|

|

|

July 15, 2003

July 15, 2003

New Child Care Resources Are Needed to Prevent the

Loss of Child Care Assistance for Hundreds of

Thousands of Children in Working Families

By

Sharon Parrott and Jennifer Mezey

| PDF of this report |

| If you cannot access the files through the links, right-click on the underlined text, click "Save Link As," download to your directory, and open the document in Adobe Acrobat Reader. |

As Congress debates legislation to reauthorize the TANF and child care block grants, child care funding remains a key issue. While much of the focus of reauthorization has been on work requirements for parents receiving TANF cash assistance, the legislation also will establish mandatory child care funding levels for the next five years. Currently, mandatory child care funding is used predominantly to provide child care assistance to working families not receiving TANF cash assistance.

Without increased child care funding, hundreds of thousands of children in working families stand to lose access to child care assistance even if TANF work requirements are left unchanged. Still larger numbers of children will lose assistance if the legislation expands TANF work requirements yet provides insufficient child care funding to meet the additional costs these new requirements will create. Ironically, unless it includes sufficient child care funding, TANF reauthorization legislation could make it harder for parents to remain employed and off welfare because they would be unable to secure child care.

How Many Children Could Be Affected?

States use four major funding streams for child care for low-income working families: mandatory child care block grant funding, discretionary child care block grant funding, TANF funds, and state child care funding used to satisfy TANF and child care spending requirements. Over the past several years, states have used significant TANF “reserve” funds — TANF funds leftover from prior years — to support child care programs. These reserve funds are exhausted or nearly exhausted in most states, reducing the funding available for child care.

The Center on Budget and Policy Priorities and

the Center for Law and Social Policy have estimated the number of child

care slots that would be funded over the next five years with mandatory

child care block grant funding, TANF funds, and state matching and MOE

funds. (Because TANF reauthorization legislation will not set

discretionary child care funding levels, that funding — and the loss in

child care slots if that funding is frozen — is not considered in this

analysis.) Using the Congressional Budget Office (CBO) baseline for

TANF block grant expenditures, current-law funding levels for the mandatory

portion of the child care block grant, the average cost per child care

slot, and CBO projections of how much the average cost per slot will rise

over the next five years, the analysis found:

The Center on Budget and Policy Priorities and

the Center for Law and Social Policy have estimated the number of child

care slots that would be funded over the next five years with mandatory

child care block grant funding, TANF funds, and state matching and MOE

funds. (Because TANF reauthorization legislation will not set

discretionary child care funding levels, that funding — and the loss in

child care slots if that funding is frozen — is not considered in this

analysis.) Using the Congressional Budget Office (CBO) baseline for

TANF block grant expenditures, current-law funding levels for the mandatory

portion of the child care block grant, the average cost per child care

slot, and CBO projections of how much the average cost per slot will rise

over the next five years, the analysis found:

There are two main causes for this projected loss in child care slots for working families. First, under current law mandatory child care block grant funding and the associated level of required state spending would remain frozen. Yet, the cost of providing child care rises over time as the wages of child care workers and the cost of space and other materials increase. Second, overall TANF spending is projected by CBO to fall significantly as reserves from prior years are exhausted. As this occurs, states will have less TANF funding to devote to child care, resulting in a loss of slots for working families.

|

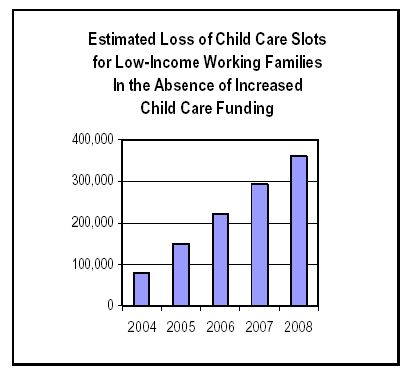

Table 1 Estimated Loss of Child Care Slots for Children in Working Families (compared to 2003) |

|||||

|

|

2004 |

2005 |

2006 |

2007 |

2008 |

|

Loss of Slots Due to Frozen Mandatory Child Care Block Grant Funding |

-27,000 |

-55,200 |

-84,000 |

-112,400 |

-140,300 |

|

Loss of Slots Due to Reduced TANF funding for Child Care |

-51,200 |

-95,000 |

-138,300 |

-180,200 |

-220,900 |

|

Total Loss of Child Care Slots for Working Families |

-78,200 |

-150,200 |

-222,300 |

-292,600 |

-361,200 |

|

COST to Fund Lost Slots |

$371 million |

$733 million |

$1.12 billion |

$1.52 billion |

$1.93 billion |

States Already Have Cut Child Care Slots for the Working Poor

This loss of child care slots would come on top of recent child care cuts in a large number of states. The General Accounting Office, the Children’s Defense Fund, and a Center report all have found that many states have made cuts to child care programs. The Center’s study found that as of June 2003, 32 states had cut child care programs in 2002 or 2003 or were proposing to do so in 2004. States have cut child care costs by reducing the income-eligibility limits for working families, instituting waiting lists or closing the program to working families, increasing co-payments, and/or reducing payments to providers.

Since states continue — for good policy reasons

— to give priority for child care slots to TANF recipients and recent TANF

leavers, working families have borne the brunt of these cutbacks.

In many states and localities, low-income working families that are not

current or recent welfare recipients cannot access child care assistance,

even if the lack of child care means they will be unable to keep their job.

A General Accounting Office study found that over just the last two

years, twelve states newly instituted waiting lists or stopped accepting

applications from all or most low-income working families.[2]

And, according to the Children’s Defense Fund, in December 2002, child care

waiting lists or closed enrollment policies were in place in all or part of

more than 20 states, including

If child care funding is not sufficient for states to maintain their current programs, low-income working families increasingly will be unable to get help paying for child care. Without such help, families may resort to inappropriate, unstable, or even unsafe child care arrangements. Alternatively, some parents may be unable to keep their jobs and may return to TANF cash assistance programs.

Conclusion

Despite the attention that has been paid to TANF work requirements in the context of the TANF reauthorization debate, the lack of child care assistance serves as a far larger impediment to employment for many low-income families than do the size and structure of TANF work participation rates. If TANF reauthorization legislation does not provide sufficient child care resources, nearly 225,000 children could lose child care assistance by 2006, and more than 360,000 children could lose assistance by 2008.

Appendix 1

Child Care Funding

Levels

The following table shows the major sources of federal child care funding, excluding federal discretionary spending. In this analysis, discretionary spending was not included because TANF reauthorization legislation will not set appropriations levels for discretionary child care.

|

|

2003 |

2004 |

2005 |

2006 |

2007 |

2008 |

|

CBO TANF Outlay Baseline (total) |

$19.63 |

$18.90 |

$18.40 |

$17.90 |

$17.40 |

$16.90 |

|

TANF MOE

excluding CCDF “double-counted” MOE[4] |

$9.98 |

$9.98 |

$9.98 |

$9.98 |

$9.98 |

$9.98 |

|

Projected TANF and MOE Funding for Child Care excluding “double counted” CCDF MOE (assumes child care funding remains a constant proportion of TANF outlays) |

$4.73 |

$4.61 |

$4.53 |

$4.45 |

$4.37 |

$4.29 |

|

CCDF Mandatory Funding Baseline |

$2.72 |

$2.72 |

$2.72 |

$2.72 |

$2.72 |

$2.72 |

|

State CCDF MOE and Matching Funds |

$2.03 |

$2.03 |

$2.03 |

$2.03 |

$2.03 |

$2.03 |

|

Total Child Care Funding |

$9.48 |

$9.36 |

$9.28 |

$9.20 |

$9.12 |

$9.04 |

Appendix 2

Technical Explanation of

Findings

To compute these estimates of the loss in child care slots, two sets of calculations were done to determine:

Each is explained in more detail below.

Mandatory Child Care Funding Analysis

This analysis compared the slots that could be funded each year with the combination of mandatory CCDF funding, CCDF MOE funding, and CCDF state matching funds with the estimated number of slots that could be funded in 2003. The estimates used an average cost-per-slot figure based on total CCDF funding (state and federal) in FY 2001 divided by the total average monthly number of children served in CCDF programs that year. (These data are from HHS.) This average-cost-per-slot figure was then inflated using the CBO inflator (as of April 2003) for child care costs. In 2003, our average per-slot cost is $4,621.[5]

This analysis assumes that states will draw down all available CCDF funds. While some states do not draw down their full allotment, the unspent funds are reallocated to states that wish to draw down additional resources.

The CCDF analysis includes state spending that is counted as both CCDF MOE and TANF MOE.

Finding: In 2004, mandatory CCDF funding and associated state funding is projected to fund 27,000 fewer child care slots than in 2003. In 2006, this figure grows to 84,000 and by 2008, reaches 140,300.

TANF Analysis

The annual number of child care slots lost due to declining TANF funding for child care is based on the same per-slot cost used in the CCDF analysis and a projection of annual TANF funding for child care. The projection of TANF funding for child care was computed by using the CBO TANF outlay baseline — which falls from $19.6 billion in 2003 to $16.9 billion in 2008, or 13.8 percent — and by assuming that TANF funding for child care would fall in proportion to the reduction in overall TANF outlays. Stated another way, the analysis assumed that states would spend the same percentage of TANF funds on child care between 2003 and 2008 as they did in 2002, the last year for which data are available. In 2002, child care spending — other than state spending to meet the child care MOE requirement — constituted 16 percent of combined TANF and MOE spending. (If the child care MOE were included, child care constituted 19 percent of total TANF and MOE spending.)

Assuming that child care funding will fall proportionately to the overall reduction in TANF spending may well understate the reduction in TANF funding of child care. In CBO’s estimate of the cost to states of meeting the work requirements in H.R. 4 and under the Grassley proposal, CBO assumed that the TANF cash assistance caseload would remain steady. If this occurs and nominal spending on cash assistance does not fall as overall TANF outlays fall, then the cuts to all other TANF funding categories will need to be larger. Moreover, in looking at the cuts states made in 2002 and 2003, it would appear that states that needed to reduce TANF spending took a more than proportionate share of those reductions from child care. This may have occurred in part because some states view child care as the place to put money that is “left over” after funding cash assistance, work programs, and, in some cases, child welfare. As TANF reserves dwindled, in some states this amount “left over” fell and child care funding fell by far larger amounts than other categories of TANF spending.

The assumption could, of course, overstate the reduction in TANF funding of child care. For example, if TANF cash assistance costs fall by more than 13.8 percent over this period, then the cuts needed in non-cash assistance spending, including child care, could be smaller. Similarly, states could protect child care from cuts of this magnitude by cutting other areas more deeply.

Finding: In 2004, some 51,200 fewer child care slots are projected to be funded with federal TANF and state MOE funds than were funded in 2003. This figure rises to 138,300 in 2006 and 220,900 in 2008.

End Notes:

[1] Fewer child care slots would be lost if states cut the size of the child care subsidy by increasing family co-payments or reducing provider payments. That, however, would reduce families’ access to quality child care providers and/or leave families with less income for other critical needs such as food and shelter.

[2] General Accounting Office, “CHILD CARE: Recent State Policy Changes Affecting the Availability of Assistance for Low-Income Families,” GAO-03-588, May 2003. In ten of these states, families that recently left welfare for work could receive child care assistance while all other working families were placed on a waiting list or stopped from submitting an application. In two states, all families not receiving TANF cash assistance, including recent former recipients, are placed on waiting lists.

[3] Danielle Ewen and Katherine Hart, State Budget Cuts Create a Growing Child Care Crisis for Low-Income Working Families, Children's Defense Fund, March 2003. In some states, the waiting lists or closed-enrollment policies were not statewide, but existed in certain jurisdictions in the state.

[4] States currently must meet a TANF maintenance-of-effort requirement equal to 75 or 80 percent (depending on whether the state meets its work participation requirements) of state spending on former AFDC-related programs in 1994 and a child care maintenance-of-effort requirement equal to 100 percent of state spending on certain child care programs that were eliminated and folded into the child care block grant. Funds used to meet the child care maintenance-of-effort requirement also can be counted toward the overall TANF maintenance-of-effort requirement. In this table, state spending that is counted toward both maintenance-of-effort requirements is shown as state child care spending and is not included in the TANF maintenance-of-effort figures.

[5] This figure implicitly includes average per slot spending on administrative costs and quality improvement initiatives.