Beyond The Rhetoric:

What The Clinton Budget And The Republican Budget Plan

Really Propose For Appropriated Programs

Is the Administration Proposing Substantial New Spending?

by James Horney and Robert Greenstein

In describing the disagreement between the Republican and Clinton plans regarding what to do with the projected non-Social Security surplus, some news accounts have stated that the Republicans prefer larger tax cuts while the Administration prefers a smaller tax cut with the rest of the surplus used for "new" or "additional" spending. In fact, both Democratic and Republican plans call for reductions in spending for appropriated (i.e., non-entitlement) programs in inflation-adjusted terms. The reductions would be much deeper under the Republican plan.

- CBO data show that the Congressional budget resolution that undergirds the Republican tax cut plan assumes $775 billion in reductions in appropriated programs over the next 10 years, compared to the FY 1999 non-emergency spending levels for these programs, adjusted for inflation.

- CBO data also show the Administration's plan contains $89 billion in reductions in appropriated programs over the next 10 years, compared to the FY 1999 levels adjusted for inflation.

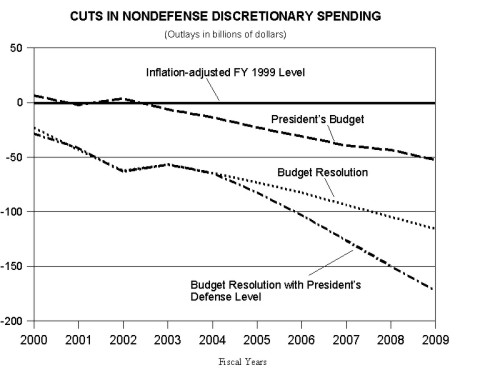

- Under both the Congressional budget resolution and the Administration's plan, non-defense programs would bear the brunt of these cuts, with non-defense discretionary spending (as this part of the budget is known) reduced 13 percent by 2009 under the Administration's plan and up to 43 percent under the Congressional plan.

The Clinton Budget

The reductions in non-defense discretionary programs would be substantial under the Clinton plan and massive under the Republican plan. The Clinton budget proposes an increase for defense spending; over the next 10 years, defense spending would exceed the FY 1999 inflation-adjusted level by $110 billion. The Clinton budget includes reductions of nearly $200 billion in non-defense discretionary spending over the period. The net effect on total discretionary spending is a $89 billion reduction.

In recent days, Administration officials have acknowledged their plan includes a 13 percent reduction in non-defense discretionary spending by FY 2009, compared to today's levels adjusted for inflation. Their proposal does not represent new or additional spending.

|

||||||||||

The Clinton budget does include new spending for a Medicare prescription drug benefit, partially offset by savings from other changes in Medicare. By the Administration's estimates, the Administration's Medicare proposals would add $45 billion in new Medicare spending over 10 years. By CBO's figures, these proposals would add $111 billion in new spending.

CBO's estimate of $111 billion in new Medicare spending over 10 years is close to the $89 billion reduction in overall discretionary spending. Excluding any effects on expenditures from the Administration's proposed Universal Savings Accounts, there would be little change in overall spending under the President's budget. (The USA subsidies would be implemented through the tax system, but under current budget accounting, a portion of the costs would be recorded in the budget as outlays.)

If non-defense spending alone is examined, the Administration proposal shows a net reduction (outside of the USA accounts), even when the Medicare proposals are taken into account and CBO estimates are used. The $200 billion reduction in non-defense discretionary spending would be about double the size of the Medicare increase. The Administration's proposal is essentially a centrist to moderately conservative one that should not be described as a "big government" plan with large amounts of new spending.

Discretionary Reductions in the Budget Resolution

The 13 percent reduction in non-defense discretionary programs the Clinton budget proposes by 2009 itself could easily prove difficult to achieve. The Congressional budget resolution that provides the framework for Republican tax cut proposals calls for reductions several times larger than that.

Tables CBO released a few weeks ago show that under the budget resolution, total discretionary spending would have to be reduced $775 billion below the FY 1999 level, adjusted for inflation, over the next 10 years. The resolution assumes $716 billion will be sliced from non-defense discretionary programs over this period. Almost one-third of non-defense discretionary spending would have to be eliminated by 2009 to reach the level the budget resolution assumes.

Moreover, these figures understate the likely effect on domestic programs if total discretionary spending is held to the level the resolution assumes. The resolution assumes that defense spending will be reduced in inflation-adjusted terms over the next 10 years, despite the fact that the Clinton budget calls for real increases in defense spending and many Congressional Republicans have criticized the President for not increasing defense enough. The budget resolution does call for roughly the same increases in defense as the President does for the next five years. But in another highly unrealistic assumption, the budget resolution assumes defense spending will, in the years after 2005, be cut below the levels needed to keep pace with inflation.

If defense spending is assumed, more realistically, to be funded at the level the Administration's budget proposes, non-defense discretionary spending would have to be cut 43 percent by 2009 to stay within the overall discretionary spending target the budget resolution sets. If defense spending is increased as the budget resolution proposes through 2004 and simply keeps pace with inflation after that, non-defense discretionary programs would have to be reduced 38 percent by 2009 under the budget resolution. Since there is strong Republican support for increasing the budgets of a number of domestic programs — including veterans programs and NIH research, among others — many of the remaining domestic discretionary programs would have to be cut at least in half.

|

||||||

Cuts of that magnitude are highly unrealistic. In recent weeks, Congress has moved to adopt a growing array of gimmicks. Not only have the appropriators designated funding for the 2000 census and various other items as emergency spending not subject to the discretionary caps, but the budget committees have agreed to underestimate the amount of non-emergency spending being approved. According to CBO, the budget committees have already indicated that for purposes of determining Congressional compliance with the discretionary spending caps, they will reduce CBO's estimates of the amount of discretionary spending that will result from the fiscal year 2000 appropriation bills by at least $13.8 billion ($9.7 billion for defense spending, $1.3 billion for highways and mass transit spending, and $2.8 billion for other non-defense spending). Further downward adjustments may be adopted later.

Even without the emergencies and without any further adjustments, if the budget committees "score" total spending from the fiscal year 2000 appropriation bills as hitting the caps exactly, CBO will estimate that outlays exceed the caps by $13.8 billion. All of these maneuvers are designed to make it appear as though Congress is complying with the discretionary caps for 2000 without making the unpopular and unrealistic cuts actually required to hit the caps.

These gimmicks, as well as the inability of the Congress even to start work on the large Labor-HHS appropriations bill, demonstrate that Congress is very unlikely to be able to cut actual funding for discretionary programs significantly. The $775 billion assumed reduction in discretionary programs in the budget resolution has little credence. Yet this is the key assumption underlying the claims by the tax bill's supporters that their plan is fiscally responsible, pays down more debt than the Administration's, and also has money left over for Medicare.