PRESIDENT’S RADIO ADDRESS AND OTHER

ADMINISTRATION STATEMENTS EXAGGERATE TAX PLAN’S IMPACT ON SMALL BUSINESSES

|

PDF

of accompanying fact sheet PDF of this report |

| If you cannot access the files through the links, right-click on the underlined text, click "Save Link As," download to your directory, and open the document in Adobe Acrobat Reader. |

In his Saturday radio address today, President Bush said that “small businesses stand to gain a great deal” from his new tax-cut proposals because 23 million small business owners would receive tax cuts averaging $2,042 this year. Unfortunately, the President’s statement was misleading, relying on deceptive use of average figures.

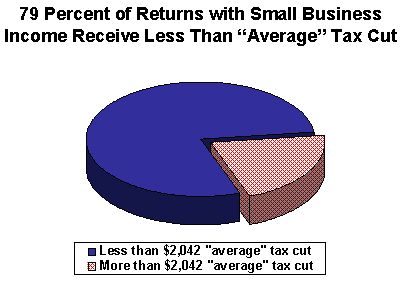

In fact, 79 percent of tax filers with small business income — or nearly four of every five such tax filers — would receive less than this amount, according to data issued by the Urban Institute-Brookings Institution Tax Policy Center. And slightly more than half of returns with small business income — 52 percent of them — would get $500 or less. The Administration produced the $2,042 average figure by averaging the large tax cuts that would go to a small number of wealthy individuals who have some small business income with the much smaller tax cuts that would go to millions of more typical small business people.

In his radio address, the President also echoed a claim contained in a recent Treasury press release that small business owners would benefit greatly from his proposal to accelerate the reduction in the top income tax rate, because two-thirds of those who pay the top rate are small business owners. This statement, as well, is misleading in two respects.

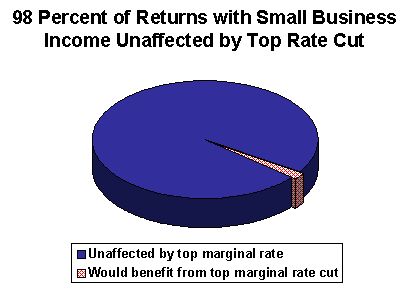

- The Administration is claiming that 500,000 of the 750,000 tax filers who pay the top rate — or two-thirds of them — are small business owners. Even if this claim were valid, it would not mean that the reduction in the top rate would broadly help small businesses. The 500,000 “small business owners” said to pay the top rate would, by the Treasury’s own figures, constitute only two percent of small business owners.

- In addition, the contention that 500,000 of those tax filers who pay the top tax rate are small business owners is derived by counting all tax filers with some small business income as “small business owners.” Wealthy individuals who do not run small businesses and simply have passive investments in partnerships, S corporations, and the like are thereby presented as “small business owners,” as though they ran a corner store. Analysis by Citizens for Tax Justice finds that when sole proprietorships with positive business income are examined (as distinguished from individuals who do not run small businesses but have passive business investments, as well as doctors and lawyers who are in partnerships), only about one-fourth of those who pay the top income tax rate turn out to be business owners.

Some Aspects of Plan Could Harm Small Business

Careful examination of the data indicates that the impact of the proposed tax cuts on most people with small business income would, in fact, be modest and that a key feature of the plan actually could have a negative impact on small businesses. Although the plan includes an “expensing” provision that is targeted toward small businesses and would be beneficial for them, the package’s largest provision — the exclusion of corporate dividends from individual income taxation — could hurt small businesses in two ways. First, reducing taxes on corporate dividends would attract investment dollars away from small businesses into corporate stocks that issue tax-free dividends. Second, by increasing the attractiveness of dividend-paying stocks relative to bonds and also by increasing long-term deficits, the dividend exclusion would likely raise long-term interest rates. These higher interest rates would raise the cost of borrowing for small businesses and partly mitigate the benefits of the expensing provision.

Use of “Average” Tax Cut for Small Business Owners

A January 7 press release from the Treasury Department argues that the Administration plan would provide significant tax benefits to a large group of small businesses. It states that “23 million small business owners would receive tax cuts averaging $2,042.”[1] President Bush repeated this claim in his January 18 radio address, stating that “the tax relief I propose will give 23 million small business owners an average tax cut of $2,042 this year.”

This is similar to the misleading use of averages the Administration has employed when describing the impact of its tax plan on all taxpayers, the elderly, and single women with children.[2] A hypothetical example helps to illustrate the deceptive nature of using averages in such situations. Suppose four individuals each receive a tax cut of $100 and a fifth person receives a $9,600 tax cut. The average tax cut for the five taxpayers would be $2,000. Yet four of the five taxpayers would be receiving far less than this $2,000 average amount.

The Urban Institute-Brookings Institution Tax Policy Center has analyzed the impact of the Administration’s tax-cut proposal on tax filers with business income.[3] The Tax Policy Center found that the average tax cut for tax filers with small business income who would receive a tax cut would indeed be over $2,000. But the analysis also found that:

- Over half — 52 percent — of returns with small business income would get $500 or less.

- 79 percent of these returns — nearly four in every five — would get less than $2,042, the amount the Administration is advertising as the average benefit for small business owners.

- 22 percent of these returns would get no tax cut at all.[4]

The Tax Policy Center analysis also found that the “average” tax cut for returns with small business income is driven up by the 0.3 percent of returns with small business income that would receive an average tax cut of more than $146,000.

These findings demonstrate that a substantial majority of returns with small business income would receive much less than the $2,042 average tax cut and that, despite the Administration’s claims, the tax plan would not provide large tax benefits to a broad group of small business owners.

Top Rate Cut Only Benefits Small Percentage of Small Businesses

The Administration also argues that accelerating the reduction in the top marginal rate would help small businesses. It contends that “owners of flow-through entities, including small business owners and entrepreneurs, comprise more than two-thirds (about 500,000) of the 750,000 tax returns that would benefit from accelerating the reduction in the top tax bracket” and that “these small business owners would receive 79 percent (about $10.4 billion) of the $13.3 billion in tax relief from accelerating the reduction in the top tax bracket.”[5]

These statistics do show that most taxpayers in the top rate bracket have some small business income and that most of the benefits of such a tax cut would go to individuals who receive some small business income. From the Administration’s own figures, however, it also is clear that lowering the top rate would help only a tiny percentage of all small businesses owners. The Treasury fact sheet states that 23 million small business owners would receive tax cuts from the overall proposal. If 500,000 of these 23 million small business owners benefit from the top rate cut, then only about 2.2 percent of these small business owners would benefit from accelerating the reduction in the top rate, a figure the Treasury fact sheet fails to mention.

The statistics the Administration itself cites thus do not support the claim that reducing the top rate would benefit many small businesses. What they show is that of the small number of affluent individuals who would benefit from reducing the top rate, many have some small business income.

One could note that nearly all of those who would receive the top rate cut own cars. These car owners would likely receive a very large share of the benefits of a reduction in the top income tax rate. It would not make sense to conclude that cutting the top rate is a pro-car policy that would broadly help car owners, since only a very small percentage of all car owners would be affected. The same holds true for the small business sector and small business owners.

Moreover, the Administration’s 500,000 figure includes many individuals who are not actually small business owners. The Treasury press release hints at this, referring to “owners of flow-through entities, including small business owners and entrepreneurs.” The category of “flow-through entities” includes not only small business owners but also wealthy individuals who are not small business proprietors but rather have passive investments in partnerships, S corporations, and rental activities. The 500,000 figure apparently even includes taxpayers with negative business income. These individuals generally are not small business owners, but rather high-income individuals with some business investments who gain so much income from other sources that they are in the top tax bracket.[6]

Citizens for Tax Justice has conducted an analysis of “sole proprietorship” returns — small businesses that file the federal Schedule C return. This definition of “small business” more readily meets the concept of small business owner or proprietor. It does not include individuals with passive business investments and doctors and lawyers in partnerships, two groups that are counted in the Administration’s figure. CTJ analysts found that only 180,000 sole proprietorships with positive business income — or about 1.4 percent of all such returns — faced the top income tax rate in 2001.

Impact of Other Parts of Tax Proposal on Small Businesses

Overall, the Administration tax proposal would have a mixed effect on small businesses. Some provisions would help small business owners. Other provisions would hurt the small business sector.

The Citizens for Tax Justice analysis found that nearly 70 percent of small business owners either paid a top tax rate of 15 percent or did not pay federal income taxes at all in 2001. As a result, most small business owners benefit much more from tax cuts aimed at middle- and lower-income families than from reductions in the top tax rates.

The Administration proposal to increase the small business expensing limit from $25,000 to $75,000 for investments up to $400,000 would provide significant benefits for some small business owners. Marriage penalty relief, the broadening of the 10 percent tax bracket, and expansion of the child tax credit also would benefit many small business owners. These benefits must be weighed, however, against the adverse long-term effects on the economy — and thus on the small business sector — from the increased budget deficits that would result from the plan.

Furthermore, the largest provision in the proposal — the exclusion of corporate dividends from individual taxation, which makes up more than half of the Administration’s “growth” package — could harm small businesses. With lower taxes on corporate dividends, corporate stocks would become more attractive investments. Small businesses could be adversely affected as investment dollars shifted away from small businesses into corporate stocks.[7] Indeed, the 1992 Treasury study on the taxation of corporate dividends that is cited as providing a framework for the Bush Administration’s current proposal — and that was directed by Glenn Hubbard, now Chairman of President Bush’s Council of Economic Advisers — acknowledged that ending dividend taxation would result in “the reallocation of physical capital (and other real resources) from the rest of the economy into the corporate sector.”[8]

The dividend tax cut also would make corporate stocks more attractive relative to bonds, requiring bonds to offer higher interest rates in order to retain investments. In addition, the tax cut would increase long-term deficits, reducing the future pool of funds available for investment. Since financial markets are forward-looking, these higher future deficits would put upward pressure on long-term interest rates now.[9] Thus, both by drawing funds away from the bond market and by worsening the long-term fiscal outlook, the dividend tax cut would likely raise long-term interest rates. These higher interest rates would hurt small businesses by raising the costs they would incur to borrow funds.

End Notes:

U.S. Treasury Department, Office of Public Affairs, January 7, 2003 KD-3741 For further discussion, see: Isaac Shapiro and Joel Friedman, “Administration’s Use of ‘Average’ Tax Cut Creates Misleading Impression About the Tax Cut Most Households Would Receive,” Center on Budget and Policy Priorities, January 15, 2003. The Tax Policy Center and Treasury data are consistent. The Treasury data show that 23 million tax filers with business income would receive a tax cut; the Tax Policy Center analysis finds 24 million such tax filers. For analytic purposes, such numbers are nearly identical. The Administration’s figures appear to ignore these returns; that is, its figure that the average tax cut for small business owners is $2,042 appears to consider only those small business owners who receive a tax cut.The figure from the Urban Institute-Brookings data that 79 percent of tax returns with small business income would get less than $2,042 includes both those returns that would receive tax cuts and those that would not. If returns with small business income that would not receive a tax cut are excluded from the calculation, the Urban Institute-Brookings data would show that among tax returns with small business income that would receive a tax cut under the Administration’s plan, 73 percent would receive a tax cut of less than $2,042.

U.S. Treasury Department, Office of Public Affairs, January 7, 2003 KD-3741. Recently released IRS data for 2000, the latest year for which such data are available, show that over one-fifth of tax filers who reported income of more than $200,000 and listed business income actually reported net losses in their business income. David Campbell and Michael Parisi, “Individual Income Tax Returns, 2000,” IRS Statistics of Income Bulletin, Fall 2002. For more on the impact of the dividend tax cut on small businesses, see: Joel Friedman and Robert Greenstein, “Exempting Corporate Dividends From Individual Income Taxes,” Center on Budget and Policy Priorities, January 11, 2003. Department of the Treasury, “Integration of the Individual and Corporate Tax Systems: Taxing Business Income Once,” January 1992. For further discussion of the relationship between future deficits and current long-term interest rates, see: William Gale and Peter Orszag, “The Economic Effects of Long-Term Fiscal Discipline,” Urban-Brookings Tax Policy Center Discussion Paper, December 17, 2002.