save more of a tax cut than moderate- and lower-income families would.

Despite its shortcomings as stimulus, reducing or eliminating individual taxes on corporate dividends is expected to be the centerpiece of the Bush Administration’s economic growth package. The Administration likely will use the continued uncertainty surrounding the state of the economy both to push for rapid consideration of its package and to argue that the package’s large long-term costs need not be offset. This, however, is the wrong context for debating the dividend proposal, since it precludes consideration of other relevant corporate tax issues and thus virtually ensures this costly tax cut will impose a permanent drain on the Treasury.

Consideration of measures to reduce or eliminate the so-called “double taxation” of corporate dividends should be accompanied by consideration of measures to curb the “zero taxation” of a rising share of corporate profits as a result of the increasingly aggressive use of corporate tax shelters and other tax-avoidance techniques. A tax cut for dividends should be considered only as part of a more comprehensive, deficit-neutral package of corporate tax reforms.

APPENDIX

Who Belongs to the “Investor Class”?

Some supporters of reducing or eliminating individual income taxes on corporate dividends argue that it will benefit a large “investor class” that includes millions of middle-income families. The implication is that a broad cross-section of the American public is now invested in the stock market and that the “investor class” is no longer confined to those with high incomes but has become a more representative group. Although this may be truer than in the past, it misses two fundamental points: First, a significant portion of investments occurs in the context of tax-deferred retirement accounts, particularly for middle-class investors. These investments would be unaffected by proposals that change the tax treatment of stock dividends and capital gains. Second, higher-income taxpayers are not only more likely to have taxable income from dividends and capital gains, but the amount of this income is far higher than for other income groups. In other words, when it comes to stock holdings in taxable accounts, the “investor class” is still dominated by those with high incomes.

These points are demonstrated by data from the Federal Reserve’s most recent Survey of Consumer Finances. The SCF data show that in 1998, nearly half of all families had investments in stocks, mutual funds, or retirement accounts.[28] But middle-income families not only had much smaller amounts of assets in these investments than high-income families did, they also had a much larger share of such investments in tax-deferred retirement accounts rather than in taxable accounts.

Using the SCF data, New York University economist Edward Wolff has estimated that in 1998, approximately 85 percent of the value of taxable stocks and mutual funds were held by the top 10 percent of the income spectrum, with the top one percent holding 49 percent of the total. The bottom 90 percent held only 15 percent of these assets.[29]

Income from Stocks and Mutual Funds

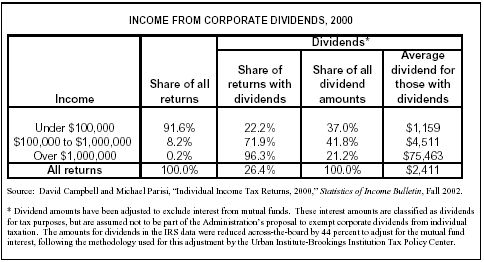

Internal Revenue Service data on income in 2000, the most recent year available, tell a similar story, showing that income derived from taxable stock and mutual fund assets is heavily concentrated at the top of the income spectrum. Only 22 percent of filers with income under $100,000 reported any dividend income in 2000, while 72 percent of filers with incomes between $100,000 and $1 million and virtually all filers with income over $1 million reported dividends. Further, the amount of dividends reported rises sharply with income. Some 63 percent of all dividend income was reported by the 8.4 percent of tax filers with incomes over $100,000, and more than one-fifth of all dividend income went to the top 0.2 percent of filers with incomes over $1 million. For those with incomes over $1 million who reported corporate dividends, average dividend income totaled more than $75,000 — 65 times more than the average for filers who reported dividends and had income below $100,000.

End Notes:

[1] Gregg A. Esenwein and Jane G. Gravelle, “The Taxation of Dividend Income: An Overview and Economic Analysis of the Issues,” Congressional Research Service, October 7, 2002.

[2] Iris J. Lav, “Bush ‘Growth Plan’ Would Worsen State Budget Crises,” Center on Budget and Policy Priorities, January 9, 2002.

[3] Esenwein and Gravelle.

[4] William Gale and Peter Orszag, “A New Round of Tax Cuts,” Center on Budget and Policy Priorities, August 23, 2002.

[5] Dividend-paying firms tend to be large, well-established companies. For example, many of the highest-yielding stocks (i.e., pay the highest dividends relative to their share prices) tend to be familiar companies, such as Philip Morris, J.P. Morgan Chase, General Motors, Eastman-Kodak, Dow Chemical, Bristol-Myers Squibb, ConAgra Foods, Ford Motor, and ChevronTexaco. See Greg Bartalos, “New Tax Plan May Yield Sweet Dividends,” Barron’s Online, December 12, 2002.

[6] William G. Gale, “About Half of Dividend Payments Do Not Face Double Taxation,” Tax Notes, November 11, 2002.

[7] Council of Economic Advisers, “Eliminating the Double Tax on Corporate Income,” January 7, 2003. See also Floyd Norros, “Bush Plan Taxes Certain Dividends,” The New York Times, January 9, 2003, and Jonathan Weisman, “It’s Not Easy to Make Dividends Tax-Free,” Washington Post, January 9, 2003.

[8] Esenwein and Gravelle.

[9] Committee on Finance, U.S. Senate, “Report to Accompany H.R. 3838, Tax Reform Act of 1986,” Report 99-313, May 29, 1986.

[10] “Integration of the Individual and Corporate Tax Systems: Taxing Business Income Once,” U.S. Department of the Treasury, January 1992.

[11] William G. Gale and Peter R. Orszag, “The Economic Effects of Long-Term Fiscal Discipline,” Urban-Brookings Tax Policy Center Discussion Paper, December 17, 2002.

[12] Gale and Orszag point out that if lower national savings leads to increased foreign borrowing, interest rates may not rise. But if foreign borrowing increases, then America’s indebtedness to rest of the world increases. The returns to these investments flow overseas, rather than raising the future incomes of Americans. As a result, higher deficits lower the nation’s income in the future, regardless of whether interest rates increase.

[13] States would also be negatively affected by the proposal because it would likely result in higher interest rates and thus increase their cost of borrowing.

[14] Reuven S. Avi-Yonah, “Back to the 1930s? The Shaky Case for Exempting Dividends,” Tax Notes, December 23, 2002

[15] Brett Ferguson, “Treasury Renews Push for Higher Debt Limit, Warns Ceiling Could be Hit in late February,” BNA Daily Tax Report, December 27, 2002.

[16] Esenwein and Gravelle.

[17] See Mihir Desai, “The Corporate Profit Base, Tax Sheltering Activity, and the Changing Nature of Employee Compensation,” NBER Working Paper 8866, April 2002, and George A. Plesko, “Reconciling Corporation Book and Tax Net Income, Tax Years 1996-1998,” Statistics of Income Bulletin, Spring 2002.

[18] Robert S. McIntyre and T.D. Coo Nguyen, “Corporate Income Taxes in the 1990s,” Institute on Taxation and Economic Policy, October 2000.

[19] Robert McIntyre, “New Gang, Old Myths,” The American Prospect, January 13, 2003.

[20] Gretchen Morgenson, “Waiting for the President to Pass the Tax-Cut Gravy,” The New York Times, January 5, 2003.

[21] McIntyre, “New Gang, Old Myths.”

[22] “Ending Double Tax Trouble,” The Wall Street Journal, December 26, 2002.

[23] McIntyre, “New Gang, Old Myths.”

[24] Joel Friedman and Isaac Shapiro, “Are Taxes Too Concentrated at the Top? Rapidly Rising Income at the Top Lie Behind Increase in Share of Taxes Paid by High-Income Taxpayers,” Center on Budget and Policy Priorities, December 18, 2002.

[25] Earnings in a non-corporate business are taxed only at the individual income tax rates. The majority of non-corporate businesses are sole proprietorships, earnings from which are taxed at the owner’s individual income tax rates. Other non-corporate enterprises such as partnerships are often referred to as “pass-through” companies because the earning pass through to the partners and shareholders and are taxed at their individual rates. See Jack H. Taylor, “Passthrough Organizations Not Taxed As Corporations,” Congressional Research Service, August 20, 2002.

[26] Of these three methods, debt receives the most favorable tax treatment. Although interest payments to bondholders are treated as income to the bondholder, just as dividend payments are treated as income to shareholders, interest payments are a deductible expense for a corporation. As a deductible expense, interest payments reduce the amount of corporate profits subject to tax; in contrast, dividends are paid out of after-tax funds. Thus, interest payments are taxed at most only once, at the individual level, and are more lightly taxed than dividends, which can face both corporate and individual taxes.

Retained earnings can also be subject to double taxation, but to a much lesser degree than dividends. When a corporation retains its earnings for investment purposes, it tends to push the firm’s share prices higher. Thus, shareholders become subject to higher capital gains taxes when (or if) they decide to sell their shares. But capital gains are taxed at a lower rate than regular income taxes, and shareholders can control when they will sell shares, potentially deferring capital gains taxes indefinitely. As a result, retained earnings generate lower taxes at the individual level than dividend payments, which are subject to tax in the year in which the payment is made at individual income tax rates.

[27] Avi-Yohan.

[28] Arthur Kennickell, Martha Starr-McCluer, and Brian Surette, “Recent Changes in U.S. Family Finances: Results from the 1998 Survey of Consumer Finance,” Federal Reserve Bulletin, January 2000.

[29] Edward N. Wolff, “Recent Trends in Wealth Ownership, 1983-1998,” Jerome Levy Economics Institute, Working Paper No. 300, April 2000.